5 minutes reading time

Reading time: 4 minutes

Fast-food enthusiasts may have heard that in England, McDonald’s recently ran out of milkshakes and Nando’s had to close a number of stores due to a chicken shortage. Has the world gone mad with panic-buying yet again?

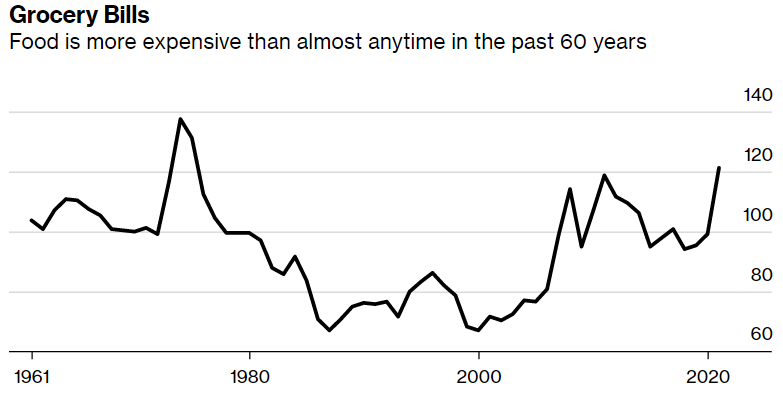

Global food prices have been on the rise, with the United Nations Food and Agriculture Organisation (FAO) Food Price Index up 3.1% from July to end August and 32.9% over the last year. Surging prices in vegetable oils, cereals, sugar and meat are resulting from a perfect storm that’s hitting the supply of food and substantially increasing their input costs1.

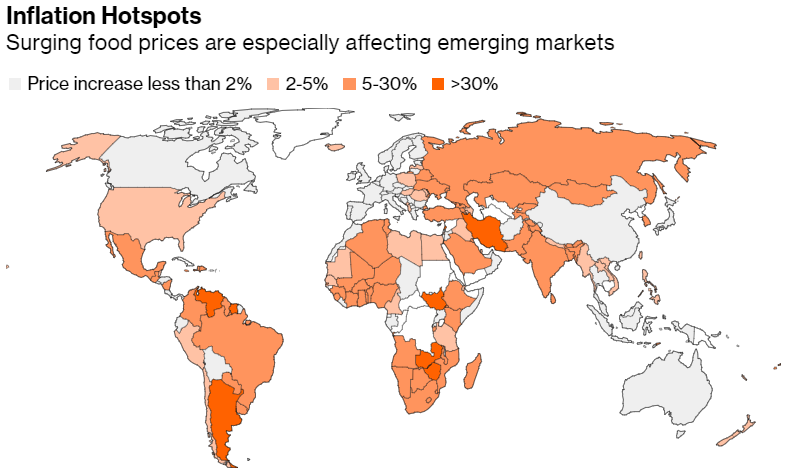

Extreme weather that is affecting crops, and persistent Covid-related issues like labour shortages, record-high shipping costs, rocketing fertiliser prices and port congestion, are contributing to near-record food prices and situations like those at McDonald’s all around the world.

Source: UN’s FAO. Real food price index, annualised and adjusted to inflation.

Source: World Bank. Note: Data is for the most recent month available in each distinct economy, as of 29 July 2021.

Let’s explore some of these issues further, and consider whether they present an opportunity for investors.

Labour issues

Australia is facing a massive supply shortage of farm labourers and fruit pickers, usually made up of overseas backpackers with fewer than an estimated 40,000 this year, compared to a pre-covid figure of 160,0002. In the U.K., farmers are dumping milk because there are no truckers to collect it. In Vietnam, the army is assisting with the rice harvest. Brazil’s robusta coffee beans took four months to harvest this year, rather than the usual three. American meatpackers are trying to lure new employees with Apple Watches.

Whether it’s shelf stackers, fruit pickers, truck drivers, slaughterhouse workers, warehouse operators, chefs or wait-staff, the issue with the food industry is that jobs are often very physical and low-paying, meaning that they tend to rely heavily on overseas workers from poorer countries. With borders still shut across a large part of the world as we deal with the Delta variant, it’s likely this will remain an ongoing issue for a while yet.

