6 minutes reading time

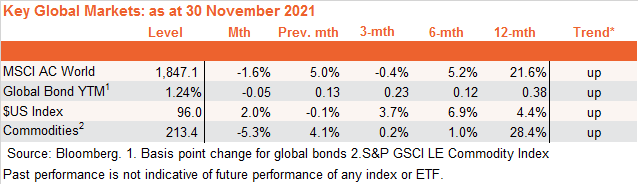

Key global market trends – rates and COVID spark concern

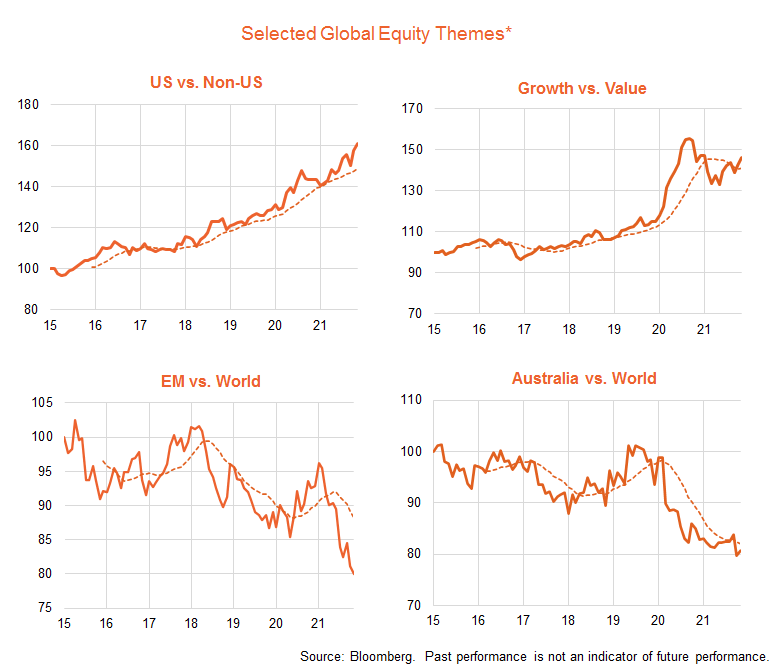

Global equities suffered a setback in November reflecting concerns about both the Omicron COVID variant and a hawkish pivot by the U.S. Federal Reserve. Bond yields and commodity prices eased over the month, while the $US strengthened. Concerns with regard to Chinese property developer Evergrande remained on the back burner, with the embattled company meeting some interest payments on outstanding debt and generally continuing to (quietly) work through its problems.

At this early stage, the Omicron variant appears highly transmissible (much like the Delta variant) but the severity of its symptoms might be sufficiently modest to reduce the need for renewed social distancing restrictions in key economies. Of potentially more market concern was Fed Chair Powell signalling a potential acceleration in the tapering of bond purchases, which increases the risk of Fed rate hikes and higher bond yields next year.

As evident in the chart set below, despite the recent pullback, the trend in stocks remains upward. The trends in bond yields, the U.S. dollar and overall commodities (driven by food and oil prices) are also positive.

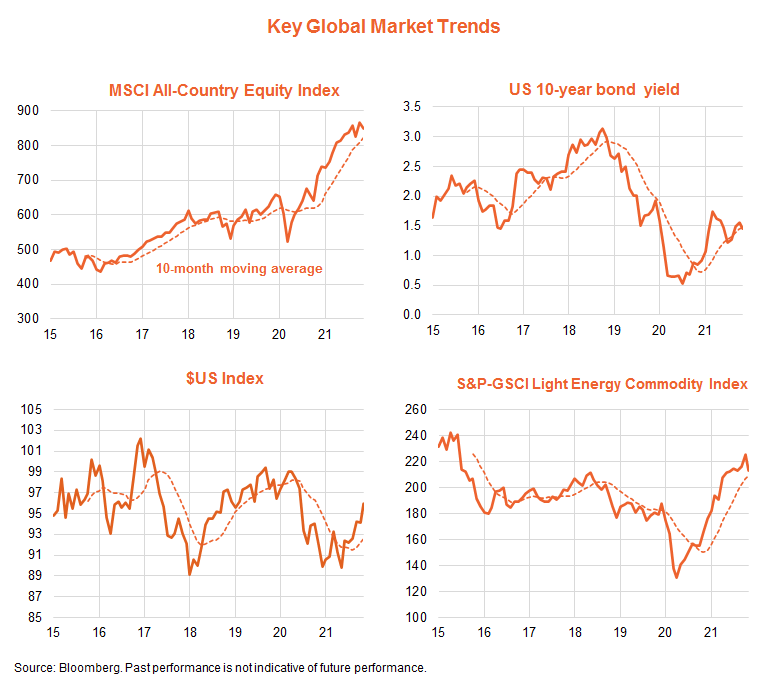

Global equity fundamentals – valuation challenges as rates rise further

As evident in the chart set below, the U.S. equity market’s uptrend in recent months has been driven by growth in corporate earnings, with the PE ratio continuing to broadly trend lower. In November, forward earnings for S&P 500 companies rose by 1.9%, while the forward PE ratio eased to 20.4 from 20.9 (-2.6%), resulting in a net 0.8% decline in the S&P 500 price index.

