5 minutes reading time

The transition from fossil fuels to clean energy technologies, such as renewable energy generation and electric vehicles, is critically dependent on a select group of Energy Transition Metals (ETMs).

Investors can now consider the Betashares Energy Transition Metals ETF (ASX Code: XMET), which aims to track the performance of an index (before fees and expenses) that provides global exposure to producers of a range of ETMs – copper, lithium, nickel, cobalt, graphite, manganese, silver and rare earth elements – as well as other companies involved in the recycling and processing of these raw materials.

Electricity demand and the shift to clean energy technologies

The energy transition requires enormous change to our economy and trillions of dollars in infrastructure spending over the next three decades.

Power generation is the largest emitter of CO2, but what is perhaps underappreciated is that direct fossil fuel use in buildings, by industry and by transport is responsible for over a third of total greenhouse gas (GHG) emissions. One of the key requirements of the energy transition is the ‘electrification of everything’, including home heating, the way we cook food, in industrial processes and the cars we drive.

For example, in 2021, 6.5 million new electric vehicles (EVs) hit the road. Bloomberg forecast this number will jump to 39.5 million in 2030.

This shift towards electrification plus a rising middle class in developing countries is expected to increase global electricity demand by more than 200% by 2050. Not only must existing fossil fuel generation be replaced with renewables for decarbonisation, but additional renewable generation is required to triple overall electricity supply.

Shifting to renewables and EVs also creates a need for massive investment in supporting infrastructure. For reliability of the grid, where renewable generation can depend on the sun or wind, we will need to build more battery storage and invest heavily in long-distance transmission networks. To support adoption of EVs in the US, the Biden administration has announced it is going to build a network of 500,000 charging stations.

Identifying the key Energy Transition Metals

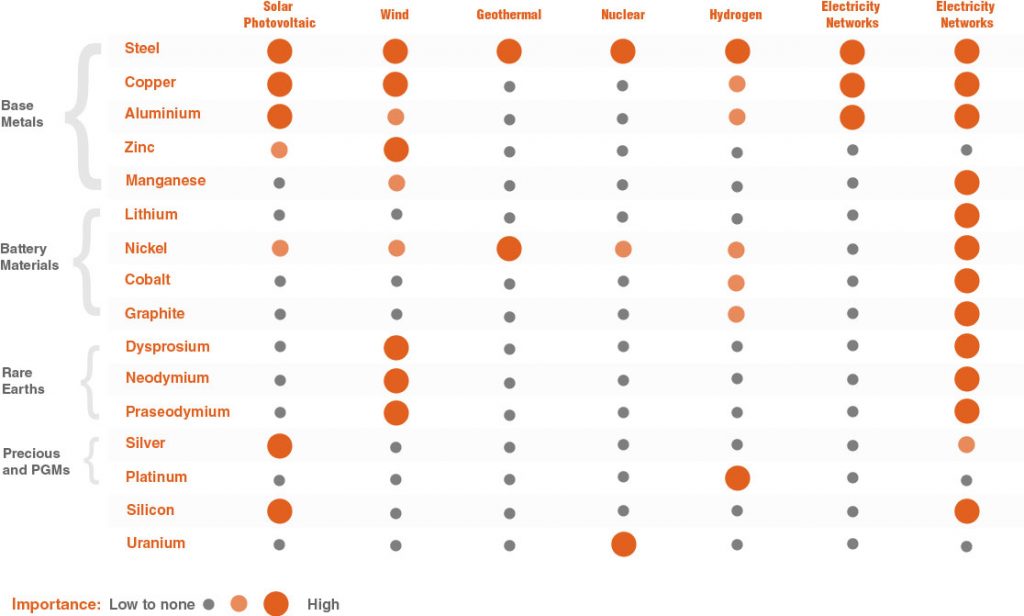

While clean energy technologies avoid the need to burn fossil fuels to generate energy, significant raw materials are needed to build the infrastructure of the energy transition. As shown in the chart below, the types of metal and mineral resources used vary by technology.

Source: McKinsey, Sprott.

While steel and copper are of high importance to almost all technologies, the use case for focuses on EVs (and stationary storage), rare earths are vital for wind turbines and EVs, and silver is used in solar PV cells.

It’s important to consider whether the adoption of clean energy technologies will cause an increase in the overall demand for a particular metal. For example, an EV requires significantly more copper, manganese and other battery materials than a conventional car.

ETMs are the raw materials that are essential to the transition to a less carbon-intensive economy. The ETMs identified within XMET’s index methodology are copper, lithium, nickel, cobalt, graphite, manganese, silver and rare earths.

These ETMs:

- have no viable substitutes if society wants to scale clean energy technologies

- are projected to experience a significant increase in demand

- are likely to be constrained by available reserves, mine development lead times or processing complexities, and

- are viewed as strategically important to nation states

Many industry analysts forecast exceptionally strong increase in demand for these ETMs between today and 2050. According to the International Energy Agency (IEA), 2040 demand for lithium will be ~13 times 2020 demand based on current government policies (the Stated Policies Scenario) and could be up to ~42 times 2020 demand based on Paris Agreement-aligned adoption of clean energy technologies (the Sustainable Development Scenario).

Source: International Energy Agency, May 2021. Demand from non-energy sector use of ETMs was assessed using historical consumption, relevant activity drivers and the derived material intensity. *Neodymium demand is used as indicative for rare earth elements. Stated Policies Scenario is an indication of where the energy system is heading based on a sector-by-sector analysis of today’s government policies and policy announcements; Sustainable Development Scenario indicates what would be required in a trajectory consistent with meeting the Paris Agreement goals. Actual outcomes may differ materially from projections.

The Betashares Energy Transition Metals ETF (ASX Code: XMET)

One way to invest in the energy transition is through the producers of the raw materials that are essential for renewables, EVs and other clean energy technologies. XMET offers Australian investors global exposure to mining companies and producers of a range of ETMs, as well as other companies involved in mining, exploration and recycling of these metals.

XMET’s index focuses on ‘pure play’ mining companies and producers that have at least 50%1 of their revenue generated from one of the eight key ETMs. Also included are diversified ETM producers, pre-production ETM mining companies and other companies involved in the recycling and processing of these raw materials.

Companies will not be included in XMET’s index if their revenue from certain business activities (such as oil and gas production and thermal coal extraction) exceeds a defined materiality threshold, if they are non-compliant with the UN Global Compact principles, or if they have a controversy rating of ‘Severe’.2

Companies that produce ETMs stand to benefit from a projected increase in demand coupled with constrained global supply. However, as the energy transition unfolds, demand for each individual

ETM may be volatile and uncertain. XMET provides a convenient and cost-effective way to gain exposure to a range of producers and other industry players across eight key ETMs.

For a more detailed discussion of the global supply and demand considerations for each individual ETM, please refer to the Case for XMET.

There are risks associated with investment in the Fund, including market risk, international investment risk, commodity price and ETM company related risks, and concentration risk. The Fund’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure, given its concentrated exposure. The Fund should only be considered as a component of a diversified portfolio, given its concentrated exposure. For more information on risks and other features of the Fund, please see the Target Market Determination (TMD) and Product Disclosure Statement, available at www.betashares.com.au.