This issue is further compounded in food and agriculture, which are among the world’s least-automated industries – workers who contract Covid at their workplace must then isolate at home which has resulted in supply-chains being massively affected. Employers may then be forced to raise wages at a double-digit pace to attract more staff, which, combined with thin margins at farms and in food processing, means rising costs, which are generally passed through to buyers, creating food price inflation.

Shipping costs and port congestion

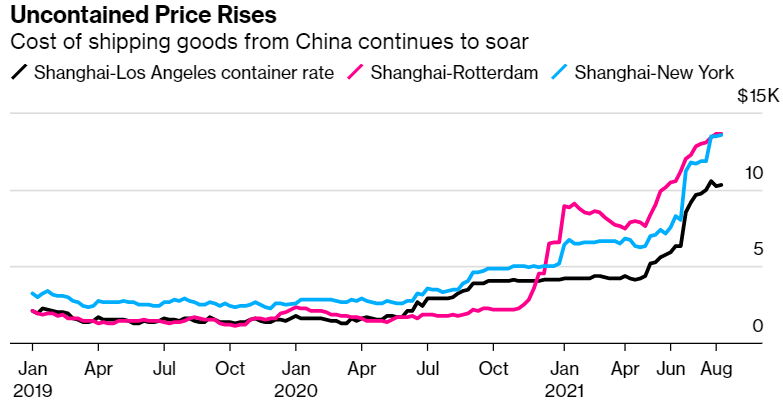

As shown in the chart below, the cost of shipping a container on the world’s busiest shipping routes from China to Europe surpassed US$10,000 in June, a rise of more than 500% in the last 12 months.

Source: Drewry World Container Index. Note: Shows benchmark rates to ship a 40-foot box.

