5 minutes reading time

Global equities weakened again last week as President Trump’s surprise announcement of a 25% global tariff on both cars and auto parts shook market sentiment ahead of this week’s ‘liberation day’.

Global markets last week

There’s not much else driving global markets at present than US President Trump’s drum beat of tariff announcements. Last week started on a positive note, with markets encouraged by suggestions the suite of US reciprocal tariffs to be announced on ‘liberation day’ this Wednesday would be not as extensive as first feared.

Optimism quickly faded, however, with the out-of-the-blue car tariff announcement. When questioned, Trump doubled down, indicating he ‘couldn’t care less’ if foreign car makers raised their prices, defiantly declaring: “I hope they raise their prices, because if they do, people are gonna buy American-made cars.”

Of course, US makers will have to pay more for imported car inputs and also likely face retaliation in their own export markets. The market verdict, so far at least, is to reduce the market value of US auto makers.

For markets, liberation day is as much about being liberated from further tariff announcements as it is the ongoing uncertainty on tariff policy that most risks undermining markets, business and consumer confidence. That said, we now also face possible retaliation from US trade partners, and then America’s possible retaliation to that retaliation.

Meanwhile, US economic data is starting to fray at the edges, with a downwardly revised reading for the University of Michigan consumer sentiment index on Friday – and a further rise in now-elevated consumer inflation expectations. February’s core private consumption expenditure deflator (PCED) was also a touch higher than expected, with annual inflation lifting from 2.7% in January (revised up from 2.6%) to 2.8%.

Global week ahead

Wednesday’s ‘liberation day’ is the global market highlight this week, with investors hoping that rumours are true and the suite of tariffs will be relatively modest (we can live in hope but anything is possible!).

US payrolls on Friday is another highlight, with another solid employment gain of around 130k expected – though this is now dated information, with markets focused on the impact of tariffs in coming months.

A likely further easing in Euro-zone annual CPI inflation mid-week (from 2.6% to 2.5%) will also keep market hopes alive for further ECB rate cuts.

