10 steps to successful investing in 2025 and beyond

7 minutes reading time

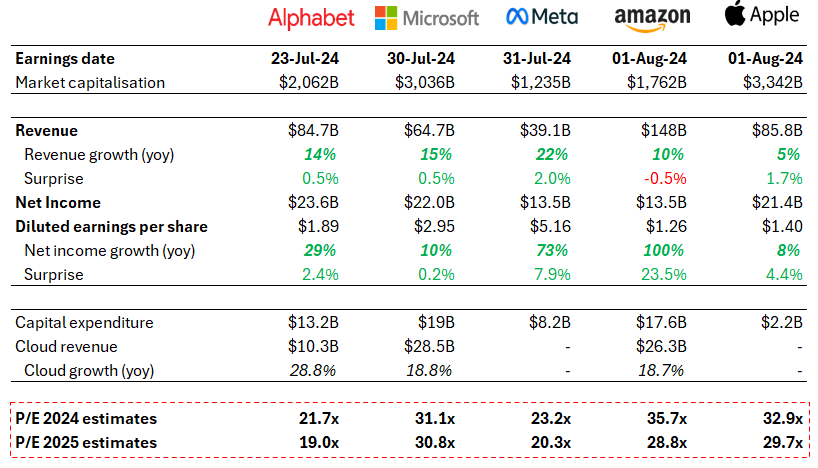

Most of the ‘Magnificent 7’ tech stocks have now reported earnings for Q2 2024, Nvidia being the exception, with its results due in late August. The results were largely positive with relatively strong revenue and earnings growth across all business segments – including digital advertising, search, e-commerce and cloud services. Indeed, most exceeded consensus analyst forecasts for both revenue and earnings.

However, beating expectations is not always enough for investors, and the post-announcement share price performance was mixed.

For Alphabet, Microsoft and Amazon investors focused on AI’s contribution to cloud revenue growth and higher capital expenditure to support the build out of data centers and servers.

Meta’s revenue beat was boosted by stronger than expected advertising revenues, whilst Apple continued to grow iPhone and iPad sales despite a challenging consumer environment.

Below is a summary of the key players.

Q2 2024 Earnings Dashboard

Source: Bloomberg. Market capitalisation and P/E estimates data as of 3 August 2024. Revenue, earnings and capital expenditure data as at relevant company’s earnings date. In US dollars. Tesla excluded on the view that its business model is not within the same supply chain as the companies represented above.

Market reactions and key takeaways

![]()

- Alphabet (Google’s parent company) shares initially sold off on concerns about the size of the company’s investment into AI without clearer evidence of a return on that investment.

- However the company reported strong revenue growth across all operating segments, with its traditional Search business and Google Cloud the highlights.

- As Google’s Search business begins to mature, investors are looking to Google Cloud as the unit with the most potential to boost growth – allowing enterprise customers like Deutsche Bank and the U.S. Air Force to build powerful AI models. Google Cloud’s revenue hit $10 billion for the first time, with growth accelerating to 28.8% yoy.

- Amazon’s main-ecommerce business slowed marginally due to softer consumer spending and Amazon’s forward guidance for the current quarter was lower than expected. The bright spot was its cloud computing platform (Amazon Web Services) which hit an annualized run rate of over $100 billion.

- Similar to Google Cloud, AWS is being viewed as Amazon’s fastest growing business unit as companies continue to modernize their infrastructure and leverage new generative AI opportunities. AWS’s revenue growth has accelerated from 12% to 19% over the last year with strong demand from both AI and non-AI applications and workloads.

![]()

- In an environment where mega cap tech stocks are priced for perfection, a slight miss in earnings and higher capex overshadowed Microsoft’s strong underlying fundamentals.

- Azure total revenues slowed marginally to 29% yoy, from 31% yoy last quarter. Whilst the slowdown in growth was disappointing relative to peers, this is still an incredible rate of growth given Azure revenues are now just shy of $20 billion. The silver lining was that Azure revenue growth attributed to AI is now up to 8 percentage points (up from 6 percentage points two quarters ago).

- Microsoft’s capital expenditure for the quarter jumped to $19 billion (including server farm leases), which was the largest figure amongst the Magnificent 7.

- Meta’s result was well received by the market, sending its shares nearly 7 percent higher.

- The core advertising business grew revenues faster than expected, benefitting from the use of AI in generating more targeted and personalised ad placements.

- The average price per ad increased by 10% year over year, and Reels (equivalent to TikTok short form video content) alone now makes up 50% of engagement time.

- While the company said it plans to increase AI R&D capital expenditures. “significantly”, Meta has been able to demonstrate its ability to monetise AI through higher user engagement and higher ad revenue.

- Despite a challenging consumer backdrop, iPhone sales slowed less than expected whilst the iPad business benefited from the release of new (M2 Air and M4 Pro) models – notably, about half the customers who purchased an iPad were new to the product.

- Offsetting this was a sales slowdown in China with competition intensifying with local players such as Huawei.

- However, the short to medium term outlook remains constructive, with rumours of a launch date of 10 September 2024 for the new iPhone 16. This model will incorporate Apple’s newest AI technology, Apple Intelligence, and it’s likely to prompt a broad refresh cycle among existing iPhone users as they look to upgrade their devices.

Why the outlook ahead remains positive despite earnings and capital expenditure concerns

What is the earnings outlook from here?

