6 minutes reading time

- Currencies

The performance of an investment is affected by many variables – unexpected geopolitical events, economic cycles, central bank monetary policy decisions and shifts in market sentiment, to name a few.

When you invest in assets denominated in foreign currencies, such as global equities or fixed income, there is another important variable to consider – movements in the exchange rate between that currency and your home currency.

Currency movements can have a significant impact on investment performance – for better or for worse. As an Australian investor, a weakening in the AUD will increase the investment’s value in AUD terms, all else being equal. The reverse is true if the AUD strengthens.

Currency movements are notoriously difficult to predict.

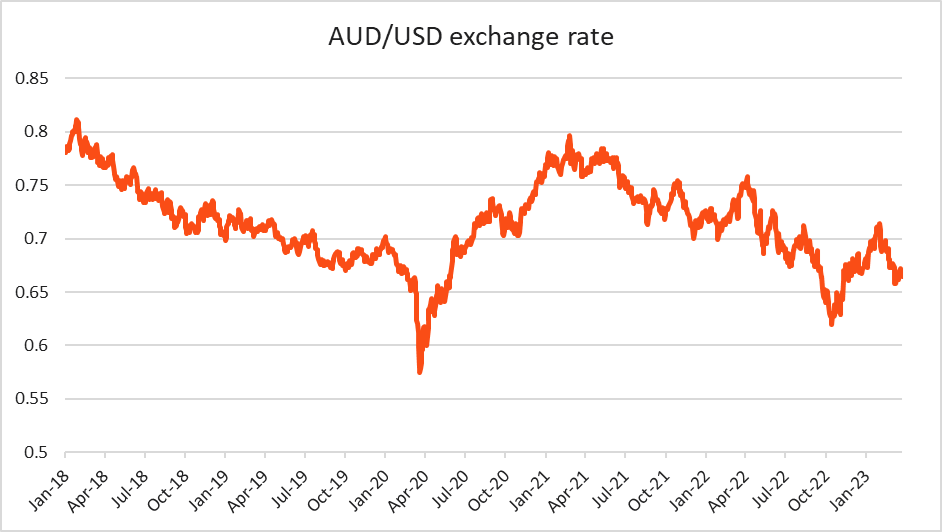

AUD/USD exchange rate over the last five years

Source: Bloomberg, Betashares, as at 27 March 2023. Past performance is not indicative of future performance.

For much of 2022 the USD earned the moniker ‘cleanest dirty shirt’, surging against all major global currencies. In a relative sense the US currently offers more attractive interest rates and faces less daunting economic challenges than other ‘safe haven’ currencies. The AUD fell to US62c in October 2022, but has since recovered to around around US66-67c at the time of writing.

Managing your currency exposure – what are the options?

An investor’s approach to managing their currency exposure may depend on their investment philosophy and may vary by asset class.

Some investors are happy leave their global investments unhedged, believing that over the long term currency movements tend to dampen overall portfolio volatility. Many view the AUD as a ‘risk-on’ currency, tied to the prospects for global growth. Indeed, Australian investors holding global equities without currency hedging during the Covid-induced sell-off of March 2020 saw smaller drawdowns in AUD terms as the AUD depreciated against most major currencies.

Other investors prefer to remove currency movements altogether as a variable from the investment equation. These investors typically do not take a view on currency movements, and try to gain ‘pure’ exposure to their chosen investment, unaffected by currency fluctuations, by hedging their currency exposure. Currency hedging is particularly common for defensive, lower volatility asset classes like global fixed income.

Another approach is to take an active view on currencies. These investors typically remain unhedged when they think their home currency is likely to depreciate, and will hedge their exposure if they think it is likely to rise.

Using ETFs to manage your currency exposure

There are two main ways ETFs can help you attain your desired ‘currency exposure profile’:

• invest in currency-hedged ETFs

• invest in currency ETFs.

