4 minutes reading time

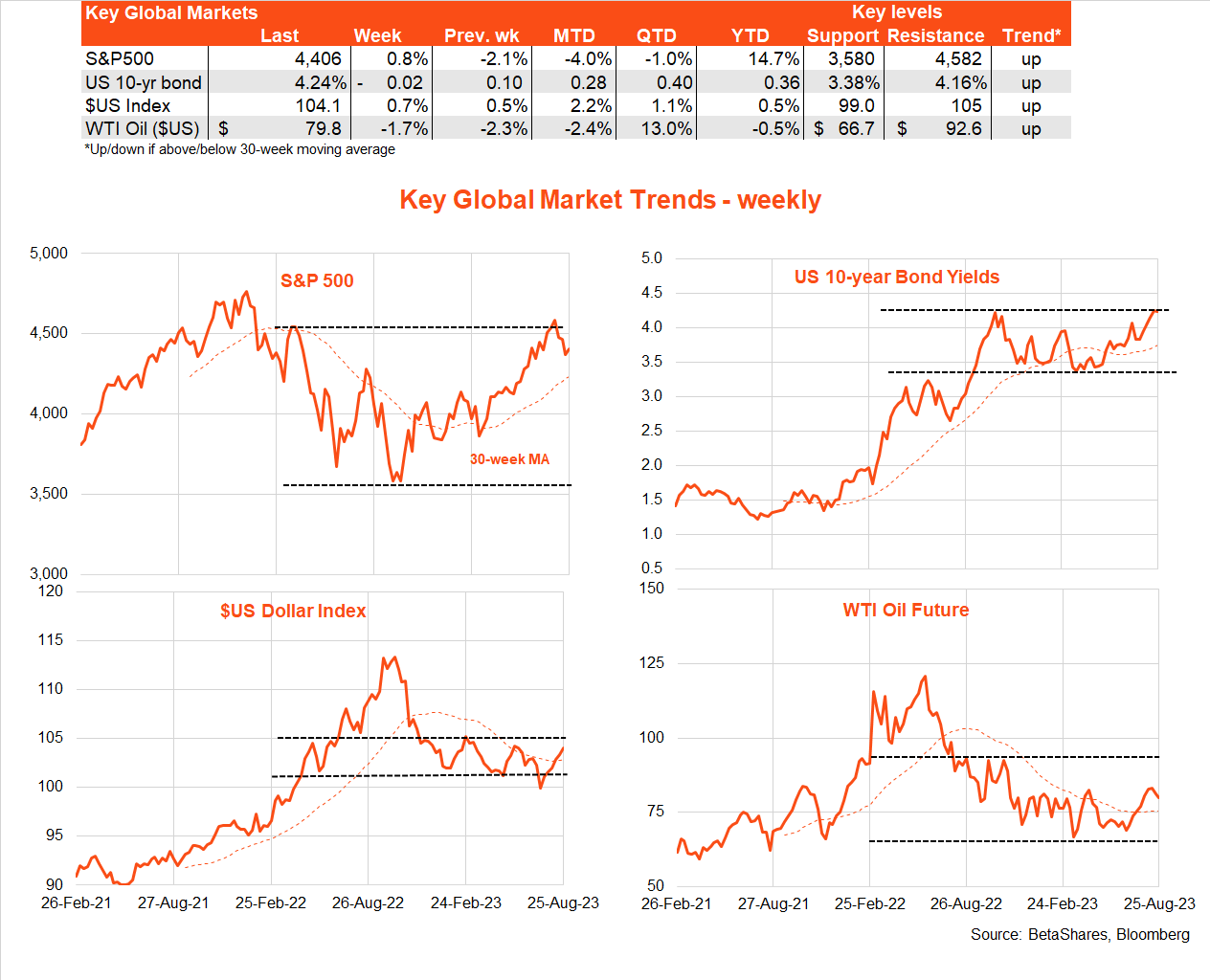

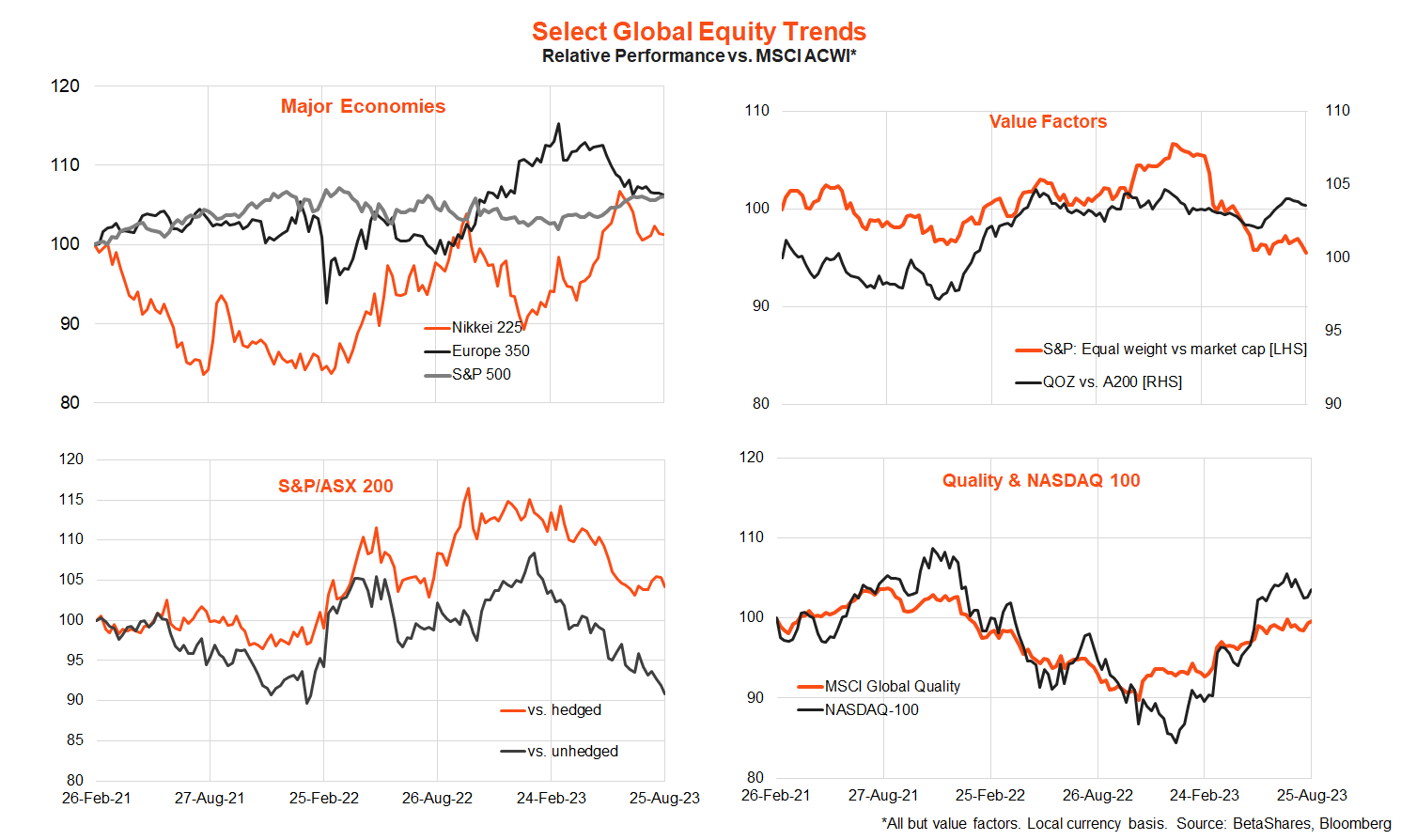

Global markets

Soft economic data and a less threatening than feared Jackson Hole speech by Fed chair Jerome Powell allowed US bond yields to steady last week and stocks to recover somewhat.

In terms of economic data, the US PMI indices for both services and manufacturing were moderately weaker than expected in August. But while the US manufacturing sector continues to flirt with recessionary conditions (an index reading of 47), the larger services sector remained comfortably in expansionary territory (an index reading of 51). The boom-bust manufacturing sector reflects the surge then slump in goods demand during the COVID disruptions, while services are continuing to enjoy post-COVID catch-up spending.

But of most importance to markets last week was Powell’s Jackson Hole speech. This suggested that while the Fed retains a tightening bias, it’s in no hurry to raise rates again. Instead, it’s prepared to “proceed carefully” and assess incoming inflation and activity data for the time being. This likely rules out a September rate rise, though keeps in play a potential hike at the next meeting in November – if either inflation surprises on the upside and/or there are further signs of a rebound in economic activity, especially consumer spending.

In terms of company news, the big event last week was the much stronger than expected earnings results from the darling of the artificial intelligence boom – Nvidia. That said, after an initial bounce higher in its share price, profit taking in the richly valued company set in one day later.

There’s key US data this week, with the all-important private consumption deflator on Thursday and payrolls on Friday. Although the 0.2% July gain in both headline and core consumer prices expected by the market should not cause too much disquiet, there could be some chatter around the fact that, due to low readings this time last year, annual growth in both measures would still tick up modestly to 3.3% and 4.2% respectively.

Another firm payrolls result is expected, with an employment gain of around 170k, an unchanged 3.5% unemployment rate and steady annual growth in average hourly earnings of 4.4%.

