11 minutes reading time

Reading time: 10 minutes

With interest rates at historic lows, investors who rely on cash or government bonds for income returns are having a harder time making ends meet.

For risk-conscious investors, the good news is that there is a range of innovative cash and fixed income investment exposures on the Australian Securities Exchange (ASX) that offer attractive income returns, typically with higher levels of capital stability than shares.

What’s more, for those prepared to accept the more volatile price return on the sharemarket, Australian equities still offer relatively good income returns through dividends and franking credits. With the right stock selection, even international equities may be able to provide decent income return potential while also offering diversification outside of the Australian market.

The Income Challenge

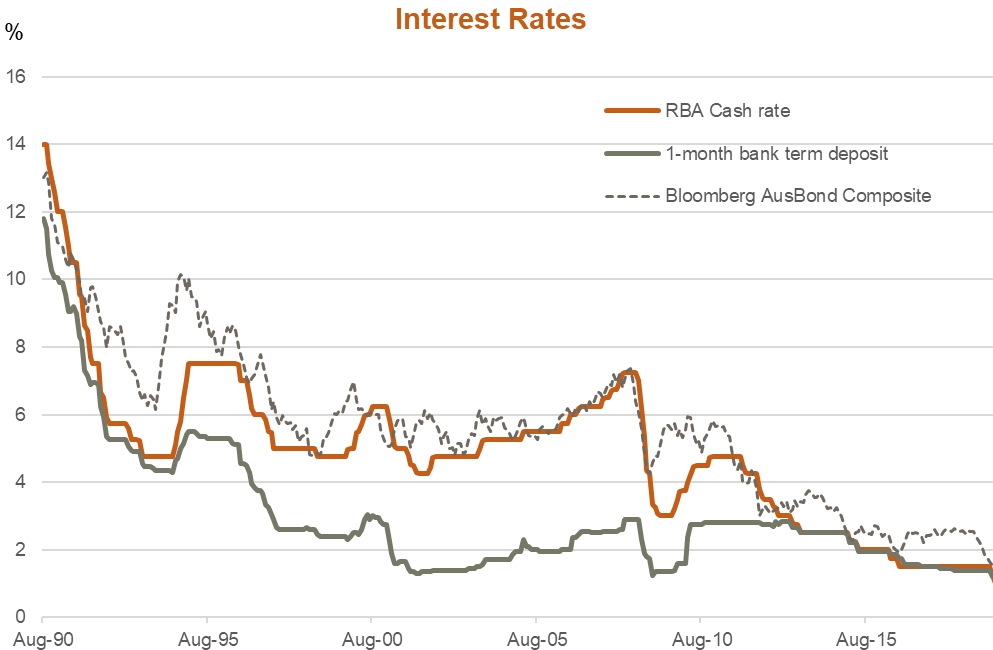

As seen in the chart below, official interest rates as set by the RBA have fallen to very low levels in recent years. In turn, this has helped drag down the interest returns investors have been able to rely on from both bank deposits and fixed-income (bond) investments.

Source: Bloomberg, RBA. Past performance is not indicative of future performance.

Source: Bloomberg, RBA. Past performance is not indicative of future performance.

The average one-month term deposit available from major banks, for example, had fallen to only 1.1% p.a. by August 2019. That rate has more than halved since 2012.

For those investing in fixed-income bonds, Australia’s benchmark bond index was offering an effective yield of only 1.4% p.a. by July 2019 – compared with yields closer to 6% p.a. earlier this decade.

So what can you do?

BetaShares has put together some options for extracting the income opportunities from this challenging financial marketplace. We’ve split these ideas between relatively defensive exposures, such as cash and bonds, and those exposed to the more volatile equity market.

All these opportunities are either exchange traded funds (ETFs) or Active ETFs1 that can be bought and sold on the ASX as easily as a company share. They attract no product commissions, and in the case of ETFs, seek to trade quite closely to the underlying market value of the securities or deposits they invest in.

