Another hawkish cut?

5 minutes reading time

- Global shares

Global markets – week in review

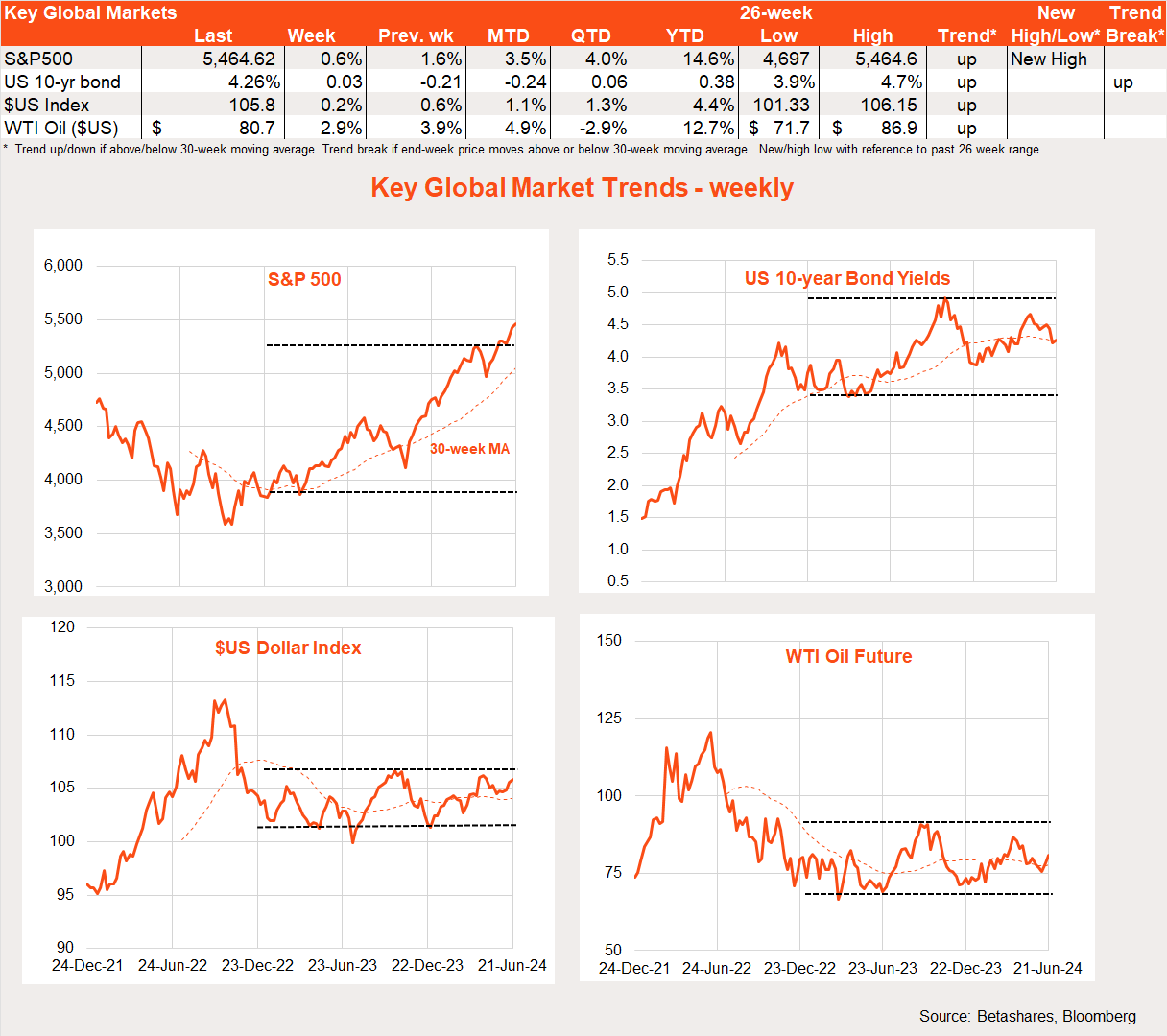

Global stocks inched further ahead last week as soft US retail spending supported hopes for eventual US rate cuts.

There was limited key global data last week, with the highlight being US retail spending which surprised on the soft side. Headline spending rose only 0.1% in May, partly reflecting weaker petrol prices – though spending was also soft in a range of other areas. All up, the result provides further tentative evidence that the US consumer juggernaut may be slowing.

