4 minutes reading time

Global markets

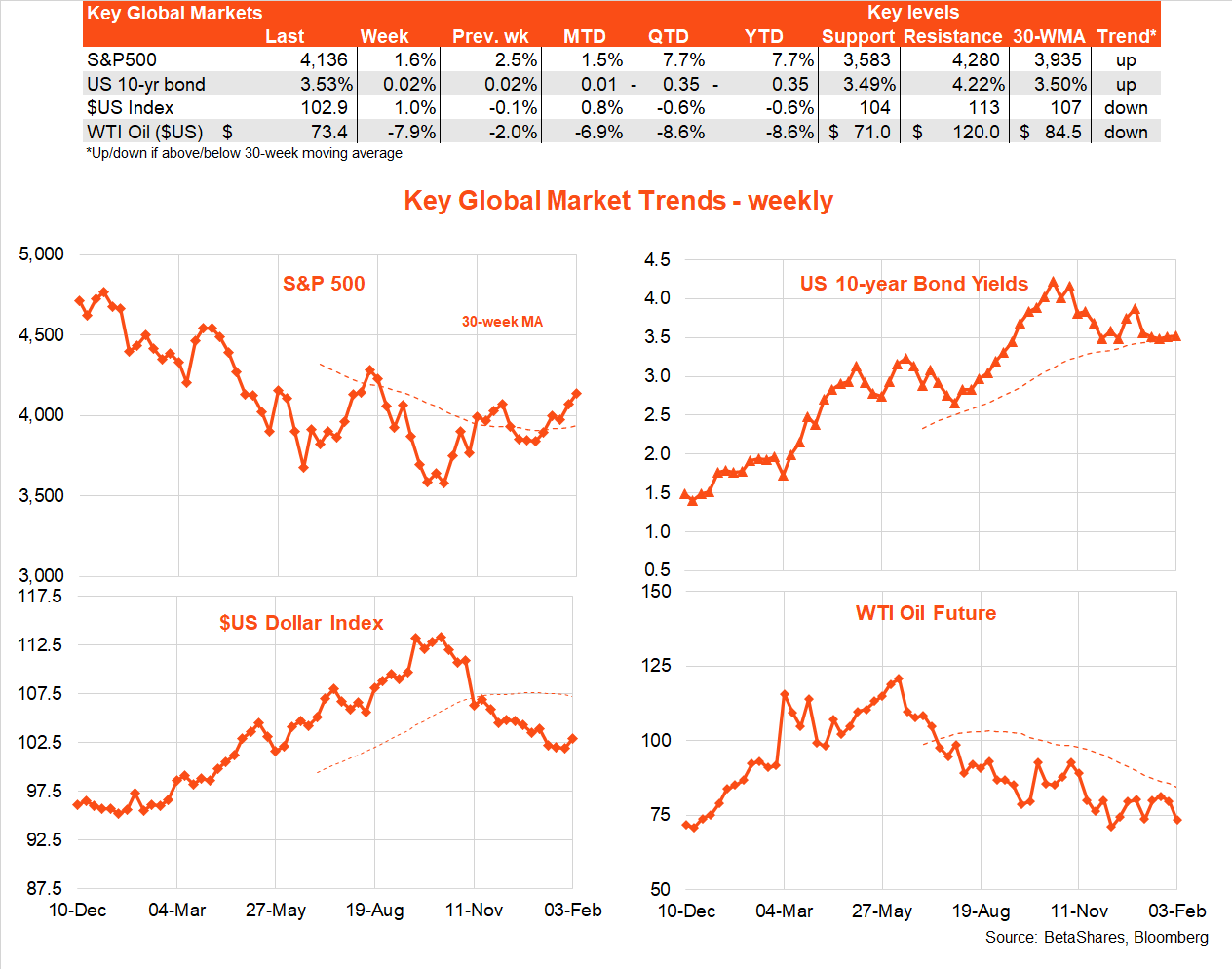

There was another assertive move higher in global equities last week, reflecting ongoing ‘soft landing’ hopes and a dovish tilt by the US Federal Reserve.

The US S&P 500 lifted 1.6% to take out the recent end-week high of 28 November and confirm a break above its downward sloping trend line from highs earlier last year. The S&P 500 also held above its 200-day moving average for the second week in a row.

The highlight last week was the Fed’s decision to lift interest rates a further 0.25% and hint (though in line with its forecasts) that it may stop raising rates after two further 0.25% moves in March and May. Most importantly, Fed chair Powell did not try to talk down the equity market, which was a green light for stocks to move higher.

In other encouraging news, two key reports on US wages suggested some moderation, with the Q4 US wage cost index a touch weaker than expected and average hourly earnings for January in line with expectations. That said, some activity indicators suggested a potential rebound in economic growth, with a much stronger gain in employment during January and a strong rebound in a key services sector index. Weekly jobless claims also remain incredibly low.

Accordingly, though the risk of a near-term US recession appears to be receding due to resilient demand, there’s now potentially some risk of ‘no landing’ rather than a ‘soft landing’, which ultimately – depending on wage and inflation pressures – might require the Fed to be even more aggressive in raising interest rates.

