6 minutes reading time

Recent geopolitical shifts have set the stage for a major increase in global defence spending.

US Vice President JD Vance’s remarks at the Munich Security Conference signalled a pivot away from NATO’s principle of collective defence. EU leaders will now have to move swiftly to bolster their own security infrastructure.

This shift could have significant implications for defence-related equities.

Europe forced to take responsibility of its own defence

“I see many great military leaders gathered here today, but while the Trump administration is very concerned with European security and believes that we can come to a reasonable settlement between Russia and Ukraine, we also believe that it’s important in the coming years for Europe to step up in a big way to provide for its own defence, the threat that I worry the most about vis-a-vis Europe is not Russia, it’s not China, it’s not any other external actor. And what I worry about is the threat from within, the retreat of Europe from some of its most fundamental values, values shared with the United States of America.” – JD Vance at the Munich Security Conference to NATO and European Union countries

This is the speech that sent shockwaves through the Eurozone. The US seems to be signalling the security umbrella that has underpinned transatlantic relations over the past 80 years has essentially now been removed.

European countries had already been increasing their defence budgets. Pressure from the first Trump administration on NATO members failing to meet targets, along with Russia’s invasion of Ukraine, has seen spending accelerate toward the current 2% of GDP target over the past decade.

Source: European Defence Agency. 2024 figure is an estimate.

However, it is now clear more will be needed. Trump has stated NATO spending targets should increase to 5% of GDP – with two members, Estonia and Lithuania, agreeing to meet this significant level (with Poland already on track to get there)1. While we do not expect 5% to become a NATO requirement, there is clearly an appetite to increase the current level.

Following the Security Conference, the British Prime Minister has said his government will spend an extra $US26 billion a year on defence to reach 2.5% of GDP, with an ambition to reach 3% in the next parliament2. Denmark has indicated that it will utilise an ‘acceleration fund’ to increase spending by $US17 billion and spend more than 3% of GDP on defence3. Most significantly, Germany’s recently elected Conservative Party leader, Friedrich Merz, stated his ‘absolute priority’ is to strengthen European defence. Merz is expected to add an extra $US210 billion to Germany’s special defence fund4 and give his blessing for the European Commission to borrow money on behalf of other EU countries with weaker fiscal positions to bolster their own defence.

Could defence companies experience ‘Nvidia style’ top line growth?

EU defence spending is currently around $US340 billion or 2% of GDP. In the short-term, spending commitments are trending towards 3%5, or an additional $US170 billion per year – and that is just within Europe. The US defence budget has increased by $US173 billion over the past 5 years to the end of 2024. To put these numbers into perspective, the mega-cap US tech hyperscalers’ capital expenditure was $US219 billion in 20246.

These trends could mean defence contractors see increases in demand comparable to what has occurred with AI infrastructure.

Since Q1 2022, Rheinmetall, Germany’s largest defence contractor, has grown its revenue by 19.4% p.a. to January 2025. Analysts are now forecasting top line growth of around 40% for the current earnings season, before settling around 25% p.a. over the next two calendar years, translating to forecasted EPS growth of around 40% p.a.7

Palantir Technologies, a US AI defence contractor, saw sales to the US government jump 45% and US commercial revenue gain 64% with headline growth of 36% over the 12 months to 31 December 20248. The company’s technology is now used across all US military branches, and by American allies in Ukraine and Israel. Palantir also recently extended one of its deals with the US Army from which they could stand to receive as much as $619 million through to 2028.