Defensive Opportunities

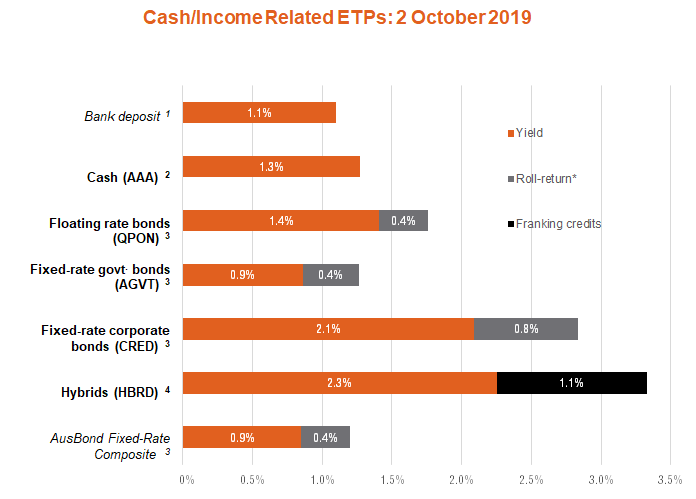

The first opportunities presented are relatively defensive in nature, in that their price volatility tends to be considerably lower than that of equities. Five such opportunities are provided in the chart below, with their income level as at August 2019 compared to the bank deposit and bond exposures referred to above. Further information on all these options is available on the BetaShares website.

Source: Bloomberg, BetaShares, RBA. Past Performance is not indicative of future performance. Yield will vary and may be lower at time of investment. Bonds and hybrids have relatively higher risk compared to cash deposits.

1 Average of 5-largest banks as per RBA website.

2 12-month distribution yield.

3 Yield-to-maturity.

4 Running yield, inclusive of franking. Not all investors will be able to obtain the full benefit of franking credits.

*Roll return is an estimate only, assuming no change in yield curve over the next 12 months. Roll returns are extra income generated over time through the process of maintaining a bond portfolio at relatively steady target average term-to-maturity. This process requires selling bonds over time as their term to maturity shortens and replacing them with bonds at a longer desired term-to-maturity. As shorter duration bonds typically trade at a price premium to longer duration bonds (as the prices of the former tend to be less volatile as they are less sensitive to interest rates changes), this trading activity may result in extra income or “roll return” over time. Roll return is not assured and may in certain circumstances be zero or negative.

The most defensive exposure is clearly cash. AAA Australian High Interest Cash ETF invests in a range of term and at-call bank deposits, and has nonetheless been able to offer a modest yield pick-up over the average one-month term deposit. As at 2 October 2019, the AAA ETF provided an interest return of 1.3% p.a. from its investments (net of management costs).

Next in line is QPON Australian Bank Senior Floating Rate Bond ETF , which, by investing in senior bank floating-rate bonds, is typically able to offer a higher income return than the AAA ETF over time for incrementally more return volatility. Because the interest income offered by floating rate bonds tends to move in line with, or ‘float’ with, movements in market interest rates, their capital value tends to be quite stable over time. As at 2 October 2019, QPON it was offering a prospective one-year income return of around 1.8% p.a.2

Fixed-rate bonds, by contrast, offer fixed nominal income payments over time. Because of these stable nominal income returns, the capital value of these bonds tends to vary somewhat more over time than floating rate bonds.

In exchange for this greater price volatility, however, fixed-rate bonds tend to offer higher yields, which vary in line with their degree of perceived credit risk and term to maturity.

CRED Australian Investment Grade Corporate Bond ETF , for example, invests in good quality corporate bonds with a relatively long term to maturity of around 6 to 7 years. As of 2 October 2019, the CRED ETF was able to offer attractive prospective one-year income returns of around 2.8% p.a.2

The last opportunity in this group is HBRD Active Australian Hybrids Fund (managed fund) , which primarily provides exposure to hybrid securities. As the name implies, hybrids contain characteristics of both equities and bonds. As with QPON, HBRD offers regular income payments that ‘float’ in line with prevailing market interest rates. But as hybrids face somewhat higher credit risk in the event of corporate financial difficulty, HBRD tends to offer higher income returns than either the QPON or CRED ETF over time. Hybrids, and by consequence, HBRD, also offer additional income through franking credits over time. As of 2 October 2019, HBRD was offering a prospective gross one-year income return (i.e. including franking credits) of 3.4%.

