6 minutes reading time

Week in review

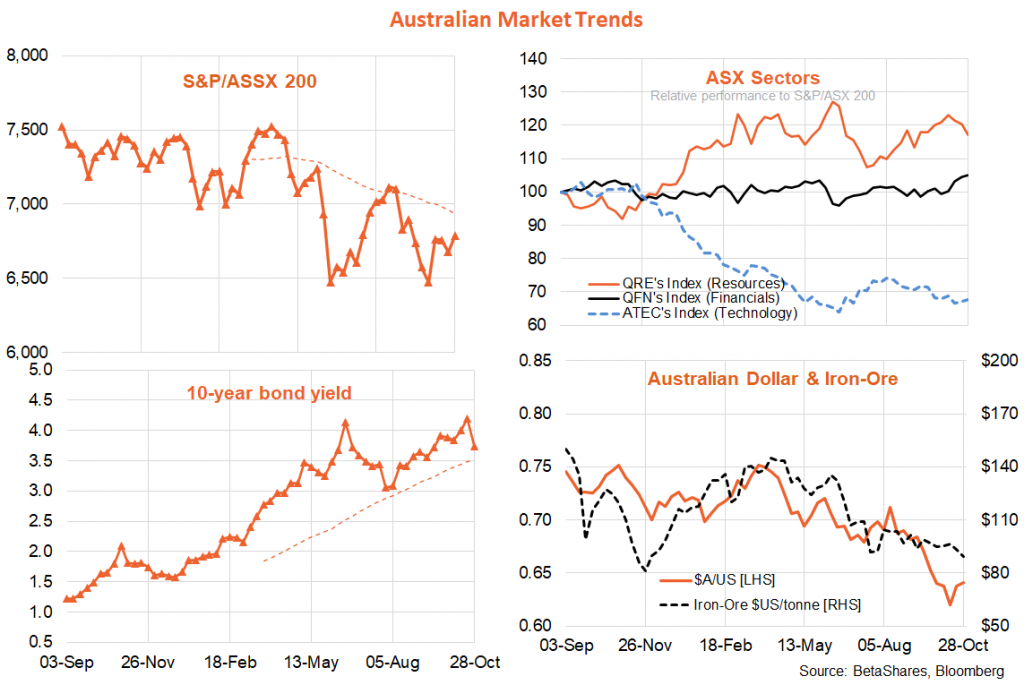

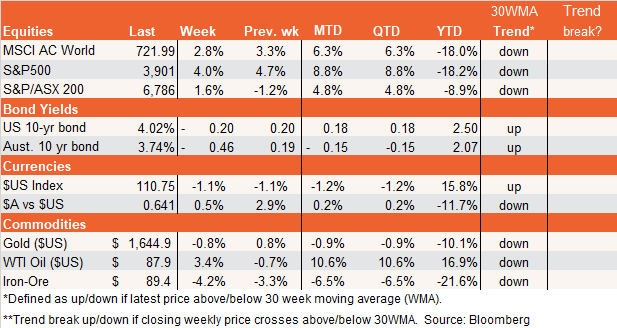

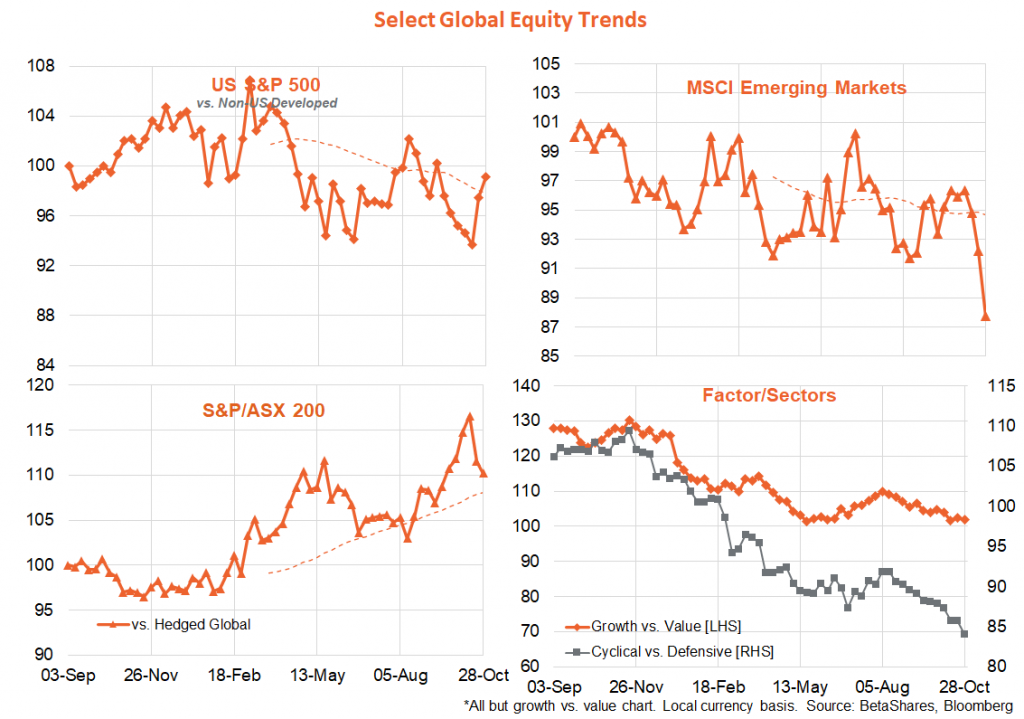

Better than feared Q3 US earnings results and ongoing hopes of a dovish Fed ‘pivot’ helped propel global equities higher again last week – despite signs of still-high US inflation and weakening economic growth. Hope on Wall Street still springs eternal. As evident in the chart set below, US 10-year bond yields also enjoyed their first weekly decline since late July – while the $US has also eased back in recent weeks, even as oil prices have moved higher.

As regards US earnings, according to FactSet, 51% of S&P 500 companies have now reported. Of these, 71% beat earnings expectations – which is only slightly lower than the 5 and 10-year averages of 77% and 73% respectively. Notable earnings misses last week came from the likes of Facebook, Microsoft, Alphabet and Amazon – though Apple did better than expected. In the main, however, the current earnings season – as with all results so far this year – is a case of results being better than feared, which really should be no surprise given the resilience of the economy to rate hikes to date and the still high profit margins being enjoyed by corporate America.

Meanwhile, Wall Street has also been lulled back into the ‘bad news is good news’ mentality, with falling house prices and weak manufacturing results leading to hopes the Fed will stop raising rates sometime soon. That said, the best that can be said about key US inflation and wages data on Friday was that it was not worse than expected – albeit still uncomfortably high. The core consumption deflator rose 0.5% in September – in line with expectations – although the annual rate was a bit lower than expected (5.1% vs. 5.2%) due to a 0.1% downward revision to the monthly gain in August. The US employment cost index (ECI) was also in line with expectations, with a 1.2% quarterly gain (5.0% over the year), albeit with surprisingly more weakness in private sector wages than public sector wages. As with price inflation more generally, it is probably true that the rate of US wage inflation is slowing – though the decline has been modest to date and overall remains too high for comfort.

Adding to the ‘central bank pivot’ narrative, the European Central Bank did hike rates by a further 0.75%, though language changes in its statement were interpreted (perhaps over-interpreted) by the market as signalling fewer rates cuts down the track. As with the RBA last month, the Bank of Canada surprised last week – raising rates by ‘only’ 0.5% rather than 0.75%.

In China, the appointment of anti-reformist hardliners to President Xi Jinping’s circle of advisers led to renewed global market despair about prospects for the world’s second largest economy. Chinese stocks sank, which in turn dragged down emerging market performance, while iron-ore prices also fell.