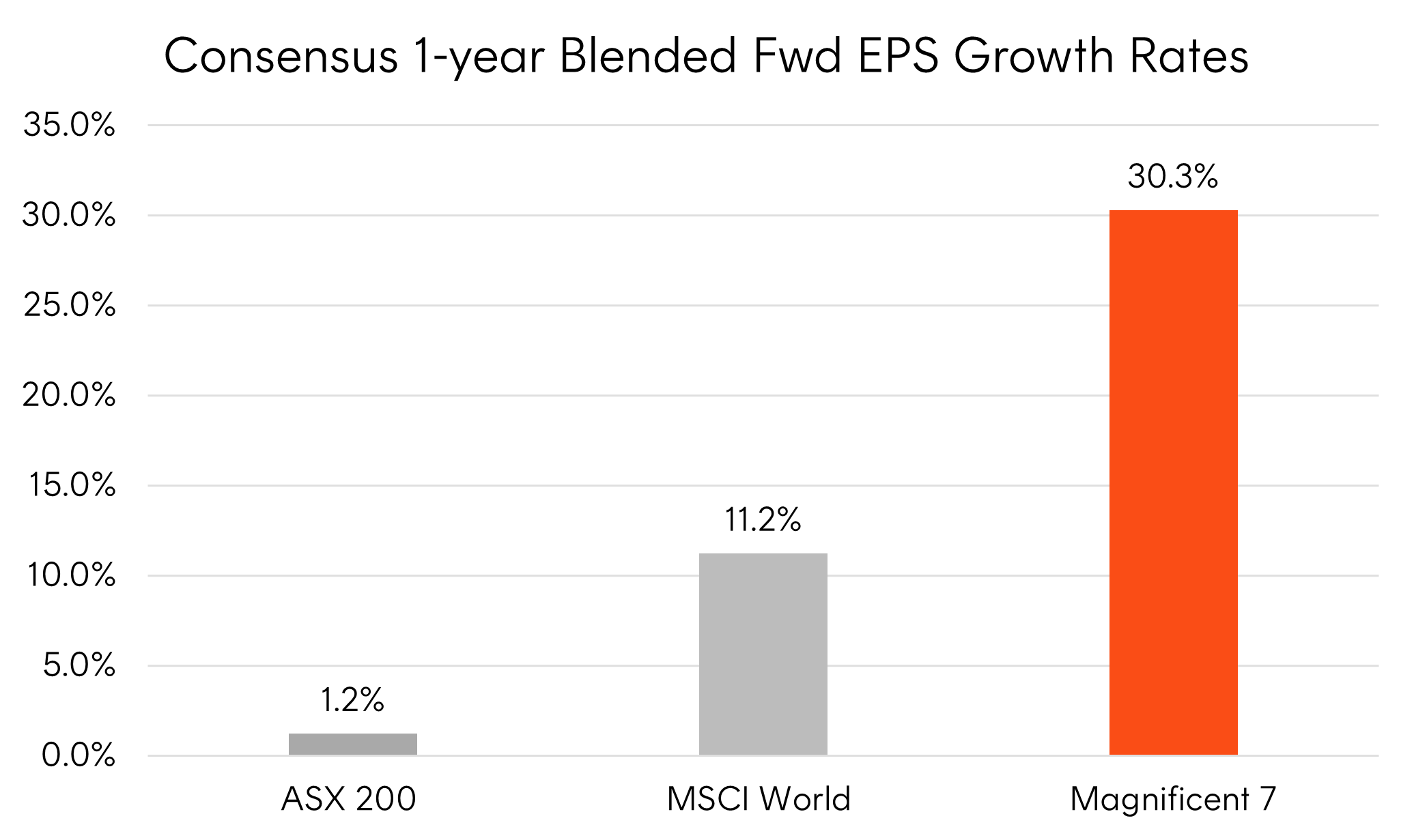

The outlook over the next year remains positive, with forward earnings per share growth rates for the ‘Magnificent 7’ expected to outpace that of the MSCI World and ASX 200 benchmarks by a significant margin.

Source: Bloomberg as of 3 August 2024. Bloomberg blended forward 12 month EPS combines actual results that have been reported and estimated results that have yet to report. You cannot invest directly in an index. Past performance is not indicative of future performance.

Of course there are risks, such as potential ramifications from the US election, consumers showing signs of stress and weakening economic data. But the Magnificent 7 and the broader Nasdaq 100 index offer investors a precious commodity in investing – growth.

Capital expenditure – are companies spending too much?

The cumulative spend on data centers and servers is expected to reach $1 trillion over the next five years across Microsoft, Alphabet, Meta and Amazon.

The pure size of this expenditure has investors rightfully questioning the risk around a return on that investment. The lack of a new consumer ‘killer’ AI Application has lead some to question the payoff, but as discussed above, AI is already making a material contribution to cloud revenue (in the case of Amazon, Microsoft and Alphabet) and advertising revenue (in the case of Meta).

It’s also important to note that spending on R&D and capex is nothing new for these companies and is crucial in the tech industry, where leading companies need to build out frontier technologies to maintain a competitive advantage. They can easily fund the build out through their enormous free cashflows, and as Mark Zuckerberg said, the bigger risk is not spending enough, “Because the downside of being behind is that you’re out of position for like the most important technology for the next 10 to 15 years.”

There is a strong relationship between R&D expenditure growth to revenue and earnings growth – with the Nasdaq 100 outpacing the MSCI World and ASX 200 indices over the past decade as shown in the chart below.

Source: Bloomberg as of 22 July 2024.

Where to from here?

The Nasdaq 100 is home to some of the largest and most innovative companies in the world including the ‘Magnificent 7’ technology stocks which had a generally positive second quarter for earnings.

The bar remains high in terms of future growth expectations, but that is justified by the potential productivity dividends that AI could deliver.