Fed meeting recap: hawkish quarter point rate cut

4 minutes reading time

- Technology

The Nasdaq 100 has grown to be one of the most widely recognised indices in the world. Measuring the performance of the 100 largest non-financial companies listed on the Nasdaq exchange, the index has become synonymous with the world’s largest technology companies including Apple, Microsoft, and Google.

While its early notoriety came in the late 1990’s during the dot-com bubble, which was characterised by unjustified valuations for unprofitable technology companies, the Nasdaq has since evolved into an index comprising global businesses with strong fundamental growth supporting their impressive returns.

We delve into three facts about the Nasdaq 100 that might surprise you.

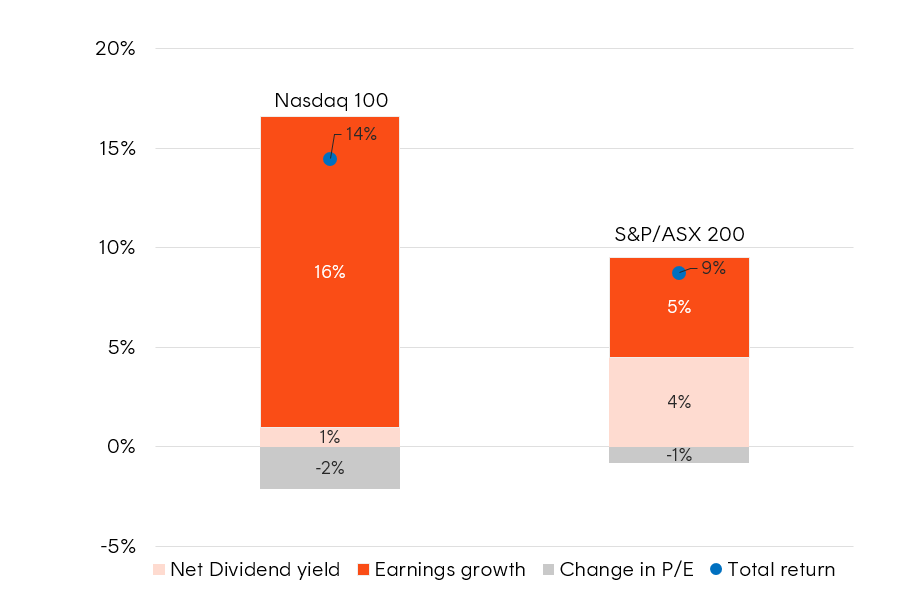

1. Fundamentals have driven the long term performance of the Nasdaq

While the Nasdaq 100 Index is trading at all-time highs, returns have been driven by strong growth in underlying earnings.

The below decomposition of the Nasdaq 100’s return over the past 20 years shows that on average the annual earnings growth of the underlying companies has been 16% p.a. Over the same period the Nasdaq index returned on average 14% p.a. This means the price to earnings ratio actually fell by 2% p.a. on average over this period.

Source: Bloomberg. 20 years to 31 December 2023. P/E is trailing 12-month P/E. You cannot invest directly in an index. Past performance is not an indicator of future performance.