Key Chinese monthly data was mixed, with better-than-expected retail spending in May though weaker-than-expected industrial production and fixed-asset investment. In short, China’s economy continues to muddle along. Also muddling along is the New Zealand economy, with a better-than-expected – though still soft – 0.2% gain in Q1 GDP, which at least suggests the economy is dragging itself from outright recession.

The week ahead

By far the major global highlight this week will be the May US private consumption expenditure (PCE) deflator – the Fed’s preferred inflation measure. After benign consumer and producer price index reports for May, markets are now expecting a very encouraging 0.1% gain for the core PCE on Friday. If realised, this would pull down annual core inflation from 2.8% (where it has been stuck for three months) to 2.6%.

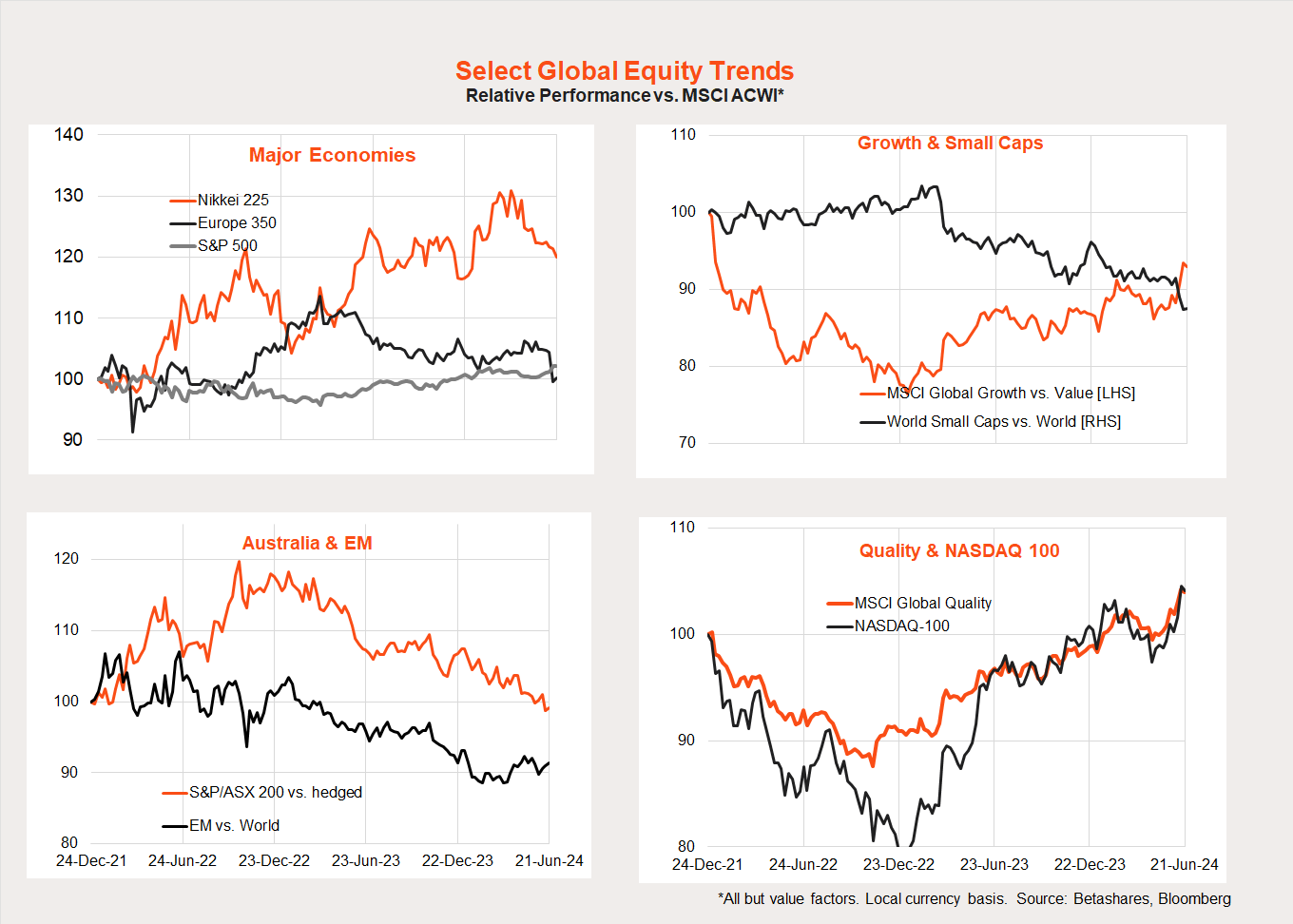

Global equity trends

Looking at global equity trends, the story remains the same. The equity rebound and ongoing AI infatuation continue to favour growth and quality over value, and as a result exposures such as the Nasdaq 100 and the Betashares global quality ETFs (QLTY and HQLT).