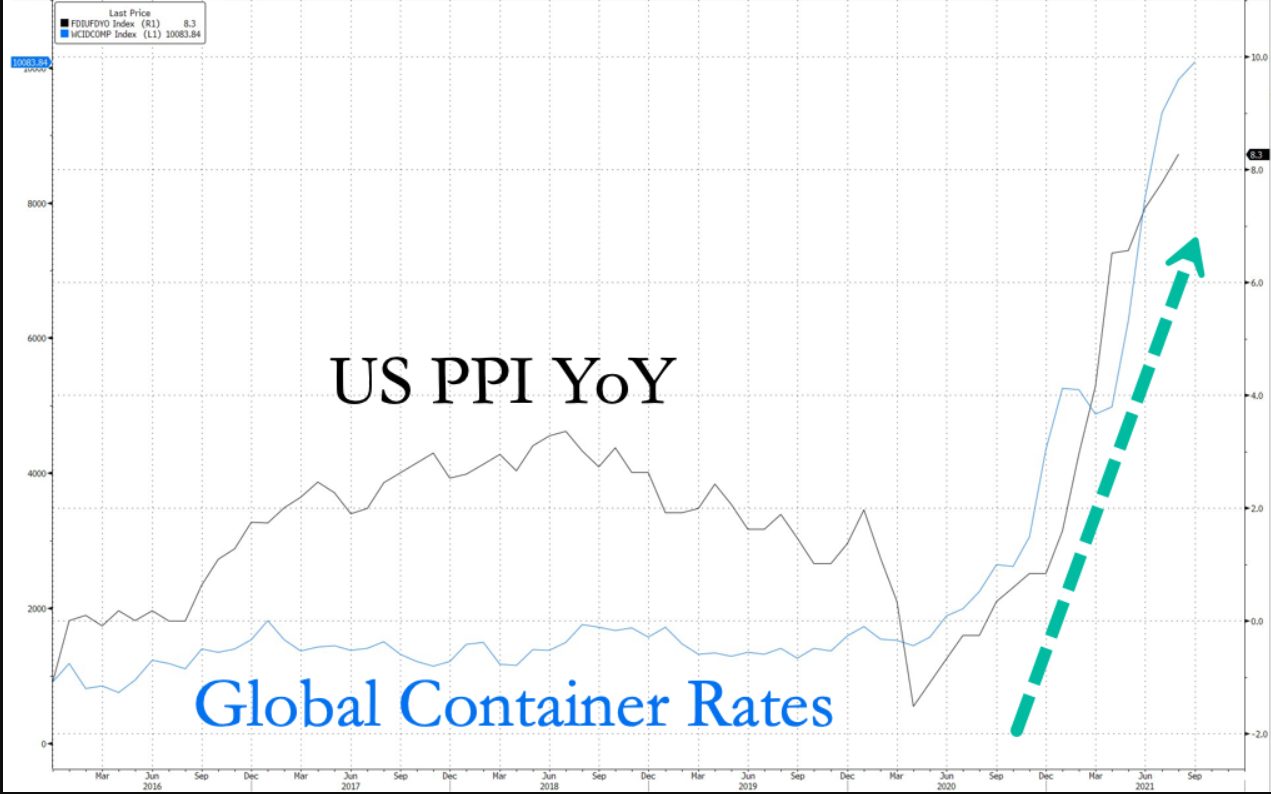

The core problem with congested waterways, high wait times, and skyrocketing transportation costs is that it can fuel an inflation surge that pushes producer prices and consumer prices higher.

Source: Zerohedge.

Maersk, the largest shipping container and vessel operator in the world, puts this down mainly to supply-chain issues such as congested ports, and a lack of dockworkers and truck drivers. While it’s true that more people are shopping from the comfort of their own homes, they say demand is only 4% higher than in 20193.

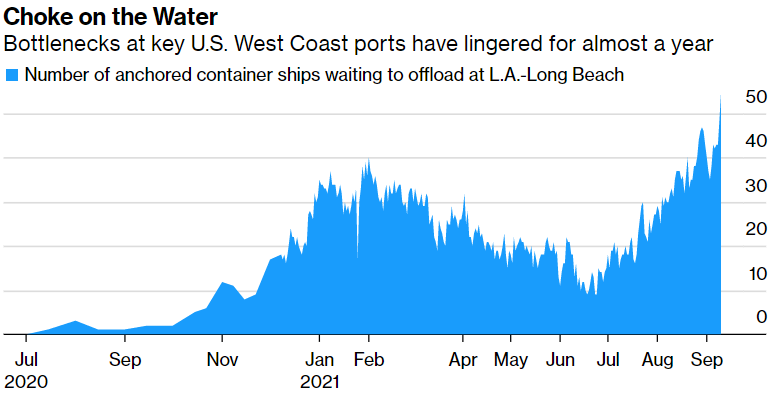

Recent Covid outbreaks, where port workers have tested positive for Covid and come into close contact with the sailors on cargo ships, have exacerbated delays along key transpacific shipping lanes, including the August shutdown of the Ningbo Meishan Container Terminal (the third-busiest container port in the world after Shanghai and Singapore) in China. The number of container ships waiting to enter the largest U.S. gateway for transpacific trade swelled to another pandemic record recently, and the average wait jumped to more than eight days4.

Source: Marine Exchange of Southern California & Vessel Traffic Service L.A./Long Beach.

