Charts of the month: March 2025

7 minutes reading time

Congratulations! You’ve just bought a home. No small feat in today’s environment. Even better, you’ve been responsible with your purchase and have $500 to spare in your budget each month. So do you:

- Increase your mortgage repayments by $500, or

- Invest that money in the sharemarket?

Let’s look at a couple of hypothetical scenarios to work it out.

But first, our assumptions

In order to make a comparison, let’s make the following assumptions for both our scenarios:

- A starting balance on the mortgage of $624,000. This was the average mortgage amount across Australia at the end of 2023[1].

- An interest rate on the mortgage of 6.18%. This was the average mortgage rate in Australia at the end of 2023[2].

- A 30-year loan period.

- A minimum repayment of $3,814 per month. This is the minimum repayment, given the above assumptions.

- Investment is via low cost ETFs with a 50/50 mix of Australian and international share exposure.

- A nominal pre-tax return on shares of 8.55% p.a. This was the average annual return on global equities (shares) between 1951 and 2015[3].

- An effective tax rate of 15.9%, resulting in an after-tax return of 7.2% p.a.*

- ETF management fees average 0.06% p.a. assuming a 50/50 mix of a broad-based low cost Australian shares ETF and a broad-based low cost global shares ETF.

- All dollar amounts are in nominal terms, unadjusted for inflation.**

Scenario 1 – Careful Cathy

Careful Cathy wants to pay off her mortgage as soon as possible. She doesn’t like having the debt hanging over her and hates paying interest to the banks. So rather than paying the minimum $3,814, she starts making repayments of $4,314 per month. In doing so, each $500 in additional monthly payments goes to principal and saves interest at 6.18%. (pre-tax), which has a compounding effect. This saves Cathy thousands of dollars in interest and reduces the length of the mortgage.

Thanks to Cathy’s diligence, she pays her mortgage off after 266 months, or just over 22 years. Over that time, she made a total of $1,147,363 in repayments, which meant she paid off her mortgage 94 months early, saving her $225,378 in interest.

Once her mortgage is paid off, she has an extra $4,314 each month that she can use. But being the diligent person she is, she decides to put that extra cash into shares. Cathy decides to invest that cash in the same way as Sally (in Scenario 2) – being a 50/50 mix of Australian and international shares, via low cost ETFs.

After nearly eight years of investing her money in the share market each month, she’s accumulated a balance of $541,562, of which, $135,885 was investment returns.

So after 30 years, she’s got no mortgage outstanding and has over $540,000 sitting in her portfolio. Cathy is very pleased with this outcome!

Scenario 2 – Share Market Sally

Sally, on the other hand, loves investing in ETFs. She decides to invest her extra $500 per month in the same way as Cathy – a 50/50 mix of Australian and international shares, via low cost ETFs.

Because she’s only making the minimum repayment, it takes Sally the full 30 years to finish paying off her mortgage. Over that time, she made a total of $1,372,740 in repayments, which included $748,740 of interest repayments – $225,378 more than Cathy.

But wait! Sally has exposure to shares that she’s been building up over the last 30 years. Her investments may have been smaller, but her portfolio has had much longer to compound. So how’s that doing?

Over this 30-year period, Sally has invested $180,000 in ETFs. But through the power of compounding, she’s received investment returns of $447,107, leaving her with $627,107 in her portfolio.

