Is your portfolio really diversified?

6 minutes reading time

Financial intermediary use only. Not for distribution to retail clients.

Passive broad market ETFs offer investors a wealth of benefits and are often used as ‘set-and-forget’ core exposures. Despite this, investors still have an onus to monitor their investments to manage portfolios from a risk perspective.

For example, the diversification benefits of broad market indices are well-known, as they generally invest in a large universe of stocks rather than a selected few. However, market cap weighting does not necessarily optimise diversification or minimise stock-specific risk.

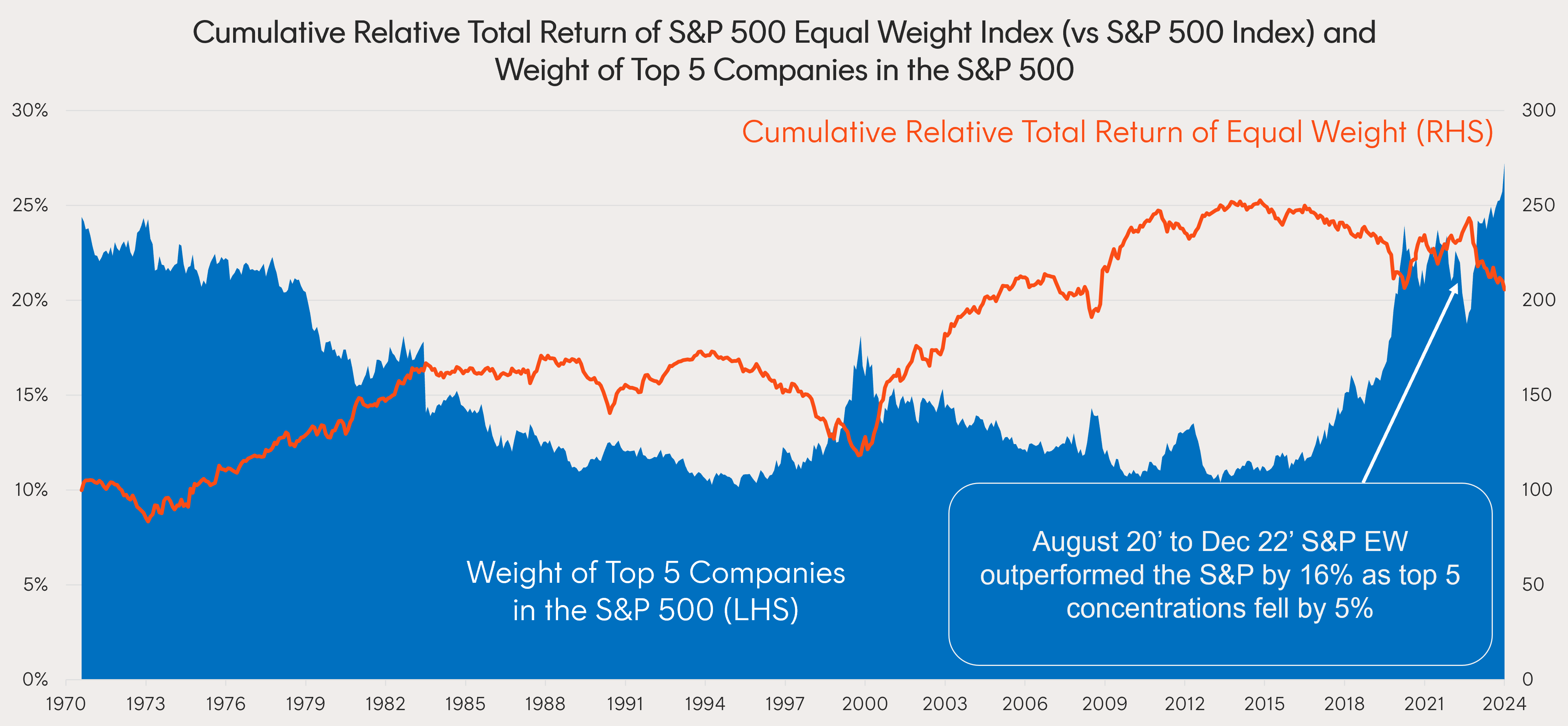

Currently, the US market, as measured by the weight of the top 5 companies in the S&P 500 Index, is experiencing its highest levels of concentration in over 50 years.

For investors with exposure to the market capitalisation-weighted S&P 500, this poses a threat to portfolio diversification, particularly since these top 5 names – Microsoft, Nvidia, Apple, Amazon and Meta, belong to related sectors. However, it may also present an opportunity.