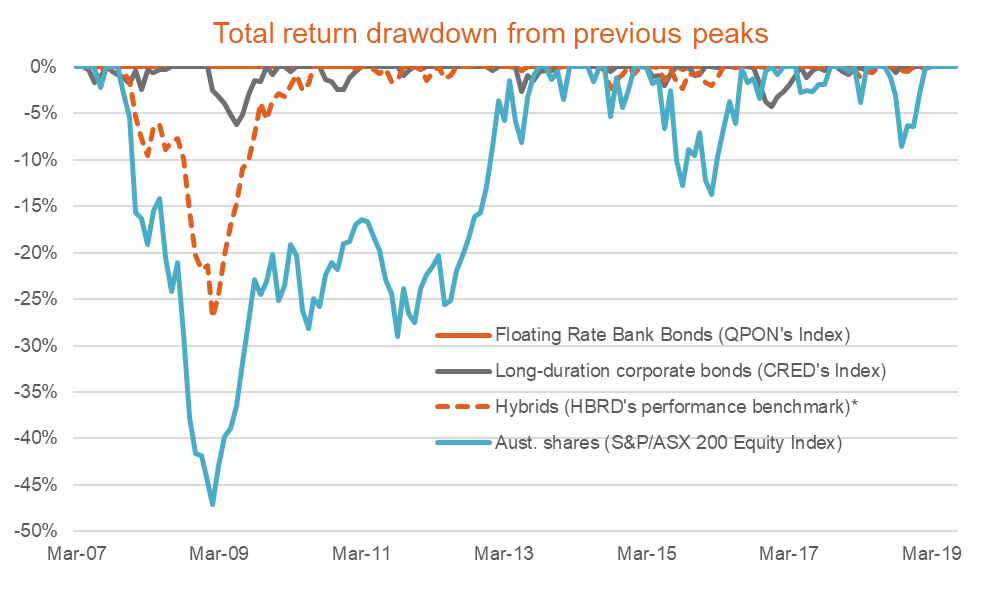

Despite their varying risks and returns, the capital volatility of these defensive options tends to be considerably less than that of equities. As seen in the chart below, for example, the downside volatility of returns from these defensive options has been much less than bank shares in recent years. Even during the worst periods of the financial crisis – when the solvency of major local banks was briefly in question – a portfolio of hybrids securities only fell about half as much as local equities.

Source: Bloomberg. Past performance is not indicative of future performance.

In more recent years, with solvency issues around banks much less of a concern, hybrid returns have held up quite well – along with that of cash and bonds in general – during recent notable sell-downs in the equity market, as evident in mid-2015 to early-2016 and late-2018.

Growth Opportunities

For investors willing to seek income in the more volatile equity market, a range of attractive options is available.

