Bitcoin ETFs: What are they and how do they work?

6 minutes reading time

- Digital assets

As at 10 September, bitcoin was trading at US$25,832. Ethereum underperformed bitcoin over the week, down 1.16% vs bitcoin’s 0.52% decline. Bitcoin’s market capitalisation sits at US$502 billion, with the total crypto market cap reducing to US$1.03 trillion. Bitcoin’s market dominance increased to 48.6%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $25,832 | $26,414 | $25,404 | -0.52% |

| ETH (in US$) | $1,616 | $1,692 | $1,605 | -1.16% |

Source: CoinMarketCap. As at 10 September 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

ARK files for US-listed spot Ethereum ETF

Cathie Wood’s ARK Invest, in collaboration with 21Shares, has submitted a regulatory filing to the US Securities and Exchange Commission (SEC) for an exchange-traded fund (ETF) focused on directly holding Ether (ETH), the second-largest cryptocurrency by market capitalisation.

This initiative, known as the Ark 21Shares Ethereum ETF, represents the first effort to list an ETF in the US with a primary focus on investing in ETH. The custody of the ETF’s assets will be handled by Coinbase Custody Trust Company.

This filing comes amidst a series of applications for a spot bitcoin ETF, including the joint application from Ark and 21Shares. Last week, the SEC postponed its decision on all of these applications.

Additionally, the industry is anticipating SEC approval for the first futures-based Ether ETF, with a decision expected on or before mid-October1.

London Stock Exchange Group explores Blockchain technology

The London Stock Exchange Group (LSEG) is actively exploring the utilisation of blockchain technology to establish a digital market ecosystem aimed at facilitating the raising and transfer of capital across various asset classes. According to Murray Roos, Head of Capital Markets at LSEG, the exchange has been studying the potential of a blockchain-powered trading platform for around a year and has now reached a pivotal stage in its development.

The envisioned digital market ecosystem is intended to enhance the efficiency of traditional asset buying, selling, and custody processes. LSEG emphasised that it is not developing anything related to cryptocurrencies but is instead seeking to leverage blockchain technology for improving these traditional processes, making them more efficient, cost-effective, and transparent, while ensuring regulatory compliance.

As part of its plan, LSEG is seeking to establish of a distinct legal entity for its digital markets business. The company aims to have this entity operational within a year, pending regulatory approvals2.

Coinbase to expand reach

Coinbase is prioritising expansion in select countries outside the US, citing their clearer crypto regulations. In 6 September blog post, Coinbase highlighted the European Union, the United Kingdom, Canada, Brazil, Singapore and Australia as “near-term priority markets.” These countries are seen as enacting more transparent crypto rules, prompting Coinbase to increase its focus on acquiring licenses, registrations, and strengthening operations in these jurisdictions.

In contrast, Coinbase noted that the US is taking an enforcement-oriented approach to crypto regulations, which the company views as a departure from global progress in the field. Coinbase expressed concern that the US is sidelining itself, risking its influence in the crypto space.

This expansion strategy is part of Coinbase’s “Go Broad, Go Deep” phase, which involves partnering with global and local banks and payment providers to enhance fiat on-ramps and ensure compliance with governance systems3.

On-chain metrics

Bitcoin (BTC): Percent of Addresses in Profit

This metric displays the percentage of unique addresses whose funds have an average buy price that is lower than the current price. “Buy price” here is defined as the price at the time coins were transferred into an address. Currently, 60% of all bitcoin addresses are sitting on unrealised gains.

Source: Glassnode. Past performance is not indicative of future performance.

