Bitcoin ETFs: What are they and how do they work?

5 minutes reading time

- Digital assets

Bitcoin approached US$38K but ended up pulling back along with the broader crypto market over the seven days to 19 November, as enthusiasm for spot bitcoin ETFs starts to wane. Bitcoin was trading at US$36,622, with Ethereum underperforming, down 4.46% vs bitcoin’s 1.46% decrease. Bitcoin’s market capitalisation declined to US$715.8 billion, with the total crypto market cap at US$1.39 trillion. Bitcoin’s market dominance is 51.4%.

| Price | High | Low | Change from previous week | |

| BTC (in US$) | $36,622 | $37,854 | $35,299 | -1.46% |

| ETH (in US$) | $1,963 | $2,112 | $1,915 | -4.46% |

Source: CoinMarketCap. As at 19 November 2023. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

BlackRock files for spot Ethereum ETF

The world’s largest asset manager, BlackRock, has filed an application with the Securities and Exchange Commission (SEC) for its iShares Ethereum Trust, which will be a spot ethereum exchange-traded fund (ETF). BlackRock is currently awaiting a decision from the SEC on its outstanding spot bitcoin ETF application.1

The application illustrates the commitment BlackRock has to digital assets, along with several other asset managers also looking to release ETF products over bitcoin and Ethereum. The launch of spot bitcoin ETFs is expected to make the asset class more accessible to the average investor.

Institutions remain committed to crypto

A survey commissioned by Coinbase, and conducted between 19 October and 6 November 2023 with 250 US institutions including venture capital firms, hedge funds, family offices, pension funds, foundations, and endowments, indicates that institutions remain committed to crypto.

Results from surveyed participants show 64% of current crypto investors expect to increase allocations in the next three years, while 45% without any crypto allocations expect to allocate within the next three years. 57% believe prices will increase within the next 12 months, compared to just 8% who held that view in October 2022.

The results suggest optimism among institutions about the future of cryptocurrencies and their resilience to systematic dislocations over the last year.2

Galaxy announces Q3 2023 financial results

Galaxy announced financial results for the 3-month period ending 30 September 2023. Due to the increase in crypto asset prices, market volatility and an increase in trading volumes, equity capital increased to approx. US$1.5 billion, and assets under management increased to $3.9 billion, up from $1.4 billion quarter-on-quarter. The company had a net loss of $94 million, an increase from $46 million in the previous quarter.3 The price of Galaxy Digital Holdings Ltd is up almost 100% year-to-date.

Galaxy Digital is a digital asset and blockchain leader providing access to the growing digital economy. Galaxy Digital is currently held in the Betashares Crypto Innovators ETF (ASX: CRYP).