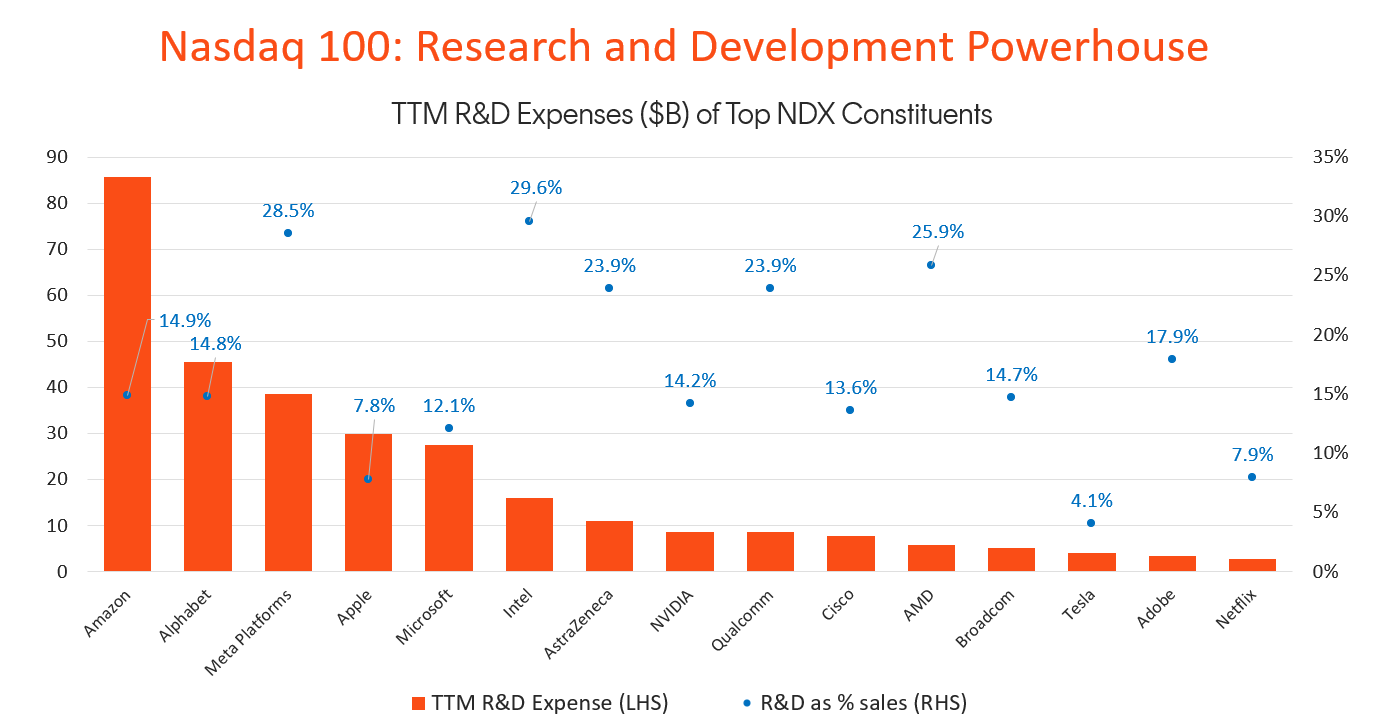

2. The largest Nasdaq constituents are the biggest R&D spenders

In order for companies to innovate and grow in the 21st century, investment in research and development (R&D) is crucial.

The largest 15 companies on the Nasdaq are the biggest R&D spenders, allocating an average of 16.9% of their revenues to R&D over the past 12 months1. It has been this spending on innovation in areas like enterprise, cloud computing, cybersecurity, and more recently AI that has ultimately led to underlying growth.

Source: Nasdaq Global Indexes, Bloomberg. Data as of 27 February 2024.