Japan is enduring a relative performance correction after earlier strong gains, while Australia and global small caps continue to underperform. European stocks slumped last week following France’s decision to hold a snap election in the face of far right political gains in EU voting. Emerging markets relative performance is meandering in a sideways range.

Australian markets

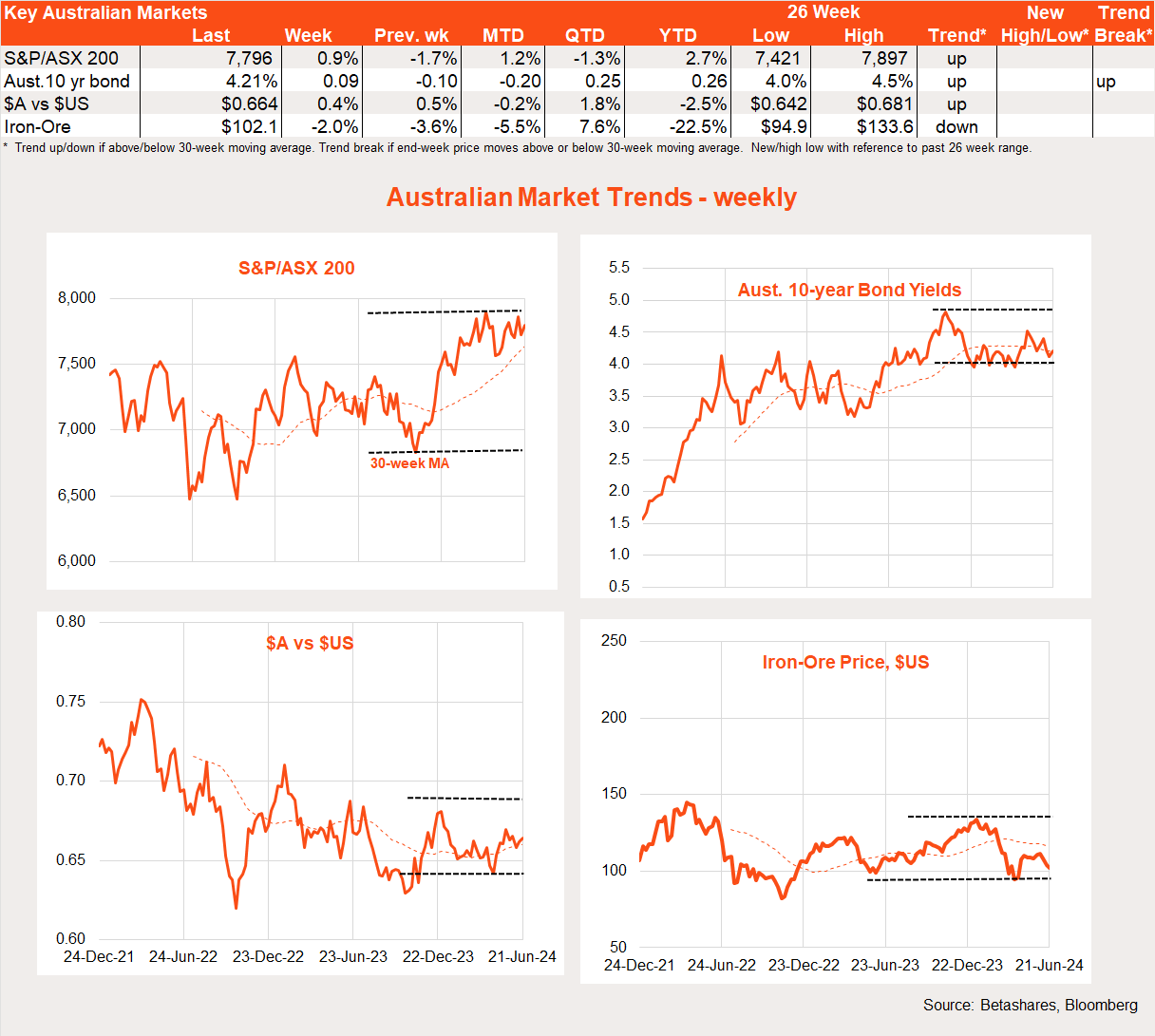

The S&P/ASX 200 managed to rebound an impressive 0.9% last week after a 1.7% drop the previous week – despite weaker iron ore prices and hawkish rhetoric from the Reserve Bank.