In this regard, it’s worth noting US 10-year bond yields and the $US were steadier last week – after declines over recent weeks which had helped support the global equity rally.

Both the European Central Bank and the Bank of England raised rates a further 0.5%, though hinted there may not be a lot more to come. Chinese activity indices bounced back solidly in January, in line with re-opening. The IMF modestly upgraded the global growth outlook due to surprising resilience in business investment and consumer spending in Europe and the US, despite the rate hikes to date.

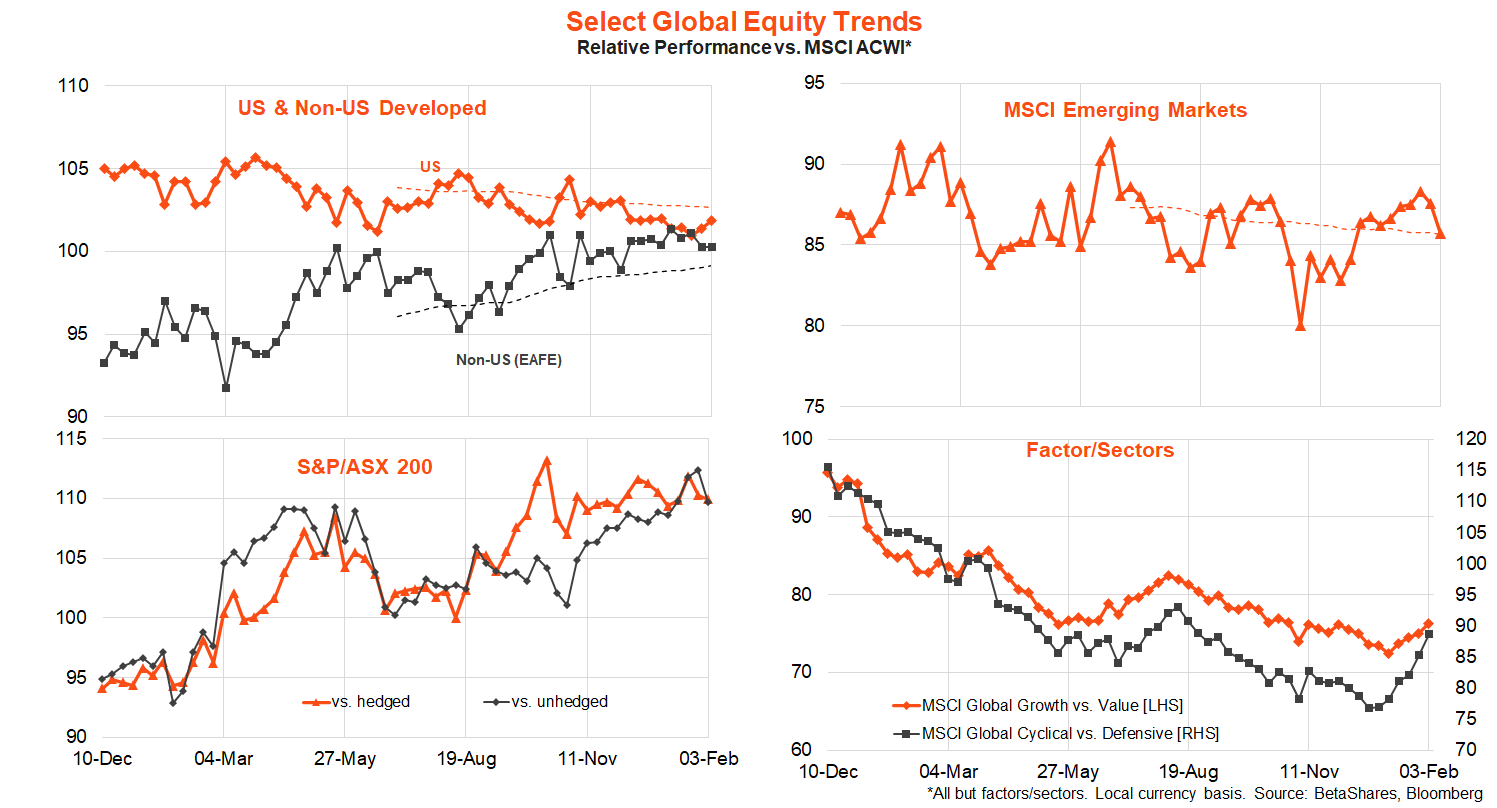

In terms of global equity themes, the risk-on/soft landing sentiment of late has supported a rebound in the relative performance of growth over value and cyclical over defensive stocks. There has also been a modest tilt back towards the US market over non-US markets.

It should be a quieter week in global markets this week, though a speech by US Fed chair Powell on Tuesday looms large. The key focus will be on the extent to which he reasserts his hawkishness to try and reign in the equity bulls – especially after Friday’s much stronger than expected payrolls report. As was evident last week, I suspect Wall Street won’t be too fazed by what Powell says, and is prepared to stick with the soft landing theme until data proves otherwise.

