In Trump we trust

5 minutes reading time

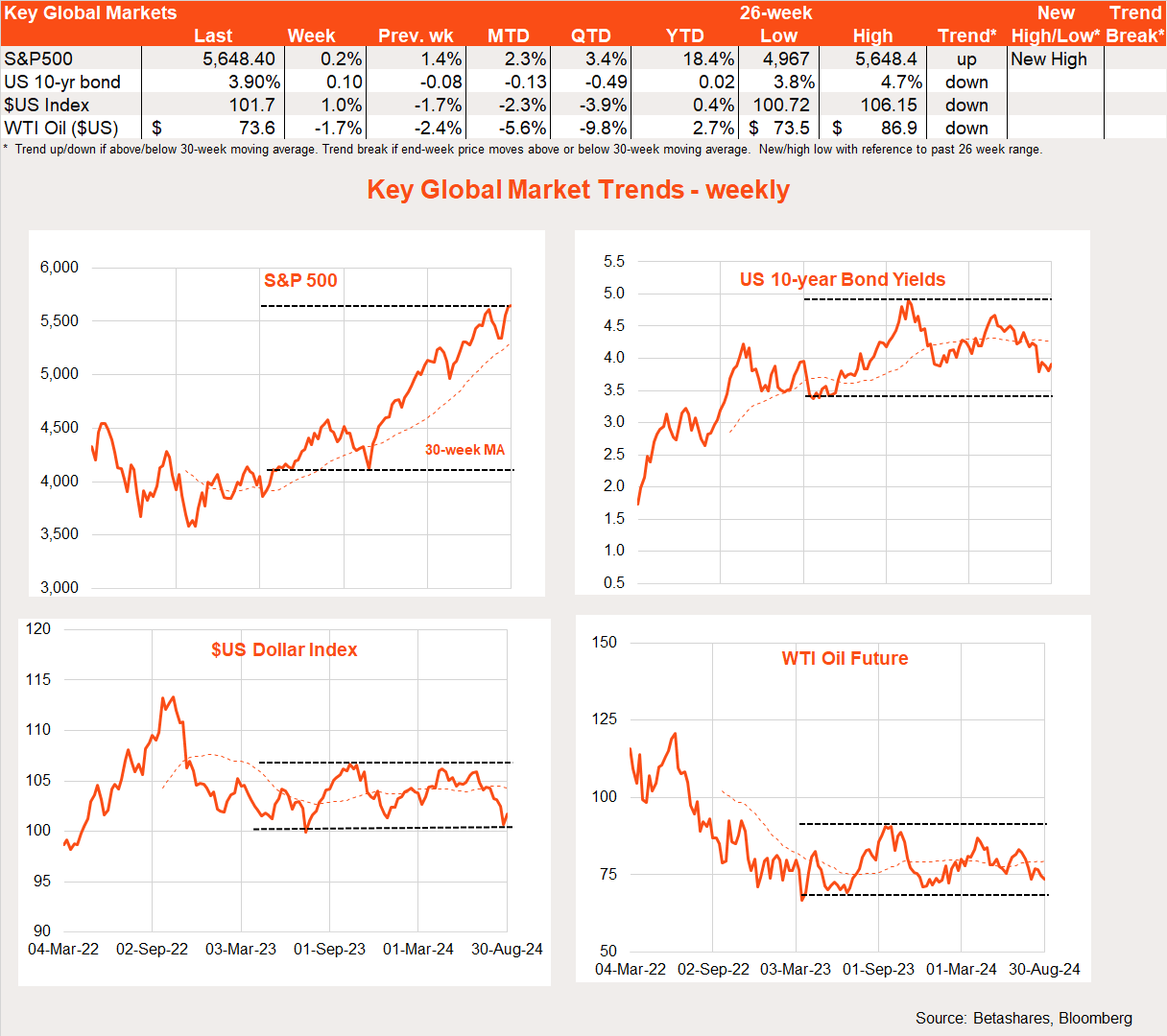

Global markets

Global equities consolidated last week, following several weeks of strength in anticipation of US Fed rate cuts ahead. Helping in the consolidation was a less-than-usually impressive Nvidia earning update. That said, the S&P 500 still closed at a new end-week market high.

