2 big tech trends for investors

6 minutes reading time

Major asset class performance

- Concerns over US tariffs led to a ‘risk-off’ month during February, with bond yields and equity prices generally lower.

- Among defensive assets, falling yields boosted fixed-rate bond returns, while safe-haven flows helped to boost gold prices.

- In terms of growth assets, global equities fell by 0.8% in local currency terms and by 0.3% in Australian Dollar terms. The weak Australian dollar helped cushion the drawdown in returns.

- Australian equities underperformed, with a -3.8% return.

Source: Bloomberg, Betashares. Cash: Bloomberg Australian Bank Bill Index; Australian Bonds: Bloomberg AusBond Composite Index; Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged); Gold: Spot Gold Price in $US; Australian Equities: S&P/ASX 200 Index; Global Equities: MSCI All-Country World Index in local currency and $A currency (unhedged) terms. Past performance is not indicative of future performance.

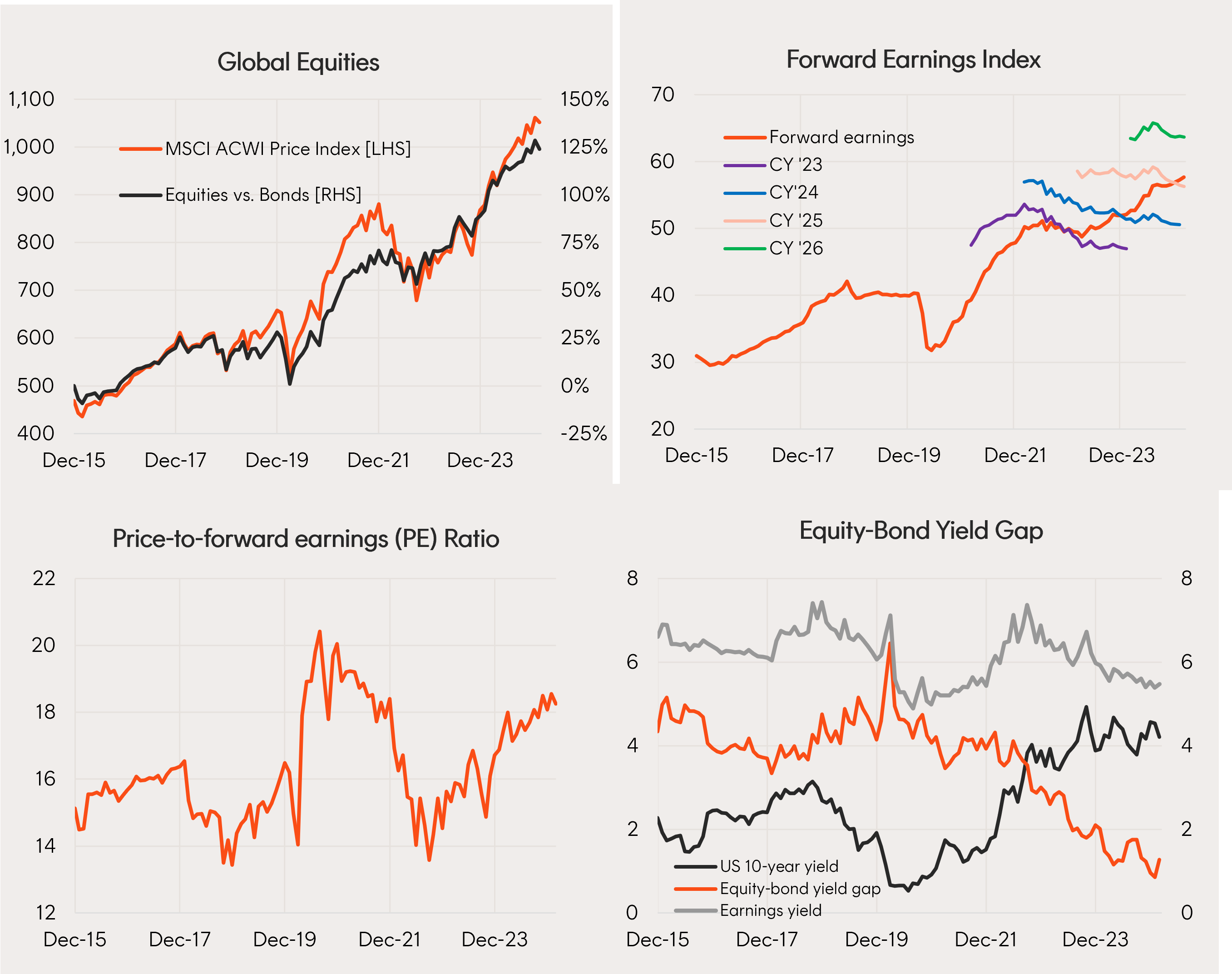

- Despite the risk-off month, equities have generally outperformed bonds over the past year. This is due to rising corporate earnings and rising equity valuations. The latter has been largely driven by a declining equity-risk premium rather than lower bond yields.

- Within defensive assets, gold has been a standout performer while fixed-rate bonds have largely matched cash returns. Government bond yields are still stuck in a choppy sideways range.

- Returns in global equities have beaten Australian shares due to stronger growth in corporate earnings. Hedged global equities underperformed unhedged equities due to the Australian Dollar’s weakness.