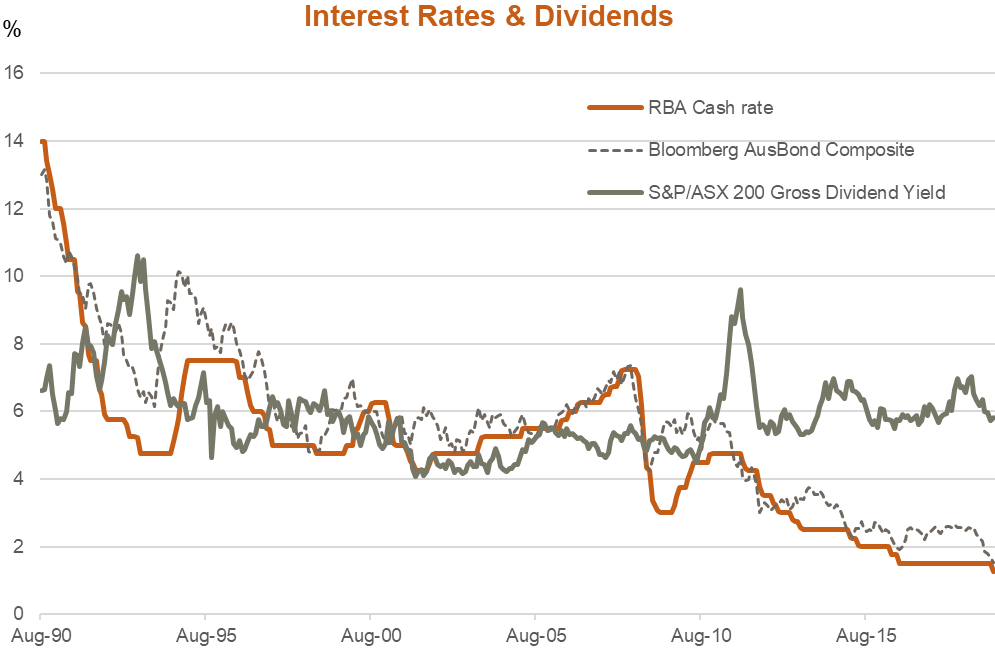

As seen in the chart below, a remarkable feature of the Australian financial landscape in recent years is that, while interest rates and bond yields have fallen, the dividend yields available from stocks have held up reasonably well. For example, as at June 2019, the gross dividend yield (i.e. including the pre-tax benefits of franking credits) on the S&P/ASX 200 Equity Index was 6.1% p.a., which is even somewhat higher than that averaged earlier last decade.

Source: Bloomberg. Past performance is not indicative of future performance.

Source: Bloomberg. Past performance is not indicative of future performance.

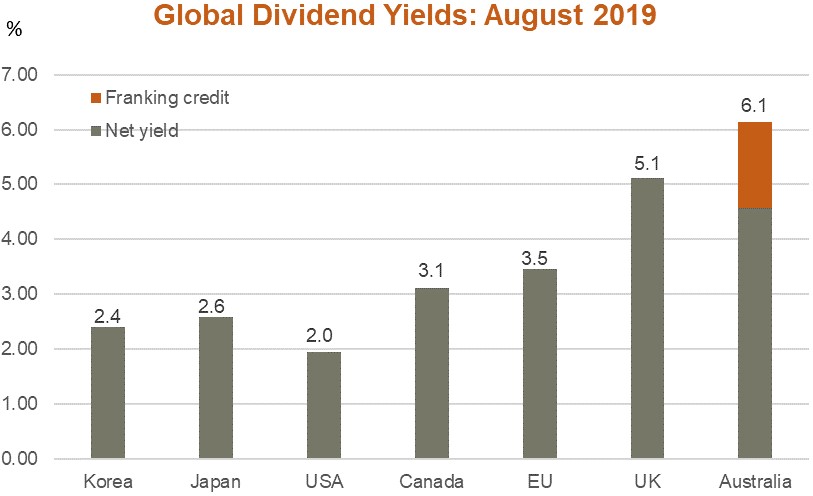

Australian investors might also be pleased to know that local dividend yields are generally quite attractive by global standards. As seen in the chart below, especially once the benefits of franking credits are allowed for, dividends have been considerably higher in Australia than in the United States, Asia and Europe. Only in the United Kingdom have yields been close to those in Australia, at least on a ‘net’ basis before franking credits are considered.

Source Bloomberg. Past performance is not an indicator of future performance.

Source Bloomberg. Past performance is not an indicator of future performance.

