5 minutes reading time

If you’ve been keeping an eye on the markets lately, you might have noticed the recent dip.

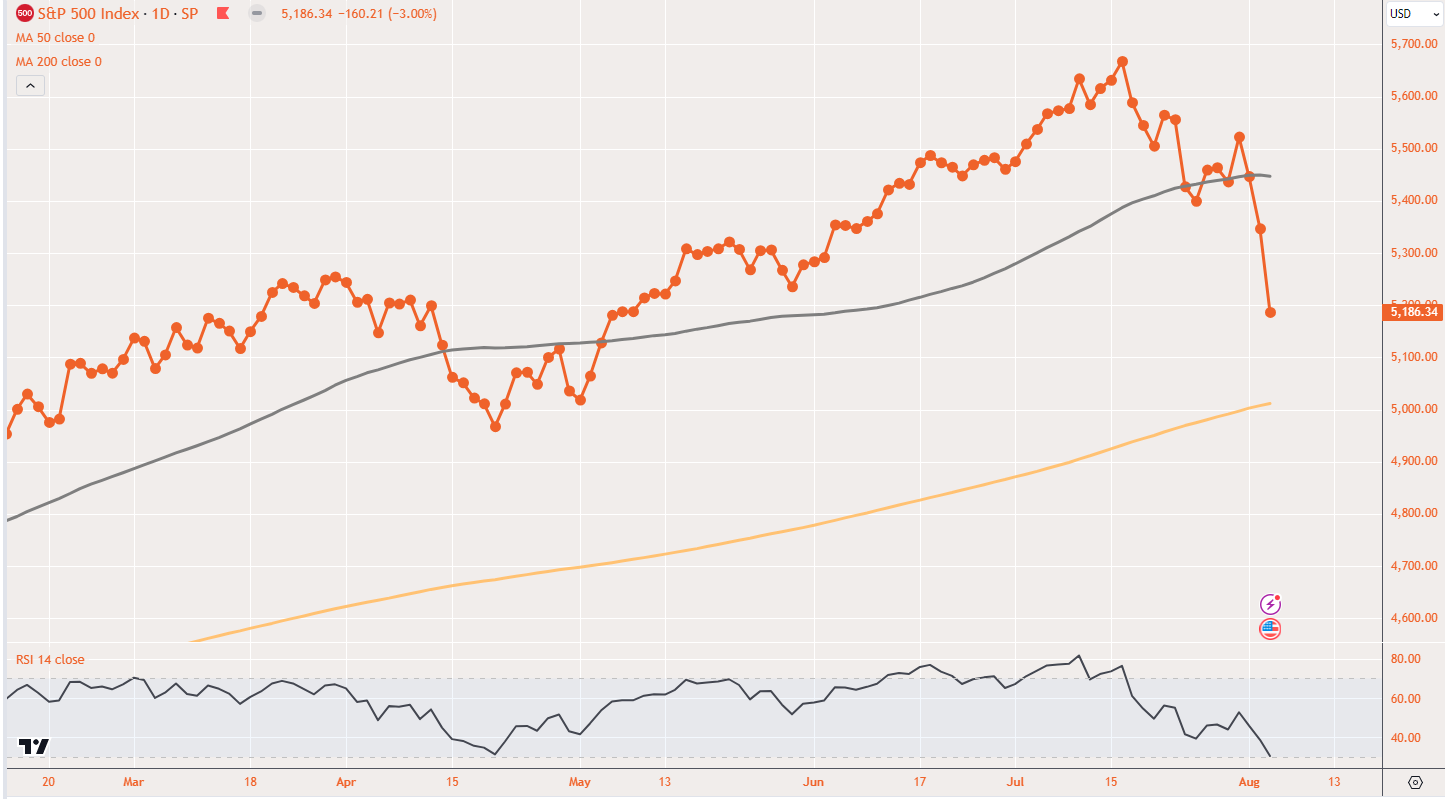

Since hitting a high of 5,669.7 in mid-July, the S&P 500 Index slid down to a low of 5,186.3, an 8.5% drop.

And just in the first two days of August, it fell from 5,522.3 to 5,186.3, a 6.1% drop. It’s enough to make anyone wonder if we’re in for a rough ride.