Defensive assets

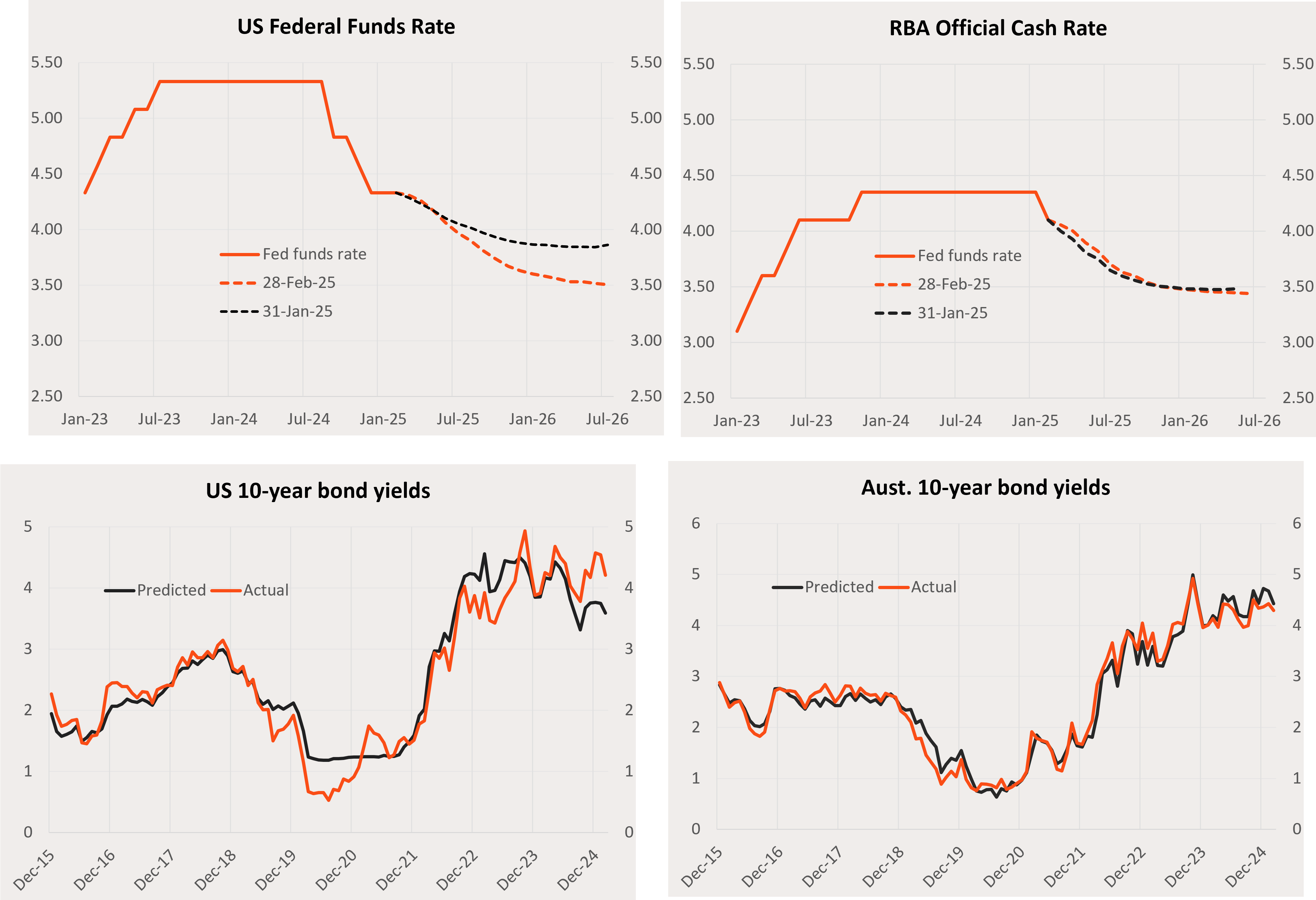

- Bond yields fell in February, helping fixed-rate bond returns.

- US 10-year bond yields fell 0.33% to 4.21%. US interest rate traders are now pricing in a higher chance of a third rate cut this year.

- Australian 10-year bond yields fell 0.14% to 4.29%, with local rate cut expectations not changing significantly over the month. The market expects two further rate cuts and, like in the US, some chance of a third.

- Further declines in inflation and prospective central bank rate cuts bode well for lower bond yields this year. However, higher inflation caused by higher global tariffs and unfunded US tax cuts are new sources of risk.

Source: Bloomberg, Betashares. Past performance is not indicative of future performance. Predicted values based on the Betashares bond yield models, which in turn reflect current policy rates and 12-month forward market expectations.

Growth assets

Global equities

- The risk-off sentiment caused the forward price-to-earnings (P/E) ratio to fall by 1.6% in February, reaching 18.3. While forward earnings rose by 0.7%, the MSCI All-World Index declined by 0.8% (though declined by a lesser 0.3% in unhedged AUD terms due to AUD weakness.)

- However, the global P/E valuation is still relatively elevated. Eventually lower bond yields should help support valuations. Earnings growth expectations stabilised in February after recent downgrades. The consensus still suggests 13% growth in forward earnings by the end of 2025 and 9% growth over 2026.

Source: Bloomberg, LSEG, Betashares. Global Equities: MSCI All-Country World Index. Global Bonds: Bloomberg Global Aggregate Bond Index ($A hedged). You cannot invest directly in an index. Past performance is not an indicator of future performance.

- Among select global equity ETFs, BNKS Global Banks Currency Hedged ETF and MNRS Global Gold Miners Currency Hedged ETF had the best relative performance trends.

- Relative performance of the HNDQ Nasdaq 100 Currency Hedged ETF has flattened off over recent months.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the MSCI All-Country World Index (local currency terms) for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.