Soaring fertiliser prices

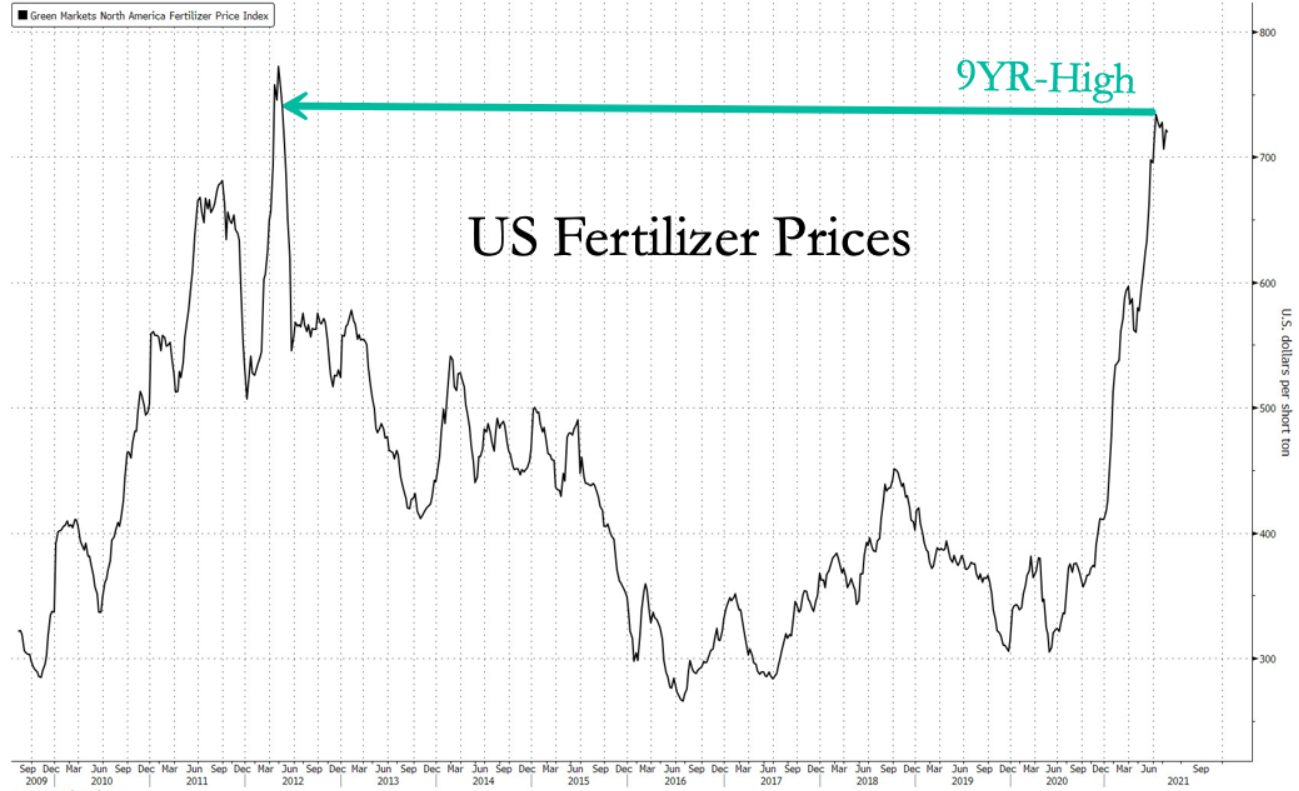

Demand for food (and thus fertiliser) is growing strongly thanks to population growth, while supply issues like those listed above are pushing the price of fertiliser higher. North American fertiliser prices are nearing a decade high.

Source: Zerohedge.