US equity correction began in mid-July from over bought levels

Betashares’ Chief Economist, David Bassanese discussed the factors that triggered the sell-off at our quarterly economic webinar on 9 August.

So, what’s causing all the fuss?

US markets: Overheated and overhyped

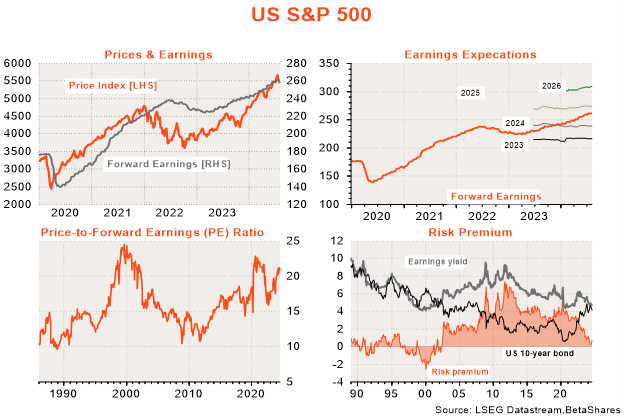

The US markets have had an impressive run, but with that came high valuations. The earnings yield (the inverse of the price-to-earnings ratio) for the US market has been squeezed, leading to a low equity risk premium, similar to levels last seen in the early 2010s.

Both the price-to-earnings ratio and the equity risk premium suggest that the market valuation is currently stretched.

US equity valuations were getting stretched

Source: LSEG Datastream, Betashares

Simply put, stocks were looking pricey and overbought.

Having said that, companies that reported earnings for Q2 in the US had solid results, particularly among mega cap tech stocks with cloud services like Google Cloud, Microsoft Azure and Amazon Web Services growing faster than expected. Given the stellar run of these companies year to date, slight misses in their core business segments like Search for Google and e-commerce for Amazon meant that markets sold off in the latter half of July.

“Recent disappointments in earnings have been a catalyst for the volatility, although overall earnings growth remains positive,” Bassanese told investors.

The US economy: A few red flags

Weaker than expected economic data saw markets fall even further in August, with unemployment in the US rising to 4.3%. This triggered fears of a possible recession.

The ‘Sahm Rule’, uses unemployment data to signal possible recessions. The rule states that when the three-month moving average of the unemployment rate increases by more than 0.5% from its lowest point in the past year, a recession may be on the way.

Fear of US recession following July payrolls report

Source: Sahm, Claudia

Based on the “Sahm” rule, the 0.5% rise in US unemployment from its low suggests a recession could be imminent.

But the recent rise in unemployment is more about adjusting to changes in the economy rather than a full-blown crisis.

“The rise in unemployment is partly due to increased labour supply, including a rebound in immigration and labour force participation post-COVID, rather than solely weak labour demand,” Bassanese said.

The job market is shifting, not crashing.

Japan’s currency jitters

Over in Japan, things have been shifting too. In response to rebounding inflation and a recovering economy, the Bank of Japan raised interest rates by 25 basis points after a long period of maintaining zero or negative rates.

Bassanese explained, “The Yen carry trade, where investors borrow Yen at low rates to invest in higher-yielding assets, has been disrupted. As the Yen strengthens, it becomes more costly to repay these loans, leading to the unwinding of these trades.”

In other words, investors who borrowed in Yen to purchase US assets would have had to sell stocks, bonds and other assets which led to further declines in markets.

Unwinding of the Yen carry trade

Source: Bloomberg, Forvis Mazars calculations

Whilst concerns of deteriorating earnings and a possible recession are longer-term factors leading to the market sell-off, the yen carry trade could be viewed as more of a shorter-term technical factor.

So, should you be worried?

Even though these signs might seem a bit alarming, they’re not necessarily cause for concern. The US economy is still in good shape overall, and Bassanese expects the Federal Reserve to start cutting rates soon, which should help stabilise markets.

“I think this is just going to be a correction in the market rather than the start of a recession bear market,” Bassanese said.

Wrapping it up

In short, while the recent dip might be grabbing headlines, in our view it’s likely to be more of a temporary blip rather than a major downturn.

The fundamentals behind the US economy are solid, and with some supportive actions likely from the Fed, we expect things should even out.

1 comment on this

Great information about stock market