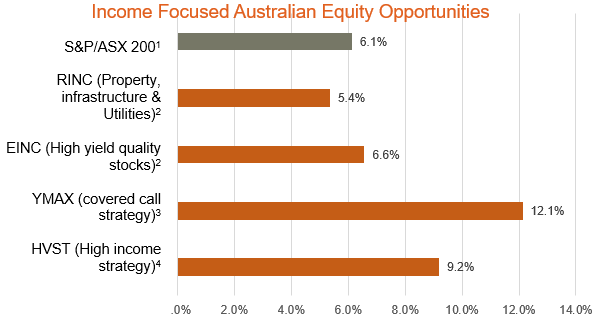

What’s more, Australian income-seeking investors can potentially do even better in the local equity market by focusing on those companies and investment strategies that seek to offer above-market income returns.

As outlined in the chart below, BetaShares offers a range of opportunities that aim to provide income returns greater than that generally available from the broader equity market.

Source: Bloomberg. As at 31 August 2019. Past Performance is not indicative of future performance.

Source: Bloomberg. As at 31 August 2019. Past Performance is not indicative of future performance.

1 Historic 12-month gross dividend yield.

2 Forecast 12-month portfolio gross distribution yield. Yield forecast is calculated using the weighted average of broker consensus forecasts of each portfolio holding and research conducted by Legg Mason Australia, and excludes the Fund’s fees and costs. Franking credit benefit assumes a zero tax rate. Actual yield may differ due to various factors, including changes in the prices of the underlying securities and the number of units on issue. Neither the yield forecast nor past performance is a guarantee of future results. Not all investors will be able to benefit from the full value of franking credits.

3 12-month historic gross distribution yield. Not all investors will be able to obtain the full value of franking credits.

EINC Betashares Martin Currie Equity Income Fund (managed fund) , for example, is an actively managed portfolio of Australian stocks that seeks to offer a relatively high and growing sustainable income return over time. The Fund’s objectives are to provide investors an after-tax income yield above the S&P/ASX 200 Index as well as growing this income over time by more than the rate of inflation. As at 30 August 2019, its 12-month forecast gross portfolio dividend yield was 6.6% p.a.

YMAX Australian Top 20 Equity Yield Maximiser Fund (managed fund) takes a different approach to generating attractive equity market income returns. First and foremost, the Fund generates income by investing in Australia’s top-20 largest stocks by market capitalisation. Extra income is produced through what’s known as a ‘covered call’ options strategy, whereby the Fund effectively sells to other investors the right to buy some of the Fund’s stock holdings at prices usually around 3 to 7% above prevailing market prices.

The upside of this strategy is that the Fund earns extra income, or call premiums, by selling this right or option irrespective of market developments. In exchange, however, the Fund may forego some upside price return in periods when share markets are rising relatively quickly. As at 31 August 2019, YMAX had a 12-month historical distribution yield of 12.1% p.a.

Another high-income strategy is available through HVST Australian Dividend Harvester Fund (managed fund) . HVST aims to generate above-market income through a strategy of holding a selection of income producing shares over a critical period, usually around two months, which are expected to pay relatively high dividends and franking credits. Once these income returns have been obtained, the Fund then rebalances into another selection of stocks expected to offer high income returns over the following holding period. To seek to protect investors from overall downside market risk, HVST also employs a rules-based risk management strategy that aims to reduce its overall market exposure in times of market weakness and high volatility.

The upside of these combined strategies is that HVST has been able to generate high income returns over time. As at 31 August 2019, the Fund had a 12-month distribution yield of 9.2% p.a. The risk management strategy has also helped to reduce overall return volatility and defend against losses in declining markets3.

