Crossing the chasm

4 minutes reading time

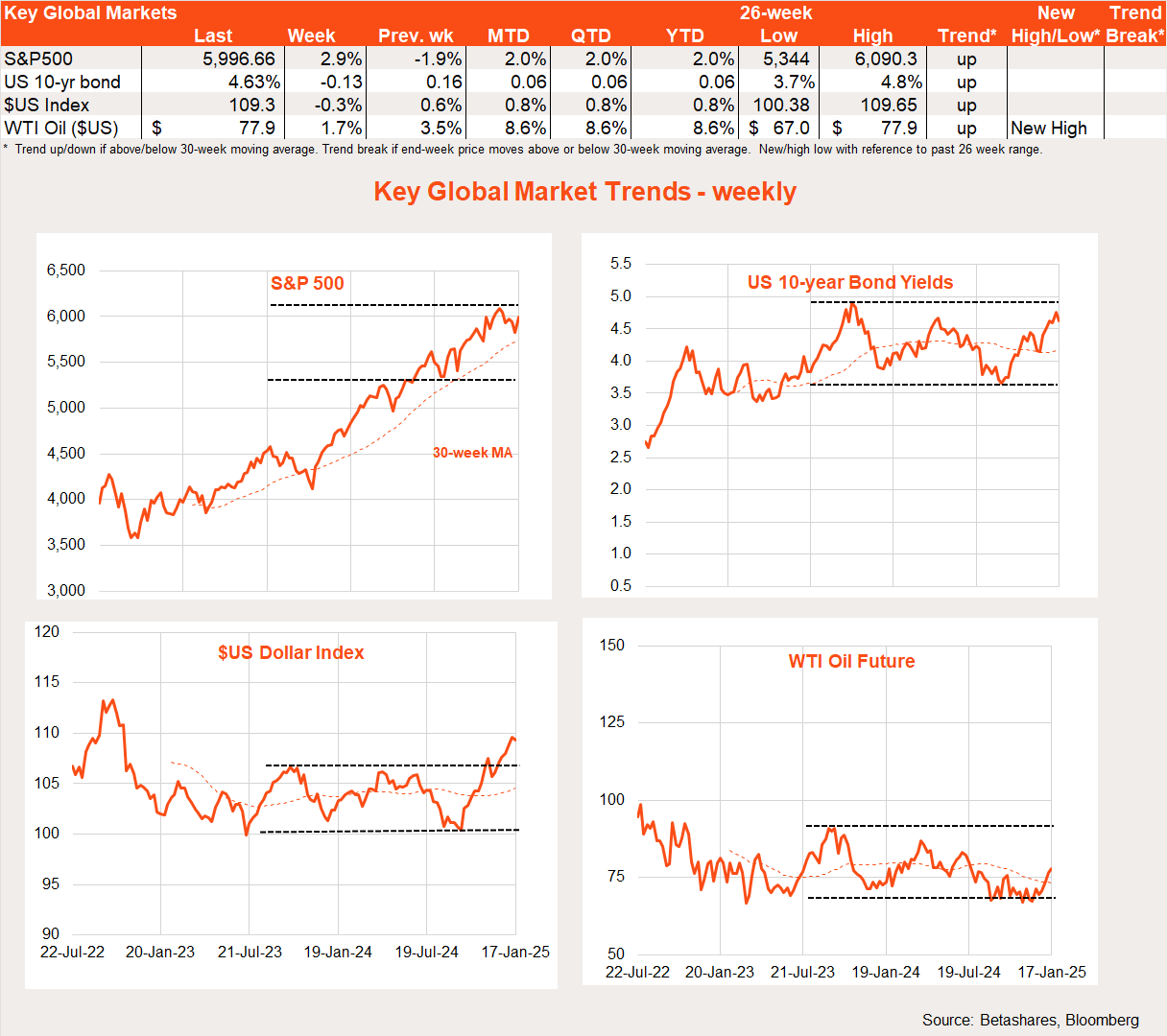

Global markets

It’s good to be back! Global equities enjoyed a bounce higher last week thanks to a lower-than-expected US inflation result and encouraging news on the Trump ‘trade wars’ front.

2025 has started somewhat cautiously, with resilient US economic growth and persistent inflation leading to a scaling back in Fed cut expectations – with higher bond yields and softer equities as a result. Adding to the mix is concern over what Trump may do in his first few days in office.

The previous week’s US payrolls result was a case in point, with stronger- than-expected employment causing stocks to drop – with markets in a “good [activity] news is bad news” funk.

So last week’s softer-than-expected December core CPI result provided some welcome relief, with core prices up only 0.2% (market +0.3%), allowing annual core inflation to ease to 3.2% from 3.3% – the first decline in annual inflation in four months.

Adding to the relief last week were news reports suggesting Trump may be less draconian in applying tariffs than feared – with more gradual increases affecting a narrow range of goods and countries.

As it stands, Wall Street currently expects only one or two rate cuts this year at most from the Fed.

