Fed meeting recap: hawkish quarter point rate cut

2 minutes reading time

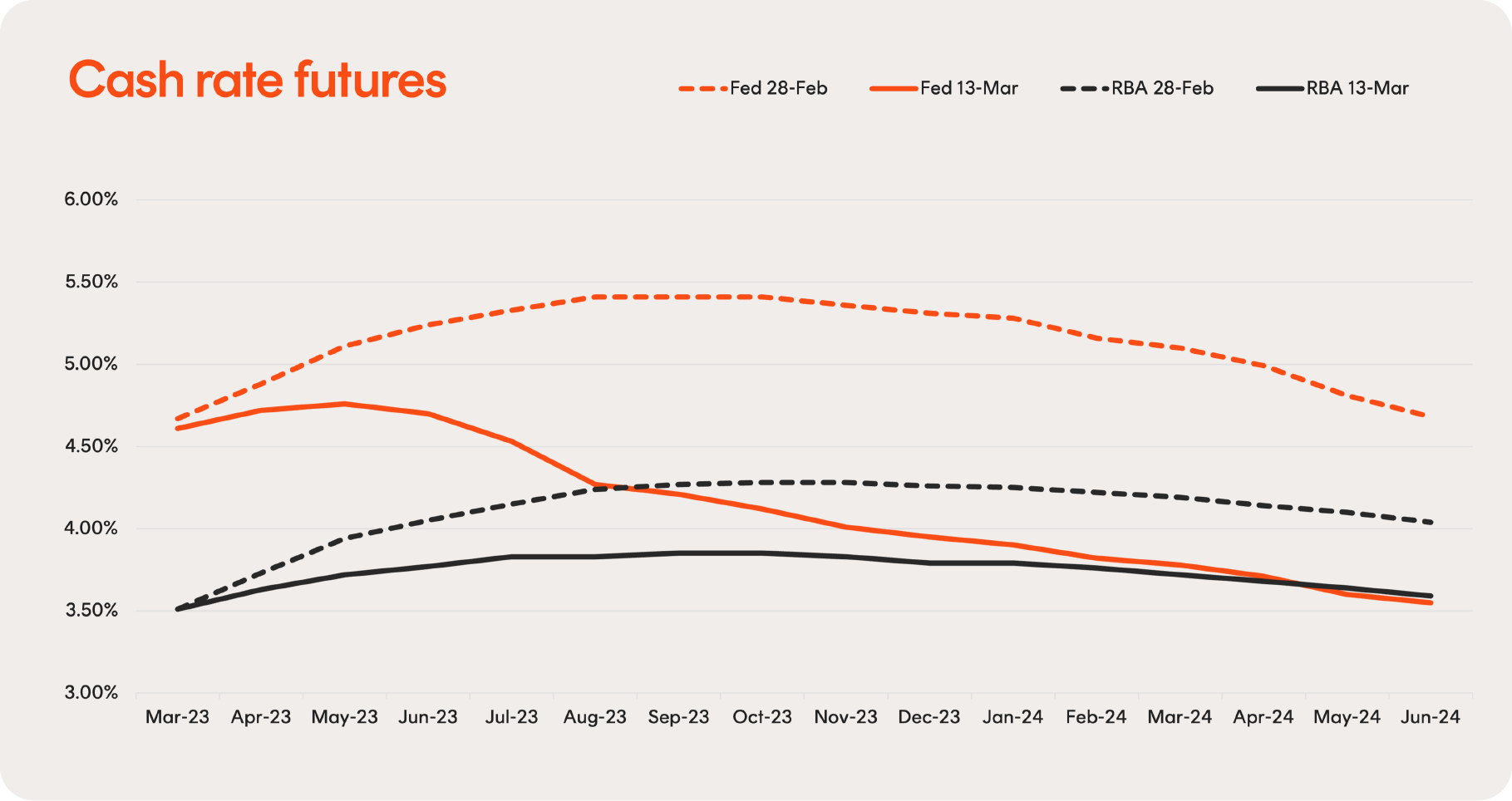

There has been a notable shift in the economic landscape in both the US and Australia over the past month – but in opposing directions.

In the US, a range of economic data has surprised on the upside – such as employment growth, service sector activity and even consumer prices.

In Australia by contrast, economic data over the past month or so surprised on the downside. December quarter GDP growth and the Wage Price Index were both softer than expected, retail spending slowed and the January monthly CPI report was also lower than expected.

In a speech at the Australian Financial Review Business Summit, RBA Governor Lowe suggested that if the economic data remained soft in the coming weeks, the RBA may well at least pause raising rates further at the April policy meeting.

Of course, a new complication regarding the interest rate outlook is the failure of US-based Silicon Valley Bank (SVB) – the biggest US bank failure since the global financial crisis of 2008.

At this stage, however, it appears the regulatory backstop given to depositors of this bank as well as the establishment of a new government lending facility available to other banks that may face depositor runs, may limit the contagion from similar failures. This would allow the Fed and the RBA to remain focused on their inflation challenge.

Assuming the issues in the US banking system are contained, it seems that the Fed could raise interest rates at least once or twice more in the coming months by a cumulative increase of at least 0.5%.

In Australia, the RBA may raise rates perhaps once more before potentially indicating a pause in further rate hikes in the minutes to the April meeting.

As a result, it seems likely that interest rate differentials between Australia and the US will widen further in the coming months, which, along with a likely hard landing for the US economy, could see the AU$ drop further.

Indeed, should the US economy go into recession later this year, the AU$ may well break below US 60c once more, potentially into the US 55-60c range.

As at 13 March 2023; Market-implied expectations based on Fed Funds and Cash Rate futures. Source: Bloomberg

2 comments on this

thanks for the article.

What is the current exchange level of hedging book for betashare funds ? is that book now going as shorter duration as possible ?

Hi Pat,

All of our funds that hold overseas assets are either completely unhedged or fully hedged for exchange rates. We do not engage in active hedging. Many of our international equity funds offer both hedged and unhedged versions, allowing investors to make their own decisions about whether to hold exposure to currency risks or not.

Regards,

Patrick