Another hawkish cut?

6 minutes reading time

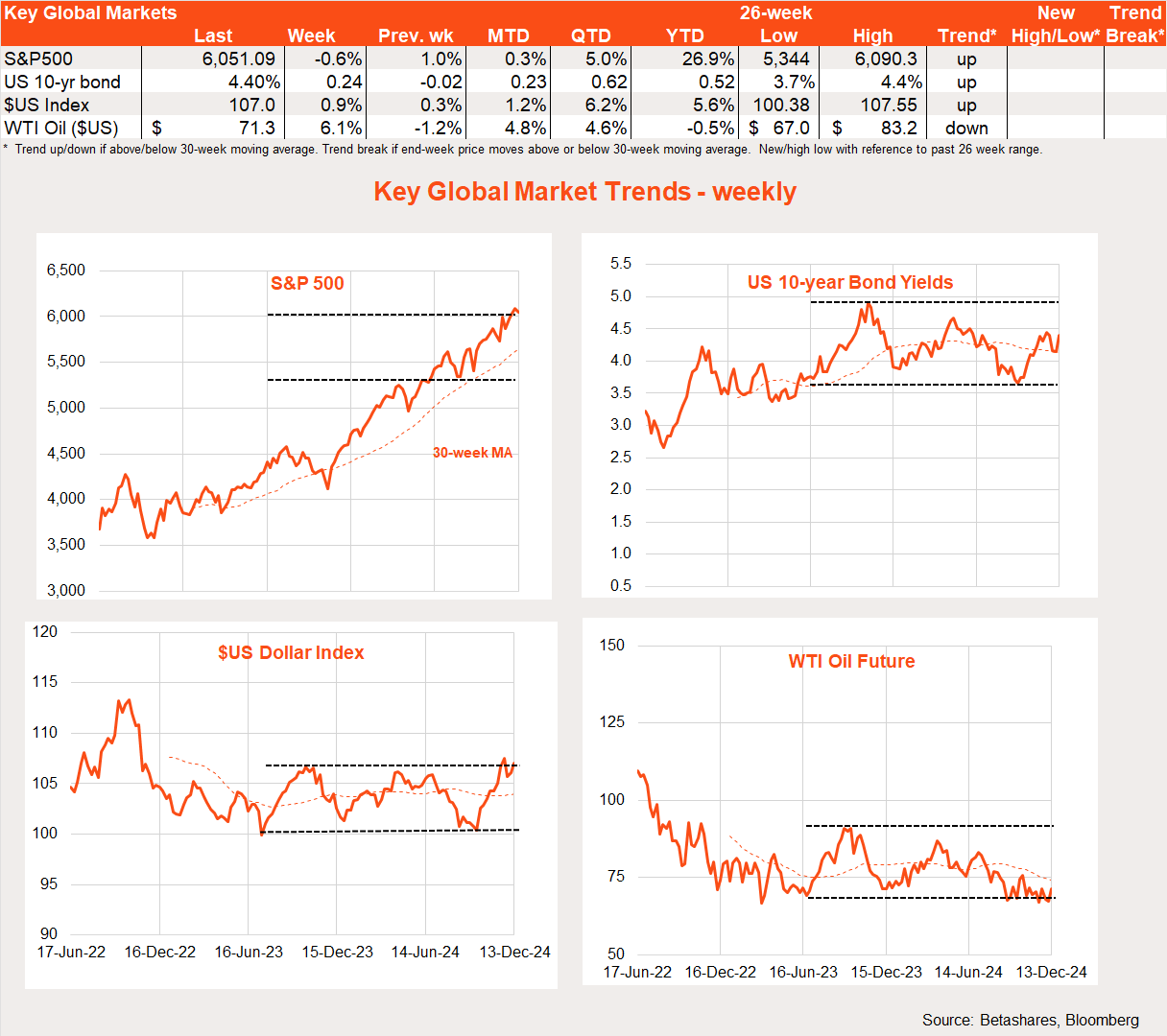

Global markets

Global equities eased back last week after three weekly gains – likely reflecting buyer exhaustion, higher bond yields, and caution ahead of the US CPI result and upcoming Fed meeting.

There were few major global market movers last week, with the US November CPI inflation report in line with expectations, albeit with core prices up 0.3% (3.3% annual) and so still suggestive of a stalling in the disinflationary process over recent months.

Also in line with market expectations, the European Central Bank and Swiss National Bank cut rates by 0.25% and 0.5% respectively – though the Swiss cut was larger than expected. With annual inflation at 0.7% and the cash rate at 0.5%, the Swiss are back to battling the pre-COVID central bank problem of overly low inflation and near-zero interest rates.

Global week ahead

The last Fed meeting of the year on Wednesday will be the key global highlight this week, with a 0.25% cut seen as a virtual certainty by the market. Of more interest will be Fed guidance and its updated set of economic and interest rate forecasts (the ‘dot plot’). Could there be a hawkish cut, accompanied by commentary that downplays the chance of future rate cuts?

Maybe, maybe not. Recall the median forecast among Fed members was for the funds rate to end this year in the 4.25-4.5% range – which would be achieved with a final 0.25% cut this week. The median forecast was for then a further 1% cut over 2025, bringing the range down to 3.25-3.5%.

The market currently thinks the Fed will cut by only 0.5% next year, so it will be interesting to see if the Fed validates the market’s more hawkish view (by reducing its own expected degree of rate cuts) or retains a more bullish outlook than the market.

My view? I think the Fed might split the difference, taking out one expected rate cut next year and penciling in a total 2025 easing of 0.75%. Powell has already indicated there’s “no hurry” to get back to neutral, but a more cautious easing cycle from here – where cuts take place only every second meeting – could eventually still be consistent with 1% of further easing next year (given there are eight meetings).

