Cause to pause

4 minutes reading time

Global week in review

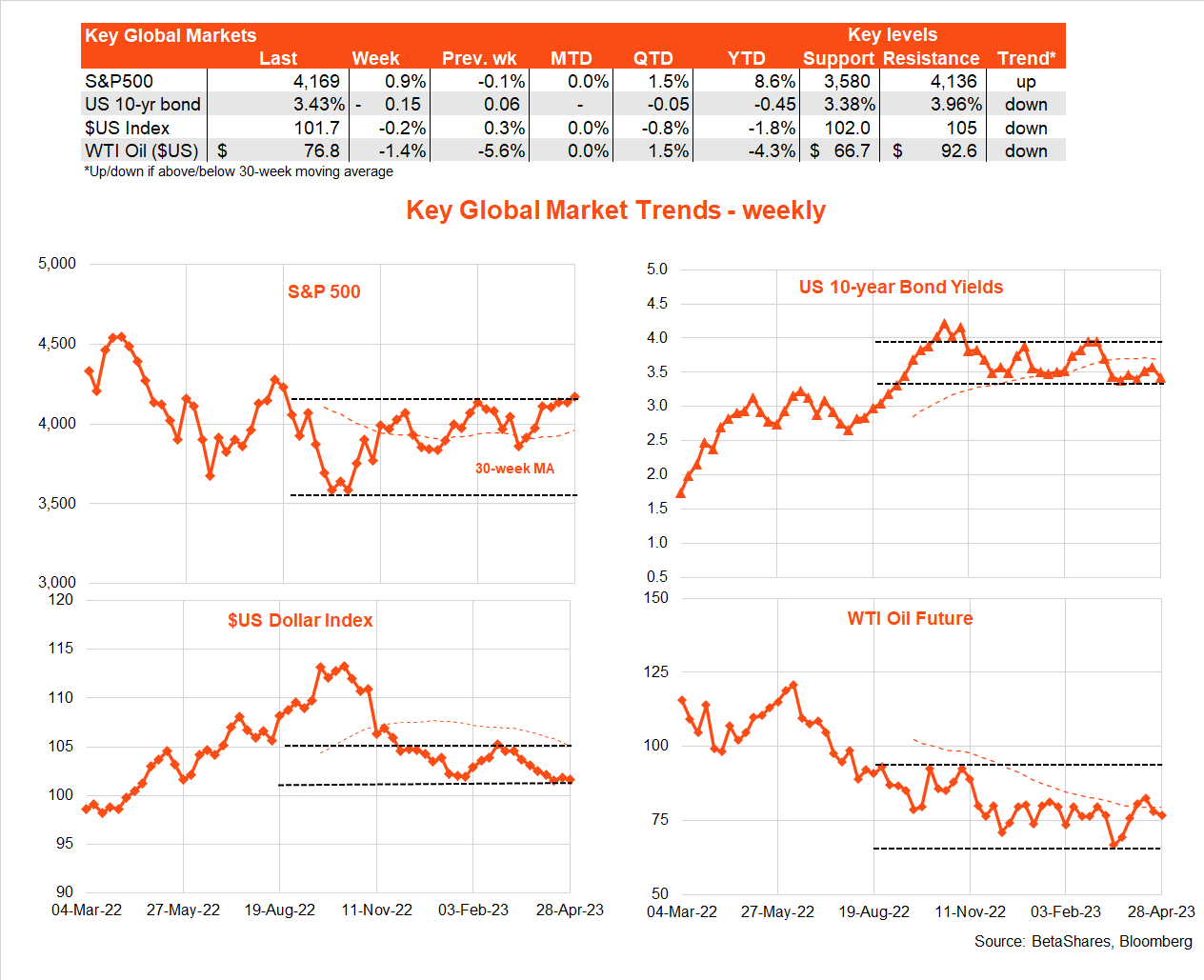

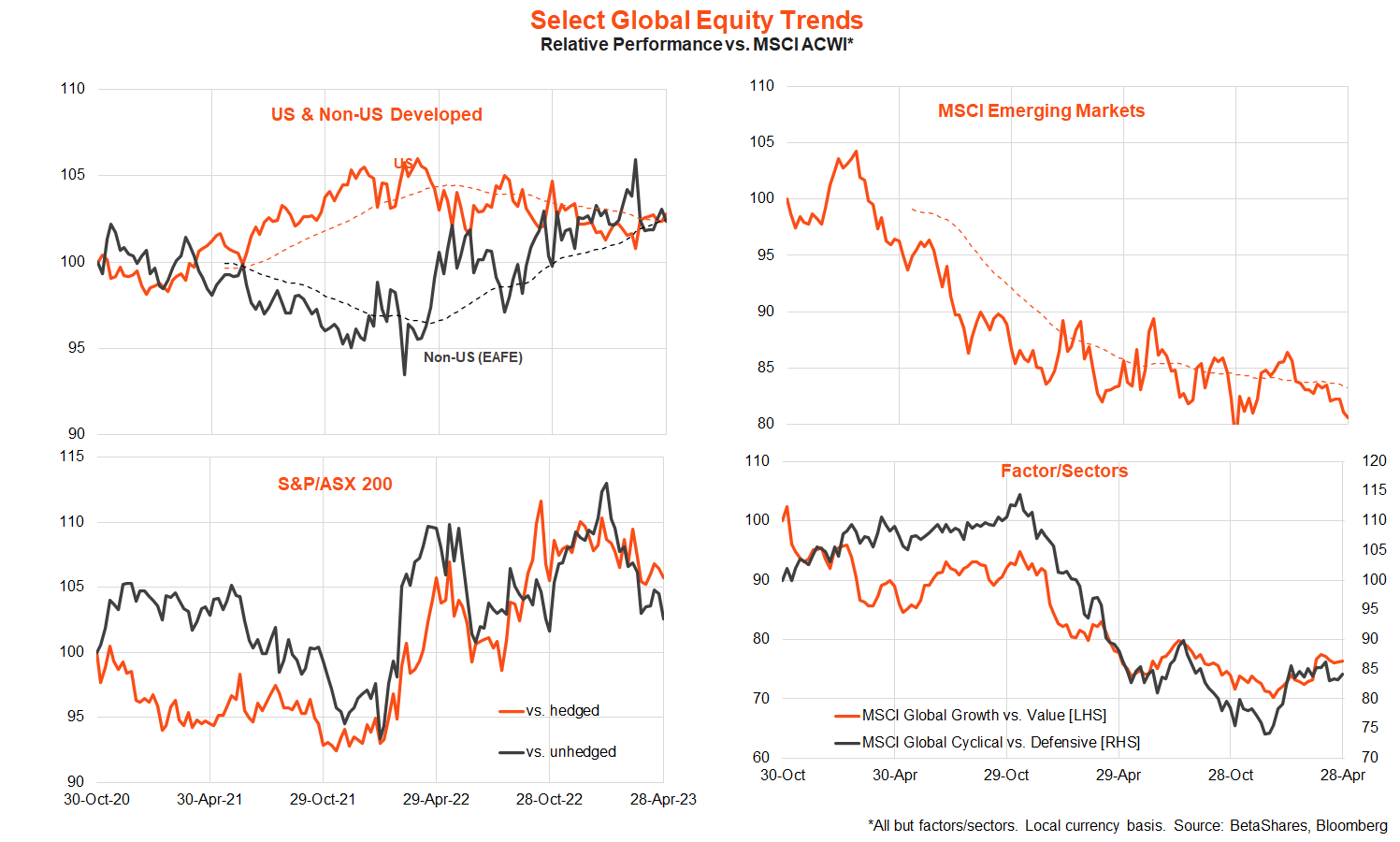

Despite a resurgence in banking woes, US stocks pushed higher last week – encouraged by falling bond yields, good corporate profits, economic resilience and inflation results not worse than feared

US banking instability re-appeared last week with First Republic’s share price plummeting amid concerns over losses and depositor outflows. For good or bad, equity markets are unsure whether to fear or welcome further banking troubles – as while it suggests a tightening in credit conditions, it also reduces the risk of further aggressive Fed tightening.

As expected, Q1 earnings reports continue to broadly hold up – especially in the tech sector – even though this reflects cost-cutting rather than top-line revenue growth.

US economic data, meanwhile, continued to suggest firm underlying consumer demand though persistent wage and price pressure – even as various manufacturing indicators continue to roll over. Although Q1 GDP was weaker than expected, this reflected an inventory rundown amid still solid consumer spending. Weekly jobless claims dropped last week after recent rises, suggesting the labour market remains stubbornly firm.

The March consumption deflator also remained firm, but not higher than expected, which was some relief to markets on Friday. That said, markets ignored the slightly higher-than-expected Q1 employment costs index, which rose 1.2% over the quarter and 4.8% over the year.

Global week ahead

The highlight of the week ahead is Wednesday’s Fed meeting where another 0.25% rate hike is widely expected. Beyond that, interest will be in whether the Fed signals a pause – which also seems widely expected – in light of recent banking woes. Given signs of economic resilience and persistent wage and price pressure, however, there is a risk that the Fed delivers a hawkish surprise this week – signalling it may not yet be done raising interest rates.

Also of note this week will be Friday’s April payrolls report, with a still firm but slowing pace of employment growth of around 150k expected. The unemployment rate is expected to tick up to 3.6% and annual growth in average hourly earnings to remain steady at 4.2%.

In Europe, the ECB also steps up to the plate with a smaller 0.25% rate hike expected on Thursday – though yet another aggressive 0.5% hike given still high inflation can’t be ruled out.

