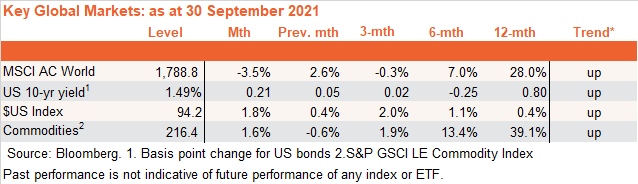

Key global market trends – higher rates take their toll

Global equities suffered a setback in September as a rebound in bond yields dragged down still lofty price-to-earnings valuations. The key market development in the month was a more hawkish than expected Federal Reserve policy meeting, which suggested a tapering in bond purchases would be announced next month and U.S. official rates could rise as early as late next year. Also unnerving sentiment were financial difficulties with leading Chinese property developer Evergrande, and persistent signs of upward inflation pressures due to lingering supply-chain disruptions.

As evident in the chart set below, despite the pullback in equities, the trend in stocks remains upward. The trend in bond yields, the U.S. dollar and overall commodities also appears upward.

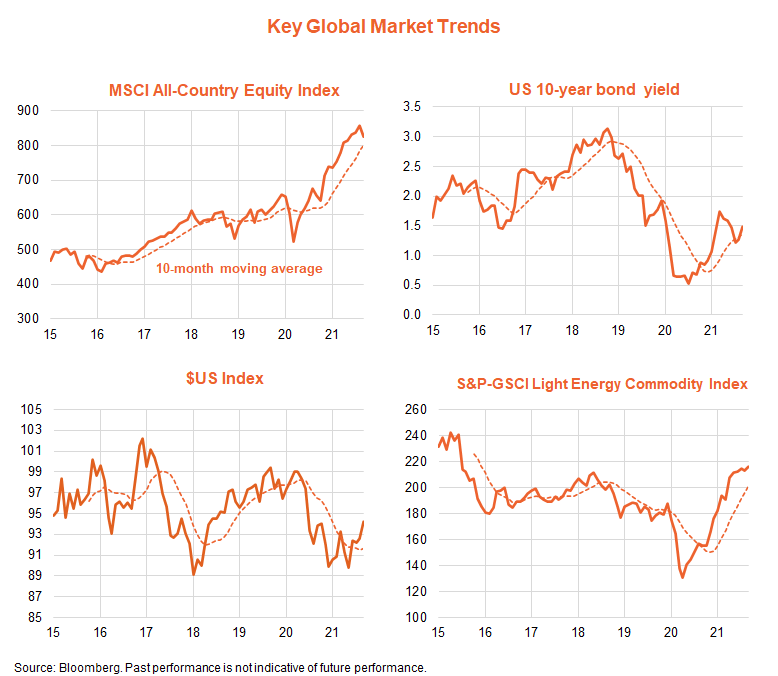

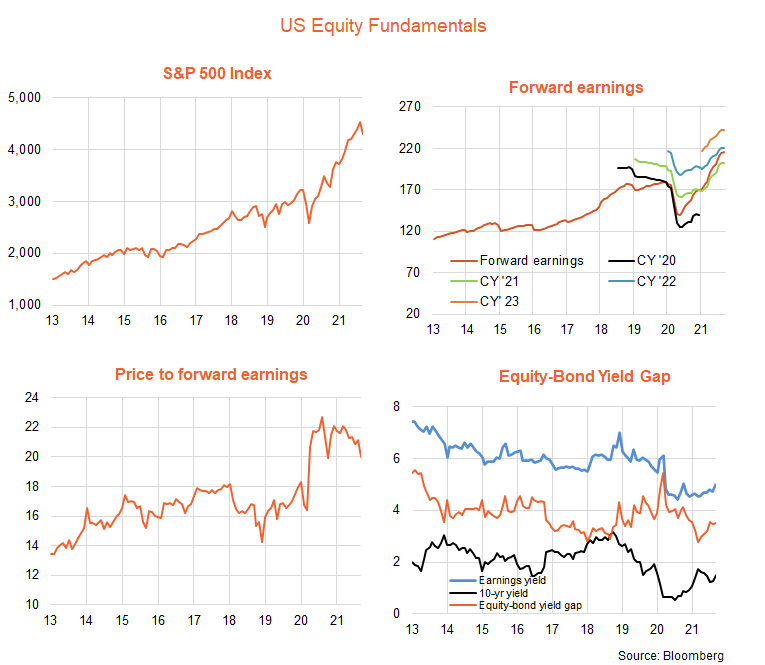

Global equity fundamentals – valuation challenges if rates rise further

The nearer-term fundamental picture for equities is mixed. As evident in the chart set below, the U.S. equity market’s uptrend in recent months has been driven by growth in corporate earnings, which are still expected to show strength over the coming year – rising by around 10-15% by end-2022 based on current market expectations.

