6 minutes reading time

As many of us have experienced in recent years, inflation can be a major barrier to wealth creation. It erodes the value of money and alters the calculations around how much is needed to maintain your lifestyle and cover essential expenses.

For long-term investors, managing inflation risk is essential to preserving wealth and maintaining the real value of returns.

While the current market narrative focuses on falling interest rates as inflation cools, it will continue to pose challenges for investors. The key difference will be the pace at which inflation rises, not its presence, with upside risks still looming due to ongoing geopolitical tensions.

We explore how inflation impacts investment portfolios and highlight strategies—such as diversification, investing in inflation-linked securities, and choosing companies with pricing power—that can help protect your assets from the long-term effects of rising costs.

How does inflation affect your portfolio?

Inflation refers to the general rise in prices of goods and services over time, which diminishes the purchasing power of money. As inflation increases, each dollar buys fewer goods, meaning that your savings or investments may not stretch as far.

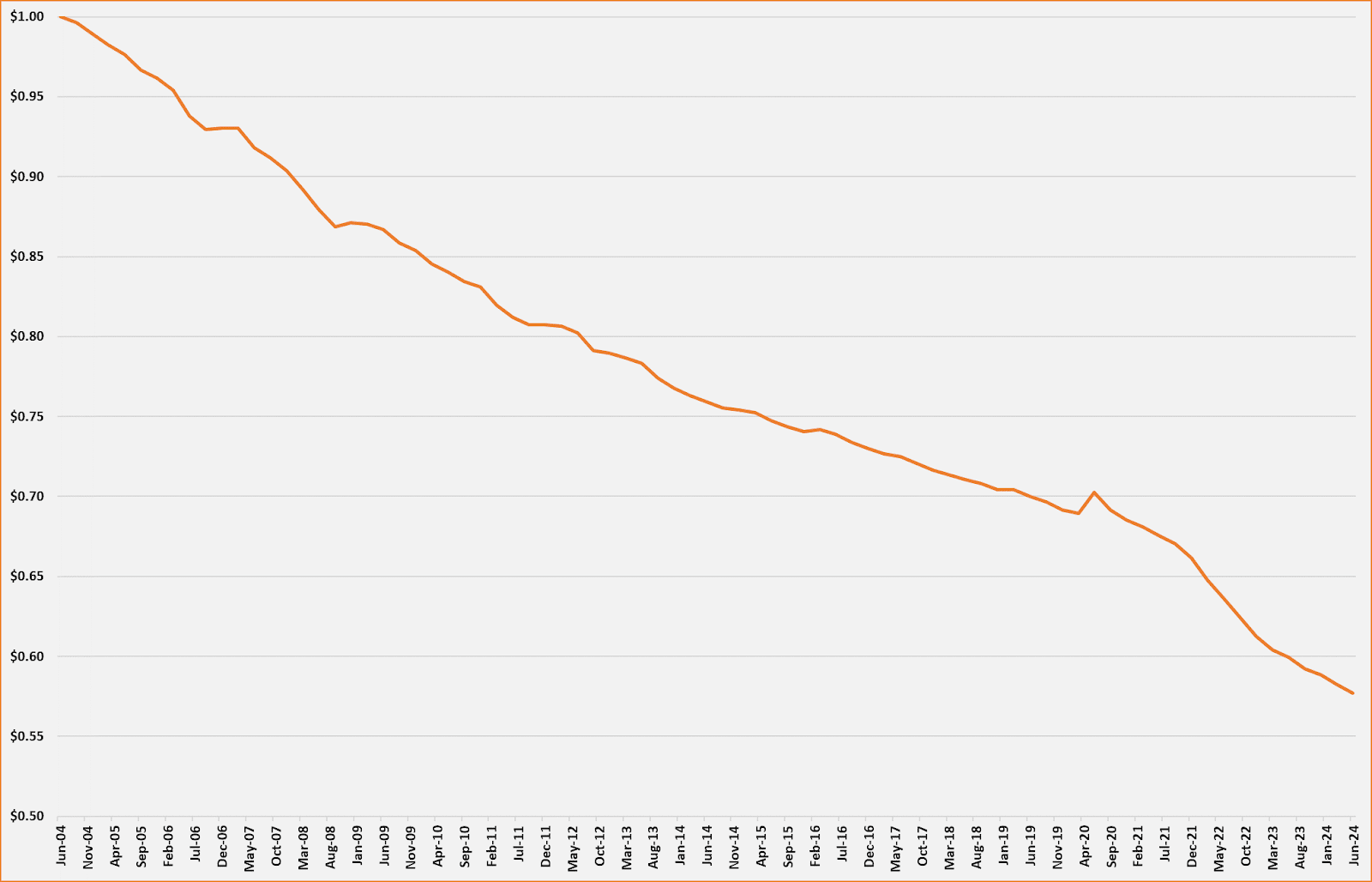

For investors, this is a significant concern because inflation can erode the real value of their returns. The chart below shows the decline in spending power of $1 over the 20 years to June 2024 in Australia.

Real value of $1

Source: ABS, Betashares. As at 30 June 2024.

Different asset classes react to inflation in various ways.

- Shares may see increased revenue as companies raise prices, but higher costs can also squeeze profit margins.

- Bonds can experience a decline in value, particularly those with fixed interest payments, because their payouts become less valuable as inflation rises.

- Cash may be the most vulnerable of all, as it loses purchasing power rapidly in an inflationary environment.

Historically, periods of high inflation, such as the 1970s in the US, have demonstrated the negative effects on investment returns. Investors who held cash or fixed-income assets during these periods saw their real returns significantly reduced. However, those who held inflation-hedged assets like gold or inflation-linked bonds were generally better able to protect their wealth1.

Strategies to hedge against inflation

To mitigate the effects of inflation on your portfolio, it’s important to employ strategies that help maintain purchasing power. Below are some approaches that may offer protection against rising costs.

Diversify your assets

Diversification can be one of the most effective ways to potentially safeguard a portfolio from inflation. By spreading investments across various asset classes, such as shares, bonds, real estate, and commodities, you can reduce the overall impact of inflation.

Different asset classes tend to react in their own ways to inflation, so having a mix may help balance the risks. For example, while bonds could be negatively affected, commodities or inflation-linked securities might perform better, helping to preserve portfolio value.

