2 minutes reading time

Reading time: 3 minutes

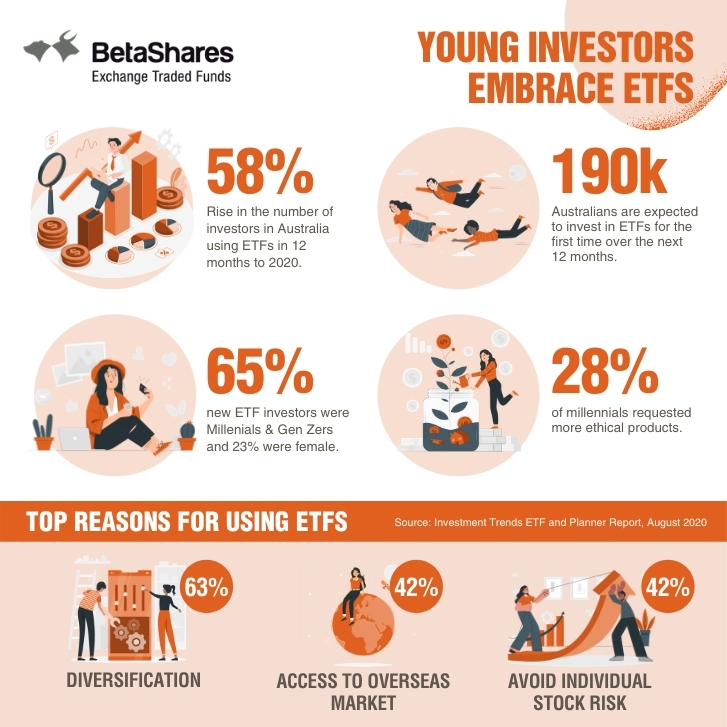

The groundswell of millennial investors is here to stay, with those under the age of 40 accounting for around two thirds of new ETF investors in 2020.

The twelfth annual BetaShares/Investment Trends ETF Report provides a unique snapshot of the key statistics and drivers in the Australian ETF industry.

The report shows ETF adoption was at a record high in 2020, particularly among younger investors.

The insights collected from this research are based on responses from around 8,000 investors and 800 advisers, making it the most comprehensive survey of the ETF industry in Australia.

First-time investors are becoming younger and younger

The average age of the ETF investor continues to fall, as first-time investors increasingly are made up of those under the age of 40.

This continues a long-term trend and demonstrates that the wealthier early SMSF adopters of ETFs are now joined by younger Australians, who are also turning to ETFs to help them achieve their financial goals.

Diversification remains the biggest reason for using ETFs, with 63% of investors reporting this as their top reason for investing. Other popular benefits mentioned by respondents include access to specific overseas markets (42%), avoiding the risks of individual stock exposure (42%), and efficiency (39%).

Australian equities and ESG in high demand

The top three investments that ETF investors sought in 2020 following the onset of the COVID-19 pandemic were:

- High growth ETFs, which 26% of investors ranked as the most desired ETFs after COVID hit

- Sector specific ETFs (24%)

- Global equities, which one in five (22%) investors looked to for their ability to provide diversification and access to companies not found in Australia.

Socially responsible products are also in high demand, particularly among younger investors, with over one quarter (28%) of millennials requesting more socially responsible investment products, compared to 20% of all current ETF investors.

More new ETF investors are on the horizon

The total number of ETF investors rose by 58% from 455,000 to 720,000 in the 12 months to August 2020.

Looking ahead, a further 190,000 Australians are expected to invest in ETFs for the first time in 2021, the biggest potential cohort of first-time ETF investors on record.

If the proportion of new ETF investors represented by millennials and Gen Z-ers remains consistent with the pattern observed since the start of the pandemic, more than 120,000 of these first time ETF investors will be under the age of 40.

The Australian ETF industry’s strong growth in 2020 has continued into 2021.

After breaking the $100 billion assets under management milestone in March 2021, the industry has powered ahead in April and May, assisted by strong sharemarket gains, higher than average net flows, and another large unlisted fund conversion on Chi-X.

BetaShares believes the Australian ETF industry is on track to hit $120 billion in FUM by the end of 2021.

1 comment on this

How can I have access to the full report?