Cautious cutter

4 minutes reading time

- Global shares

Global markets – week in review

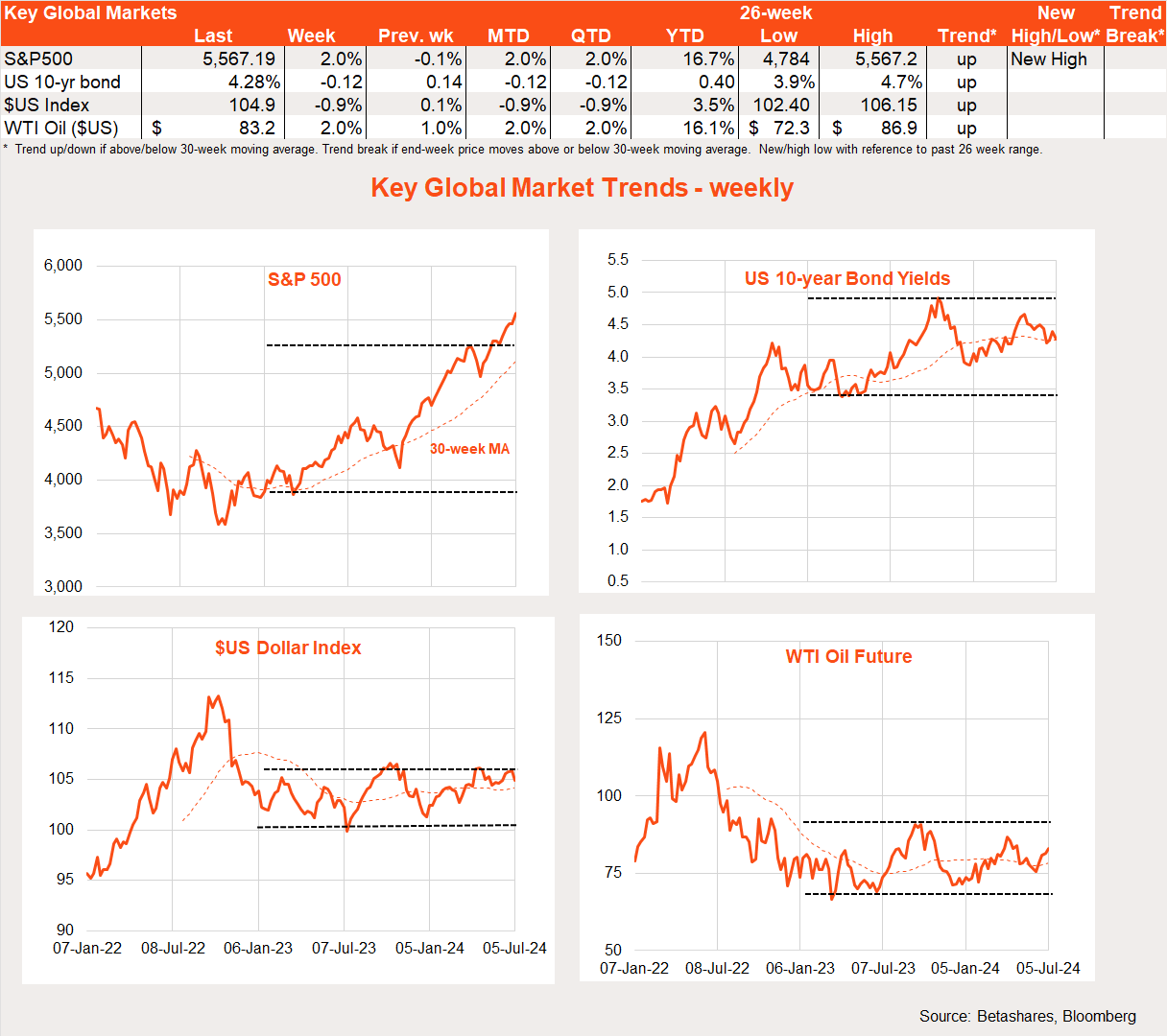

US stocks bounced back last week and bond yields eased as soft economic data supported the idea of rate cuts this year. With regard to US economic activity, markets are still in a “bad news is good news” mode.

The early part of last week was dominated by US service and manufacturing surveys – both of which were softer-than-expected. Although manufacturing has been subdued for some time, the real surprise was the slump in the services index to 48.8, compared to market expectations of an easing to 52.7 from 53.8. The survey has been choppy in recent months so at this stage we could just attribute the rogue result to volatility. Markets, at least, remained more focused on the good news with regards to possible rate cuts.

Then came Friday’s US payrolls report, with a modestly stronger headline result (+209k vs. market 190k), offset by a large 111k downward revision to employment in the previous two months and a further lift in the unemployment rate to 4.1% (market 4.0%). Annual growth in average hourly earnings eased to 3.9% from 4.1% – in line with market expectations.

As in Australia, all this is consistent with a gradual cooling in the US labour market. Indeed, one indicator of US recession is now flashing amber, with the three-month moving average unemployment rate 0.4% above its rolling 12-month low (according to the ‘Sahm rule’, recessions have usually been triggered when this measure moves 0.5% above its 12-month low).