There was little more in the way of good news to drive markets last week following the euphoria around Fed chair’s Powell’s Jackson Hole speech.

Key news included a modest consumer led upgrade to Q2 US GDP growth (from 2.8% annualised to 3%) and still reassuringly low weekly jobless claims – both of which further reduced lingering fears the Fed may be “late to the party”, and a recession is around the corner. Expectations are firming for only a 0.25% US rate cut at the September 17-18 policy meeting.

The US July core PCE inflation report was again benign, with a 0.2% monthly gain in line with market expectations. Annual core inflation edged lower to 2.6% from 2.7%.

Other key global developments of note included Nvidia’s good but less than usually impressive earnings update, with the rate of expected annual revenue growth now decelerating from extremely lofty levels.

There was also a mini-spike in oil prices last week on news of potential supply disruptions in Libya – though prices were unwinding again by week’s end. Containing oil prices, moreover, are growing expectations that OPEC will lift oil production limits next month.

Global week ahead

Key highlights this week are US labour market data, including job openings on Wednesday, weekly jobless claims on Thursday and the August payrolls report on Friday. With the Fed stating it no longer wants to see a further weakening in the labour market, any signs of softness would be mixed for equity markets – reintroducing fears of recession but also heightening expectations for a 0.5% Fed rate cut next month.

Job openings are expected to decline further, from 8.2m to a still relatively high 8m. Jobless claims are also expected to remain low. With forward labour market indicators still holding up well, markets are anticipating a firm payrolls report, with a jobs gain of 164k and an easing in the unemployment rate back to 4.2% from 4.3%.

US manufacturing and service sector ISM surveys are also released this week, with the former expected to lift modestly but remain weak (47.5 from 46.8) and the the latter to ease from 51.4 to 50.9. A surprise drop in the non-manufacturing survey to sub-50 might be a concern for the market, though it could also boost expectations for a larger US rate cut.

With inflation in the middle of the 1-3% target band and the unemployment rate at 6.4%, the Bank of Canada is widely expected to cut rates for the 3rd time in a row this week to 4.25%.

