Fed meeting recap: hawkish quarter point rate cut

6 minutes reading time

We all make mistakes in life, but when it comes to mistakes in your investment portfolio, the outcomes can be poor returns and significant losses.

Some investing mistakes can be obvious very quickly, while others may take years to become apparent – and it may be too late to repair the damage.

Whether you’re a seasoned investor or just starting out, let’s look at seven common investing mistakes to avoid.

Mistake 1: Having a concentrated portfolio

One of the biggest mistakes you can make as an investor is having your portfolio concentrated in a small number of stocks, or a single asset class – in simple terms, putting all your eggs in one basket. This means the fate of your entire portfolio depends on the performance of a small number of investments.

To avoid this, you need to diversify your investments. Diversification is spreading your investments across multiple geographic regions, industry sectors and asset classes. By doing so, you spread your investment risk and reduce the impact on your overall portfolio if one part of the portfolio underperforms.

Mistake 2: Missing out on compounding

Compounding refers to earning returns on both your original investment and on subsequent returns.

In order to reap the benefits of compounding, you should consider reinvesting the income from your investments, which we cover in the next point.

Simply put, the sooner you start putting your money to work, the more you’ll benefit from the compounding effect and the less you’ll have to save to reach your goals.

Mistake 3: Not investing regularly

One effective approach is to invest at regular intervals, in a strategy known as dollar cost averaging. This involves investing the same amount of money at set intervals (for example monthly or quarterly) over a number of years, whether market prices are up or down.

When prices are up, your fixed dollar amount will buy fewer ETF units. When prices are down, your regular investment will buy more.

The point of dollar cost averaging is not to try and pick whether the market is going to rise or fall, but rather to remove timing from the equation.

