Our rules for momentum investing

4 minutes reading time

Global Markets

Solid economic data and a reasonably benign inflation report provided further reassuring signs to Wall Street last week that the US economy remained on a “soft landing” track. Even Powell’s ongoing threat of two additional rate hikes is being taken in its stride – on the view that the economy appears resilient enough to withstand it. Core inflation is high and slowing less quickly than headline inflation, though the trend at least appears downward.

Perhaps a greater near-term risk to markets is not that the US economy suddenly slips into recession, but that it remains too strong or reaccelerates – particularly the labour market. In this regard, key reports this week on jobs growth, job openings and jobless claims will provide an important temperature check.

Fundamentally, the US equity market appears richly valued, which does make it vulnerable to surge higher in bond yields if growth reaccelerates and the Fed becomes a lot more hawkish. But otherwise, economic resilience is now being reflected in a levelling out in earnings expectations – if inflation continues to ease in the face of a still solid “goldilocks” economy, lower interest rates and higher earnings could be the catalysts for the next leg higher in equity prices.

Soft landing hopes continue to favour growth/technology/quality exposures over value/commodity exposures – which, in turn, is not favouring the local Australian markets compared to global peers.

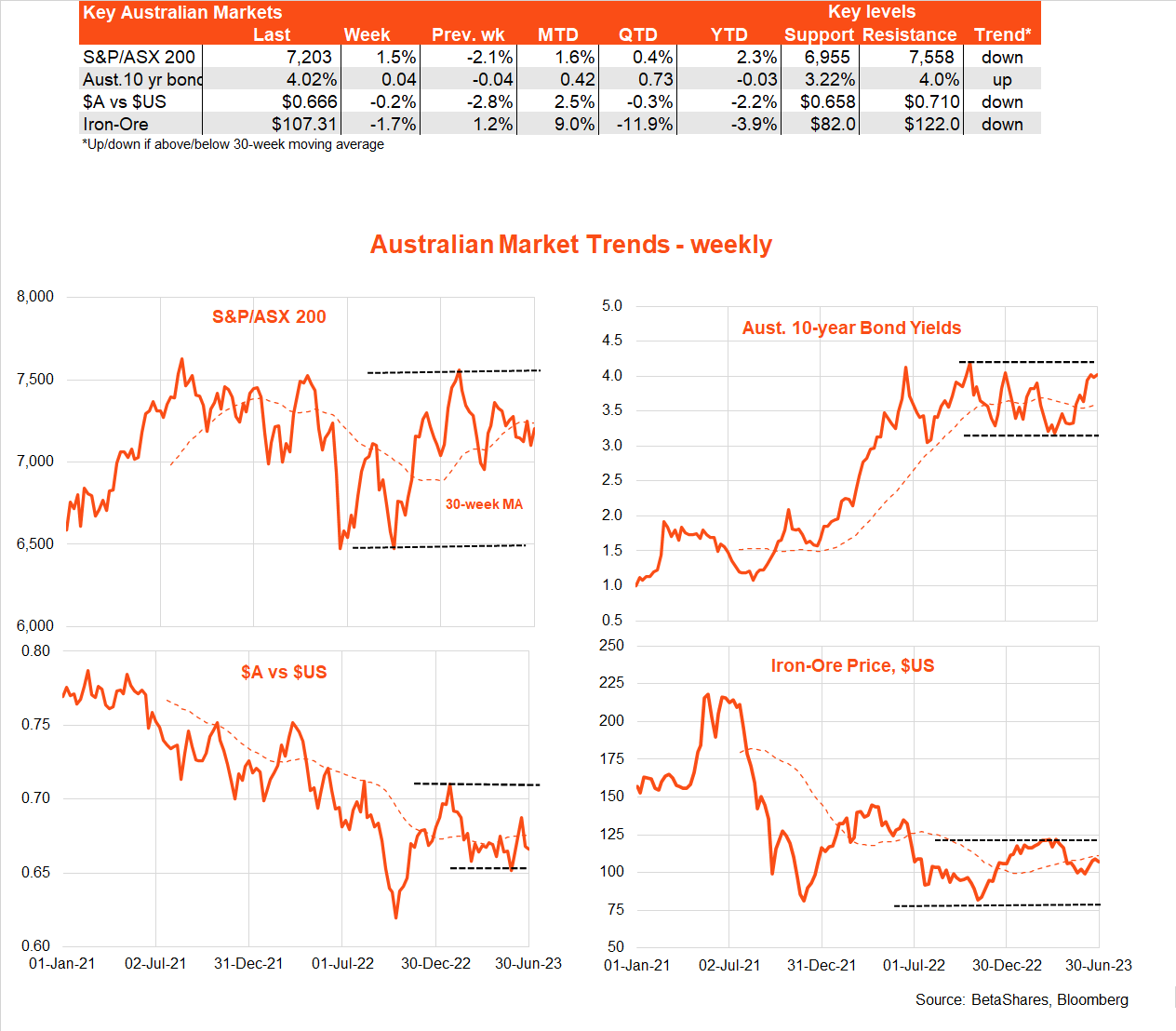

Australian Market

There were mixed local economic data last week – with an encouraging decline in monthly inflation though a solid rebound in consumer spending. This likely leaves this week’s RBA decision another line-ball event. On balance, I suspect the RBA will give more weight to the apparent resilience in consumer spending and house prices and hike rates again on Tuesday. Though there is a risk it could hold off until August and await the more detailed quarterly CPI result due later this month.

Either way, the RBA appears concerned that the global disinflationary forces now underway could be less evident in Australia – not helped by local supply tightness in the energy and housing markets. Although these are supply issues, solid demand aggravates the pressure on prices in both sectors and, more generally, is making it easier for both workers and businesses to seek compensatory wage and price gains.

Given these cost pressures, the RBA likely wants to ensure a decent slowing in economic growth – and a rise in unemployment – to limit second-round inflation effects.

Have a great week!

| Top events of the past week | Comment |

| Powell’s comments | In a talk in Europe, the Fed Chair reiterated his base case expectation of two further rate hikes this year. |

| Solid US economic data | A solid gain in durable goods orders, an upward revision to Q1 GDP growth and a fall in weekly jobless claims doused fears of an imminent US recession. |

| Moderating US inflation | The Fed’s preferred inflation measure, the private consumption deflator, moderated further in May, helped by lower energy and food prices. Core inflation also eased, but remains uncomfortably high on an annual basis. |

| Encouraging Australian monthly CPI | The May Australian monthly CPI report revealed a sharp slowing in annual headline inflation thanks to falling petrol prices. The decline in the various measures of underlying inflation was more modest, through still encouraging, albeit annual rates remain at a high level of around 6%. |

| Solid May Australian retail sales | After a flat April result, retail sales bounced by 0.7% in May, thanks to a bring forward of EOFY discounting and solid gains in cafes/restaurants. |

| Key events to watch this week | Comment |

| US payrolls | A solid 200k gain in employment is expected, with the unemployment rate expected to hold steady at 3.7%. Focus will also be on the extent of any easing in average hourly earnings growth. |

| US job openings/jobless claims | Although US job openings have eased from their peak in recent months, they bounced in April. Weekly jobless claims have also fallen back. Another gain in job openings and decline in weekly claims could lead to concerns that the labour market remains too hot. |

| US services and manufacturing PMI indices | US manufacturing is weak, but appears to be stabilising, while the services sector remains on a more solid footing. It will be worth watching pricing pressure and new orders for both. |

| RBA board meeting | In what could be another line-ball decision, the RBA seems likely to raise rates further given signs of resilience in consumer spending, house prices, and underlying inflation. |