The S&P 500 Equal Weight Index is the equal-weight version of the widely used S&P 500. The index includes the same constituents as the market capitalisation-weighted S&P 500, but each company in the S&P 500 Equal Weight Index is allocated a fixed weight at each quarterly rebalance – being 0.2% of the index total – helping to ensure greater diversification across the top 500 US companies.

Source: S&P Dow Jones Indices LLC. Chart shows cumulative relative returns for the S&P 500 Equal Weight Index versus the S&P 500, based on monthly total returns between December 1970 and February 2024. Cumulative weight of largest five S&P 500 companies based on month-end constituents. Past performance is no guarantee of future results.

Historically, concentration in the US market has been mean-reverting, and when concentration has been high and subsiding the S&P 500 Equal Weight Index has tended to experience its greatest periods of outperformance compared to its market capitalisation-weighted counterpart.

For example, between August 2020 and December 2022, the S&P 500 Equal Weight Index outperformed the market capitalisation-weighted S&P 500 Index by 16% as top 5 concentration fell from 24% to 19%.

US Equity Market Rotation

Most recently, as markets digested a third straight soft US CPI print in July and the reality grew of rate cuts later this year the S&P 500 Equal Weight Index outperformed the market cap Index by 4.2% from 11 July to 8 August.

Counter to conventional wisdom, the higher rate environment acted as a tailwind for the US Tech mega caps who issued long-term debt at low interest rates in 2020/21 and benefitted from growing interest on their huge cash balances. It was US cyclicals, small/mid-caps, and value that were hardest hit by rising rates (due to shorter term debt on average and more reliance on debt financing in their capital structures).

In addition, the Fed easing increases the probability of a soft landing, which should favour cyclicals as the market – being forward looking – starts to price in what comes after the “landing” – the next cyclical acceleration.

Source: Bloomberg. Since Bloomberg data available: March 2010 to July 2024. Past performance is not indicative of future performance of any index or ETF. You cannot invest directly in an index.

The Equal Weight Index stands well placed to benefit from a size and cyclical rotation. The S&P 500 Equal Weight Index maintains the quality of the companies on the S&P 500, with expected earnings growth of close to 10% expected over the next year1, while its weighting mechanism favours cyclicals, smaller caps, and value. All this while the S&P 500 Equal Weight Index’s fwd P/E is trading at close to a historical discount to the S&P 500’s.

Worth the weight

However, the S&P 500 Equal Weight Index should not just be considered a tactical trading idea, but also suitable as a core long term US equity allocation.