It will be fascinating to track if this becomes yet another recession indicator (a bit like the yield curve so far) which will be thrown into the dustbin of history in the wake of this unusual COVID-driven US economic cycle.

In other news over the weekend, France has avoided outright victory by the Far Right National Rally party – though the likely fragile centrist/left governing coalition that emerges will hardly be much more conducive to much-needed economic and fiscal reforms. After a step to the right in the first round of elections, voters jumped back to the left on the weekend – helped by centre and left wing candidates avoiding running against each other so as not to split the anti-right vote.

All this will still allow the French Far Right to keep throwing stones from the sidelines – leaving them still a threat at the French Presidential election in three years’ time.

The week ahead

The major highlight of the week will be the US June CPI inflation report on Thursday (US time) – with another benign core monthly gain of 0.2% expected. Barring an upside surprise, this will likely cement the case for a September US rate cut.

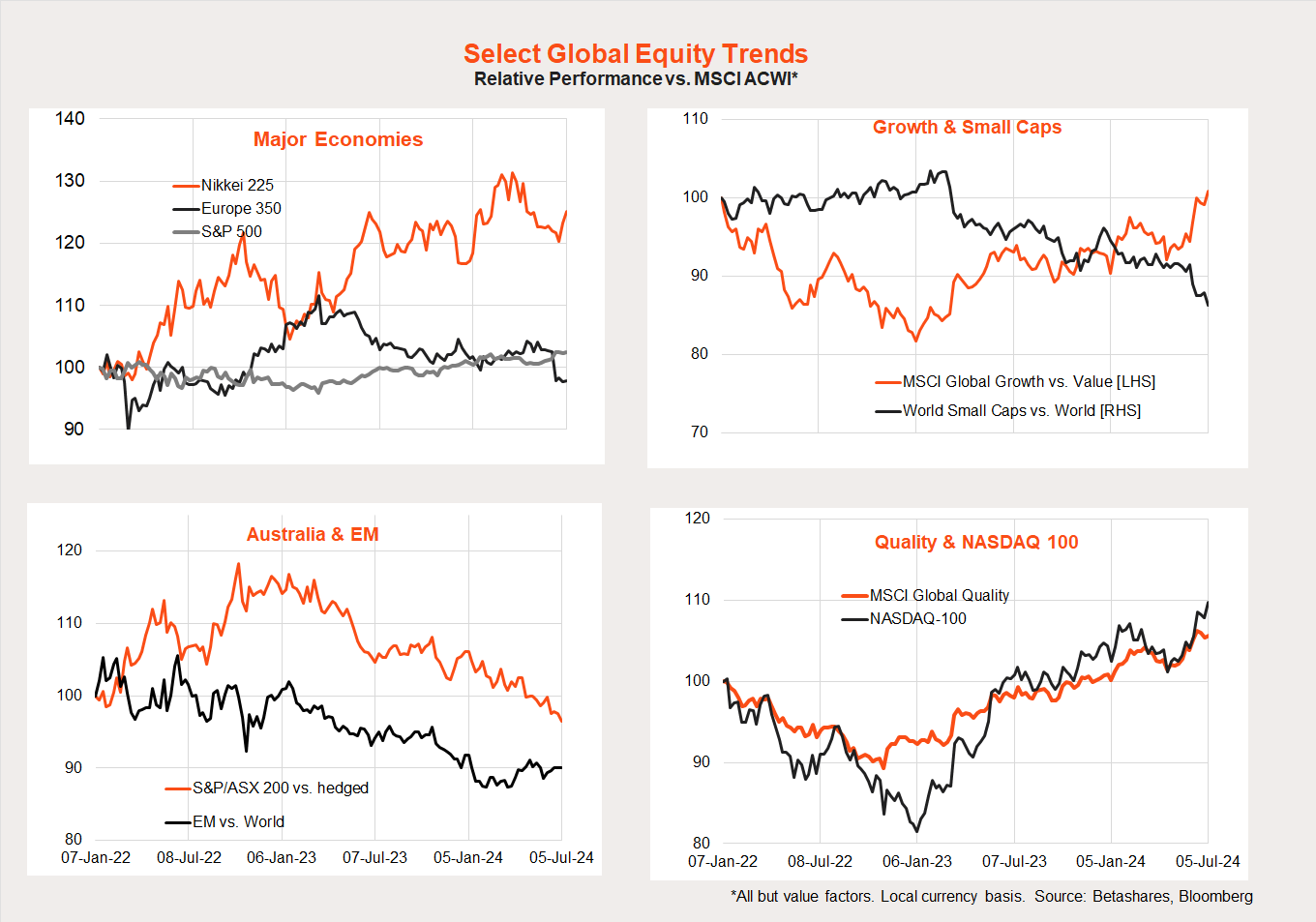

Global equity trends

Concerns around the French election have seen relative European equity performance slump of late, with (as noted above) one potential beneficiary being Japan. Japanese equities had another solid gain last week, though even European stocks moved higher.