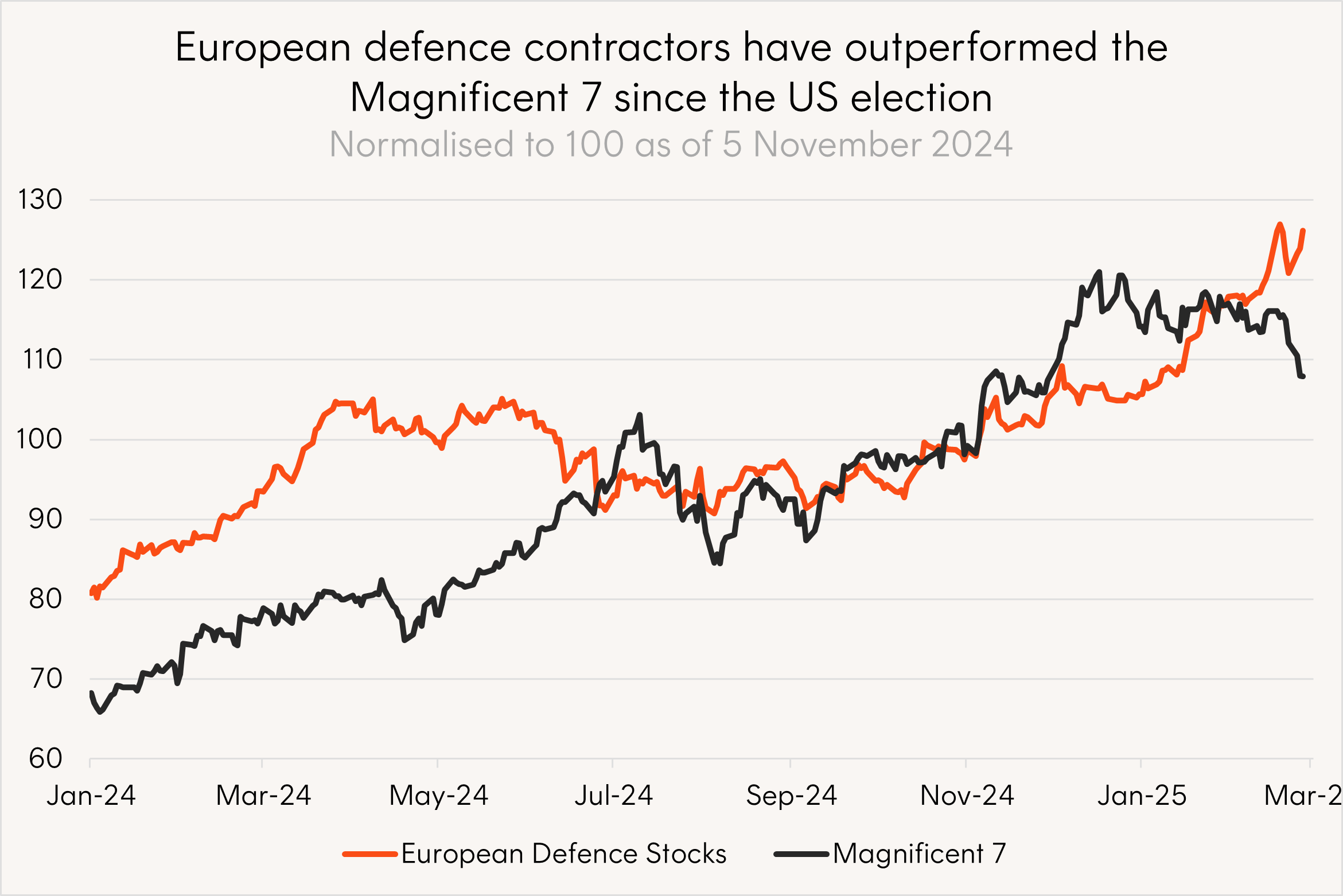

Results like these have been translating into investor returns. European defence companies have outperformed even the US tech giants since Trump’s election victory in November 2024 (remembering of course that past performance is not indicative of future performance).

Source: Bloomberg. Shows performance over the period from 1 January 2024 to 26 February 2025. European Defence Stocks represented by the MSCI EMU Aerospace & Defence Index, Magnificent 7 represented by the Bloomberg Magnificent 7 Total Return Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

While it remains to be seen if growth for defence contractors will reach the incredible heights that have been experienced in AI infrastructure, the prospect of significant growth in global defence budgets, tied to countries’ GDPs, may make global defence companies and attractive investment.

Investing in defence

ARMR Global Defence ETF is a simple way for Australian investors to gain exposure to the global defence sector.

ARMR’s index seeks to provide pure-play exposure to leading companies which derive more than 50% of their revenues from the development and manufacturing of military and defence equipment as well as defence technology.

ARMR currently holds 13 of the top 20 defence contractors in the world by defence revenue9, including US and European defence leaders like Lockheed Martin, Palantir Technologies, BAE Systems, Rheinmetall, and Thales (the 7 companies in the top 20 not held are either not ‘pure-play’ or not headquartered in NATO-aligned countries).

ARMR may be considered for use as a satellite or minor allocation in an investor’s portfolio.

There are risks associated with an investment in ARMR, including market risk, sector risk and concentration risk. Investment value can go up and down. An investment in ARMR should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of ARMR, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

References

1. Source: https://www.piie.com/blogs/realtime-economics/2025/trumps-five-percent-doctrine-and-nato-defense-spending & https://www.politico.eu/article/poland-backs-trump-calls-to-ramp-up-nato-defense-spending/ ↑

2. https://www.gov.uk/government/news/prime-minister-sets-out-biggest-sustained-increase-in-defence-spending-since-the-cold-war-protecting-british-people-in-new-era-for-national-security ↑

3. https://www.bloomberg.com/news/articles/2025-02-19/denmark-plans-17-billion-defense-spending-boost-to-deter-russia ↑

4. https://www.france24.com/en/live-news/20250225-germany-s-next-leader-grapples-to-boost-defence-spending ↑

5. Source: International Institute for Strategic Studies. ↑

6. Source: Goldman Sachs Investment Research. Datacenter supply/demand model. January 12, 2025. Includes Amazon, Microsoft, Alphabet, Meta and Oracle. ↑

7. Source: Bloomberg and Bloomberg consensus estimates. Actual results may differ from estimates. As at 19 February 2025. ↑

8. https://investors.palantir.com/news-details/2025/Palantir-Reports-Q4-2024-Revenue-Growth-of-36-YY-U.S.-Revenue-Growth-of-52-YY-Issues-FY-2025-Revenue-Guidance-of-31-YY-Growth-Eviscerating-Consensus-Estimates/ ↑

9. Source: Defense News, Top 100 for 2024 list. Data for the Top 100 list comes from information Defense News solicited from companies, from companies’ earnings reports, from analysts, and from research by Defense News, the International Institute for Strategic Studies and SPADE Indexes. ↑