Australian week in review

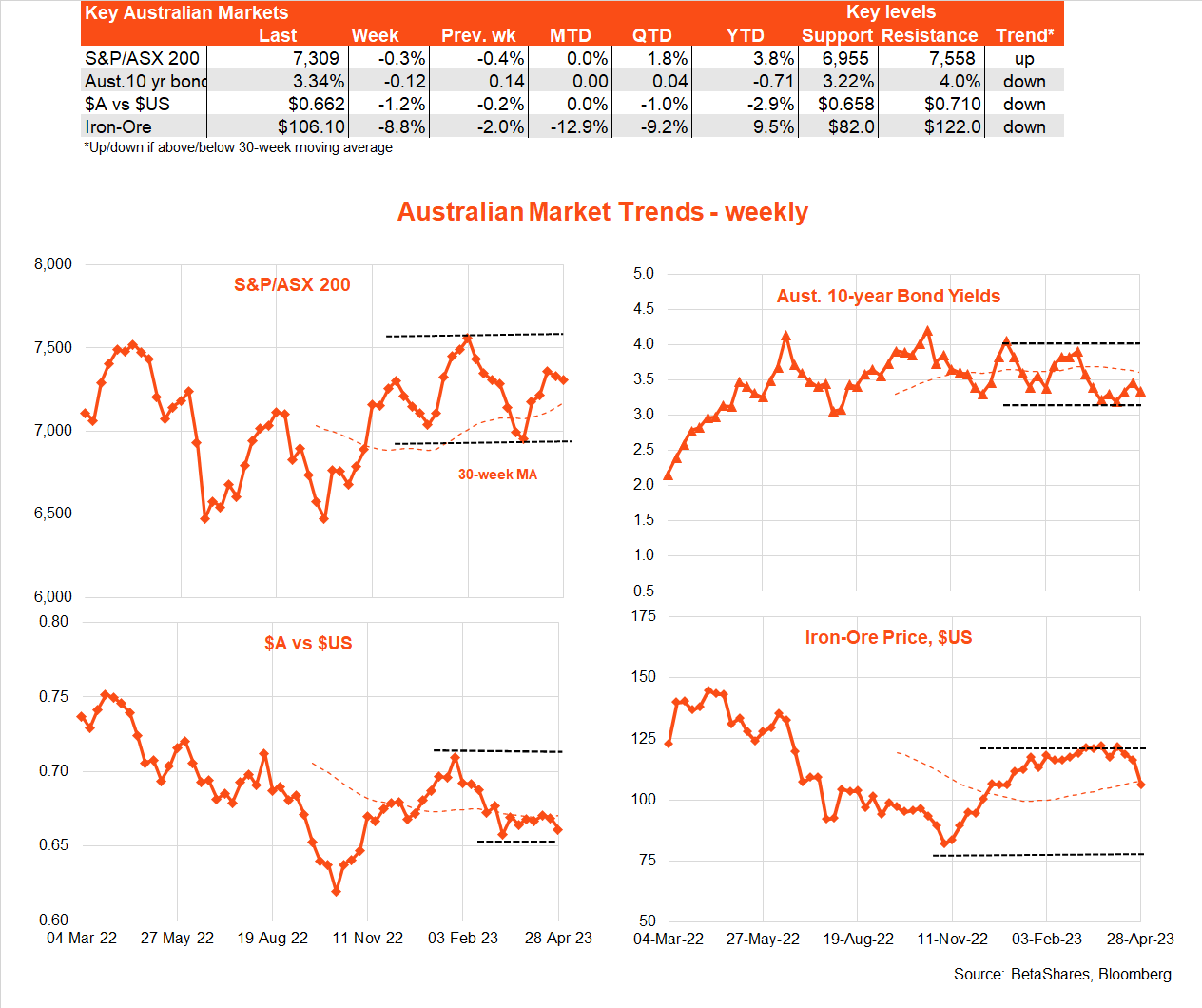

The local highlight last week was the Q1 CPI which confirmed annual inflation likely peaked late last year – though it still remains uncomfortably high.

The headline CPI did come in slightly higher than expected (1.4% vs. 1.3%) though annual growth slowed notably from 7.8% to 7.0%. Perhaps most encouragingly, the trimmed mean price gain was a tad lower than expected (1.2% vs. 1.4%) with annual growth in underlying inflation slowing from 6.9% to 6.6%.

While goods inflation and petrol costs continue to broadly ease, rising rents and gas-related electricity prices are providing an offset – while service sector inflation also remain high as Australia gets back to travelling and eating out.

In terms of markets, the most notable development of late has been the slump in iron-ore prices given a patchy Chinese economic recovery and Beijing’s stated aim to reduce reliance on our exports and contain prices. We’ll see!

Australian week ahead

The highlight this week is Tuesday’s RBA meeting. While the market and most economists (myself included) expect the RBA to extend its pause, some suggest last week’s CPI was high enough to justify a hike. So along with the Fed, there is a risk of a hawkish surprise this week.

I suspect the RBA will instead await the results of the Q2 CPI on 26 July. If prices then remain stubbornly firm (which I don’t expect) it might feel compelled to hike again if consumer spending has been holding up reasonably well (which I don’t expect).

1 comment on this

The article includes valuable information and stimulating ideas. Thanks for sharing your knowledge and expertise.