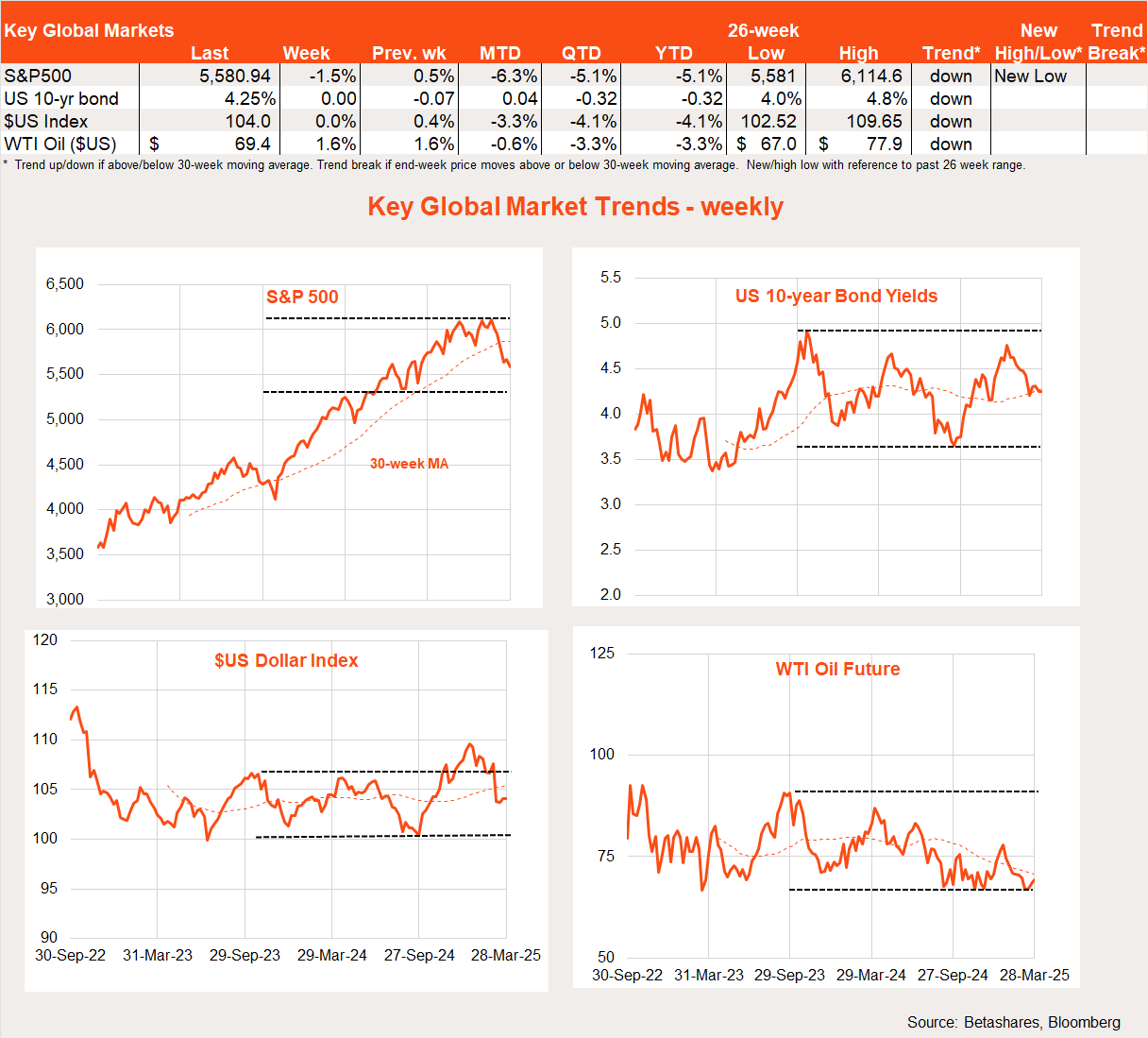

Global market trends

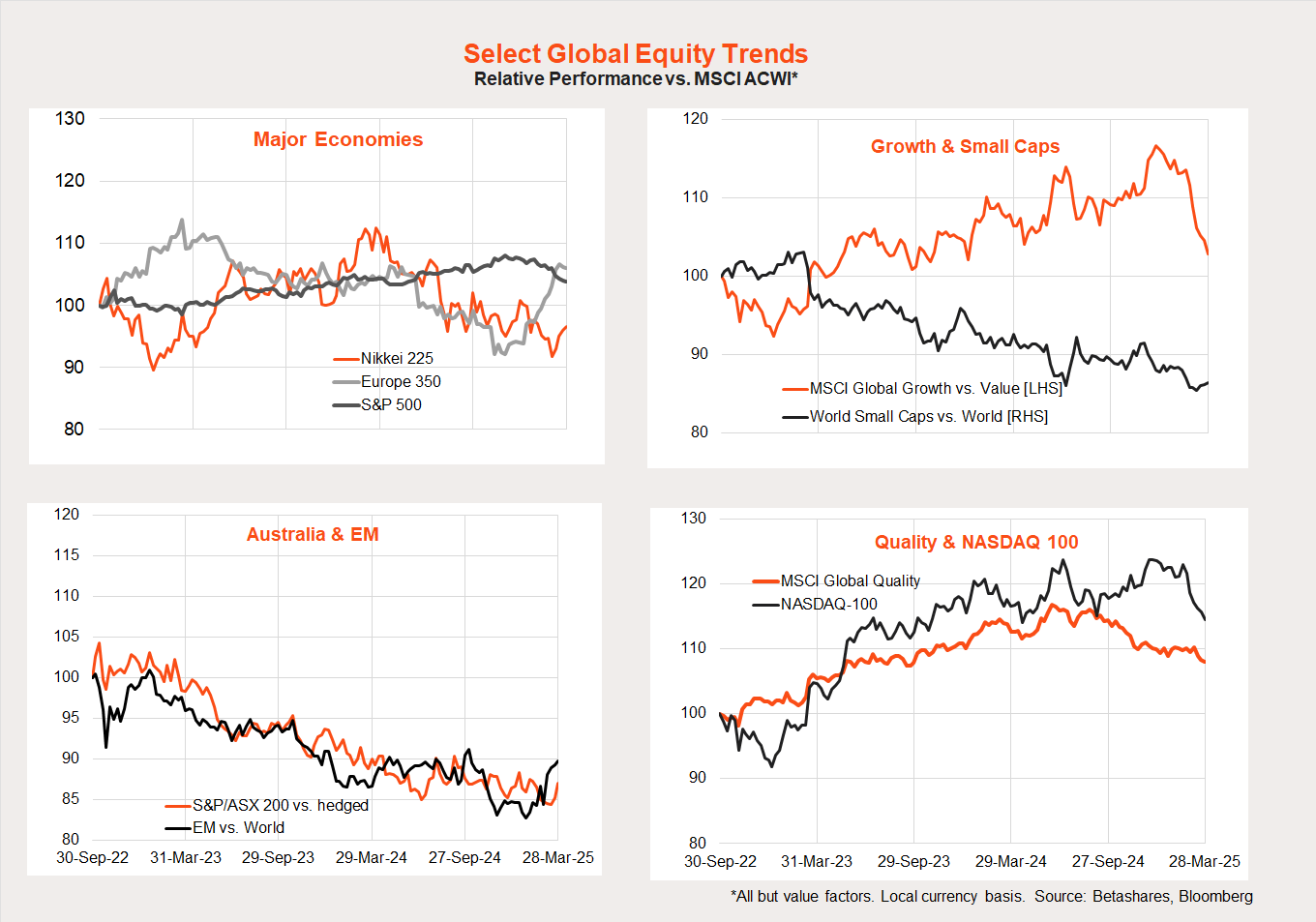

Non-US stocks marginally outperformed US stocks again last week, with equities in Japan and emerging markets falling a bit less than the S&P 500. The Nasdaq 100 again underperformed, dropping 2.4%.

This has continued the pullback in the relative performance of the Nasdaq 100 and global growth over value. Australian stocks also outperformed again last week, although it’s too early to call an end to the downtrend in relative performance.