Market trends

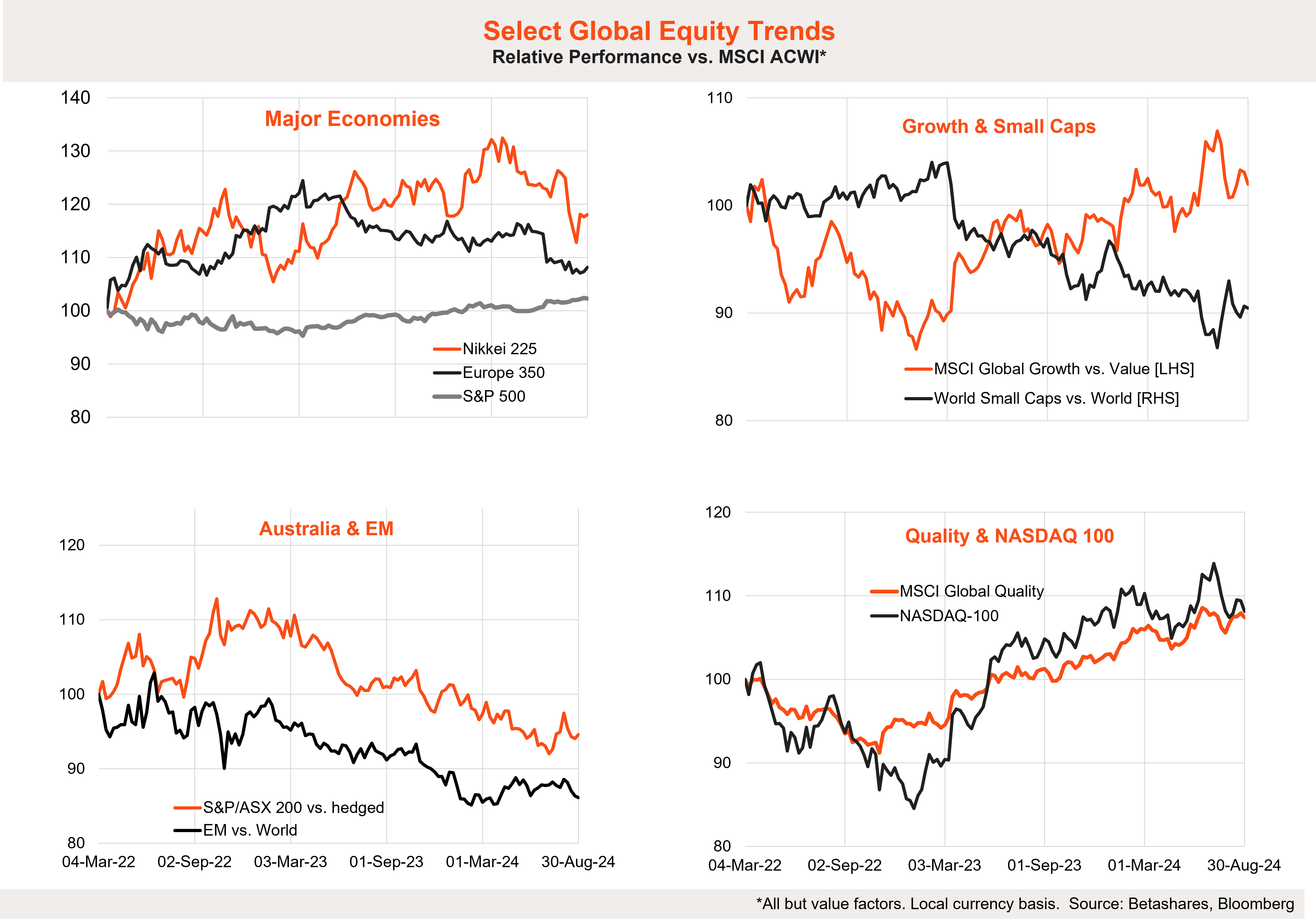

Current global equity trends are relatively messy.

To date the broad trend of outperformance by large-cap developed market growth stocks has tended to be directional – it has largely remained in place since the global equity market bottom in late 2022, although there have been a few corrective challenges to this narrative along the way. The market shakeout earlier last month again tested this narrative, though the subsequent rebound has again tended to favour these stocks.

All up, as I’ve argued here previously, we’ll need the dust to settle from recent market volatility to discern whether the much-debated broadening in the global equity rally beyond Japan/large-cap technology will gather steam. Can cheaper value stocks outperform as equity markets continue to trend up? I suspect that they can, but the evidence to date remains patchy.