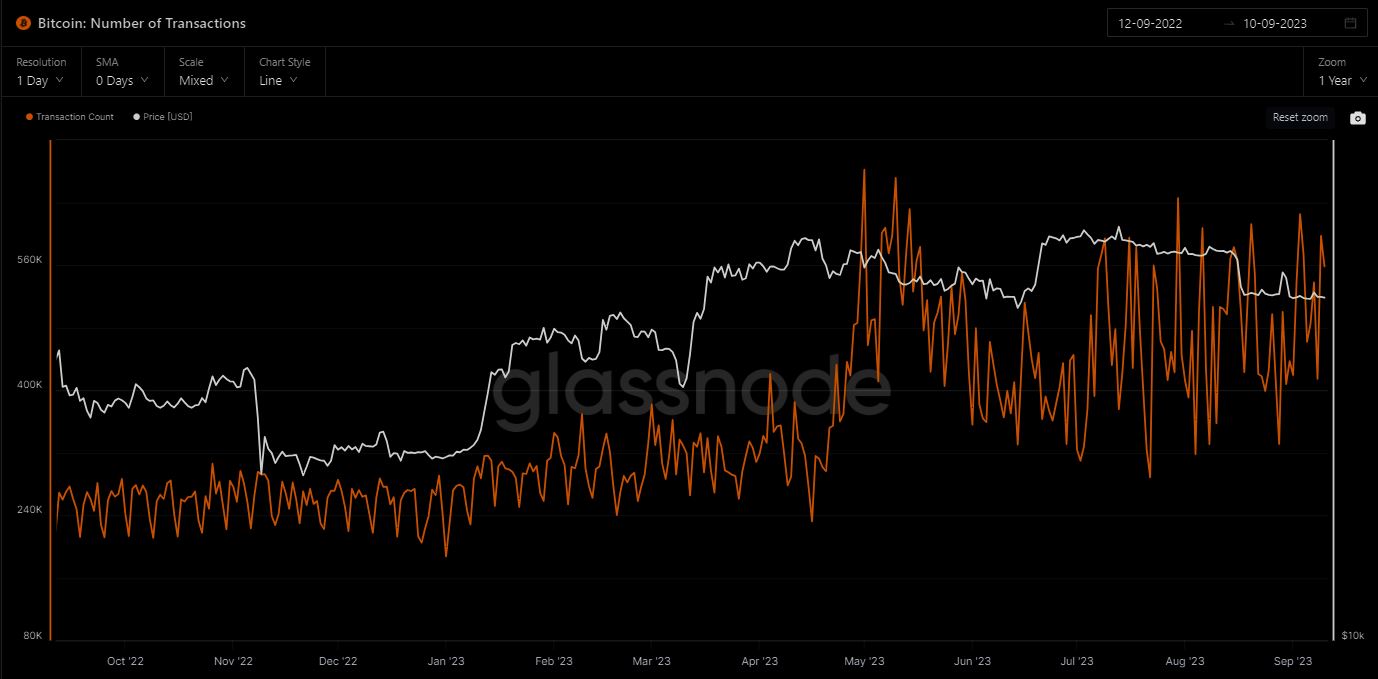

Bitcoin (BTC): Number of Transactions

This metric shows the total amount of transactions. Only successful transactions are counted. Since the start of 2023, BTC has experienced a considerable rise in transaction count off the back of the increasing price, highlighting renewed interest in the cryptocurrency.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

The SEC is pushing for a mid-case appeal in its ongoing legal battle with Ripple Labs over XRP’s classification as a security. This move is notable as SEC Chair Gary Gensler previously stated that existing guidelines were sufficient for the crypto market.

The SEC argues that a ruling by Judge Analisa Torres in July, which generally categorised XRP as not a security in the context of retail exchange-based transactions, has raised substantial legal questions. If granted, this motion would propel the case to the Second Circuit Court of Appeals, where these legal complexities would receive further scrutiny.

Off the back of the ongoing legal battles facing Ripple Labs, XRP emerged as the worst-performing and most-traded altcoin in August. XRP fell by nearly 21% over the past month while experiencing an average daily trading volume of US$462.8 million, four times higher than the second-ranked Solana (SOL)4.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio

References:

1. https://www.etf.com/sections/news/odds-ends-ark-files-ether-spot-fund

2. https://www.reuters.com/technology/lse-group-draws-up-plans-blockchain-based-digital-assets-business-ft-2023-09-04/

3. https://cointelegraph.com/news/coinbase-near-term-priorities-eu-canada-brazil-singapore-australia

4. https://www.bloomberg.com/news/articles/2023-09-01/ripple-opposes-sec-appeal-of-ruling-that-crypto-isn-t-security#xj4y7vzkg

Past performance is not indicative of future performance.

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.