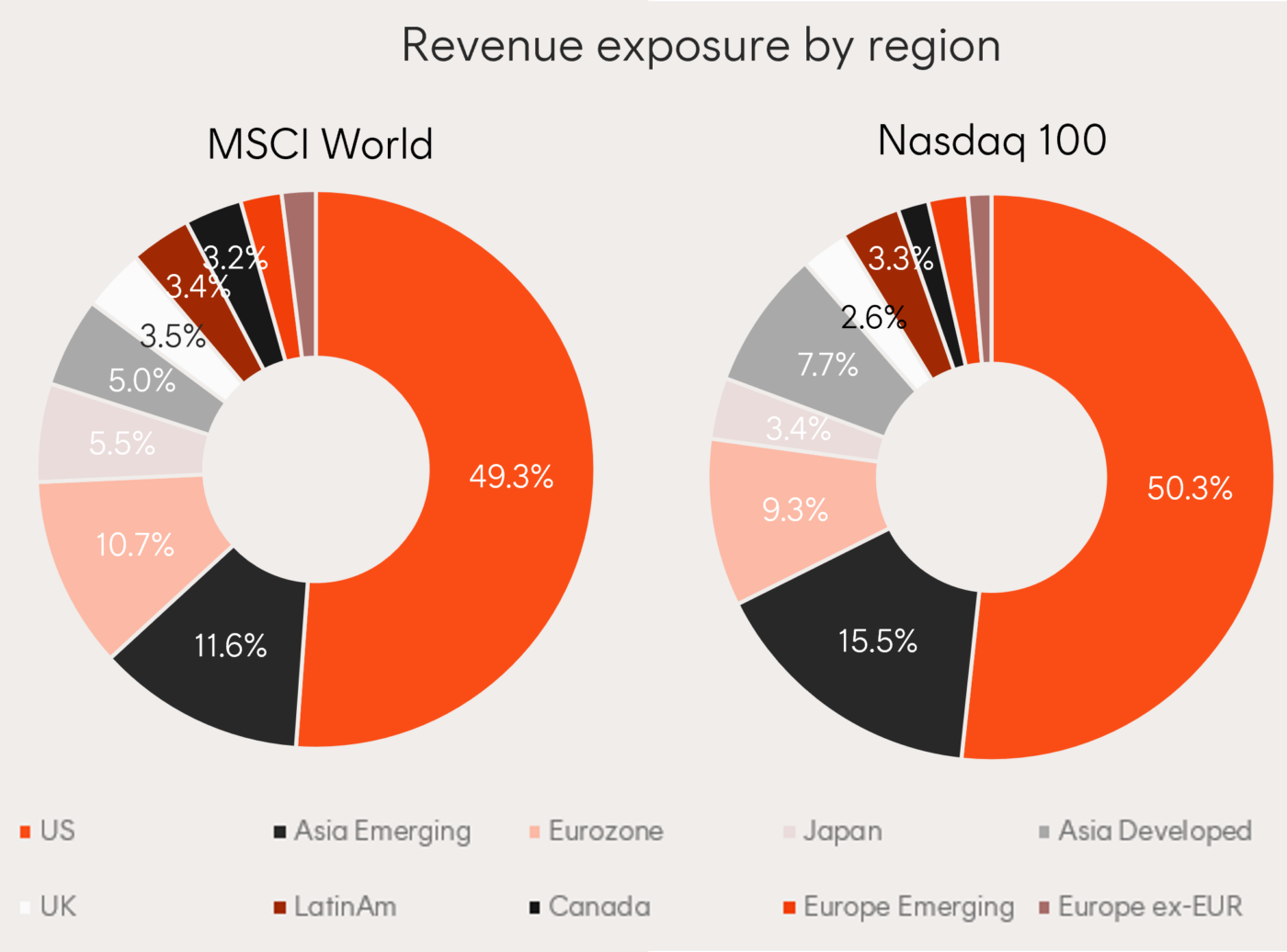

3. The Nasdaq 100 is not just a US index

Six Nasdaq stocks now boast market caps well over US$1T, raising questions whether US economic activity can support the ongoing growth of such giants. However, Nasdaq companies should not be seen as US centric businesses. With scalable platforms that transcend national borders, Nasdaq companies generate revenue from a globally diverse customer base.

Source: Morningstar, data as at 31 January 2024.

This is evident looking at the revenue source by country of the Nasdaq 100 (on the left) with a very similar split to global equities (as shown for the MSCI World benchmark on the right). This proportion of non-US revenue share has increased over time for the Nasdaq 100, and is now far greater than the S&P500 non-US revenue share of only 40%.

How to gain exposure to the Nasdaq

You can get access to NDQ Nasdaq 100 ETF in a single trade on the ASX.

QNDQ Nasdaq 100 Equal Weight ETF now offers Australian investors more ways to access the innovative companies on the Nasdaq exchange.

QNDQ Nasdaq 100 Equal Weight ETF aims to track the performance of the Nasdaq 100 Equal Weighted Index (before fees and expenses), providing exposure to 100 of the largest non-financial companies listed on the Nasdaq, with each holding in the Index weighted equally.

Source:

1. Nasdaq. As at 27 February 2024. ↑

1 comment on this

I am one who has made decent money on the Nas 100. I moved to Gold as when this oncoming correction occurs, most of the Nas 100 profits will be blown away. IMO, look at what is happening in the USA. When the USA gets a Cold, Australia will get the Flu in economic say.