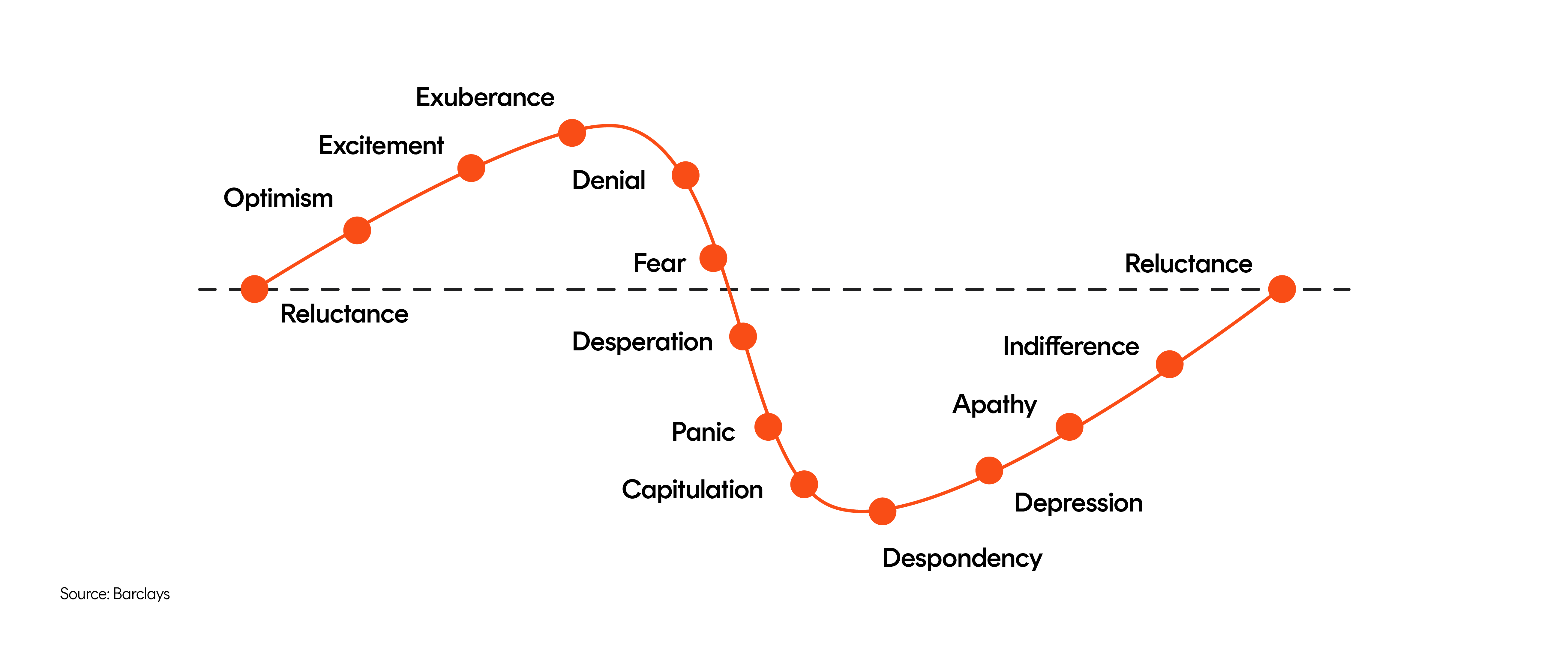

Mistake 4: Letting your emotions drive your decisions

Sometimes our emotions can affect our investment choices – and not for the better. As we enter market upturns, the optimism and excitement of rising values can lead us to think that making gains will be easy.

These positive emotions can lead us to increase our level of risk at a time when we should be more cautious.

On the other hand, when markets are in a downturn, panic and fear may prevent us from investing, cause us to reduce our risk levels, or even lead us to exiting markets altogether – at precisely the wrong time.

It is important to ask yourself whether your investment decisions are rational, or are being driven by your emotions?

Mistake 5: Having vague investment goals (or none at all)

If you are going on a journey to a new destination, you are likely going to need a map to ensure that you don’t get lost along the way. This also applies to investing.

Be clear on what you are trying to achieve. For example, are you saving for a deposit on a house? Or are you saving for retirement?

It is important to be able to articulate your goals as these will largely direct your strategy and the level of risk you are comfortable taking on to reach these goals.

Mistake 6: Poor record-keeping

Each time you buy or sell an investment, you’ll receive material that you’ll need at tax time to work out your capital gains or losses. At the end of the financial year, you will also receive information regarding the distributions from any ETFs you hold, which need to be reported in your annual tax return.

Misplacing this material will cause a major headache, so ensure that you keep it in a safe, easy-to-find place.

If you have made an investment with Betashares, you’ll need to register with Link Market Services and set your communication preferences to receive email notifications when information about your investment is issued.

Link Market Services, on behalf of Betashares, will send you distribution statements if the fund has paid a distribution, annual statements detailing the investment balance, transactions, and management costs paid during that period and tax statements if your investment has paid a distribution during the financial year.

There are no costs involved to register, it’s fast and easy to do and will make record keeping a whole lot easier.