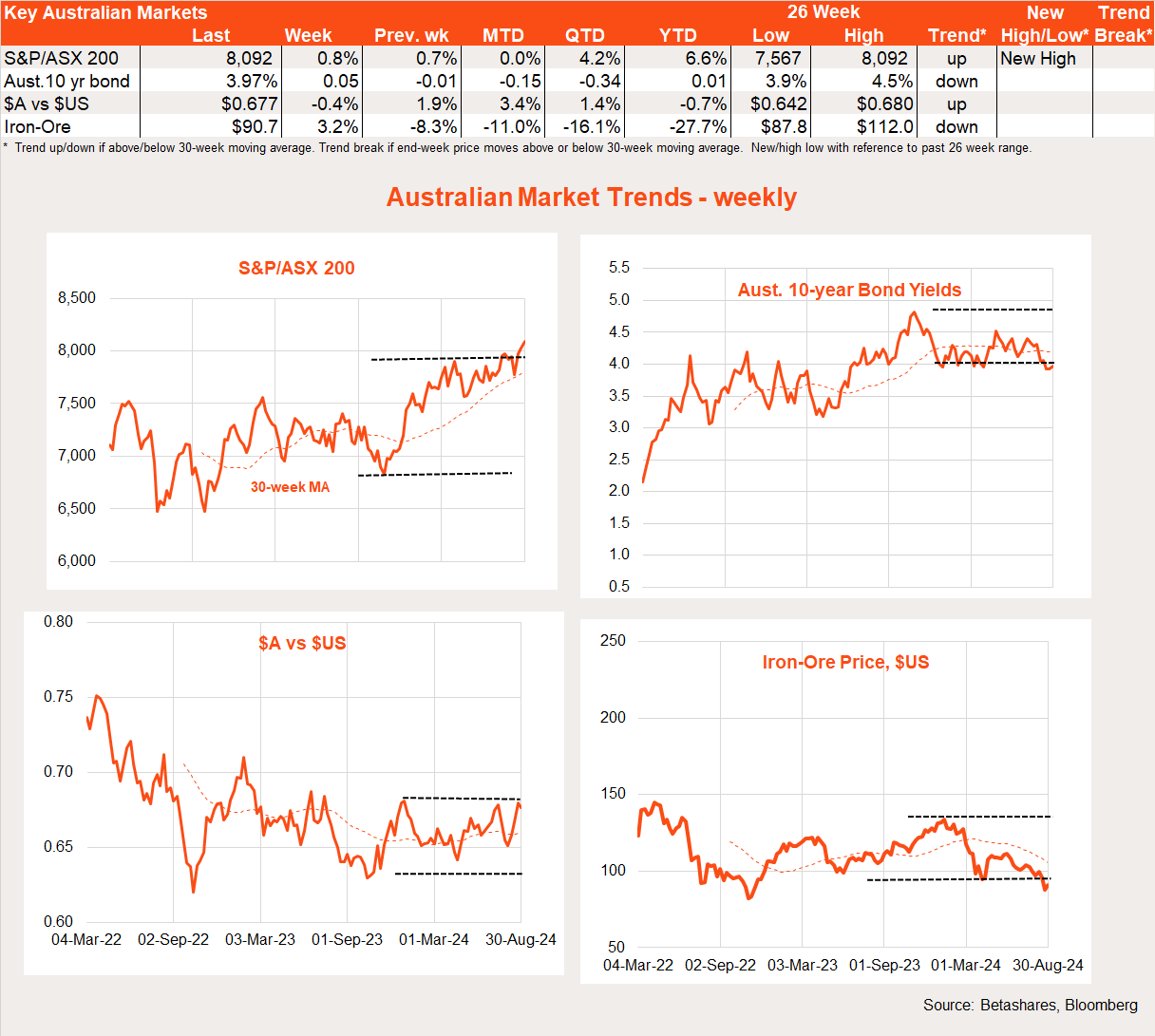

Australian market

Local stocks edged up further again last week, with the S&P/ASX 200 holding above 8,000 and closing at a new end-week high. The gains mainly reflected better-than-feared earnings results in the current reporting season, with local economic data and the interest rate outlook still far from encouraging.

To summarise the earnings season thus far, it appears consumer/retailing stocks have surprised to the upside – with reasonable earnings despite an apparently bleak consumer spending picture. Banks have also fared well, with fears of mass home loan defaults dissipating over time. Our small but dynamic group of technology stocks are also carving out profits. Resources, however, remain under pressure – with China still producing more steel than it needs given the bursting of the housing construction bubble.

Local economic news last week was hardly inspiring. The July monthly CPI report was a touch higher than expected, though appeared to show some broadening in disinflationary trends. Q2 business investment and construction activity were both softer than expected. The outlook for private capital spending and infrastructure remains firm – albeit less so for the crowded out housing construction sector.

The local highlight (or more likely, lowlight) for this week will be Wednesday’s Q2 GDP report, along with the usual trade and inventory building blocks today and tomorrow. Given weak consumer spending and housing construction, this week’s result is likely to remain fairly soft, with a miserly gain of around 0.2%.

The frustrating aspect to this is that although the economy is only crawling ahead, the RBA suspects this largely reflects capacity constraints – with the overall level of demand still high relative to available supply. In short, don’t expect the RBA to shed many tears over another likely lacklustre GDP report.

Have a great week!