Consider commodities

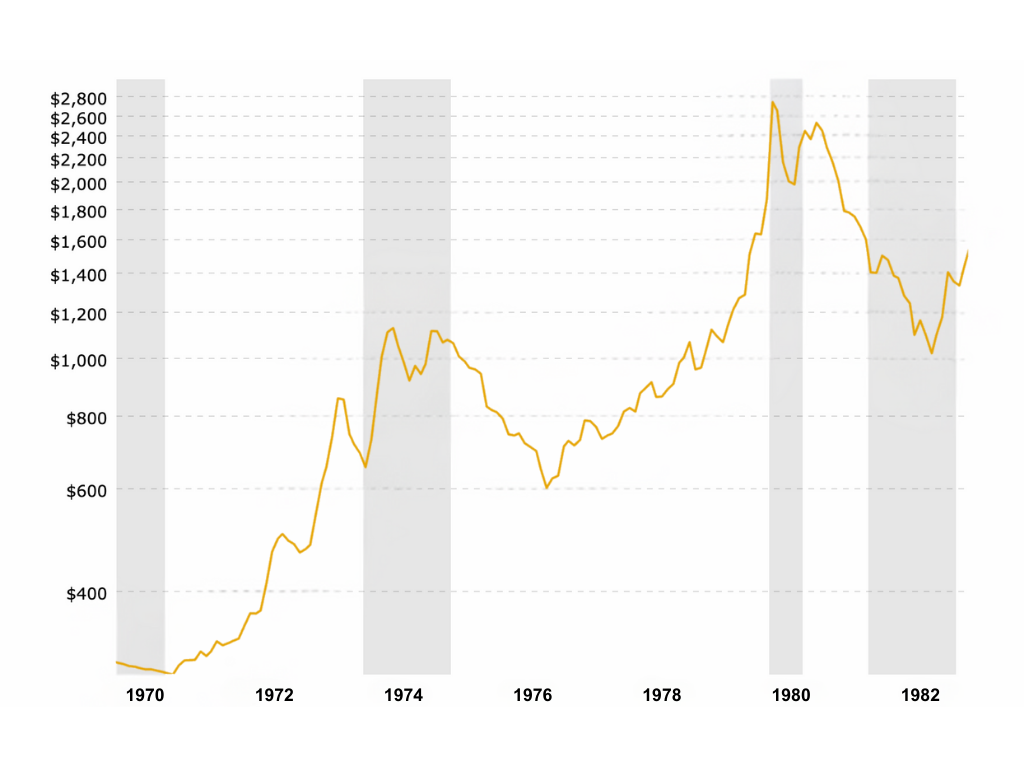

Commodities, like gold and energy products, are often regarded as useful hedges against inflation. Historically, commodities prices have generally risen in inflationary environments. Gold, in particular, has tended to hold or increase in value during periods of inflation and economic uncertainty, so it may serve as a potential option for those looking to protect their wealth in such times.

Gold price (USD) in inflation-adjusted terms during 1970s

Source: MacroTrends.com. US recessions in shaded areas. Past performance is not an indicator of future performance.

QAU Gold Bullion Currency Hedged ETF provides investors with a simple and cost-effective way to gain exposure to the price of gold, which has often been viewed as a potential hedge against inflation. This fund aims to track the performance of the price of gold, measured in Australian dollars (before fees and expenses), without the complications of physically owning the metal.

Inflation-protected securities

Inflation-linked bonds, such as US Treasury Inflation-Protected Securities (‘TIPS’), offer another way to hedge against inflation. These bonds adjust their principal value in line with inflation, which can help maintain the real purchasing power of the income they generate.

UTIP Inflation-Protected U.S. Treasury Bond Currency Hedged ETF offers exposure to TIPS, which are bonds designed to adjust their principal value (and interest payments) based on inflation. By investing in TIPS, this fund helps preserve investors’ purchasing power if inflation rises (noting the principal value of TIPS (and interest payments) would decrease in declining inflationary environments). The currency hedging feature also aims to reduce the risk of fluctuations in the AUD/USD exchange rate.

Companies with pricing power

Companies with strong pricing power may also offer some protection against inflation. These are businesses that can raise their prices without significantly reducing demand for their products or services.

Companies in industries with limited competition or those providing essential goods tend to have this advantage, which allows them to maintain or grow their revenue as costs rise. Including shares from such companies in your portfolio may help offset some of the negative effects of inflation.

QLTY Global Quality Leaders ETF invests in a portfolio of high-quality global companies that are selected based on their strong balance sheets, earnings stability, and return on equity. Companies with these characteristics tend to have the pricing power needed to maintain profitability during inflationary periods, making this ETF a potential inflation ‘hedge’.

Companies receiving royalties

Royalties are payments made to owners of an asset by others wishing to use it. For example, a mining company may pay a royalty to the landowner for the right to exploit a deposit on their property. Royalties are not just paid on mining deposits, but also on a range of intellectual property rights such as pharmaceuticals, patents, trademarks, and even film and music rights.

These businesses often have resilient revenue streams that can adjust to inflationary environments, as many royalties are based on commodity production or revenue-sharing agreements, which may increase as prices rise.

ROYL Global Royalties ETF provides exposure to companies that earn a substantial portion of their revenue from royalty income, royalty-related income and intellectual property income.

Conclusion

Inflation is an unavoidable factor that can erode the real value of your investments over time if not properly addressed. For long-term investors, understanding how inflation impacts different asset classes and employing the right strategies is key to protecting your portfolio. Diversifying your assets, investing in inflation-protected securities, and selecting companies with strong pricing power are just a few approaches that may help mitigate the effects of rising prices.

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Source:

1. Aswath Damodaran, NYU Stern – Historical Returns on Stocks, Bonds and Bills: 1928-2023 ↑