The highlight last week was the RBA meeting and press conference by Governor Bullock. While rates were left on hold, the tone of the commentary suggested the Bank was increasingly nervous about the levelling out in annual inflation in recent months at still too high a level.

The Governor pointed to the June quarter CPI at the end of next month as an important source of new information – so much so that it raises the risk (at least in my mind) that the Bank could lift interest rates at the next meeting in August if that inflation result is higher than expected.

How high? My line in the sand would be a trimmed mean quarterly gain of around 0.9% or more – as that would result in the Q2 annual trimmed mean inflation outcome being higher than the RBA’s 3.8% May forecast. If the RBA is forced to revised up its longer-term inflation forecasts in the August Statement on Monetary Policy, it may feel under pressure to raise interest rates at the same time. All up, I attach around a 40% chance to an August rate rise, as I’m counting on a trimmed mean quarterly price gain of only 0.7% (resulting in an annual gain of 3.8% – in line with the RBA’s latest forecast).

Adding to the RBA’s challenge, ANZ Jobs ads dropped a further 2% in May to be down 18% over the year. Although ads remain above their long-run average level, their notable decline from their peak is consistent with easing labour market pressures, which could give the RBA a bit more comfort over the medium-term inflation outlook.

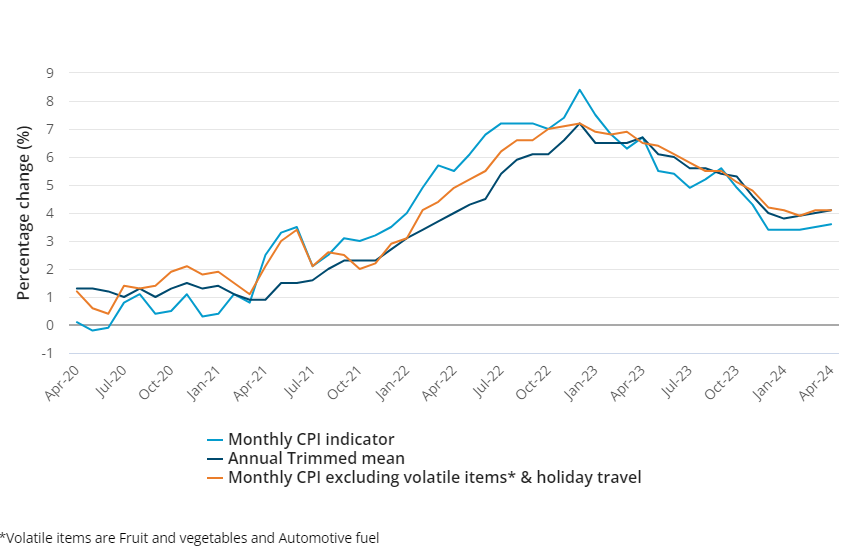

Against this backdrop, the local highlight this week will be the May monthly CPI report on Wednesday. I’m still unconvinced this patchy piece of price information provides more signal than noise each month – but now that it’s official, we’re left to analyse its entrails every four weeks.

Given a 0.4% decline in the non-seasonally adjusted May CPI last year, it will be hard for the annual rate of headline CPI inflation not to lift this week from its current rate of 3.6%. The market expects a lift to 3.8% (which could shock some) though it still implies a 0.2% decline in prices during the month.

Perhaps more signal will come from the underlying measures (annual trimmed mean and the CPI excluding volatile items and holiday travel). As evident in the chart below, annual inflation in these measures has moved sideways so far this year. Accordingly, if this week’s report continues to show them moving sideways (or even up) it would likely be discomforting for the RBA, while signs of a decline would be encouraging.

Monthly CPI Measures (YOY% change)

Source: ABS

We also get the official quarterly estimate of Q2 job vacancies on Thursday, which are likely to decline further – further confirming a softening in the labour market.

Have a great week!

1 comment on this

Our RBA will move to lower rates, and Only, only, after the FED makes its move.