In Australia, highlights last week were the Federal Budget and the Q3 CPI. For markets, the key budget takeaway was that it was not restrictive enough to reduce pressure on the RBA to hike rates further in coming months.

At best, the Budget could be considered neutral in terms of economic impact. While Treasurer Chalmers talked up long-term budget challenges and the “dark clouds” on the economic horizon – last week was probably the best opportunity to make tough budget cuts ahead of the next election. With global and local economic growth likely to slow from here, any reduction in the structural budget deficit in coming years will be pro-cyclical (slowing growth in a weak economy), whereas last week the Treasurer had the opportunity to be counter-cyclical (slowing growth in a strong economy).

Also somewhat disappointing was the Q3 CPI, which came out higher than expected. With overall wage growth still relatively benign, and flooding affecting food prices, more of Australia’s high inflation appears to reflect local and global supply-side pressures than is the case in the US. Nonetheless, with local consumer spending and employment growth still strong, the RBA will remain concerned that the longer inflation stays high, the greater the risk of it being embedded through a pick-up in inflation expectations among wage and price setters.

Week ahead

Central banks are front and centre again this week with key policy meetings in both Australia and the US. The US Federal Reserve is expected to hike rates by another large 0.75%, reflecting continued high inflation – though market are hoping the Fed could surprise with a smaller 0.5% increase or at least signal a smaller move at the following meeting in December. US payrolls on Friday will also be critical, with another solid 200k in employment expected – though the market will also be hoping for signs of moderating growth in average hourly earnings.

In Australia there’s no question the RBA will raise interest rates again on Melbourne Cup day, the only issue is whether it will be 0.25% or 0.5%. Following last week’s higher than expected inflation results, there is some risk the RBA could return to hiking rates by 0.5% – but having shifted down to a 0.25% move last month I suspect the RBA won’t try to rock the boat too much on Tuesday, and will settle with another 0.25% hike. Of course, they are still likely to raise rates a further 0.25% in December – and likely at least another 0.5% in the first few months of 2023, so pressure on home loan rates won’t let up any time soon. Apart from Tuesday’s decision and accompanying statement, we’ll also learn more about the RBA’s intentions with the quarterly Statement on Monetary Policy due on Friday.

Last but not least, today’s September Australian retail sales report is expected to show consumer spending (as in the US) remains stubbornly firm in the face of rate hikes. A very hot result today might just be enough to goad the RBA into hiking by 0.5% tomorrow.