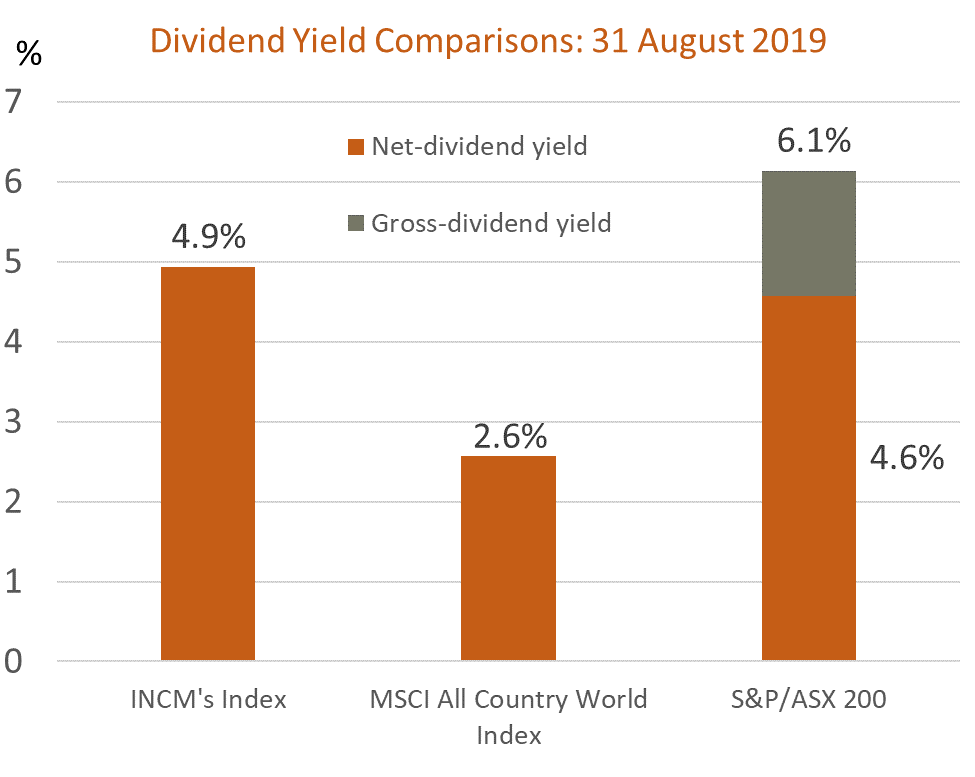

Last, but not least, for investors seeking both a reasonable level of equity income and an element of global diversification, INCM Global Income Leaders ETF is another option. The Fund seeks to provide investors with exposure to a diversified portfolio of global shares along with attractive, regular income. The Fund aims to track an index that comprises 100 high-yielding global companies, screened to select companies that have track records of paying dividends regularly.

As seen in the chart below, as at 31 August 2019, INCM had a 12-month distribution yield of 4.9% p.a., which was almost twice that available from the broader benchmark global equity index. This was also comparable to the yield available on the Australian market before allowing for franking credits.

Source: Bloomberg. Past Performance is not indicative of future performance.

Source: Bloomberg. Past Performance is not indicative of future performance.

INCM also offers a further level of equity diversification for Australian investors. Due to its income focus, the Index which INCM aims to track currently holds no resource stocks and has a notably higher weight to utilities than the benchmark Australian sharemarket index. And although INCM’s Index generally has a comparatively similar weight to financials as the Australian market, these include a diverse range of global banks much less tied to the Australian property market than is the case for major banks in Australia.

1 Exchange trade funds (ETFs) are open-ended managed funds available on the ASX which typically passively track an index of, say, company shares or bonds. Active ETFs differ in that they do not explicitly track an index but aim to produce returns through discretionary security selection.

2This estimates includes both current yield-to-maturity and projected roll returns assuming credit spreads remain unchanged over the next twelve months.

3 That said, as the Fund’s regular rebalancing strategy means it is often holding stocks about to go ex-dividend, the Fund can be exposed to some capital underperformance relative to the market – and potential losses – as and when these shares are eventually sold after the dividend has been paid. While helping limit downside during steep and sustained market declines, the risk management strategy can also act as a drag on return in sideways or increasing market environments. For investors seeking a somewhat different balance of income and price returns from the Fund, there is also the option of automatically reinvesting all or part of their income distributions, through the Fund’s Distribution Reinvestment Plan.