4 minutes reading time

Week in review

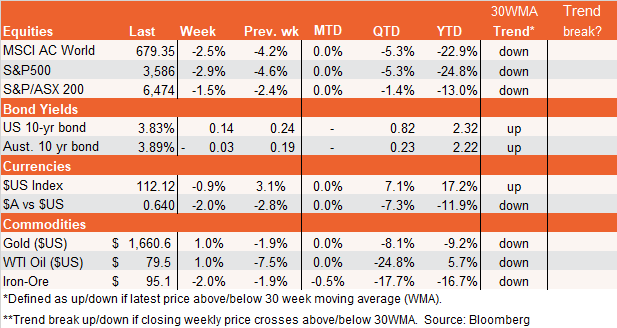

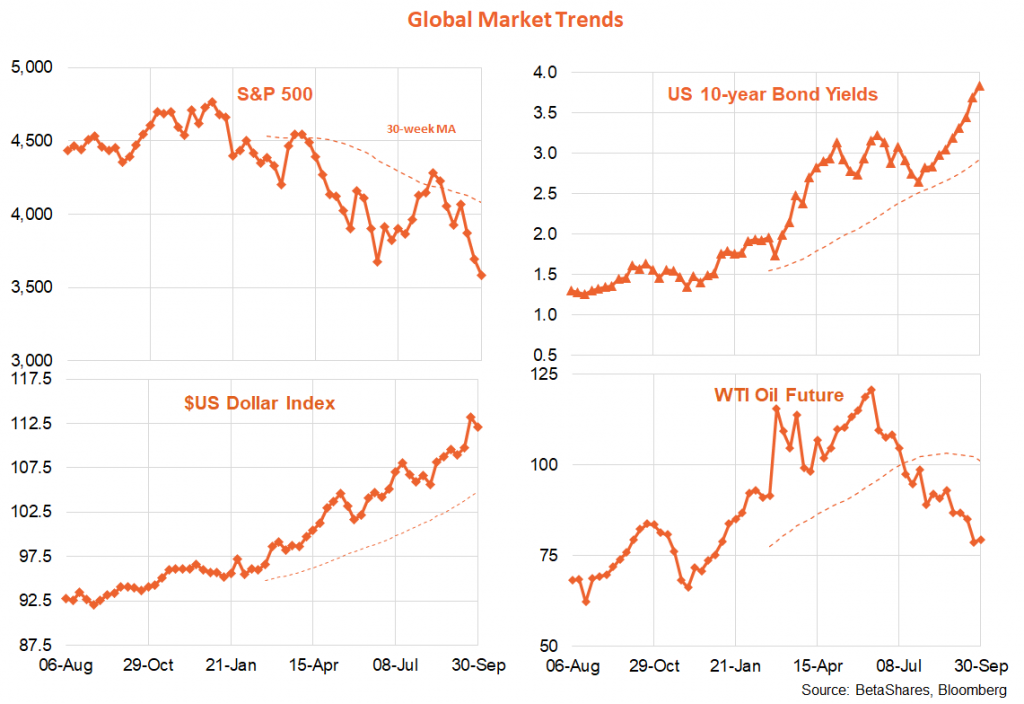

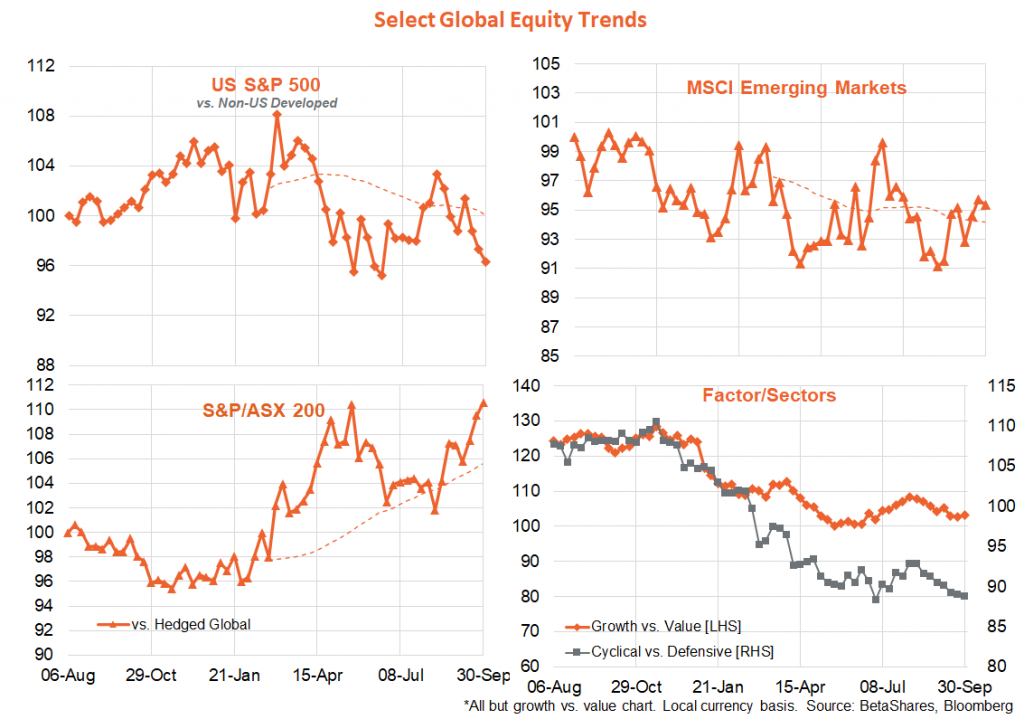

It was another down week for global equities as the unrelenting hawkishness of Fed speakers continued to weigh on sentiment. That said, bond yields have attempted to rally at various points over the past week on financial stability concerns – first with concerns over UK pension funds and more recently with concerns over the financial viability of Credit Suisse investment bank. As the old saying goes, the Fed usually keeps hiking “until something breaks” – and many investors might be hoping that something could break soon so that central banks re-think their aggressive rate hike intentions.

Alas, the Bank of England’s intervention in the UK bond market – and the UK Government’s backdown on removing the top marginal tax rate – appears to be stabilising conditions somewhat in London. Meanwhile, it remains to be seen how seriously at risk some global investment banks are in the face of mounting bond market upheaval. But even the vulnerability of one or two banks – provided their issues remain company-specific and it does not spark wider contagion – appears unlikely to alter the mindset of central bankers. We are not likely at another Lehman’s moment. And even if it were a Lehman’s moment this would hardly be bullish for equity markets given it would imply a sharp curtailment of credit at a time of global economic vulnerability.

