Market Trends: November 2025

10 minutes reading time

Many Australians enjoy staying active with regular gym sessions, surfing, or long walks. Building long-term wealth requires a similar commitment.

We deserve a pat on the back for prioritising our health and taking the first steps in investing. But imagine the compounding benefits for your financial well-being if you followed a structured plan built around quality investments.

This guide delves into habits and principles to help you maximise your investments during your working years.

Step 1: Start with clear goals

Serious athletes don’t just wander into the gym and start lifting random weights. They have a meticulously crafted plan – specific exercises designed to sculpt their ideal physique within a set timeframe. Similarly, effective investing goes beyond a casual “chucking money into the market” at random intervals approach.

Checklist for creating an investment plan

You can use the following checklist as a guide to assist in creating financial goals and tailoring your financial workout plan:

- Define your dream lifestyle and retirement: Imagine your ideal lifestyle leading up to and in retirement. Will you travel the world, downsize or maintain the family home or pursue hobbies? Create a list of specific goals, including desired living location, travel aspirations, and preferred lifestyle expenses.

- Estimate your expenses: How much annual income will you need to maintain your desired lifestyle after retirement? Research average costs of living in your preferred location and try to factor in inflation.

- Know your cash flow: Analyse your current and anticipated income and expenses. How much can you realistically contribute towards your investment goals after covering essential costs?

- Set your time horizons: When do you envision you’ll need money for the milestones listed in your goals? Knowing the timeframe helps determine the appropriate investment strategies and risk tolerance.

Tip: Get specific! General ideas are great, but financial planning for yourself requires concrete details. Translate your dreams into dollar figures. An illustrative example could be:

- Current situation:

- Age: 25

- Monthly contributions capacity: $700

- Current portfolio balance: $30,000

- Financial goals:

- Short-term (By age 30): Travel across Canada on a budget of $10,000

- Mid-term (By age 45): Purchase an apartment for $600,000

- Long-term (By age 65): Retire debt-free with a nest egg of $2 million

Once you have a clear picture of your goals and financial resources, you can delve into the nitty-gritty of your investing plan and the returns needed to move closer to your ambitions (being mindful of risk tolerance).

Step 2: Reduce volatility with different asset classes

Market volatility is a part of life, but a diversified portfolio that provides exposure to different asset classes including domestic shares, international stocks, fixed income and alternatives can mitigate overall volatility.

Building a diversified portfolio may seem daunting, but ETFs have simplified the process as they offer ‘pre-packaged’ assortments of investments or assets, making diversification more accessible, efficient and cost-effective.

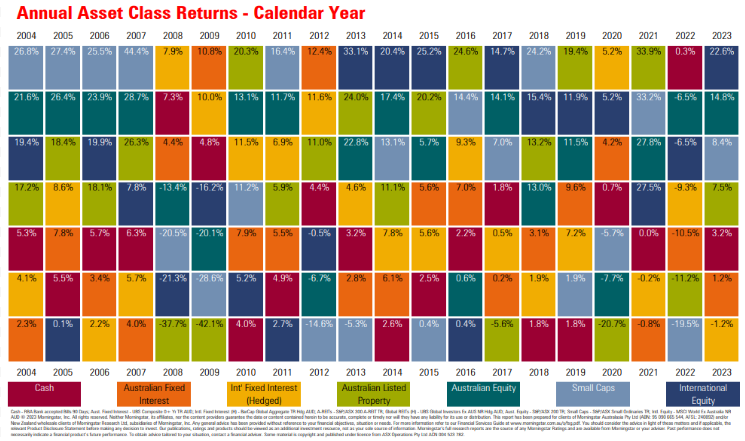

As indicated in the table below, asset classes will exhibit significant performance variations over time. During the 2008-09 crash, shares and listed property saw substantial declines, while fixed interest investments delivered robust returns, which somewhat cushioned portfolios exposed to equities.The key message being that when doing your research, consider products across different asset classes to manage risk and diversify return sources within your portfolio.