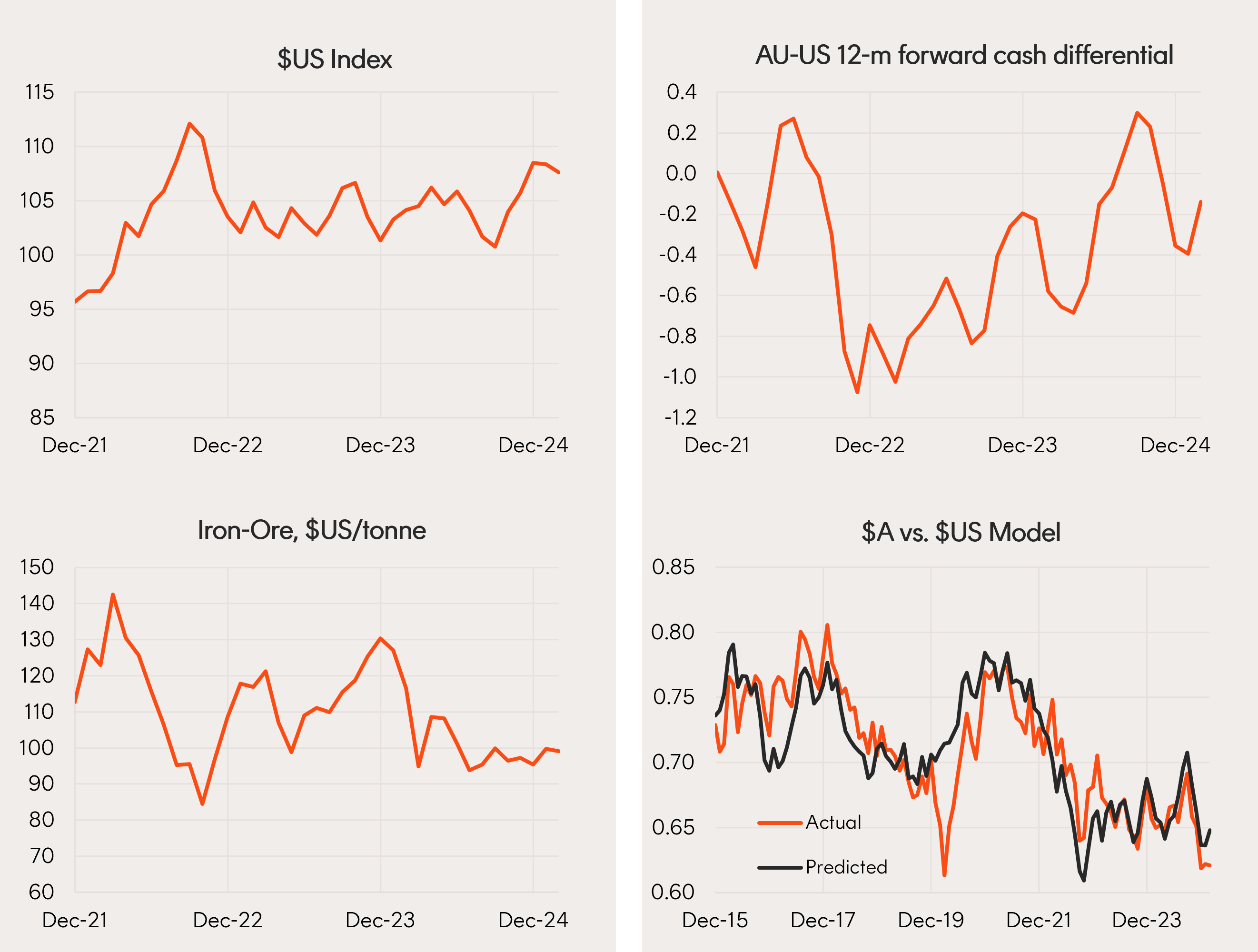

Australian dollar

- The Australian dollar was broadly steady against the US Dollar over February, easing from 62.2 US cents to 62.1 US cents. This happened even though the US Dollar was modestly weaker against major currencies in the month.

- One supportive Australian Dollar factor was a deepening in US rate cut expectations relative to Australia over the month. Iron ore prices remained steady.

- Markets expect the Fed to cut rates slightly more over the coming twelve months than the RBA (-0.75% vs -0.6%). This implies a narrowing in the negative short-term interest rate differential between Australia and the US, which has implications for investors who hold shares, bonds, and currencies.

- Global trade tensions present a downside risk to the Australian Dollar, though the US Dollar is very expensive on long-run valuation grounds and could ease if sentiment shifts.

