Reality check

5 minutes reading time

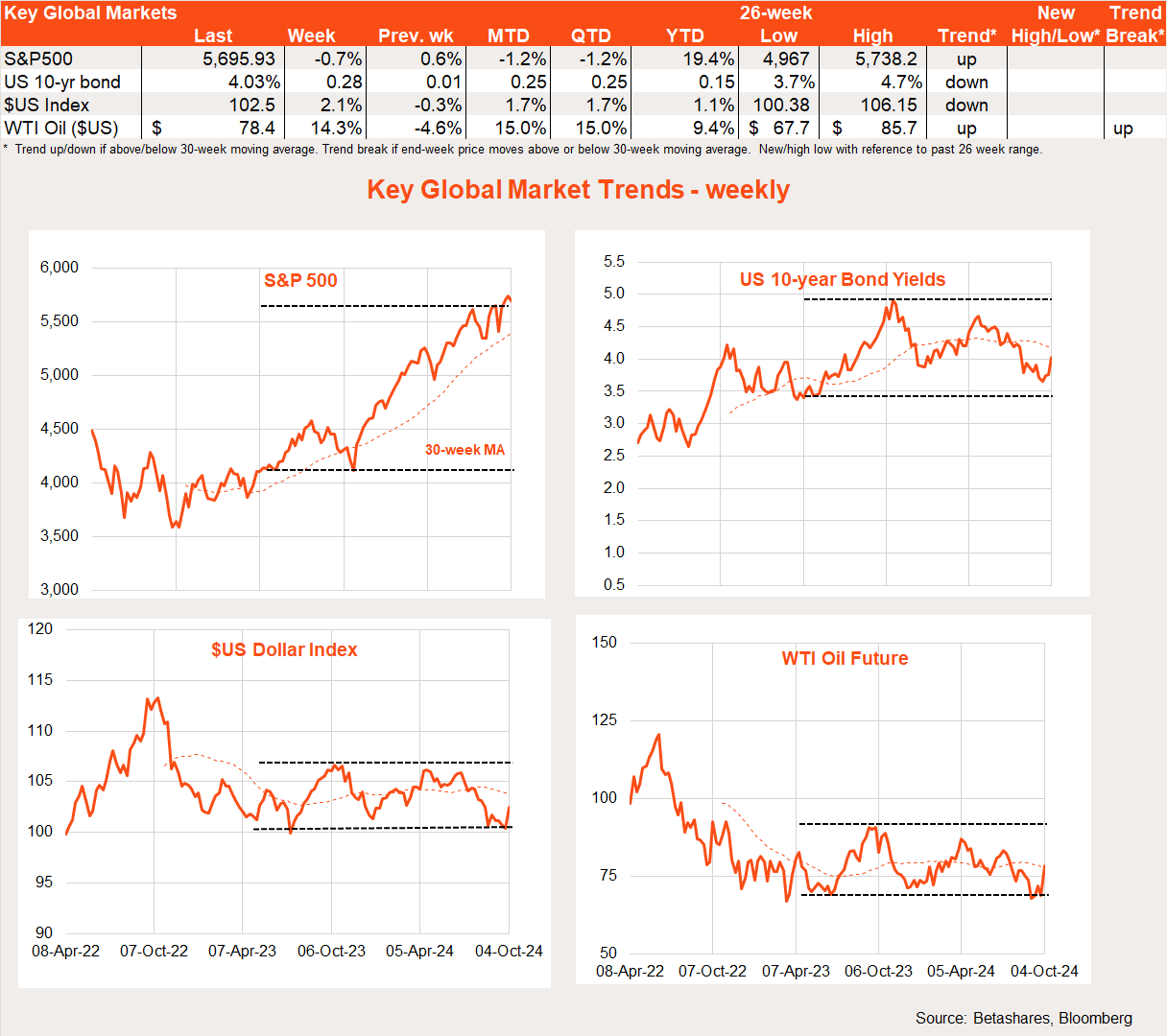

Global markets

Global equities eased back over the past week, reflecting a rise in Middle East tensions and stronger-than-expected US economic data – which, in the latter case, has scaled back near-term US rate-cut expectations.