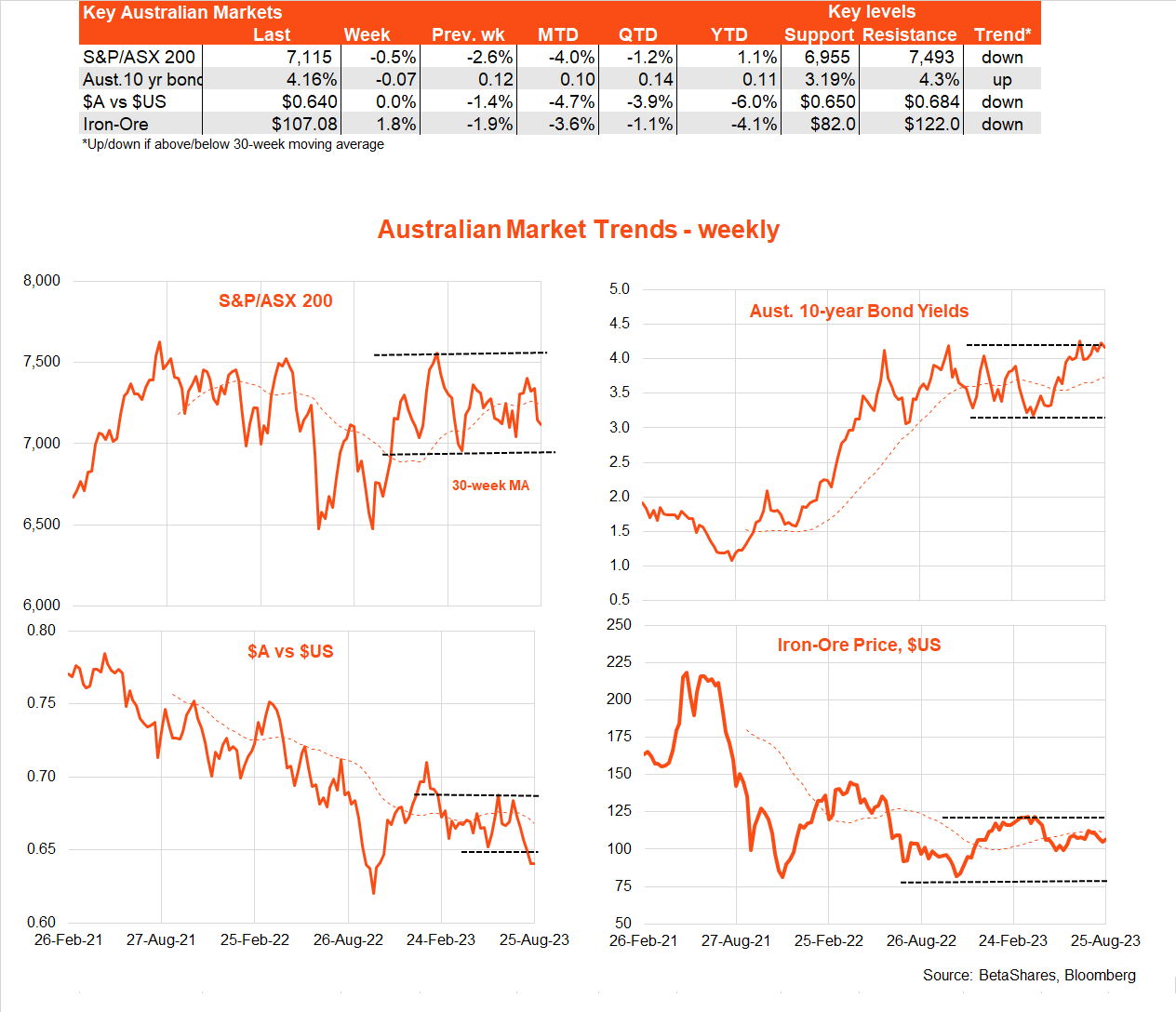

Australian market

The stabilisation in US interest rates last week flowed through into relatively steady local bond yields and $A – helped by a lack of key local data. In fact, the only real news last week was the latest Intergenerational Report on the long-term Federal Budget outlook. This regurgitated long-known challenges around population ageing and eroding tax bases – with as yet little indication the current government, like the previous one, will do anything about this.

There’s a range of economic data this week, which collectively should support the narrative of slowing economic growth and inflation – enabling the RBA to remain on hold at next week’s policy meeting. July retail sales today are expected to bounce back only modestly after slumping in June, while annual growth in the monthly CPI is expected to ease further from 5.4% to 5.2%. There’s even a possibility annual inflation slows to below 5%, which would be a welcome surprise.

We also get Q2 construction work and business investment on Wednesday and Thursday respectively, which are both expected to show positive contributions to economic growth in the quarter. Of course, while business investment and non-residential construction are still chugging along, the anticipated big drag on growth in the June quarter will be weakness in consumer spending, with a supporting role played by weakening dwelling construction.