The more challenging aspect is valuations: while the PE ratio has corrected from 22 to 20 so far this year, it remains above its range of 14 to 18 in the pre-COVID years since 2013, which in turn reflects the fact that 10-year bond yields and the equity-to-bond yield gap (EBYG) are also somewhat below their average over this period.

If bond yields rise further, there will be greater downward pressure on PE valuations, unless the EBYG holds at lower levels than that evident in recent years (indeed, it did average well below 3% in earlier decades).

For example, if U.S. 10-year bond yields rise from 1.5% to 1.75%, and the EBYG holds around the current rate of 3.5%, the PE ratio would fall to 19 (or 5% below end-September levels). If bond yields rose to 2% (my end-2022 target), with the EBYG holding steady at 3.5%, the PE ratio would need to fall to 18.2, or 9% below end-September levels.

All up, allowing for growth in earnings and some dividends, it’s still possible for U.S. equities to produce positive returns on a one-year view, though potentially in the mid-single digit growth range. That said, the one-year base case outlook for bond returns would be even lower.

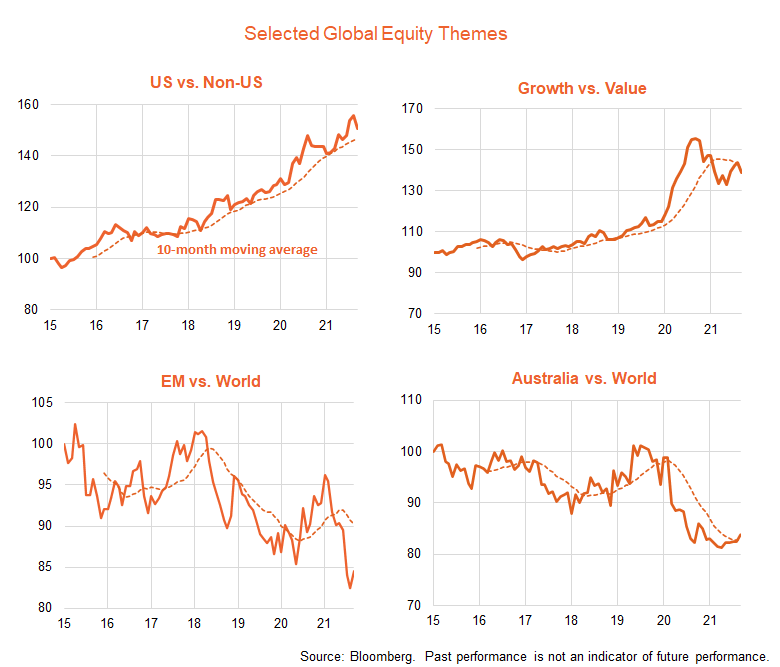

Global equity themes** – potential value opportunities

The chart set below outlines trends in several key ‘thematic tilts’ across global equity markets. As evident, U.S./growth exposures suffered a relative pullback in September likely reflecting higher bond yields. More broadly, based on trends relative to their 10-month moving average, current trends still favour U.S. over non-U.S. markets, though value is now trending ahead of growth, which is also consistent with tentative signs of improvement in Australia relative to the global market. Developed markets are also still trending ahead of emerging markets.

In terms of ETF investment opportunities, value exposures in the energy sector (FUEL) and the financials sector (BNKS and QFN) have had relatively good return performance in recent months and also appear relatively cheap compared to the broader global market. If oil prices and interest rates continue to move higher in coming months, these sectors may continue to enjoy relatively good performance.

Japanese and European exposures (HJPN and HEUR) are also relatively cheap and could benefit if U.S. interest rates and the U.S. dollar continue to move higher in coming months, and the shakeout in the growth/technology sectors continues.

Further information on the complete range of BetaShares exchange traded products can be found here.

*Trend: Outright trend is up if the relevant NAV return index is above its 10-month moving average and down if the index is below this moving average and the slope of the moving average is negative.

**Equity theme proxies: US: S&P500; Non-US: MSCI Ex-US Developed Markets Index; Growth vs. Value: MSCI Global Growth and Value Indices; Emerging markets: MSCI Emerging Markets Index; Australia: S&P/ASX 200 Index.