The nearer-term fundamental picture for equities remains mixed. On the positive side, earnings continue to be revised up and current expectations are consistent with forward earnings growth of 10% by end-2022. I anticipate further upward revisions such that forward earnings may rise by 15% over this period.

At 20 times earnings, however, the U.S. PE ratio remains above its range of 14 to 18 in the pre-COVID years since 2013, which in turn reflects the fact that 10-year bond yields and the equity-to-bond yield gap (EBYG) are also somewhat below their average over this period.

Even though current very high U.S. consumer price inflation should moderate, I now expect the Fed to hike rates next year rather than hold off until 2023 (due to a tight labour market and firm wages growth). That could see U.S. 10-year bond yields eventually reach around 2.25%. If the earnings yield-to-bond yield gap (EBYG) holds at its present level of 3.5%, a lift on 10-year bond yields from 1.4% to 2.25% would drag down the PE ratio to around 17.5, or around 15% lower than its end-November level. If the EBYG returns to its average of recent years at around 3.75%, it would imply a PE ratio of 16.6, or 18% below its end-November level. Such a potential downward valuation adjustment would largely negate gains from increased earnings, resulting in a fairly flat outlook for the major U.S. market for the year ahead.

That said, key uncertainties are whether bond yields rise as much as expected given the predicted Fed rate hikes (as to some extent the latter could moderate current inflation concerns). And there’s also a risk that the EBYG declines to help preserve PE valuations in the face of higher bond yields – given it remains well above its longer-run 20 to 30 year average level.

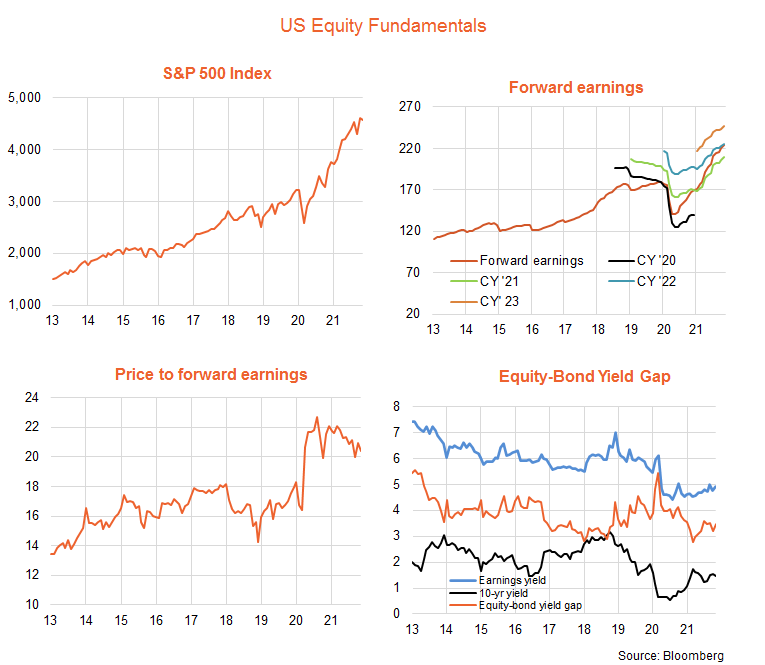

Global equity themes* – potential value opportunities

The chart set below outlines trends in several key ‘thematic tilts’ across global equity markets.

As evident, the U.S. market continues to generally outperform, while emerging markets remain in a firm relative performance downtrend. Trends in the relative performance of ‘growth vs. value’ have largely tracked trends in bond yields – rising yields from late-2020 to early-2021 due to the ‘re-opening’ trade favoured value, whereas the Delta-related easing in bond yields in subsequent months has favoured growth.

The relative performance of the Australian market also remains negative, not helped by recent weakness in iron-ore prices and resource stocks, and recent strength in technology stocks, which enjoy a bigger weight in global markets.