Source: Morningstar Australasia (Note: Past performance is not indicative of future returns). For further information on each asset class, please see footnote 1 below.1

Step 3: Keep fees and expenses in check

Think of investment fees like gym membership costs. Just like you wouldn’t choose an overpriced gym, high fees throughout your accumulation phase can significantly reduce your investment returns. Here’s why understanding fee structures is crucial:

- Management fees: Funds generally charge a percentage of the assets under management as a fee, regardless of performance.

- Brokerage fees: Stockbrokers and online brokerages can charge fees based on the value of a trade or a flat fee per trade.

- Performance fees: Funds may charge a percentage of the returns on an investment.

It’s important to be aware of the fee structures of investments and to choose low-fee options where possible. For example, using a platform like Betashares Direct enables you to make zero-brokerage fee investments in more than 350 ASX-traded ETFs, or to access low-cost portfolios that are automatically rebalanced.2

Step 4: Consider different strategies

Savvy investors understand that consistent investing is just one piece of the puzzle. They leverage defined routines to put their money to work and maximise returns.

No matter your approach, remember to research your investments, manage costs, and establish a disciplined plan for buying/selling or making regular contributions. Here are some popular strategies to consider:

- Buy-and-hold: Invest in quality assets and hold them long-term, weathering market ups and downs.

- Dollar-cost averaging (DCA): Invest a fixed amount regularly, regardless of price. This smooths out market volatility and averages out your investment cost per share.

- Core-satellite strategy: Split your portfolio. A “core” of low-risk, diversified assets provides stability, while a “satellite” portion allows for higher-risk investments; typically for higher growth.

- Sector rotation: Shift investments between sectors based on economic cycles, aiming to capitalise on growth opportunities.

Whether you’re a buy-and-hold investor seeking long-term market exposure or a sector rotation enthusiast capitalising on short-term trends, ETFs provide a flexible and cost-effective solution for executing your strategy.

Step 5: Harness the power of compound interest

If you’re a millennial or member of Gen Z—and even if you’re older but don’t plan to access your funds soon— time and compound interest are your best friends when it comes to getting the most out of your accumulation phase.

With decades likely remaining in your career, even modest contributions today can grow significantly by the time you retire. As the famous investment adage goes: “time in the market beats timing the market.” Equally important is resisting the temptation to sell in response to inevitable downturns or shock-factor headlines. When markets recover, nearly 80% of the best days or biggest rallies occur during the recovery period.

Long-term returns deteriorate significantly when investors fail to pick the bottom and miss the top five and 20 performance days (see table below).

| S&P/ASX 200 | S&P/ASX 200 (minus top 5 days) | S&P/ASX 200 (minus top 20 days) | |

| 1 Year (%) | 12.21% | 12.21% | 12.21% |

| 3 Years (%, p.a.) | 5.96% | 1.66% | -4.28% |

| 5 Years (%, p.a.) | 8.51% | 5.84% | 2.09% |

| 10 Years (%, p.a.) | 8.79% | 7.44% | 5.52% |

| 20 Years (%, p.a.) | 9.31% | 8.04% | 4.52% |

| 30 Years (%, p.a.) | 9.80% | 8.73% | 6.36% |

Source: Bloomberg, Betashares. As at 30 June 2024. Past performance is not an indicator of future performance. Top five and top 20 days since over the last 30 years have been removed from the respective data sets. None of these days occurred in the past year so one year returns are unaffected.

While all investors face the temptation to sell during market downturns to minimise losses, this data demonstrates that missing just the 5-20 best days of the market—which tend to occur in close proximity to the worst market days—can have a devastating impact on long-term returns.

Step 6: Regularly review portfolio performance and goals

You can’t stick to the same workout plan forever. In the same vein, regularly reviewing your life goals, financial objectives and portfolio is essential.

Market conditions, personal circumstances, and the economy can all change over time, and while staying the course and avoiding rash decisions is key, adjustments to your strategy are sometimes necessary.

Conditions might change such that your portfolio becomes out of balance based on your goals and your asset allocation targets (e.g. 80% stocks and bonds), requiring some reallocation of your investments to rebalance it.