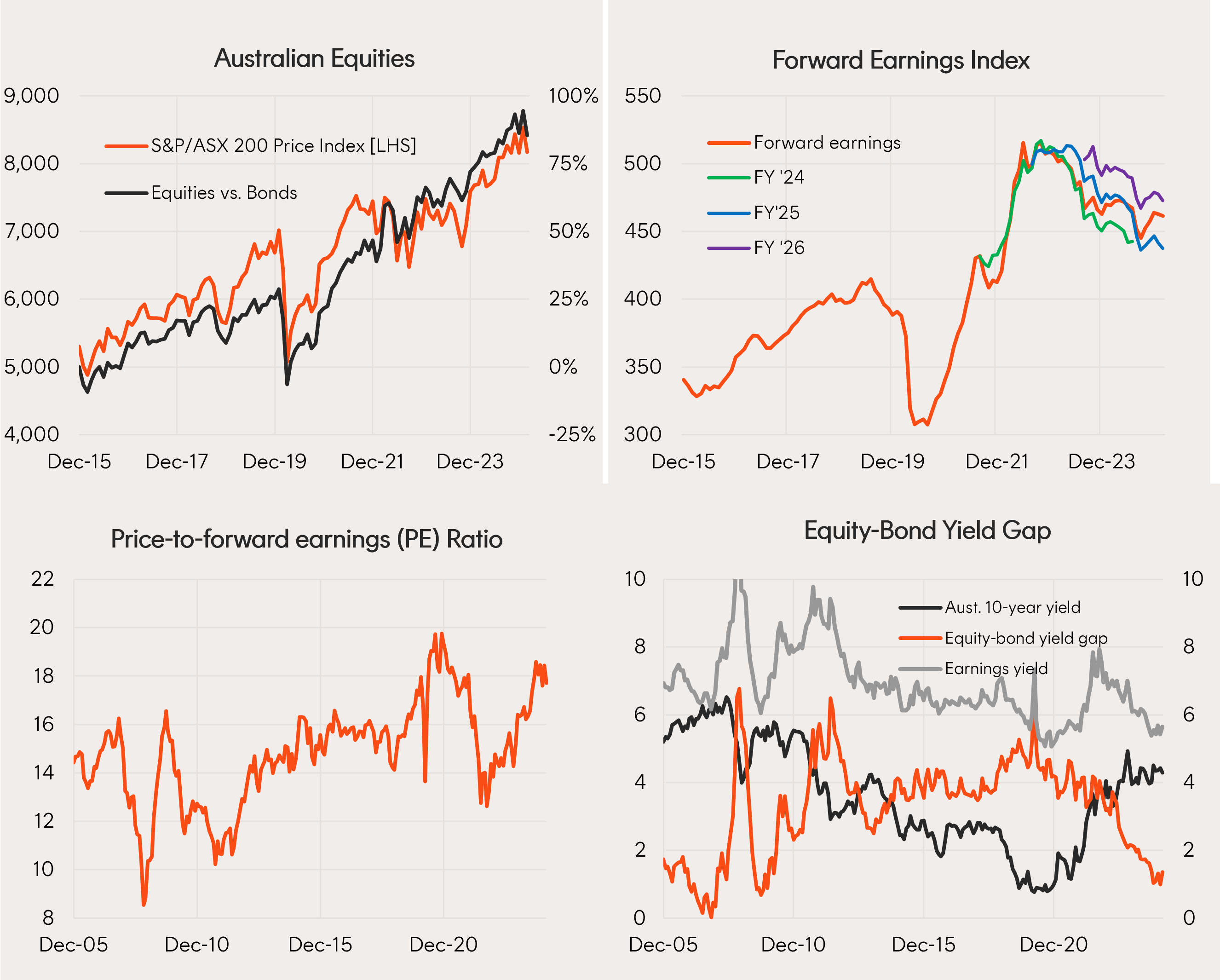

Australian equities

- Risk-off sentiment also took its toll on Australian equity valuations over February, with the forward price-to-earnings ratio declining 3.9% to 17.7. Forward earnings edged down a further 0.3%, resulting in a total return for the S&P/ASX 200 of -4.2%.

- As is the case globally, relatively high valuations leave the local market vulnerable without a decent decline in bond yields. Expected growth in forward earnings is also about half the 10-12% expected globally. Local earnings expectations are choppy but remain in a broad downward trend.

Source: Bloomberg, LSEG, Betashares. Australian Equities: S&P/ASX 200 Index. Australian Bonds: Bloomberg AusBond Composite Index. You cannot invest directly in an index. Past performance is not an indicator of future performance.

- Weakness was broad-based among Australian equity ETFs over February.

- The long-outperforming technology sector, represented by the ATEC S&P/ASX Australian Technology ETF has – along with the US NASDAQ 100 – endured a relative performance correction in recent months. Meanwhile, the past outperformance of the QFN Australian Financials Sector ETF and the AQLT Australian Quality ETF has also flattened out.

Source: Bloomberg, LSEG, Betashares. Relative performance versus the S&P/ASX 200 Index for the indices which the relative ETFs track. You cannot invest directly in an index. Past performance is not an indicator of future performance.