3 minutes reading time

Major global market trends

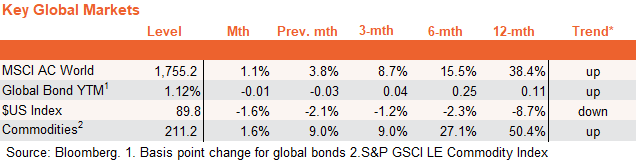

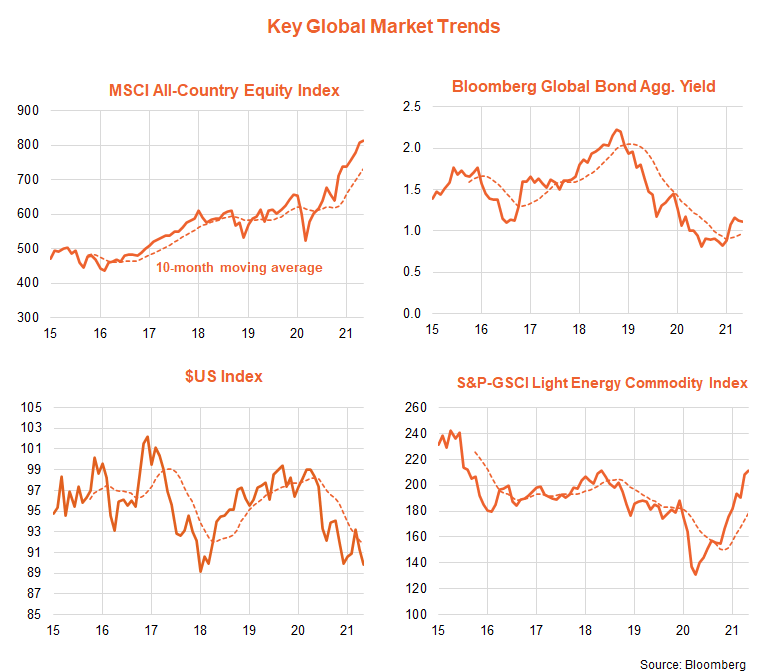

The global equity rally continued in May, with the MSCI All-Country World Equity Index returning 1.1% in local currency terms, to be up 38.4% over the year. Global bond yields and the $US eased back further, while commodity prices continued to rise.

All up, investors appeared to be backing the view that inflationary pressures would prove temporary and not cause major central banks to bring forward policy tightening. This remains consistent with my view, with ongoing strength in corporate earnings and relatively contained bond yields likely to remain supportive of equities markets over the remainder of this year.

Relative to their 10-month moving average, the trend in equities – though also bond yields and commodity prices – remains to the upside, while the trend in the $US is still down.

Major global equity trends

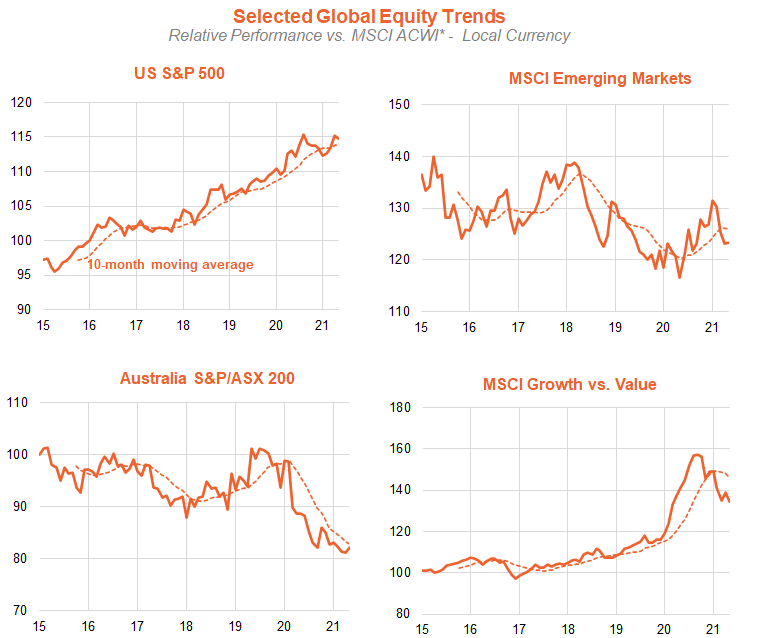

Global value reasserted its outperformance over growth in the month – after slipping back in April. This shift back to value was reflected in relatively strong performances by financials and energy over the technology and consumer discretionary sectors – as well as strength in European and Australian equities over those of the United States.