Developments over the past week have tended to be bearish for bond markets – at least over the short term – which in turn has dented equity market enthusiasm.

For starters, the escalation of the military conflict in the Middle East (Israel’s moves into Lebanon and Iran’s missile attack on Israel) lifted the oil price further, raising the spectre of at least a short-run rebound in inflation.

Secondly, more cautious Fed rhetoric and solid US economic data – especially last Friday’s blockbuster payrolls report – has understandably scaled back hopes for back-to-back 0.5% rate cuts from the US Federal Reserve. Recent comments from Fed chair Powell, for example, indicated the Fed is in “no hurry” to cut rates quickly. Then on Friday, September jobs growth was +254k – well above market expectations of +150K – with the unemployment rate ticking back down to 4.1% (and almost 4.0%). Wage growth was also firm.

Against this backdrop, markets have scaled back hopes for a 0.5% cut at the November Fed meeting, with now an 85% chance of a 0.25% cut and 15% chance of no cut all.

One might question why the Fed is considering another cut at all! One complication is that US economic data remains somewhat mixed: while payrolls continue to boom, a range of other employment indicators (manufacturing and non-manufacturing employment indices, household employment perceptions, small business sentiment) are less robust. Provided the inflation story remains benign, the Fed is likely to keep taking out insurance against a deeper-than-desired economic downturn.

Global week ahead

A major focus this week will be the scale of any retaliation Israel inflicts on Iran in response to last week’s missile attack. Talk is swirling of a possible strike on oil – and possibly even nuclear – capabilities. The stronger the response, the greater the likely upside move in oil prices and perhaps bond yields – and downside in equity markets.

Otherwise, this Thursday’s (US time) US consumer price index report will be the global data highlight of the week – with another benign result required to keep near-term US rate cut hopes alive. The market expects headline and core CPI prices to rise 0.1% and 0.2% respectively, which would see annual rates of both inflation measures continue to ease.

We also have an array of Fed speakers giving their thoughts on policy through the week – and producer prices on Friday.

Also of note, the Q3 US earnings reporting season kicks off on Friday, with several major Wall Street banks (as usual) opening the batting. According to FactSet, analysts’ earnings downgrades have been a little larger than usual in the lead-up period, though the percentage of companies offering negative earnings guidance has been a little lower than average. All up, earnings are currently expected to grow by 4.2% on year-ago levels.

Elsewhere, the Reserve Bank of New Zealand meets tomorrow, with markets increasingly confident it will cut by 0.5% in the wake of continued economic weakness and easing inflationary pressures. I agree! Indeed, the start-of-the-year call for a 1% cut in NZ rates this year is looking good.

Market trends

The most interesting development in global equity markets of late has been the Chinese stimulus, which has helped produce a nice pop higher in emerging market equities. The energy sector is also benefiting from the rebound in oil prices in the wake of heightened military tensions.

That said, the major global market theme – the ‘soft landing’ miracle – remains in place, and could be starting to benefit cheaper areas of the market beyond US large-cap technology stocks.

Indeed, there appear to be increased signs of a waning in the growth/quality/technology trend of outperformance, though this has yet to clearly favour global small-caps and/or clearly dis-favour the US market overall.