Global week ahead

There’s only second-tier data in the US this week so the focus will naturally be on the inauguration of Donald Trump as America’s 47th President, and his actions in the first few days of office. My working assumption is that while Trump adds a new element of volatility to markets (unlike Biden) on balance he won’t want to risk the health of either the US economy or Wall Street – so will talk tough but tread cautiously.

Elsewhere, the Bank of Japan is expected to raise interest rates on Friday – its first move since its last rate increase in August caused a mini-meltdown in markets. This time around markets seem better prepared and recent weakness in the yen (with the $US resurgent) provides the BOJ a degree of cover.

In New Zealand, a further expected easing in annual inflation from 2.2% to 2.1% in Wednesday’s Q4 CPI report should open the way for another RBNZ rate cut next month – most likely another chunky 0.5%.

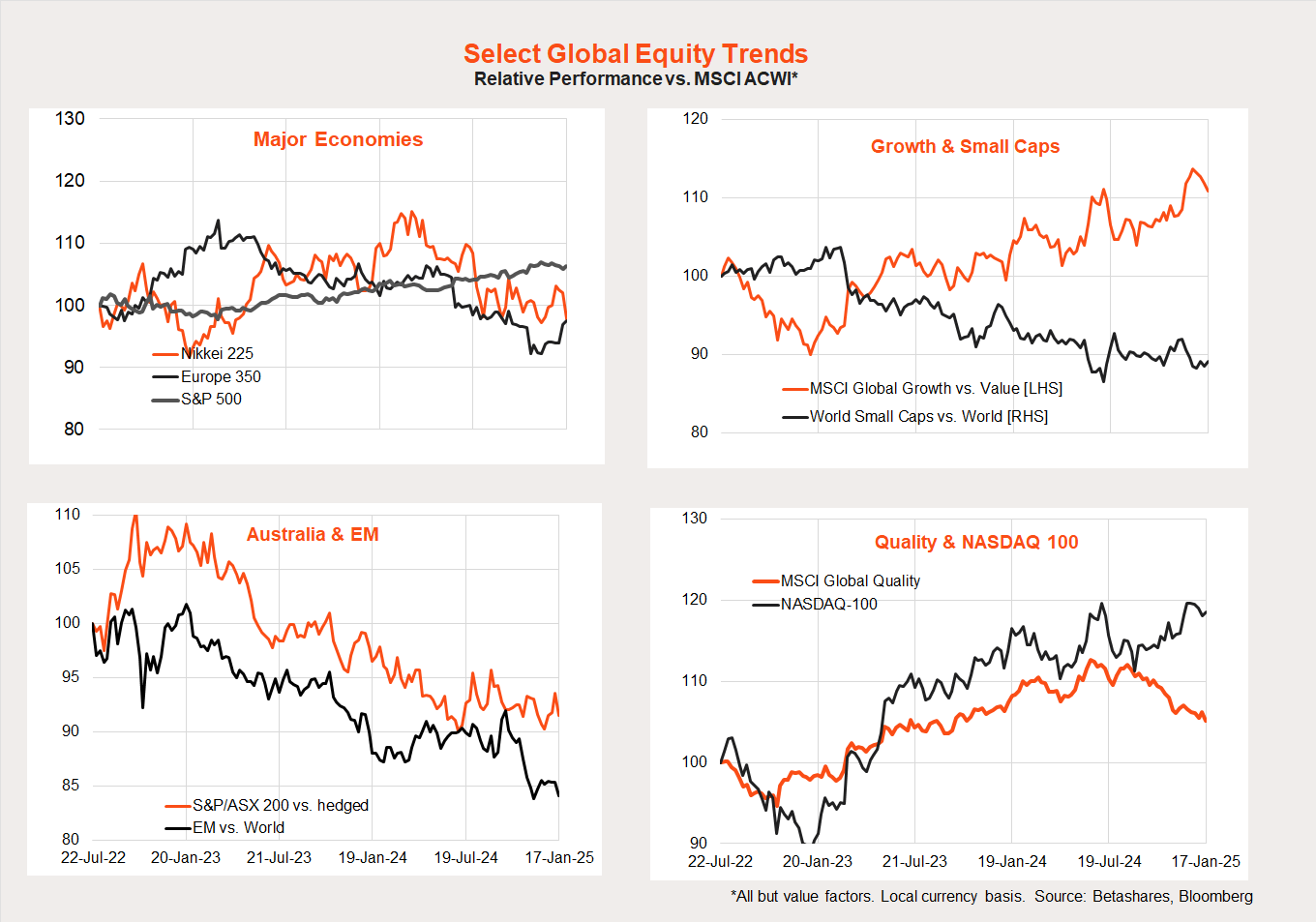

Global market trends

The only noteworthy development in terms of trends at this early stage of the new year is a bounce in the relative performance of downtrodden Europe. Global quality’s relative performance remains on the back foot, but otherwise there remain limited signs as yet of the ‘great rotation’ out of US and technology stocks.