Some ETFs have inbuilt currency hedging. These are easily identified because ‘currency hedged’ or ‘hedged’ is typically included in the fund name. The issuers of these ETFs take care of hedging the currency exposure of the underlying portfolio, so as an investor you don’t need to take any action.

In some cases, the ETF issuer will offer a hedged and an unhedged version of the ETF.

For example, Betashares offers the NDQ Nasdaq 100 ETF , which aims to track the performance of the NASDAQ-100 Index (before fees and expenses), and the HNDQ Nasdaq 100 Currency Hedged ETF . HNDQ obtains its investment exposure by investing in NDQ, and hedges the foreign currency exposure back to the AUD.

This gives investors the choice of exposure to the stocks in the NASDAQ-100 Index with or without the impact of exchange rate fluctuations.

The other way to gain currency exposure through ETFs is by investing in an ETF where a currency (or more accurately, a currency pair) is itself the underlying asset of the ETF.

For example, the USD U.S. Dollar ETF holds assets in a USD bank deposit account. If the USD rises 10% against the AUD, the AUD net asset value of the ETF is designed to go up 10% too (before fees and expenses and interest earned). Conversely, the Fund will do down if the USD falls against the AUD. This ETF could therefore be attractive to an investor who thinks the AUD is likely to weaken against the USD. USD also has the potential to generate attractive income on its US dollar bank deposits, for investors comfortable with foreign exchange fluctuations. It currently offers an interest rate of 4.13% p.a.1

One of the advantages of using ETFs to gain currency exposure is that, since they are traded on the ASX like any share, they avoid the inconvenience and complexity of opening a foreign currency bank account, trading CFDs, or dealing in FX markets.

Some currency ETFs offer geared exposure. For example, the AUDS Strong Australian Dollar Complex ETF aims to generate a positive return of between 2% and 2.75% for a 1% rise in the value of the AUD against the USD on a given day (and vice versa).

For an investor who has a view on currency movements, these ETFs offer the potential for leveraged returns. It’s important to remember, however, that gearing is a double-edged sword – the risk of leveraged losses goes hand-in-hand with the possibility of leveraged profits. For this reason, gearing involves significantly higher risk than non-geared investments and may not be a suitable strategy for all investors. Geared currency ETFs are only likely to suit investors with a very high tolerance for risk.

For the hedger looking to offset the currency exposure of another investment (for example, a portfolio of US-listed shares), a geared currency ETF means they do not have to tie up as much capital in the hedging strategy. Investors should be aware, however, that as with all geared ETFs, exposure is reset from time to time and this means that returns over periods longer than a day will not necessarily be equivalent to the expected return on a given day. Investors will therefore need to monitor their positions as frequently as daily to ensure their gearing remains in line with their desired level.

Summary

Exchange rate movements can have a significant impact on the performance of an investment in global assets. Approaches to managing currency exposure range from doing nothing, to partially or fully hedging out currency exposure, to actively taking positions according to your view on likely exchange rate movements. You can use ETFs to help manage your currency exposure in two main ways – investing in currency hedged ETFs, which take care of currency hedging within the ETF itself, or by investing in currency ETFs, whose value is determined by exchange rate movements.

There are risks associated with an investment in the Funds, including market risk, currency risk, sector risk and hedging risk. In relation to the YANK fund, investment risk also includes gearing risk, currency futures and concentration risk. Gearing in YANK magnifies gains and losses and may not be a suitable strategy for all investors. Investors should be willing to accept higher levels of volatility and potentially large moves (both up and down) in the value of their investment. Investors considering YANK should note that the return on their investment over any period longer than a day will not necessarily be equivalent to the 200% to 275% of the return on the USD relative to AUD over that period. As such, investors should check the Betashares website for details of YANK’s historical performance, as well as gearing exposure, to ensure it continues to meet their investment objectives. YANK does not track a published benchmark. For more information on risks and other features to the Funds, please refer to the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for each of the Funds.

References:

1. As at 24 March 2023.