Australian market

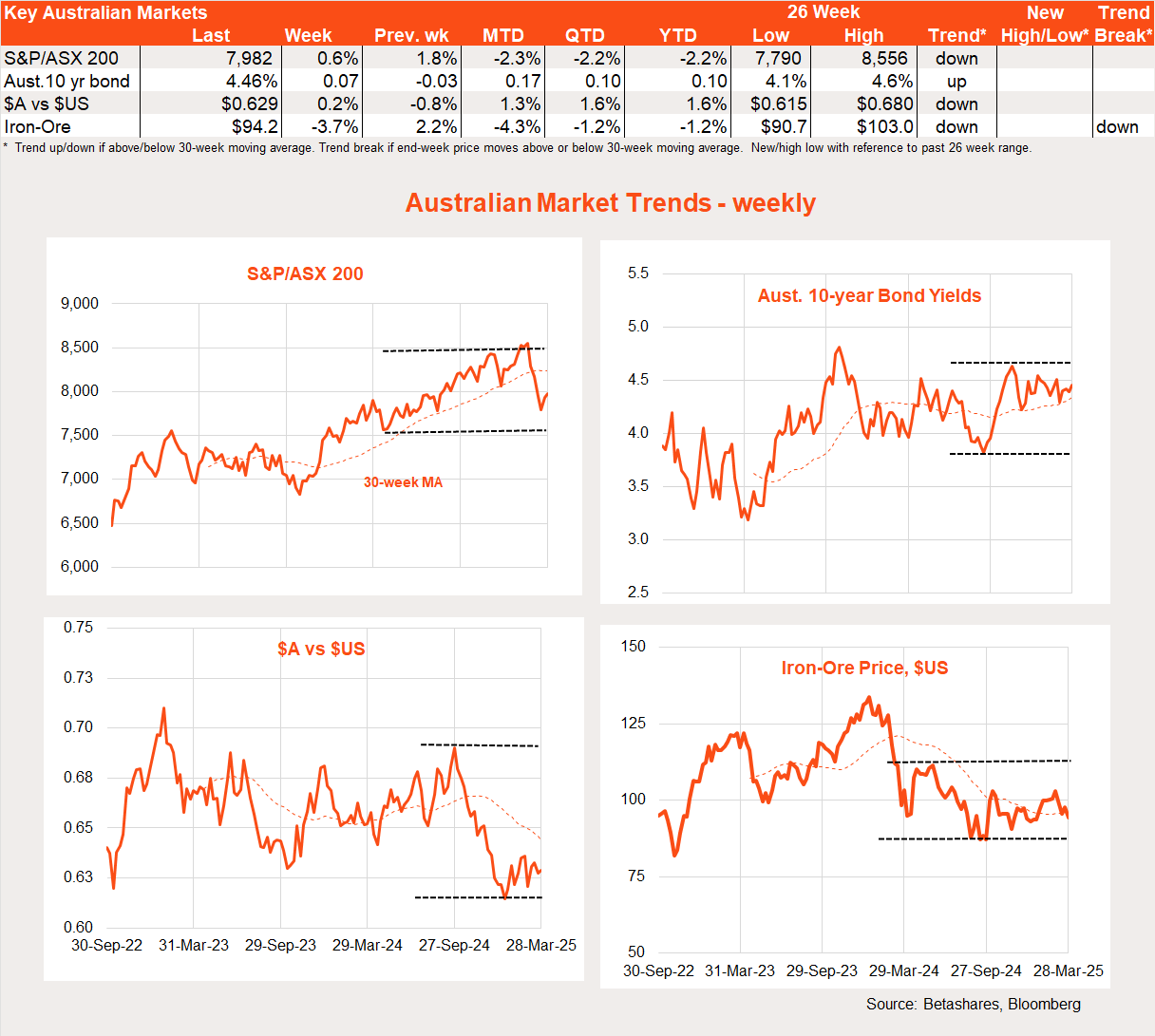

Local stocks again held up last week though are yet to reflect Friday’s slump in US stocks.

Last week’s local highlight was the Federal Budget, which seems broadly neutral in terms of economic impact. The Budget deficit outlook improved modestly, thanks to stronger than expected employment and lower than expected interest rates and inflation since December’s Mid-Year Review (which boost revenues and lower projected spending), with this partly offset by increased social policy spending – and a tiny surprise tax cut from July next year.

All up, the Budget was neither significantly contractionary (no surprise given an election is imminent) nor significantly expansionary. All up, it would not sway RBA deliberations one way or another in coming months – although the Bank will still keep a keen eye on election promises.

The other highlight last week was the February monthly CPI report, which revealed a welcome decline in annual trimmed mean inflation from 2.8% back to 2.7%. This bodes well for a sub-3% annual trimmed mean inflation result in the Q1 quarterly CPI report later next month, which in turn bodes well for another RBA interest rate cut in May.

Local highlights this week

The RBA is not expected to cut rates at this week’s meeting, though markets await the statement tomorrow afternoon for hints on the Bank’s inclination to cut rates in May. I suspect the statement will be less hawkish than when it cut rates in February (which was designed to play down the risk of an April cut) and leave open the prospect of a May rate cut if the Q1 CPI is benign.

Retail sales, building approvals and official job vacancies data are also released this week. All up the data is likely to be consistent with still relatively subdued private sector activity – which should not stand in the way of lower interest rates in the months ahead.

Have a great week!