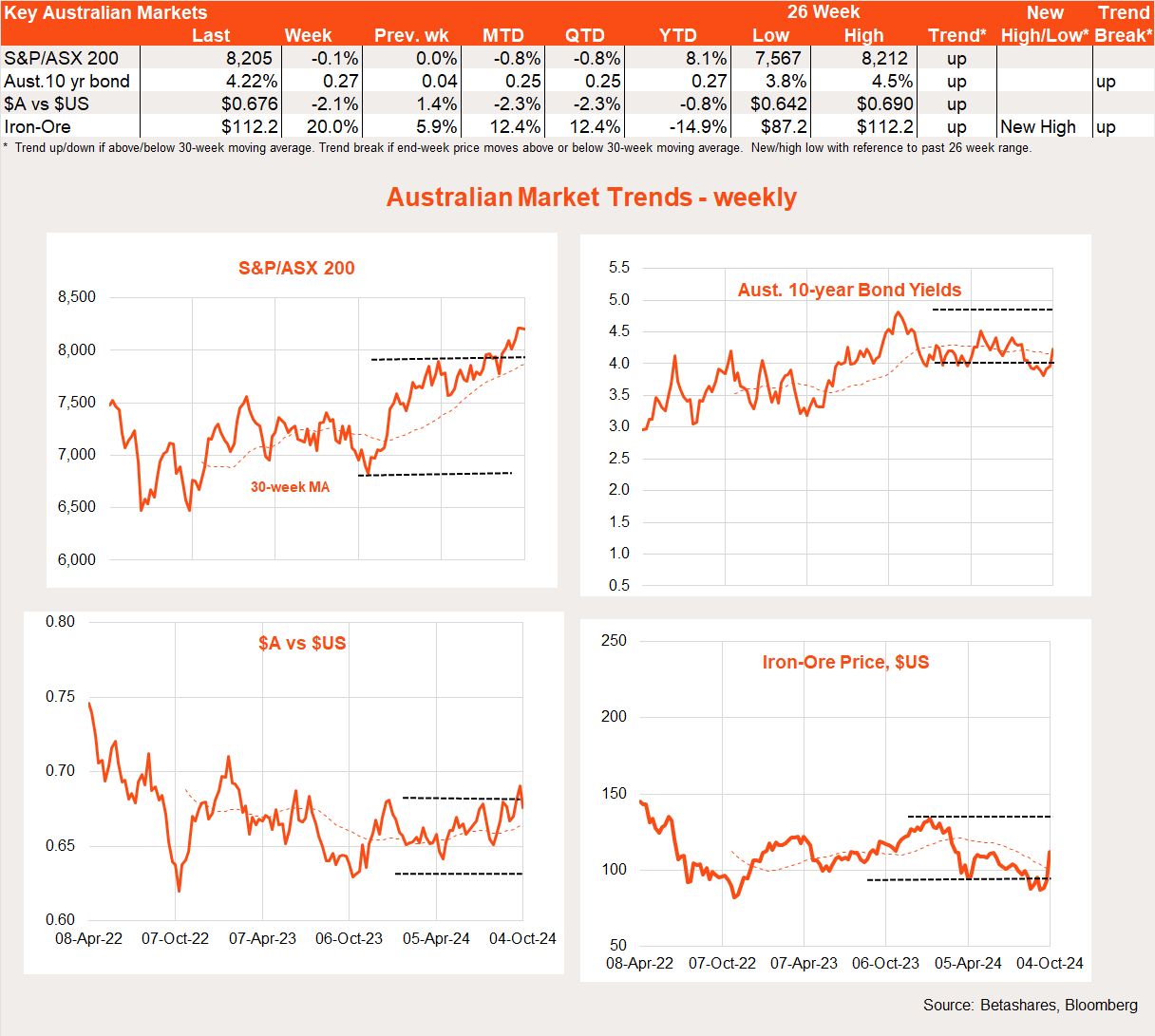

Australian market

The local S&P/ASX 200 index has also edged back over the past week, with mixed local data doing little to increase the chances of an RBA rate cut any time soon.

Local data of interest in the past week included September house prices, which remained firm overall though with stronger growth in the cheaper markets of Adelaide, Perth and Brisbane relative to Melbourne and Sydney. In further bleak news for housing supply, home building approvals dropped 6% in August and remain in the doldrums.

August retail sales were stronger than expected, with a 0.7% gain (market +0.4%), though this followed a soft 0.1% gain in August. Overall, therefore, it’s still hard to conclude whether there’s been much boost to consumer spending from the July tax cuts.

Local highlights this week includes minutes to the recent RBA policy meeting this afternoon, and Westpac’s and NAB’s surveys of consumer and business confidence. We already know consumer confidence enjoyed a nice 6% bounce in October, which could reflect tax cut effects and reduced fears of an interest rate hike. Consumer confidence could finally be picking itself off the canvas.

Tomorrow we’ll learn if business sentiment – which has dropped to just below long-run average levels – continued its weakening trend in September.

Have a great week!