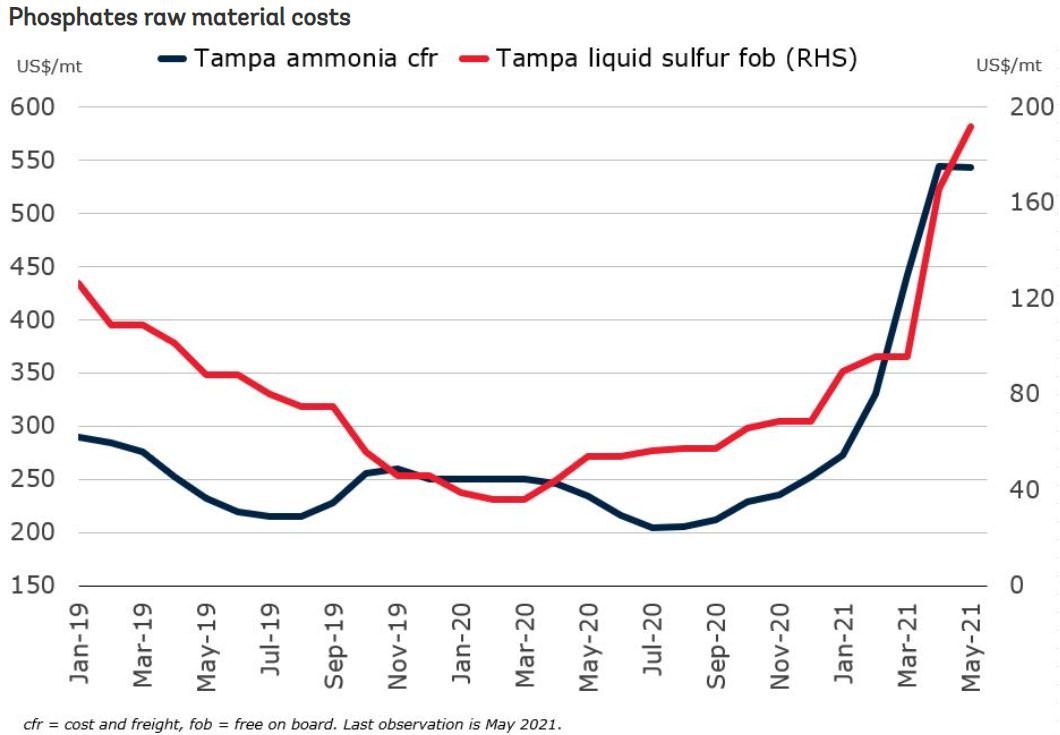

One additional factor affecting the price of fertiliser is higher input costs. Fertiliser is made from raw materials like sulphur and ammonia, which have seen prices increase sharply due to refinery curtailments resulting from Covid restrictions and limited supplies5.

Sources: Bloomberg, World Bank.

Summary

Thanks to labour shortages, and higher input and transportation prices, it seems likely that food prices will continue to remain elevated for some time yet.

Investors can gain access to this sector through FOOD Global Agriculture Companies Currency Hedged ETF , which provides global exposure to many of the themes highlighted in this article. As at 30 September 2021, FOOD has delivered a 12-month return of 31.4% and a 5-year return of 8.8% p.a.6 Given that this ETF has concentrated sector exposure, investors should note that FOOD’s returns can be expected to be more volatile (i.e. vary up and down) than a broad global shares exposure.

| There are risks associated with an investment in FOOD, including market risk, international investment risk, agriculture sector risk and concentration risk. For more information on the risks and other features of FOOD, please see the Product Disclosure Statement, available at www.betashares.com.au. A Target Market Determination is also available at www.betashares.com.au/target-market-determinations. An investment in FOOD should only be considered as a component of a broader portfolio. |

1. Food and Agriculture Organization of the United Nations. “The FAO Food Price Index Rebounded Rapidly in August of the United Nations.” Food and Agriculture Organization of the United Nations, 2 Sept. 2021, www.fao.org/worldfoodsituation/foodpricesindex/en.

2. Gross, Sybilla. “Australia Agriculture Labor Crisis Deepens as Lockdowns Drag On.” Bloomberg, 8 Sept. 2021, www.bloomberg.com/news/articles/2021-09-08/australia-agriculture-labor-crisis-deepens-as-lockdowns-drag-on.

3. Greg Miller, Senior Editor. “Global Demand Isn’t Booming. So Why Are Shipping Rates This High?” FreightWaves, 3 Sept. 2021, www.freightwaves.com/news/global-demand-isnt-booming-so-why-are-shipping-rates-this-high.

4. Wang, Cindy, and Enda Curran. “The World Economy’s Supply Chain Problem Keeps Getting Worse.” Bloomberg, 26 Aug. 2021, www.bloomberg.com/news/articles/2021-08-25/the-world-economy-s-supply-chain-problem-keeps-getting-worse.

5. Baffes, John, and Wee Chian Koh. “Fertilizer Prices Expected to Stay High over the Remainder of 2021.” World Bank Blogs, 8 June 2021, blogs.worldbank.org/opendata/fertilizer-prices-expected-stay-high-over-remainder-2021.

6. These return figures are after fees have been taken into account. Past performance is not indicative of future performance.