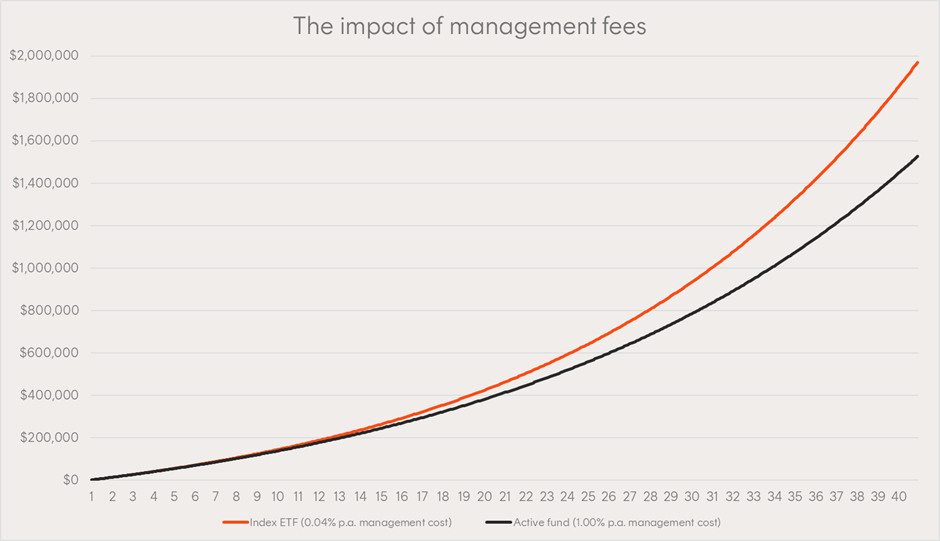

Mistake 7: Paying too much in fees

It would be nice if you could control markets and their impact on your investments, but unfortunately, you can’t. One thing you can control, however, is the amount you are paying in ETF management fees.

Small differences in ETF fees may not appear to matter to your overall investment portfolio, but they can have a significant impact on your returns over time.

The lower the fee, the better, as management costs are measured as a percentage of your investment in the ETF.

For example, the A200 Australia 200 ETF , which provides exposure to the largest 200 companies on the ASX, is ultra-low cost, with a management fee of 0.04%1 (or just $4 for every $10,000 invested).

To illustrate, let’s compare the projected returns for a hypothetical active equity fund with a management cost of 1.00% p.a. to a low-fee broad market-based index ETF charging 0.04% p.a.2 For the purposes of this example, let’s also assume the risk level associated with the active equity fund is not materially different from the broad market-based index ETF.

Over the course of 40 years, that 1.00% p.a. management fee can make a significant impact on investment returns. Assuming the return is the same for both funds, the investor paying the higher fee ends up with $1,526,020, while the investor paying the lower fee ends up with $1,970,010.

That’s $443,990, or 29% more! Of course, it’s important to remember management costs aren’t the only factor that impacts returns.

Illustrative only. Assumed performance is not indicative of actual performance Actual performance of A200 and actively managed Australian share funds may differ and may be higher or lower than the assumed performance.

Takeaways

Even the most successful investors make mistakes along the way. But being aware of these common investing mistakes can help you to avoid them, and keep you on track to building a successful investment portfolio.

If all else fails, remember to diversify your portfolio, take advantage of compounding, make rational decisions, set clear goals, keep your records safe, and keep an eye on fees.

1Management fee includes other ongoing expenses of the Fund, excluding transaction costs of buying and selling the Fund’s investments. Refer to Product Disclosure Statement for more information.

2Based on the management cost for Betashares Australia 200 ETF (ASX: A200).

6 comments on this

Very good and commonsense advice 🙂

Great insights!

It is well known that Harry Markowitz, creator of Modern Portfolio Theory (diversification) didn’t apply the theory to his own investments because he realised it didn’t work as well in practice as it did in theory. Warren Buffett has been critical of diversification as well. So beware.

Secondly, for those that care to look, they will find empirical evidence that shows that dollar-cost-averaging doesn’t work as well as people are led to believe, and is as harmful long term to investors, as is ‘contrarian’ investing.

Great advice. Thanks.

Useful and informative content.

In response to the comment made by Paul. Dollar cost averaging has been found to lead to considerable wealth destruction as it has a tendency to ride your losers down and down and down. Unless you are prepared to wait what could be a very long time for things to turn around (if they ever do) and are very sure the market is wrong and you are tight then this is a strategy to avoid, at least for small investors. As for Warren Buffett I know he has said he is a not a fan of diversification but his company Berkshire Hathaway owns outright or has shares in 41 other companies. So BH is diversified. Also despite saying his idea is to never sell BH indeed sells. Last year it sold its holdings in 4 companies: General Motors, Johnson & Johnson, Procter & Gamble and United Parcel Service. To be fair it does have 80% of its share holdings in only 6 companies but it also has 167 billion in cash. The companies BH owns have few counterparts on the ASX. We don’t have a Visa, Apple, Coca Cola, American Express or Kraft. Few of our companies dominate the global landscape and are ubiquitous.