Overall, value over growth remains a relatively consistent trend since late last year. Among major regions, trend outperformance by emerging markets has waned in recent months, while that of the United States has tended to strengthen again. Australia continues to generally underperform, though the degree of underperformance has slowed in recent months.

Source: Bloomberg.

*except growth vs value indices.

My base case is that value areas of the global market can continue to outperform over at least the next three to six months, though the ‘reflation/re-opening’ trade should then give way to a reassertion of the pre-COVID relative outperformance of growth sectors such as technology. Technology/growth may be challenged again once bond yields start to re-normalise and/or if inflation picks up more than I expect.

BetaShares sector/thematic ETFs

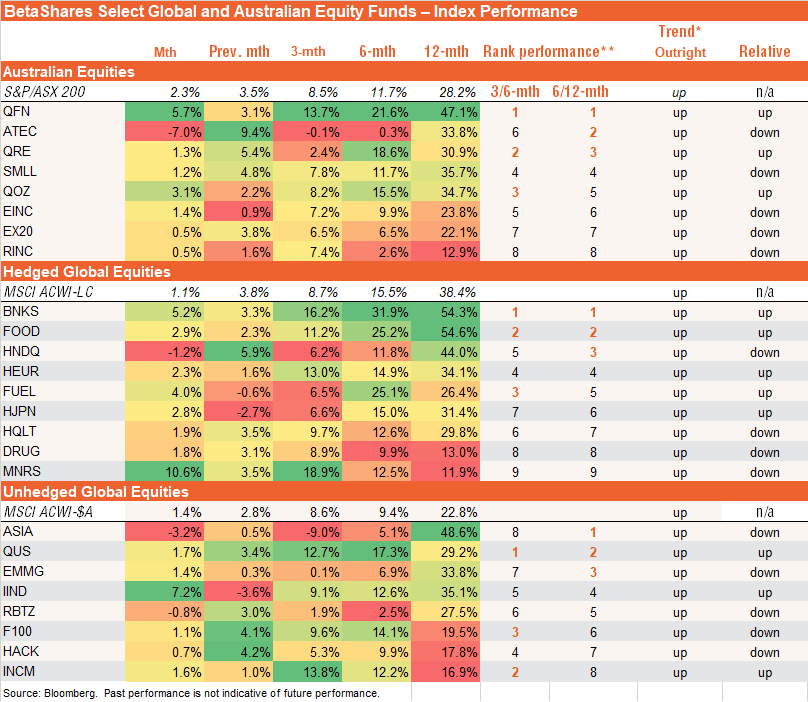

As seen in the table below, the above global trends are reflected in the performance of BetaShares’ thematic global and Australian equity ETFs.

Tables ordered by 6/12 month return performance (excluding latest month performance) for Fund. Past performance is not indicative of future performance of any index or fund. You cannot invest directly in an index. Index performance doesn’t take into account any fund fees and costs.

Within Australian equities, the strongest performer in the month was financials (QFN), while our technology exposure (ATEC) suffered a setback. Our fundamentally-weighted Australian equity fund (QOZ) also performed relatively well. Reflecting these shifting performances over the past year, both QFN and ATEC – along with resources (QRE) – were the top three performers on an equally-weighted 6/12 month return basis**.

Among the global currency-hedged funds***, strength in gold prices (which rose 7.8% in $US terms in May) helped produce strong returns for our global gold miners ETF (MNRS), while value exposures such as global banks (BNKS) and energy producers (FUEL) also performed well. By contrast, the tech-exposed NASDAQ-100 (HNDQ) lagged after a strong performance in April. BNKS, global food producers (FOOD) and HNDQ were the top performers on a 6/12 month basis.

Among the global currency-unhedged funds, Indian equities (IIND) bounced back strongly last month, while Asia technology (ASIA) and global robotics (RBTZ) weakened. ASIA, however, along with our equally-weighted S&P 500 exposure (QUS) and emerging markets (EMMG) were the top three performers on a 6/12 month basis.

Further information on the complete range of BetaShares’ exchange traded products can be found here.

*Trend: Outright trend is up if the relevant NAV return index is above its 12-month moving average and the slope of the moving average is positive, and down if the index is below this moving average and the slope of the moving average is negative. No trend is displayed in all other cases. Relative trend is based on the ratio of the relevant return index to its broader Australian or global benchmark index.

**The ranking of performance is based on an equally-weighted average of 6 & 12 month return performance, excluding the latest month. A short-term ranking is also provided based on equally-weighted 3 and 6 month returns.

***Where both currency-hedged and unhedged global equity funds are available, my analysis focuses only currency-hedged fund performance to abstract from exchange-rate movements.