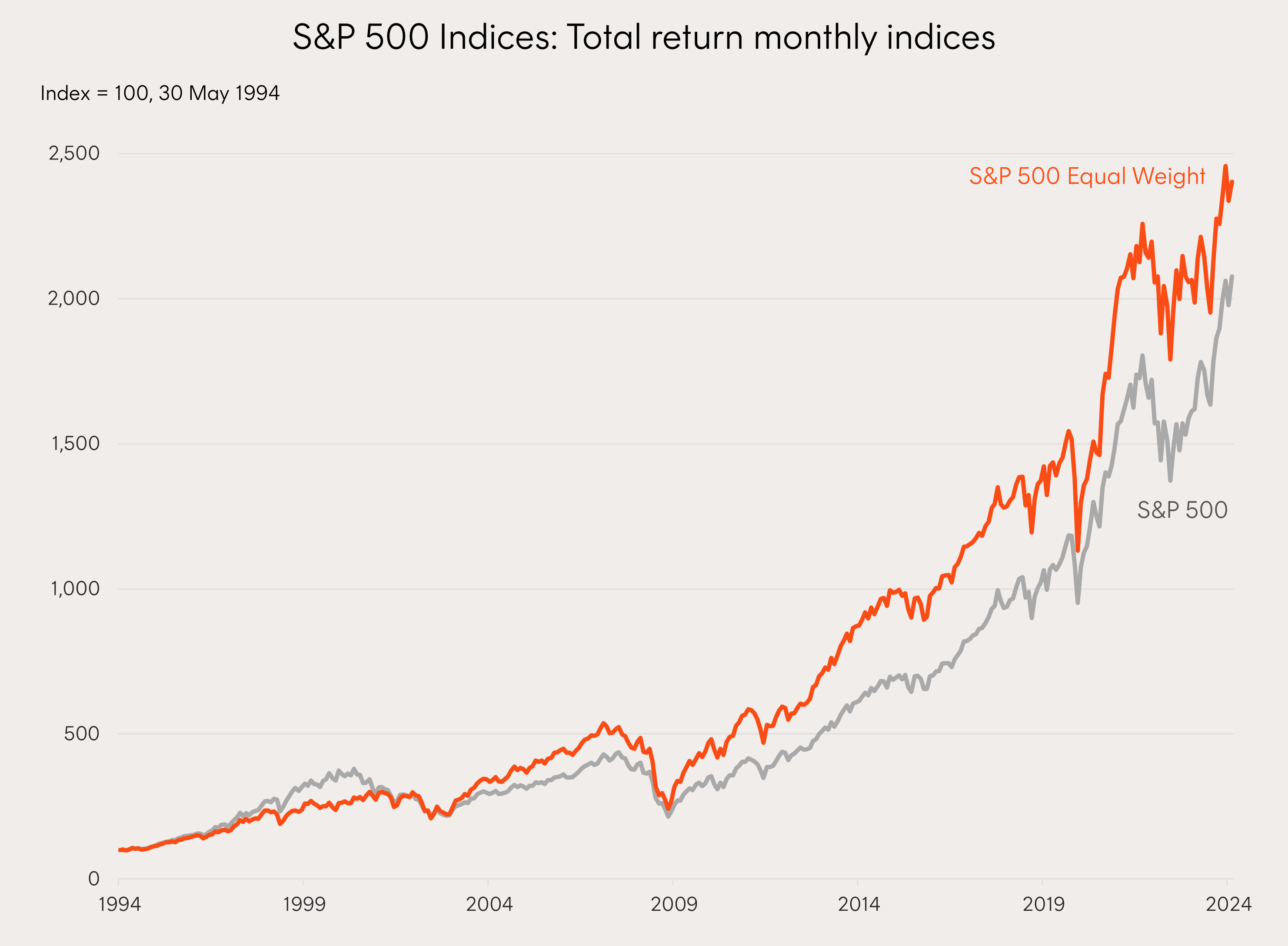

Over the past 30 years, the S&P 500 Equal Weight Index has outperformed the S&P 500 Index by 0.54% p.a. That said, over the shorter run, the equal-weighted index has gone through periods of underperformance, when larger cap stocks had periods of outperformance.

Source: Bloomberg, as at 28 June 2024. Shows performance of the index that Betashares S&P 500 Equal Weight ETF (ASX: QUS) seeks to track, and not the ETF itself. Does not take into account QUS’s management fee and costs (0.29% p.a.). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

Whilst not targeting any specific investment factor, the S&P 500 Equal Weight Index’s longer-term outperformance can be attributed to 4 key drivers:

1. Rebalancing impact:

- Each quarter, as stocks are rebalanced to 0.2%, those that have risen in value are sold and stocks that have fallen in value are bought. This systematic “buy low sell high” rebalancing strategy can add value over time.

2. Increased diversification/lower concentration:

- Diversification is often said to be the only ‘free lunch’ in investing. This alone could make an equal weight strategy a compelling consideration as a longer-term investment approach in US equities.

3. Size impact:

- The size premium refers to empirical evidence that smaller companies have on average tended to offer greater growth potential compared to larger cap stocks over the long run.

4. Stock return skew:

- Historically, in equity markets, the average stock return has tended to be higher than the median stock return. Given that the average return is higher than the median return, it means that more than half the stocks deliver a return below the average. Equal weight indices typically hold a higher weight in a larger number of stocks compared to the equivalent market capitalisation index resulting in a higher probability of an overweight position in the smaller subset of stocks with outsized returns.

Portfolio Implementation

Betashares offers the QUS S&P 500 Equal Weight ETF and the recently launched HQUS S&P 500 Equal Weight Currency Hedged ETF which can be used a core international equites exposure or help to re-balance and existing US equity allocations in portfolios, and potentially benefit from a US equity rotation.

Currency hedging may be preferred for Australian investors as the Fed is expected to cut rates sooner and further, remembering US rates are ~1% higher than Australia’s, and any cyclical recovery will likely be associated with Australian dollar strength.

You can find more information on the S&P 500 Equal Weight Index in this investment brochure.

There are risks associated with QUS, including market risk, index methodology risk, country risk and currency risk. Investment value can go up and down. An investment in the fund should only be made after taking into account the investor’s particular circumstances, including their tolerance for risk. For more information on risks and other features of the fund, please see the Product Disclosure Statement (PDS) and Target Market Determination (TMD), available at www.betashares.com.au

1. Source: Bloomberg consensus estimates. As at 18 July 2024. ↑