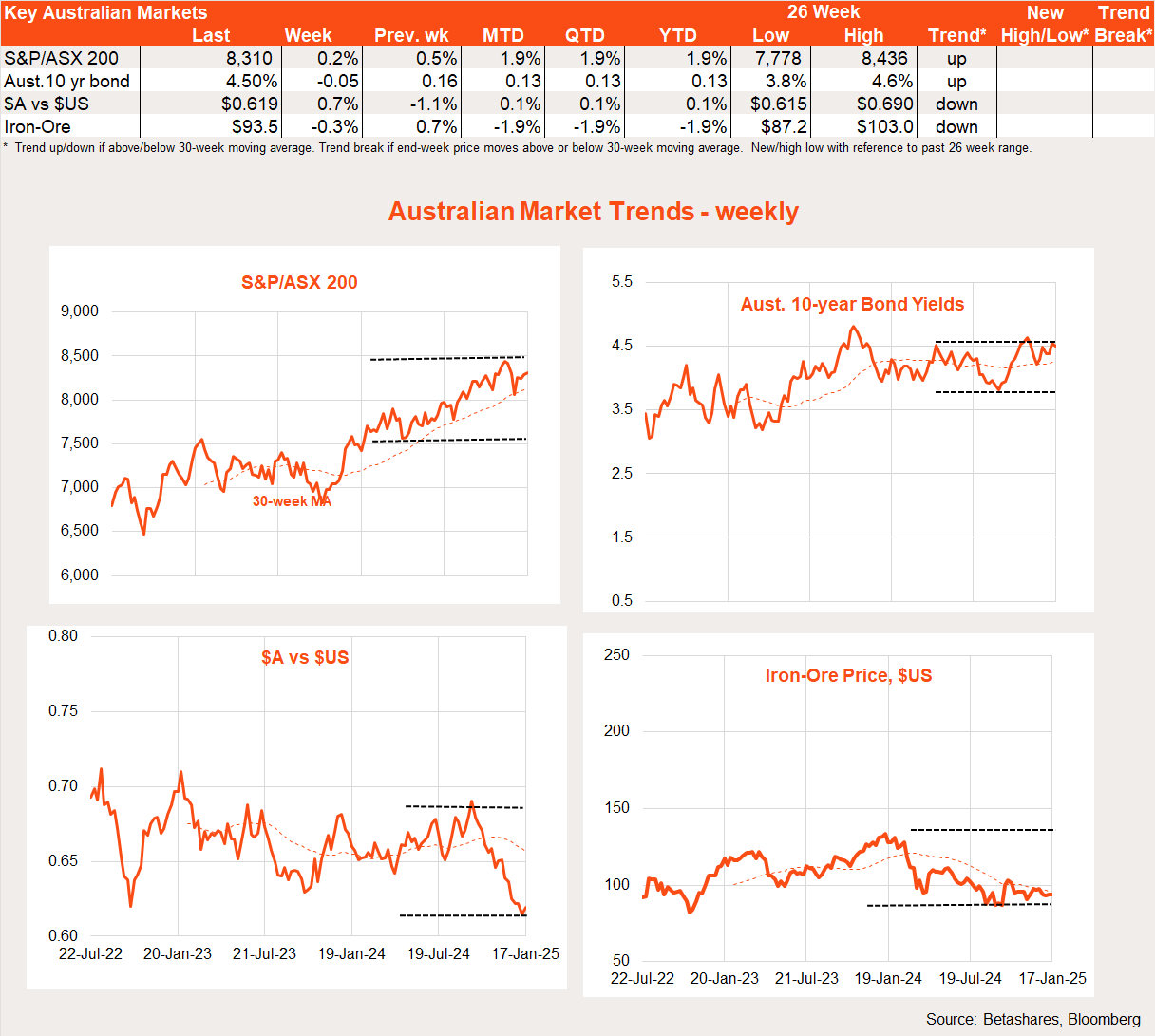

Australian market

The S&P/ASX 200 inched ahead 0.2% last week following a modest 0.5% gain the previous week. So far this year, local stocks are up 2% – in line with the S&P 500.

As is the case in the US, “good news is bad news” in Australia at present, with another strong labour market report last week hurting stocks by denting hopes for a RBA February rate cut.

Employment rose a further 59k in December, though it was mainly part-time jobs, and the unemployment rate did edge up to 4.0% from 3.9%. Nonetheless, the report did highlight the economy’s continued remarkable ability to create jobs for the still rapidly expanding labour force despite weak GDP growth and consumer spending. For that we can thank the booming care and infrastructure sectors.

The other major piece of local economic news in recent weeks was the softer-than-expected monthly CPI report for November, which showed annual trimmed mean inflation dropped back to 3.2% from 3.5%.

Despite the November CPI report, my own view remains that the RBA is unlikely to cut rates next month, given still solid employment growth, a vulnerably weak $A and likely continued sticky inflation in next week’s all-important Q4 CPI report.

To my mind, an easing in annual trimmed mean inflation from 3.5% to 3.4% (as I expect) would not be good enough for the RBA, though a drop to at least 3.25% likely would be. That said, I’m still hopeful for a rate cut in May following a further likely fall in underlying inflation in the Q1’25 CPI report.

There is little on the local data front this week, leaving attention focused on global developments.

Have a great week!