5 minutes reading time

Reading time: 2 minutes

“What is the chances that me will eventually die?” – Ali G

A recent conversation with my GP reminded me of the unfortunate truth that one day I am going to die. I consider this to be a bit of a stitch-up.

Thankfully, with some luck, I’ll be around for a few more decades. For those of us who have time on our side and are looking to invest for the long term, compounding is a gift – as Einstein is reputed to have said: ‘Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.’

In the last issue of Launchpad, Tom covered how to invest – maybe the next key question to answer is what to invest in that can give us the most bang for our buck in the time we have left?

How should I construct my portfolio?

The investment universe is big

Most people don’t realise how vastly, mind-bogglingly big it is – you may think there are a lot of options on CommSec Pocket, but that’s peanuts compared to the investment universe.

Thankfully, we can cut up the investment universe into handy pieces (or asset classes), including:

Bonds: Just like hydrogen makes up most of the observable universe, bonds make up the majority of outstanding investable assets1. Bonds are effectively loans provided to a government or company by investors. The principal of the loan is returned after a set amount of time, with interest typically paid to the investor every six months. Because most bonds provide a steady cash flow and the return of capital when the principal is paid back, their prices tend to be more stable than other asset classes.

Equities: Commonly known as stocks, equities are little pieces (shares) of companies that you can buy on a stock exchange. A stock will fluctuate in value (up or down) depending on variables such as expectations for future profit and can also provide returns through dividends.

Currencies: The Australian dollar, U.S. dollar, Japanese yen etc.

Commodities: Gold, silver, oil, wheat, soybeans, coffee beans.

Derivatives: Derivatives might be considered the dark matter of the investment universe, complex, high risk products that are usually only tinkered with by institutional investors – although they have attracted some interest from retail investors recently, particularly in the U.S., where trading apps like Robinhood allow for cheap access to futures and options contracts.

Risk and return

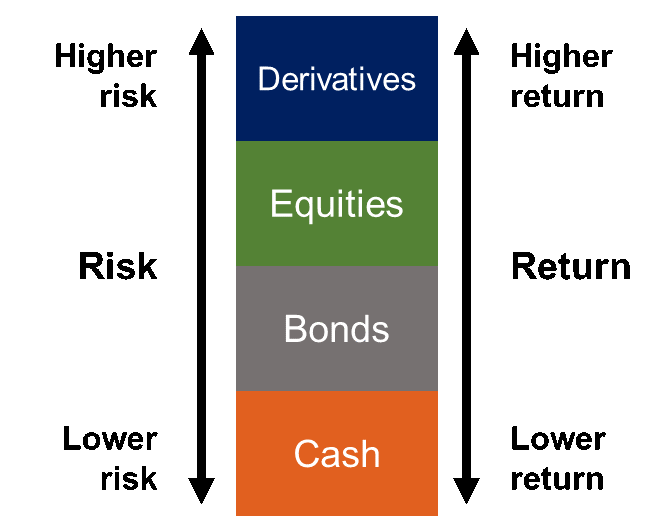

The relationship between risk and return is a cornerstone of investing.

Just like placing a bet on a horse or your favourite sporting team, investment risk and potential returns are correlated. Back the favourite, and the odds will be low – meaning that if the favourite wins, the payout is low, since the chances of success are high. Back the rank outsider, and the odds will be high – your potential payout is large, but the chances of it happening are low.

The same applies with investing. Greater risk means greater opportunity for price growth, but also greater chance of significant loss. You can roughly estimate the risk of an asset by the volatility of its price.

The risk/potential return relationship

*Provided for illustrative purposes only.

For example, a stock will likely have a more volatile price than a bond – as such, the stock entails more risk. Equally, most stocks potentially provide a higher price return than the more stable bond. High risk/return assets are known as growth assets. Low risk/return assets are known as defensive assets.

Risk and return characteristics also differ within asset classes. For example, in the last 5 years (to 31 March 2021) the S&P/ASX 200 has provided a return of 10.71% per annum2, whereas over the same time period, the S&P 500 (an index of U.S.-listed companies) has provided 16.14% per annum2. Even the stocks within these indices have a range of risk/return characteristics. Technology companies, for example, are typically more volatile than companies selling consumer staples, and a speculative mining stock will have higher risk than stock in one of the big four banks.

Likewise, some bonds offer a higher return than others, depending, among several things, on the creditworthiness (risk) of the issuer. Some bonds may offer more defensive qualities than others, and may have an inverse correlation to equities, providing protection when the sharemarket performs poorly.

Building a portfolio

When it comes to building a portfolio as young investor, there is a greater ability, and a higher propensity, to take on risk. You probably do not have as many responsibilities as you might in the future. In the financial advice world, you are in the ‘accumulation phase’ (literally, accumulating wealth).

You also have time on your side; if things do go pear-shaped and wealth is lost, you have time to rebuild it. Many young investors will tend to have a higher allocation to equities, and a lower allocation to cash and bonds.

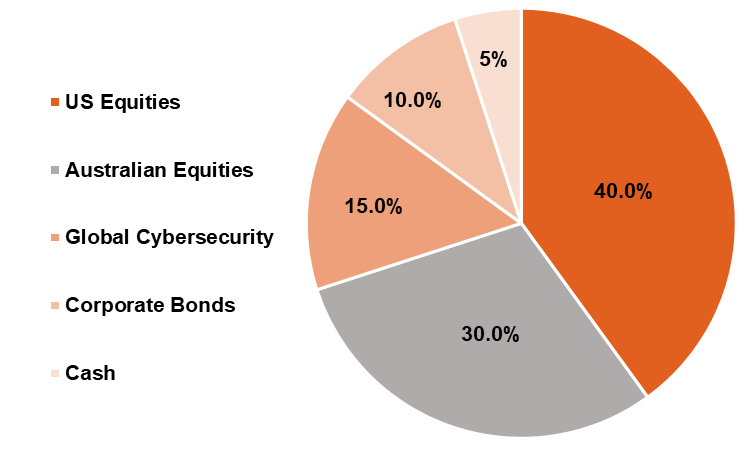

Geographically, you might also look towards equities with the potential for higher returns, such as U.S. and emerging market exposures, over Australian stocks. You might also want to set aside a portion of your portfolio to sectors with higher growth potential, such as robotics or cybersecurity. If you’re feeling especially courageous, maybe even some cryptocurrency could top off the risky portion of your holdings.

ETFs offer a cost-effective and convenient way to obtain these types of exposures. Because ETFs typically offer exposure to a portfolio of shares, you don’t have to pick a particular stock – you get diversified exposure to a basket of stocks in a single trade on the ASX.

Below is a possible asset allocation for an investor with a long investment timeframe and a high tolerance for risk, such as a younger investor. There is a high allocation to riskier assets (stocks) and a lower allocation to defensive assets (bonds and cash), which could be attained by investing in easy-to-access ETFs. Of course, this is a hypothetical example provided for illustrative purposes only- it doesn’t take into account any investor’s personal circumstances.

Ultimately, the way you construct a portfolio depends on a number of factors, including personal circumstances, investment timeframe, and financial goals. Just as important as these is your personal tolerance for risk – it’s important that the level of risk you take on allows you to sleep at night.

We will discuss these factors more in a future issue of Launchpad.

1. Source: Securities Industry and Financial Markets Association 2020 Capital Markets Fact Book

2. Source: Bloomberg. Past performance is not indicative of future performance.