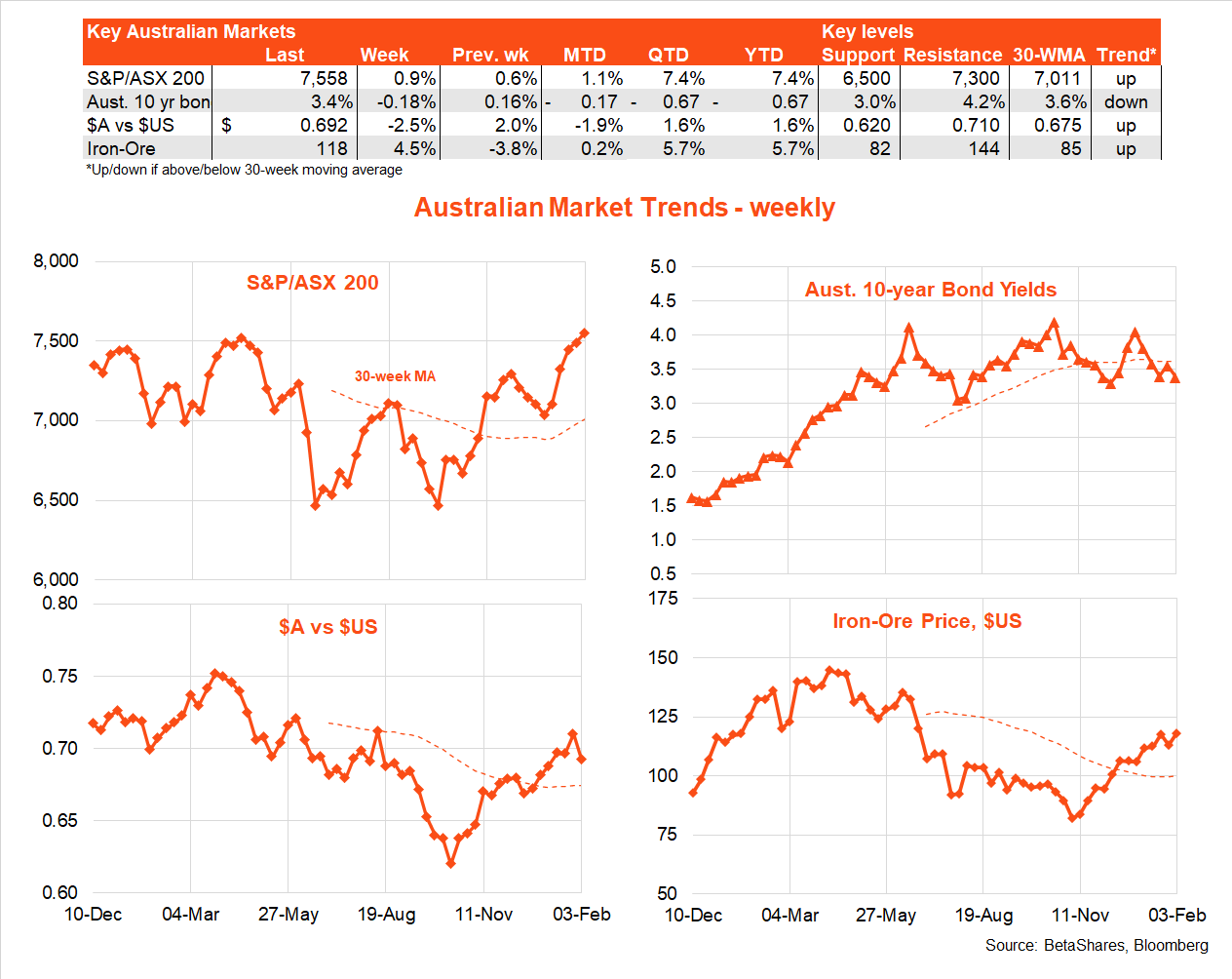

Australia

Local equities moved higher and bond yields lower again last week, continuing the trend since late last year. A much stronger than expected US payrolls report on Friday, however, dented the $A’s recent rise. Iron-ore prices are also moving higher, supported by Chinese re-opening hopes.

Last week’s economic data remains consistent with a slowing economy, though was not weak enough to rule out another RBA rate hike tomorrow. National house prices continued to fall in January, though the rate of decline appears to be moderating. Home lending also remained weak in December. Of most note last week, however, was a surprisingly large 4% slump in retail spending – though seasonal distortions due to the growing popularity of pre and post-Christmas sales could be partly to blame for the latter.

There’s little critical local economic data this week, though the RBA releases its quarterly Statement on Monetary Policy on Friday. The latter should reveal a modest downward revision to the headline inflation outlook, largely reflecting a moderation in oil prices.

Given the recent firm Q3 wage price index and a higher than expected Q4 trimmed mean CPI outcome, however, the RBA may still project uncomfortably high underlying inflation for some time – which argues against it hinting at a pause in rate hikes, much less rate cuts, anytime soon.