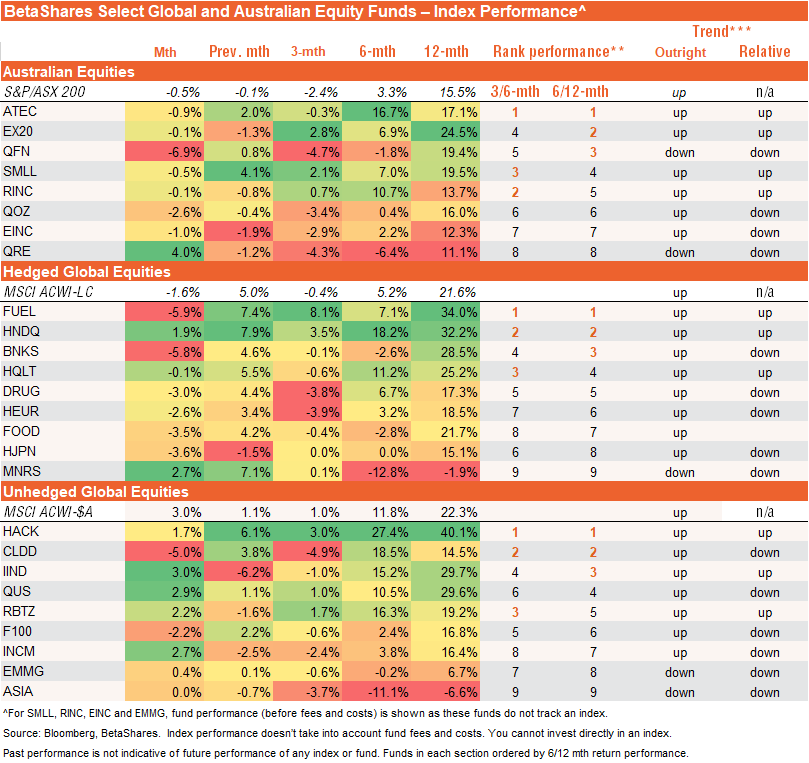

ETF performance snapshot

The table below sets out a selected list of BetaShares ETFs across various regional, sector and factor thematics.

In Australia, some key ETF sector themes are as follows:

- After outperforming during the late-2020/early-2021 ‘re-opening trade’, the relative performance of local financials (QFN) has levelled out in recent months.

- Although bouncing back in November, the relative performance of the resources sector (QRE) has been negative for much of this year due to declining iron-ore prices.

- As with global growth exposures more generally, relative performance of the local technology sector (ATEC) has waxed and waned in line with the trend in bond yields and COVID concerns.

Globally, some key ETF sector themes are as follows:

- Growth versus value performance is mixed, reflecting volatility in bond yields and COVID concerns. This is reflected in the fact the top-3 performing hedged global equity exposures include two value sectors, financials (BNKS) and energy producers (FUEL), along with a key growth exposure, the NASDAQ-100 (HNDQ).

- Among unhedged global exposures, technology thematics such as cybersecurity (HACK) and cloud computing (CLDD) are among the top 3 performers, along with India (IIND) which has been the standout emerging market performer over the past year.

- Asian technology (ASIA) is yet to show a marked turnaround in relative performance reflecting ongoing Chinese regulatory and growth-slowdown concerns.

2022 outlook

On the view of rising bond yields next year, and fading risks related to COVID, 2022 could be a year in which value enjoys at least a period of outperformance versus growth sectors. An especially favoured sector (at least in a relative sense) in periods of rising bond yields is financials (BNKS), as higher medium-term lending rates tends to improve their profit margins. By contrast, despite a likely strong long-term outlook, 2022 could be a challenging year for technology stocks, especially those whose valuations are based on long-term future earnings potential, rather than current strong levels of profitability.

Despite likely solid corporate profit growth, rising bond yields also threaten to constrain overall equity returns due to downward pressure on still elevated PE valuations (especially in the United States). Indeed, a correction at some point during next year (price decline of around 10% or so) seems a good chance.

Further information on the complete range of BetaShares exchange traded products can be found here.

* Equity theme proxies: US: S&P500; Non-US: MSCI Ex-US Developed Markets Index; Growth vs. Value: MSCI Global Growth and Value Indices; Emerging markets: MSCI Emerging Markets Index; Australia: S&P/ASX 200 Index.

** Ranking based on average of 3 and 6 month performance and 6 and 12 month performance, excluding latest monthly return performance.

*** Trend: Outright trend is up if the relevant NAV return index is above its 10-month moving average and down if the index is below this moving average. Relative trend is up if the ratio of the relevant NAV monthly return index to the return index for the MSCI ACWI is above its 10-month moving average, and down otherwise.