The results

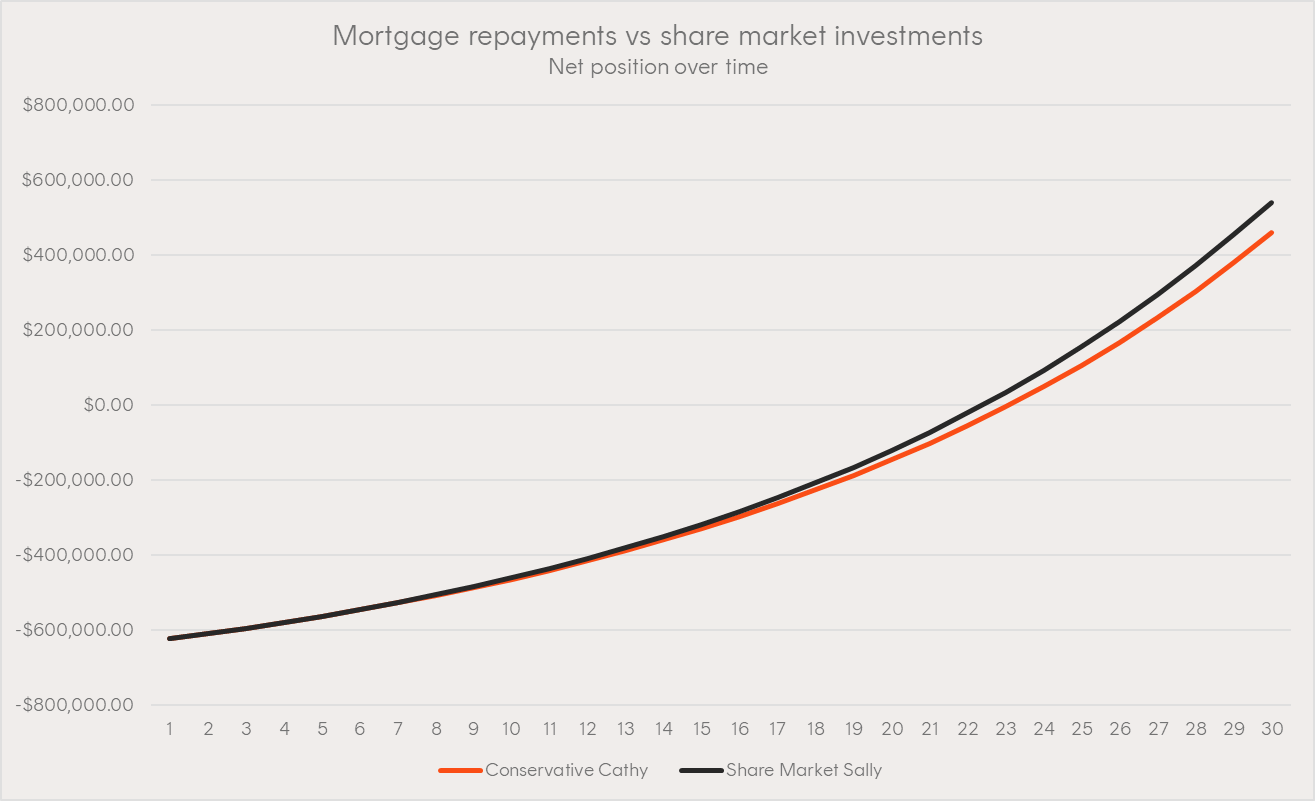

At the end of all this, both have fully paid off their mortgages, but Share Market Sally has over $85,000 more in her portfolio. The chart below shows how their respective positions grew over time.

Source: Betashares. Hypothetical example provided for illustrative purposes only. Not a recommendation to invest or adopt any investment strategy. Actual results may differ materially.

A few final considerations

While in this hypothetical, Share Market Sally came out ahead, real life is not as simple.

Firstly, the two options are not mutually exclusive. The examples are considered separately here for the purpose of comparison, but there’s no reason someone couldn’t do a mix of both.

We’ve also used current average interest rates, which can change over time. And while 7.2 percent p.a. might be a reasonable long-run return to expect from shares, the actual outcomes will depend on how investors construct their portfolios, and the market’s future performance. Also, the outcome will be different if the investor is subject to a higher effective tax rate.

There is also the option of making additional super contributions, allowing our hypothetical investors to put their extra cash to work within the super system. There are tax concessions available for investing in super which could make this an attractive option to build long term wealth, but there are also rules around contributing to super that Cathy and Sally would need to consider. However, the logic explored in the hypotheticals above still applies whether the investments are made inside super or not.

Another important factor to consider is risk. This is a simplified example, but in real life, Sally and Cathy’s returns from shares should be expected to be volatile (i.e. vary up and down), while Cathy’s additional mortgage repayments are risk-free.

When all is said and done, there’s not just a single correct answer as to the best option. An investor’s risk tolerance, investment goals and time horizon all need to be considered. But now you know the important factors to consider when making this decision for yourself. You may also want to consider seeking personalised advice from a financial adviser or tax professional.

* Underlying assumptions for effective tax rate:

- 34.5% marginal tax rate (including 2% Medicare levy).

- 50% CGT discount.

- 82.5% franking on distributions from a broad-based Australian shares ETF.

- A 5% distribution a broad-based Australian shares ETF.

- A 2% distribution (unfranked) on broad-based global shares ETF.

- A franking credit percentage of 35.29%.

- A foreign tax offset percentage of 15% for a broad-based global shares ETF.

**Inflation impacts the value of money. Returns can be thought of in ‘nominal’ or ‘real’ terms. The nominal return is the actual rate in percentage terms. The real rate of return is the nominal return less the inflation rate. Nominal figures have been used in this article as the examples are for illustrative purposes only. The impact of inflation on future projections would be greater for Sally than Cathy given the longer timeframes involved for both the mortgage payments and the share investments as compared to Cathy.