Similarly, as you reach the later stages of your accumulation phase, your risk tolerance may change, requiring a review and a shift towards a more conservative setting. Alternatively, you may receive an unexpected windfall that impacts your strategy.

By regularly monitoring your investments and your overall plan, you can ensure your portfolio structure is aligned with your goals and circumstances.

ETF ideas for accumulation years

During the accumulation phase of investing, aimed at long-term wealth building, the following ETFs could be considered as core holdings.

A200 Australia 200 ETF- Provides diversified exposure to 200 of the largest companies listed on the ASX.

- Diversifies risk across various sectors for long-term growth potential.

- BGBL provides instant exposure to an index comprising approximately 1,500 companies from more than 20 developed market countries.

- Offers exposure to global markets, diversifying risk and capturing growth opportunities across different economies.

- Focuses on high-growth sectors like technology and innovation, which can potentially deliver superior long-term returns during periods of economic expansion.

- Offers exposure to 100 of the largest non-financial companies driving innovation and growth in the digital economy including NVIDIA, Amazon and Netflix.

- Aims to generate attractive quarterly income and reduce the volatility of portfolio returns by implementing an equity income investment strategy over a portfolio of the 20 largest blue-chip shares listed on the ASX.

- Offers potential downside risk management as the additional income may partly offset potential losses in falling markets.

- Aims to provide investors with attractive income returns from an actively managed, diversified portfolio of primarily hybrid securities.

- The fund is actively managed by a fixed income specialist that targets lower volatility and reduced risk.

- Provides a cost-effective way to benefit from moderately geared exposure to the returns of the broad Australian sharemarket.

- May suit investors seeking to build long-term wealth who are comfortable taking on the increased risk of gearing.

- Provides a cost-effective way to benefit from moderately geared exposure to a diversified portfolio of Australian and global equities.

- May suit investors seeking to build long-term wealth who are comfortable taking on the increased risk of gearing.

Plan, diversify, stay consistent and keep fees low

Staying physically and financially fit shares many similarities: a solid plan, consistency, and regular reviews.

With time and the power of compound interest on your side, each dollar invested can significantly grow by retirement. Adhering to proven strategies such as choosing low-fee investments like ETFs, maintaining diversification, investing consistently, and avoiding market noise can help you reach your goals quicker than you might expect.

There are risks associated with an investment in the ETFs mentioned, which may include for example (fund specific), market risk, security-specific risk, industry sector risk and index tracking risk. Specifically in the case of G200 and GHHF, investors will be exposed to market risk, underlying ETF risk, gearing risk, rebalancing and compounding risk and lender risk. Particularly in the case of these two ETFs, investors should monitor their investment regularly to ensure it continues to meet their investment objectives. Gearing magnifies gains and losses and may not be a suitable strategy for all investors. Investors in geared strategies should be willing to accept higher levels of investment volatility and potentially large moves (both up and down) in the value of their investment. Geared investments involve significantly higher risk than non-geared investments. An investment in these specific ETFs is high risk in nature.

Investment value can go up and down. An investment in any ETF should only be made after considering your particular circumstances, including your tolerance for risk. For more information on risks and other features of these ETFs, please see the Product Disclosure Statement and Target Market Determination, both available on the Betashares website.

Footnotes:

1. Morningstar: Cash – RBA Bank accepted Bills 90 Days; Aust. Fixed Interest – UBS Composite 0+ Yr TR AUD; Intl. Fixed Interest (H) – BarCap Global Aggregate TR Hdg AUD; A-REITs – S&P/ASX 300 A-REIT TR; Global REITs (H) – UBS Global Investors Ex AUS NR Hdg AUD; Aust. Equity – S&P/ASX 200 TR; Small Caps – S&P/ASX Small Ordinaries TR; Intl. Equity – MSCI World Ex Australia NR AUD © 2018 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement (Australian products) or Investment Statement (New Zealand products) before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance ↑

2. Refer to the Betashares Direct PDS for information on interest retained by Betashares on cash balances and portfolio fees associated with AutoPilot portfolios. ↑