India: The new global growth engine – Part 2

4 minutes reading time

A new engine for global growth

Investors seeking the historically high returns from broad emerging markets (EM) exposures have largely been left disappointed since 2021.

Over the past 10 years, EM portfolios became overly reliant on China to power returns. When the Chinese economy started to falter following lengthy Covid lockdowns and issues related to their property market, EM Funds generally went down with it.

Investors are now looking to fill this void, with a strong candidate emerging in India.

Last year India was declared the most populous country in the world, overtaking China. Arguably more insightfully, the median age of India’s population is just 28 years old, 10 years younger than China and the U.S.

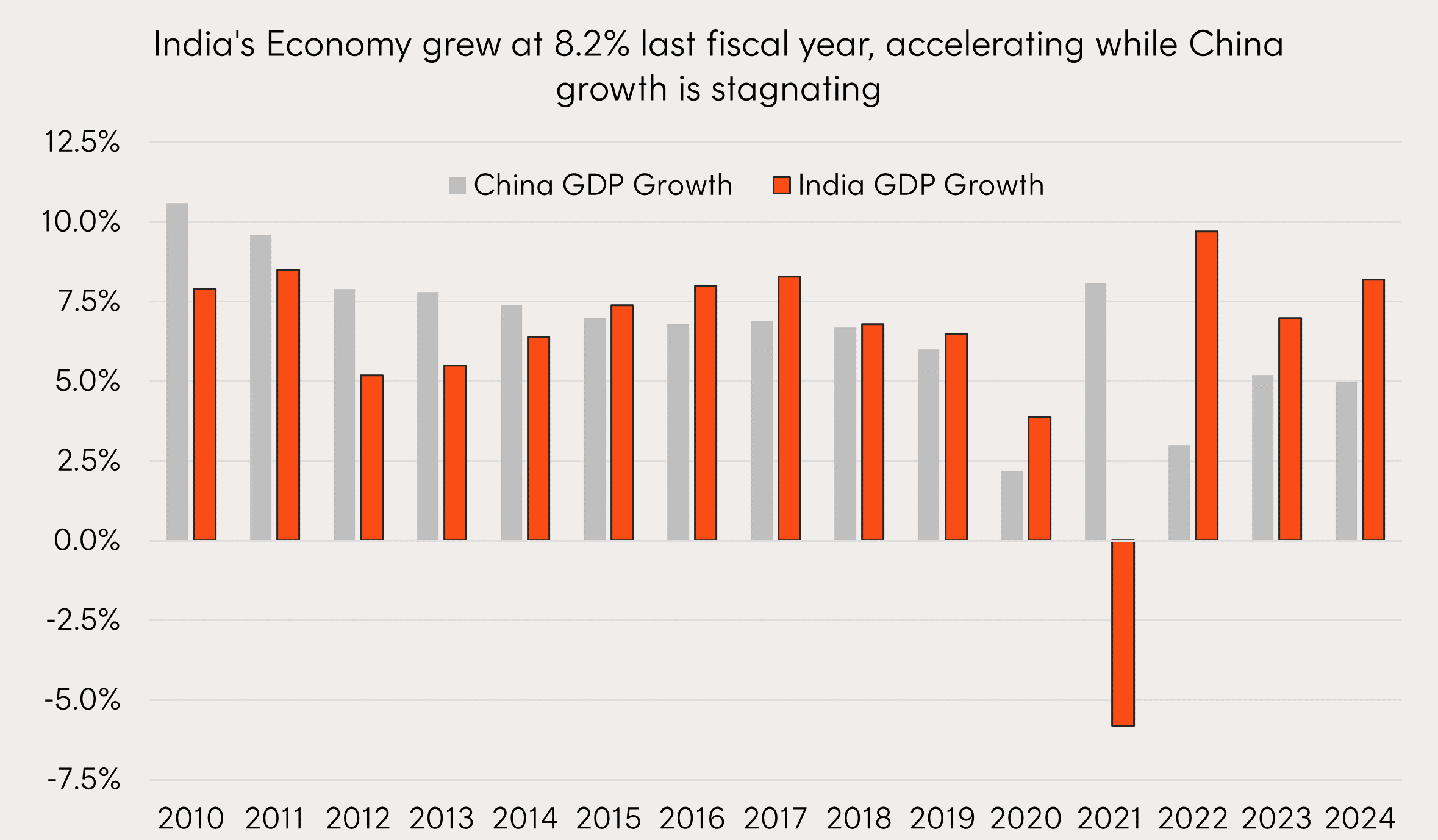

Source: Trading Economics, India’s data is for each fiscal year, China’s is for each full year. The Chinese 2024 figure is based on Chinese government’s 2024 growth target, which may or may not be realised.

India also now boasts the highest projected economic growth rate amongst major developed and developing nations. Having overtaken China since 2021, India grew at 8.2% for the fiscal year, versus the Chinese government growth target of 5.0%. India now sits as the world’s 5th largest economy with plenty of room left for growth.

What has triggered India’s growth, and will it continue?

India’s large, young, tech-savvy, and well-educated workforce should provide both the foundation for economic growth, as well as a domestic consumer base to fuel it.

Despite having doubled in the past decade, India’s GDP per capita still sits below US$3,000 ranking it amongst the lowest in the world.

While a low base and favourable demographics are a great starting point, it is the Modi government’s commitment to reform, nation building and a more Western geo political alignment that has seen India starting to fulfill its potential.

Since coming to power in 2014, Modi has liberalised rules on foreign direct investment, as well as introducing:

- a goods and services tax, to simplify the tax system,

- the world’s leading real time payment system, the Unified Payments Interface, and

- better bankruptcy laws, making it easier to do business in India.

In addition, over that time India’s investment in infrastructure has led to:

- A doubling of the number airports, kilometres of national highway and railway track.

- Quadrupling the number of metro cities,

- Near universal provision of electricity to rural villages (up from just 50%), and

- Improved internet penetration from 25% to 93%.

These developments have coincided with the developed world and particularly U.S. companies shifting away from Chinese manufacturing. India has effectively repositioned itself as the primary global alternative for labour intensive manufacturing – working to entice the supply chains of major companies including Samsung, Dell and iPhone manufacturers to their shores.

Despite the recent increase in foreign direct investment, India’s economic model does not mirror that of East Asia. Its growth is largely driven by internal consumption and services, which tends to be a more sustainable path to growth than relying on an export-oriented economy. As incomes rise, a new middle class is emerging. Household consumption has nearly doubled in the past decade.

Given the productivity improvements from modernising reform and it’s demographic advantages, India is very much an economy on the rise.

You can get access to Indian equities through Betashares IIND India Quality ETF . IIND’s Index selects the 30 highest quality Indian companies based on a combined ranking of the following key factors – high profitability, low financial leverage and high earnings stability.

Read India: The new global growth engine – Part 2

There are risks associated with an investment in IIND, including market risk, index methodology risk, international investment risk, concentration risk and currency risk. Investment value can go up and down. An investment in IIND should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the fund, please see the Product Disclosure Statement and Target Market Determination, both available on the Betashares website.