This article has been prepared by Betashares Capital Limited ABN 78 139 566 868, AFSL 341181 (Betashares). The information is general in nature only and does not take into account any person’s financial objectives, situation or needs. Investors should consider its appropriateness taking into account such factors and seek financial advice. It is not a recommendation to make any investment decision or adopt any investment strategy.

Investments in Betashares Funds are subject to investment risk and investors may not get back the full amount originally invested. Future outcomes are inherently uncertain. Actual outcomes may differ materially from those contemplated in any opinions, estimates, assumptions, projections and opinions or other forward-looking statements contained in the article.

References:

1. Source: ABS ↑

2. Source: ASIC Money Smart ↑

3. Source: Jordà, Òscar, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, Alan M. Taylor. 2017. “The Rate of Return on Everything, 1870–2015” Federal Reserve Bank of San Francisco Working Paper 2017-25. Page 13. ↑

16 comments on this

The big sleeper is how can we continue to find returns above 7% given that this equates to a doubling every 10 years. A couple who retiree in their mid 60s with $1 million in investments and a pension may conceivably end with $8 million + property value when their estate is wound up in the 2050s doing nothing at all and living comfortably on the pension. How could this be when we readily acknowledge that young people have no prospect of owning a home. Something is askew when loafers earn $10 million and workers are skint.

Thanks for the comment Patrick

why haven’t concessional/non-concessional Super contributions and offset mortgage/bank accounts been factored in to their considerations?

Hi Frank,

Any additional savings kept in an offset account have the same effect on interest charges as making additional repayments. So all else being equal, you could treat these the same.

The hypothetical examples we explored above are supposed to be illustrative, not comprehensive. The goal is to show people the key factors they should be considering, rather than show every possible scenario. Investing within a superannuation structure would affect the effective tax rate of course, which would in turn affect the question as to which is the better option for that investor. But in this example, we were looking at investing outside the super system.

We might look at an example of investing inside super vs outside super at some point in the future, so keep an eye out.

Cheers,

Patrick

Hi there,

Does either of the strategies factor in debt recycling?

Hi Rob,

No we did not factor in debt recycling into the projections. A bit too complex and too many assumptions involved for the scope of this article.

We might look into it in a future article though, so keep an eye out!

Cheers,

Patrick

Patrick

Did you factor in closing CGT liabilities for Cathy and Sally?

Hi Jon,

CGT was factored into the after-tax returns throughout the projection rather than as a lump sum at the end. The tax calculations were reviewed by our internal tax expert.

I would note however, that the tax rates are dependant on the assumptions used. For someone on a different marginal tax rate, or who made the investments through a concessional structure (e.g. superannuation), the outcomes would be different. Other variables to consider are amount of the capital gains that are discounted, the level of distributions and franking credits, and the credit from foreign tax paid. This is almost certainly not an exhaustive list either!

It’s important to consider your own situation, and best to consult a financial advisor and/or a tax advisor. But hopefully you’ve got a better understanding now of how to think about this question.

Cheers,

Patrick

Want to make God laugh? Tell him your 30 year plan !

Best thing Cathy and Sally can do is eat well do plenty of exercise and stay off the booze and cigarettes. Health is key. Mortgage? ETF’s? Mix if both? Who cares? If you’re lucky enough to be healthy $85K over 30 years won’t be relevant

No disagreement there Harry! Health is the most valuable thing we have.

But the two aren’t mutually exclusive. And if Cathy and Sally avoid drinking and smoking, it might free up some cash to put towards their mortgage or investment portfolio!

Cheers,

Patrick

Hi Patrick,

Great article – I have also wondered a third scenario.

They begin as share market sally for first 5-7 years to get the compound snowball rolling then switch to paying off the mortgage early like careful Cathy while they let the shares continue to compound.

What is the likely outcome then?

Harry’s comment makes a lot of sense. All parties use sophisticated marketing to achieve their own motives. I am retired, lucky to have what I have, through hard work. I have invested in ETF’s and glad to have done so.

Would appear Sally didn’t have her ‘portfolio’ in EFT’s returning less and less but still remaining at the mid to low teen in value. Beta Harvest being the best example of that.

Hi Alan,

The scenarios in the blog assume a rate of return for broad-based Australian and international shares, rather than from an income focussed equity strategy such as the HVST fund where income returns may account for the majority, if not all, of the strategy’s total returns.

If you have any further questions or issues relating to Betashares products, feel free to contact us by emailing [email protected].

Cheers,

Patrick

Love it Patrick. Invest the booze and bunger money! Talk about win win !

Could someone please explain this last point, ‘a foreign tax offset percentage of 15% for a broad-based global shares ETF.’