On-chain metrics

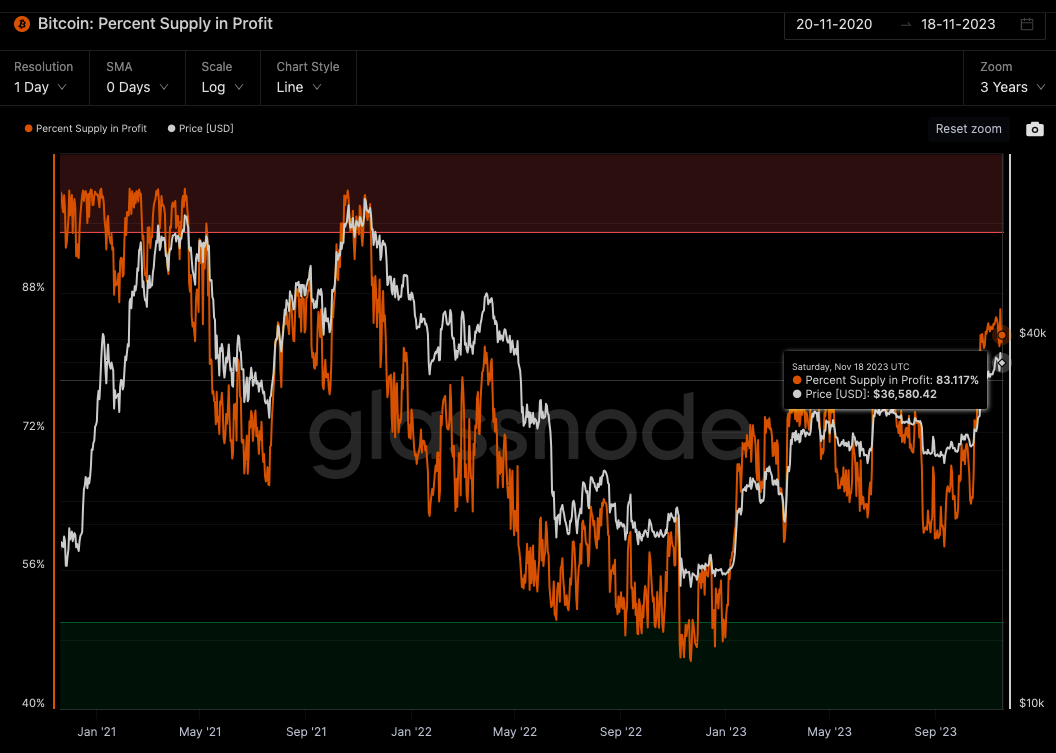

Bitcoin: Percent of Supply in Profit

This metric displays the percentage of circulating supply in profit i.e. the percentage of existing coins whose price at the time they last moved was lower than the current price.

Source: Glassnode. Past performance is not indicative of future performance.

This metric shows the bundle of all active supply age bands, aka HODL waves. Each coloured band shows the percentage of Bitcoin in existence that was last moved within the time period denoted in the legend.

According to data from Glassnode, 70% of supply has been held by investors for a year or longer.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

The top-performing Top 20 altcoin over the seven days to 19 November was Avalanche (AVAX), returning just over 20%, 135% in the last 30 days, and 69% over the last 365 days. Helping push the price higher was increased adoption and network activity through the newly launched GameFi subnets. A subnet (subnetwork) is a dynamic set of validators working together to achieve consensus on the state of a set of blockchains4.

According to the Avalanche website, Avalanche is a smart contracts platform that scales infinitely and regularly finalises transactions in less than one second.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://www.coindesk.com/policy/2023/11/16/blackrock-files-application-for-spot-ether-etf/

2. https://www.coinbase.com/blog/institutional-investor-survey-confirms-staying-power-of-crypto-among

3. https://www.newswire.ca/news-releases/galaxy-announces-third-quarter-2023-financial-results-and-october-update-876195832.html

4. https://www.fxempire.com/forecasts/article/avalanche-analysis-3-reasons-avax-price-rally-could-exceed-30-1389181

Past performance is not indicative of future performance.

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.

1 comment on this

Blockchain is a truly revolutionary tech and it will play a vital part in our future global digital economy powered by web 4.0 + AI + Blockchain & Crypto projects. The decentralized nature of these networks will allow users to share storage space, VPN networks, allow P2P DeFi loans available to the unbanked masses, etc… it will further decentralize the web space while helping its community and users to potentially earn income (while providing these services) and compete vs other establishment business services. That’s why this tech will keep further developing and evolving, we already have interoperable blockchains able to communicate and transmit transactions, instead of legacy isolated blockchains of the past… With Bitcoin ETF, Ethereum ETF and others opening the doors for the Wall Street players – this will be the most positive news for the crypto universe together with EU’s passage of the MiCA Act, which is quite crypto & blockchain friendly set of laws. Right now what we see is logical development. We have seen or assumed that there is a high degree of correlation. That Tether #USDT and Binance have been manipulating the crypto markets for years and it is understandable why the US authorities and other governments are increasing pressure on these entities and establishing regulations, which is not bad news for the crypto space as long as those rules won’t establish any obstacles for newly emerging crypto projects. The next bull run (2025-2026 might start in 2024 as Bitcoin halving approaches) will be massive – mega bull run and potentially shoot the overall crypto market cap to $7-$10 trillion range. Crypto market cap will outperform gold very soon. The future looks unique and interesting!