The other way bond yields could sustainably fall is if we start to see more consistent signs of weakening in the US economy. On this score, the story remains mixed – with durable good orders (a proxy for business investment) proving somewhat resilient last week, consumer confidence improving and weekly jobless claims hitting a five-month low. As noted here previously, the decline in oil prices over recent months – while contributing to a decline in in headline inflation – appears to have also offset some of the contractionary effects of higher interest rates, therefore complicating the outlook for core inflation. That said, overnight US stocks and bonds rallied on a weaker than expected manufacturing index – in a re-run of the “bad news is good news” narrative.

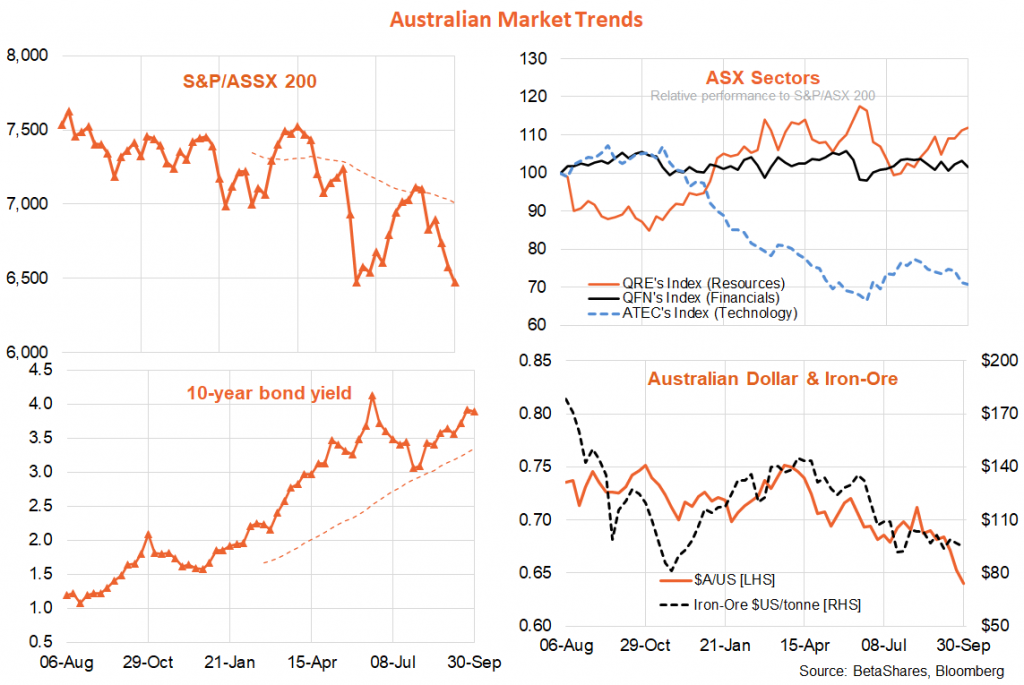

In Australia, local economic data was mixed – with still firm nominal retail spending in August though a decline in quarterly job advertisements (albeit they remain at high levels).

Week ahead

In terms of the week ahead, the key global highlight will be Friday’s US payrolls report – which is expected to reveal still firm jobs growth of around 250k. Job openings and a key service sector survey mid-week will also provide important updates on the lingering momentum in economic growth. There’s also a further smattering of Fed speakers who may provide an insight into how concerned central bankers are with recent tentative signs of financial instability (I suspect not much – as yet!)

In Australia, last week’s data was not weak enough to suggest the RBA won’t follow through with yet another 0.5% rate hike today, especially given the recent aggressive 0.75% rate hike by the US Federal Reserve. As is the case in the US, the local economy (apart from the housing sector) remains remarkably resilient in the face of rate hikes to date. With rates still fairly low and inflation very high, this suggests central banks won’t be inclined to change their hawkish narrative anytime soon.