The companies that could be set to benefit from a global ‘regime change’

4 minutes reading time

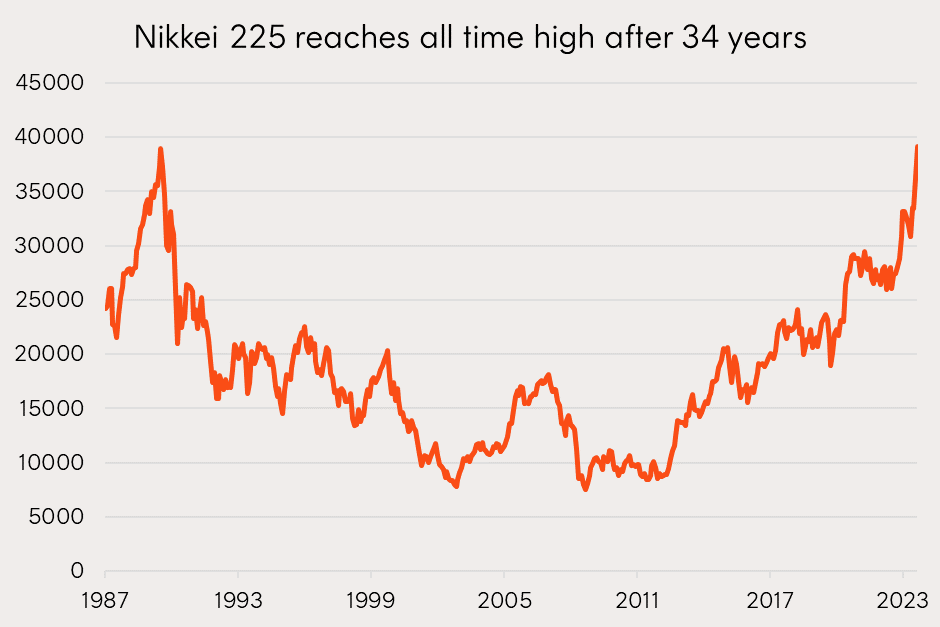

Following up on a series of insights here and here Japan’s Nikkei 225 crossed all-time highs this week, last seen in 1989.

Japanese equities continue to be the shining light for global equity market growth outside of the US’s mega-cap technology sector. Japan was the best performing developed equity market in both 2023 and year-to-date.

Source: Bloomberg. As at 22 February 2024. You cannot invest directly in an index. Past performance is not an indicator of future performance.

The driving force between Japan’s recent performance lies in the success of structural reforms aimed at the country’s corporations to enhance shareholder returns. These have led to record levels of dividends, share buy-backs and earnings per share growth for the country’s equities.

Beyond these reforms, the outlook remains strong for investors on a number of fronts.

Geopolitical tensions have led countries to reassess supply chains and Japan has been a key beneficiary. For example, an internal push to regain its position as a global chip powerhouse was bolstered last year by bi-lateral deals with Europe and the US. Seven of the world’s largest semiconductor companies have also laid out plans to expand manufacturing in Japan. This all comes amid efforts of western economies to diversify the global chip supply chain with fears of reliance on China.

Japan also remains a global leader in robotics with 45% of all industrial robots globally originally designed or produced by Japanese companies. This manufacturing specialisation not only benefits from any trend towards the western economies onshoring manufacturing, but also from the growth in applications for artificial intelligence. Nvidia’s CEO, Jensen Huang, met with Japanese government officials in December to discuss how the two can partner to set up AI hubs and capitalise on Japan’s decades of experience in megatronics, manufacturing and robotics.

Financial conditions in Japan also remain very accommodative on the back of BoJ policy, which has kept interest rates negative to foster sustainable levels of growth and inflation.

Finally, well documented working age population issues stemming from Japan’s population peaking around 2010 are beginning to subside. Foreign workers in Japan reached record levels in 2023 with 2 million workers, up 12% from a year earlier. Government support has also seen the female workforce growing significantly over the past decade to 74% today.1

Looking ahead, Japan appears uniquely placed for future growth. Projections for 2024 and 2025 earnings per share have fallen across every region in the world, with the sole exception of Japan.2

About HJPN

Betashares Japan ETF – Currency Hedged (ASX: HJPN) was the best performing Japanese equities ETF in Australia over the past 1-, 3-, and 5-year periods, outperforming the Topix Index by 4% p.a. over the 5-year period3. With a thoughtful investment approach favouring Japanese exporters and currency hedging its exposure, HJPN benefits from the relatively weak Japanese Yen and structurally lower interest rates in the Japanese economy. Due to interest rate differentials between Australia and Japan, HJPN’s currency hedging mechanism currently generates an additional ~4% in returns per annum (due to foreign exchange hedging carry)

There are risks associated with an investment in HJPN, including market risk and country risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on the Betashares website.