Overall, however, trends continue to favour growth/quality/US over value/non-US markets.

Australian markets

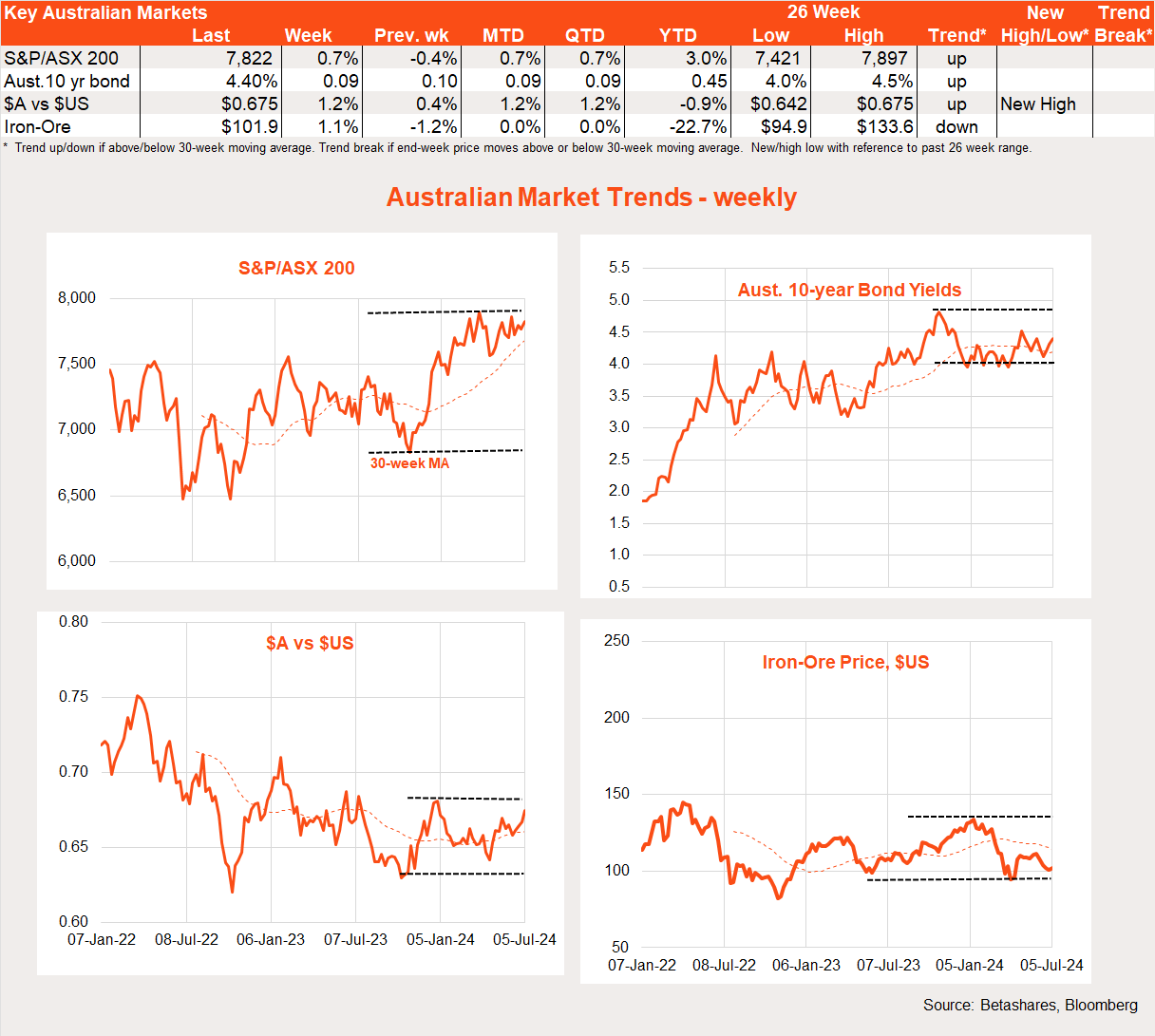

The S&P/ASX 200 bounced back an unconvincing 0.7% last week, dragged higher by global markets. Unlike in the US, bond yields moved higher and the diverging interest rate outlook between Australia and the US has seen the $A also move higher – reaching a new 26-week high.

The local highlight last week was May retail sales which, for a change, were stronger-than-expected with a 0.6% gain (market +0.3%). Albeit volatile, home building approvals were also stronger than expected, with a 5.5% gain in May (market +1.5%). All up, the activity data last week was firm enough to still keep a potential rate hike next month in play if the June quarter CPI is uncomfortably high.

Turning to the week ahead, we get updates tomorrow on business and consumer sentiment with the NAB and Westpac/Melbourne Institute surveys respectively. Despite tax cuts kicking in this month, consumer sentiment is likely to remain subdued (especially given increased media chatter around rate rises).

Of possibly more interest will be the degree to which the NAB measure of business sentiment also continues to weaken, given its impressive resilience over the past year or so. Also of note will be the degree of ongoing cost pressures business face – which, worryingly, have remained firm over recent months.

Have a great week!