The 7 principles of an investing plan

4 minutes reading time

Asset Class Performance

- October was generally a risk-off period with declines in both global equity and bond returns.

- Solid US economic data and uncertainty ahead of the US Presidential election saw both bond yields and the $US rise, and the $A fall.

- Among major assets classes, the strongest performance over the past year has been gold, followed by global equities.

Source: Bloomberg, Betashares. Cash: Bloomberg Australian Bank Bill Index; Australian Bonds: Bloomberg AusBond Composite Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged); Gold: Spot Gold Price in $US; Australian Equities: S&P/ASX 200 Index; Global Equities: MSCI All-Country World Index in local currency and $A currency (unhedged) terms. Past performance is not indicative of future performance.

Defensive Assets

- As noted above, bond yields rose over October, hurting fixed-rate bond returns, as ongoing solid economic growth in the United States produced an easing back in rate-cut expectations over the coming year.

- US 10-year bond yields rose 0.5% to 4.29%, while Australian 10-year bond yields rose 0.51% to 4.5%. Credit spreads continued to narrow.

- That said, the Fed is still expected to cut by just over 1% over the next 12 months (from 4.88% to 3.72%), while the RBA is expected to cut by just under 0.5% (from 4.35% to 3.95%). If so, this should continue to place downward pressure on bond yields and positive fixed-rate bond returns. Global bonds have modestly outperformed Australian bonds over the past year, reflecting an earlier start to the rate cut cycle.

- Despite rising bond yields, gold continued to perform well with a 4.2% gain in October – perhaps reflecting uncertainty ahead of the US Presidential election. Eventually lower bond yields and a weaker $US (due to relatively deeper Fed rate cuts) should continue to support gold.

Source: Bloomberg, Betashares. Past performance is not indicative of future performance. Predicted values based on the Betashares bond yield models, which in turn reflect current policy rates and 12-month forward market expectations.

Growth Assets

- Higher bond yields helped to drag down global equity price-to-forward earnings (PE) valuations in October. With forward earnings flat – in part reflecting a modest downgrade in future earnings expectations – this produced a small 1.1% negative return for global equities in local currency terms.

- As noted above, however, global equities on an unhedged basis rose 3.5% over October, due to a decline in the $A. Against the $US, the value of an $A fell from US69.1c to US 65.8c.

- While the global PE valuation is still relatively elevated at 17.8, lower bond yields should help support valuations going forward. What’s more, notwithstanding the further small tick down in October, earnings expectations remain upbeat, consistent with 13% growth in forward earnings over the coming year.

Source: Bloomberg, LSEG, Betashares. Global Equities: MSCI All-Country World Index. Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged). You cannot invest directly in an index. Past performance is not an indicator of future performance.

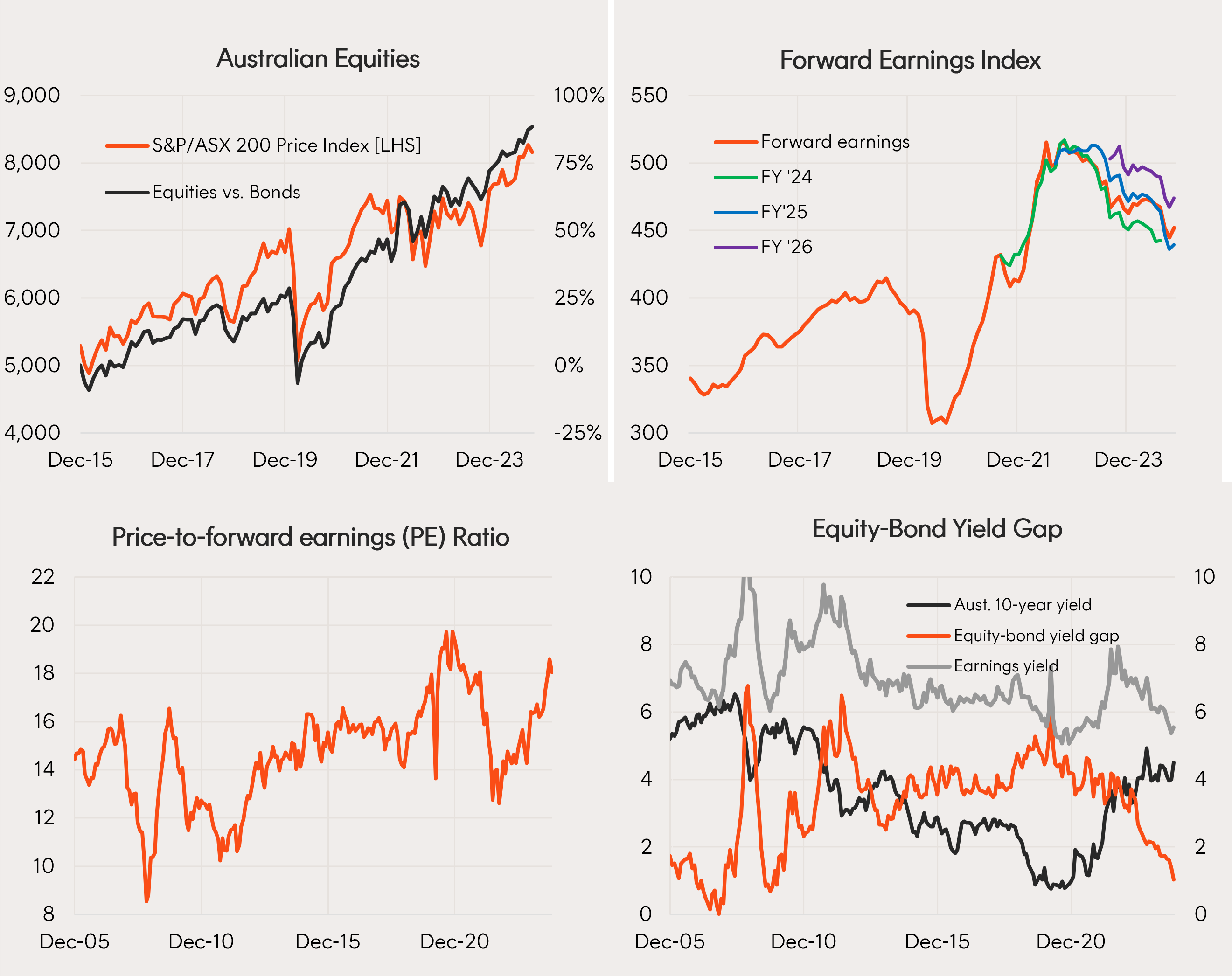

- Australian equities also slipped back over October and have tended to underperform global equities over the past year.

- At 18 times forward earnings, local equity valuations are broadly fair value compared to global equities. That said, the major headwind to better relative performance is a more sluggish local earnings outlook.

- Analysts currently expect 7% growth in forward earnings for the Australian market over the coming year, though these expectations remain under downward pressure.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.