Much will depend on Trump’s policies next year – the degree of upfront fiscal stimulus via tax cuts and/or disruption to markets through his tariff plans.

Also relevant this week will be the Fed’s preferred inflation measure – the private consumption expenditure deflator (PCED) on Friday. The good news is that core prices are expected to rise only 0.2% in November (down from the 0.3% gains in each of the previous three months). The bad news is that this would still see the annual rate lift back to 2.9% from 2.8% – and a low of 2.6% back in June. The lift in annual core PCED inflation over recent months partly reflects several low 0.1% monthly gains over H2’23, though the recent monthly run rate of 0.3% gains must also share the blame.

As I’ve noted here in recent weeks, Wall Street remains remarkably relaxed about the recent stalling in US disinflation – most likely because the Fed still appears relaxed. Trump tax cut hopes have also recently distracted market attention from its once obsessive inflation focus. Heading into 2025 something’s got to give: either the disinflation trend resumes or the Fed and market must surely start to lose patience, especially if Trump’s policies add to the inflationary risk.

In other non-US news next week, despite a healthier level of inflation and still near-zero interest rates, the Bank of Japan is expected to leave rates on hold for the fourth meeting in a row on Thursday – out of concern to not overly strengthen the Yen and cause the type of global market disruption when it first hiked rates back in August. But the BOJ must surely risk such a fate and bite the bullet some time in the new year.

The Bank of England also meets this week and is expected to leave rates unchanged at 4.75%, especially following a recent upside CPI surprise.

Market trends

So much for the ‘great rotation’ – the main themes post Trump’s election appear to be reassertion of the outperformance of US stocks generally, and technology/the NASDAQ-100 in particular. Global quality, however, has not yet returned to favour, likely reflecting weakness in defensives/health care companies.

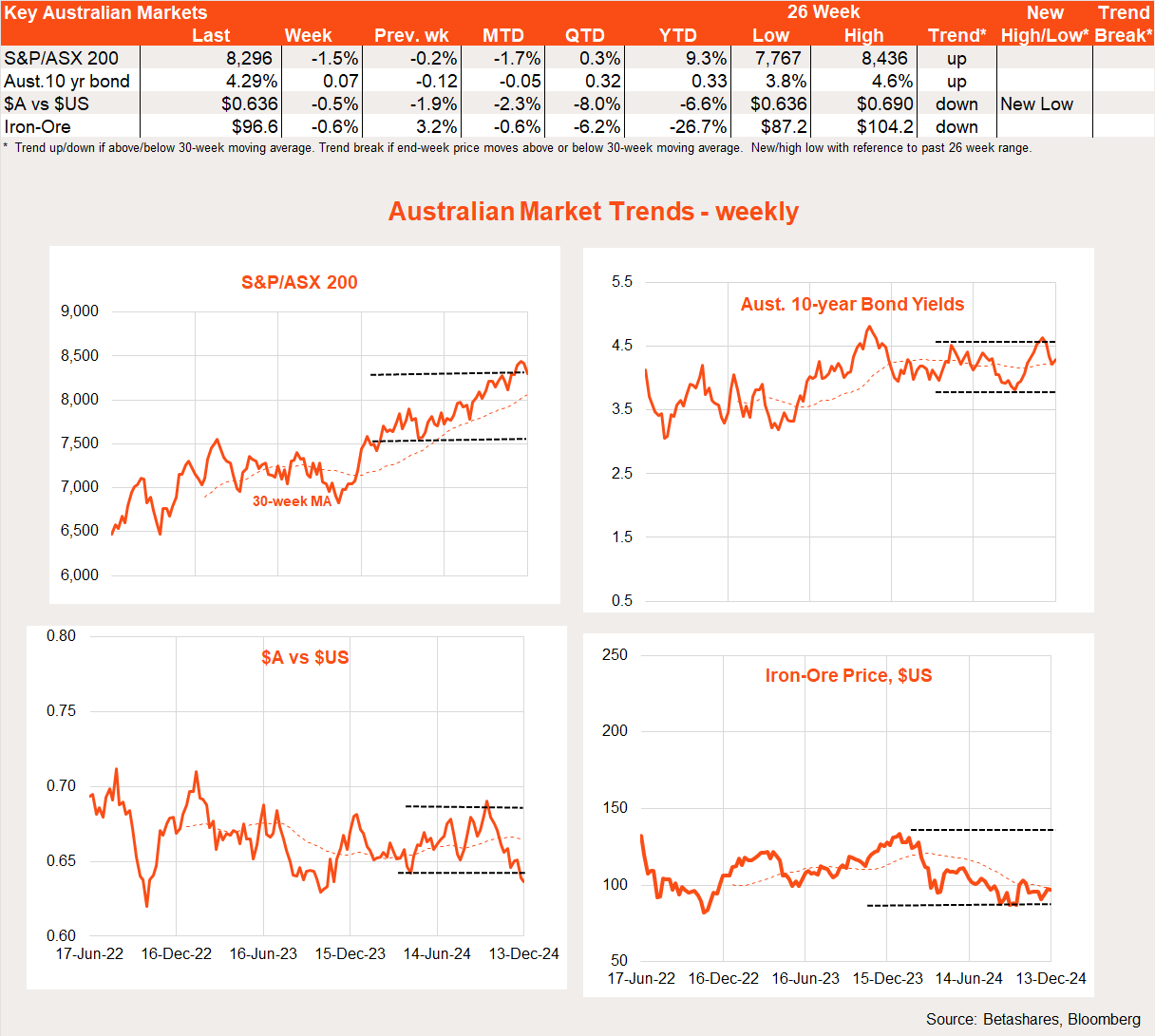

Australian market

Local stocks dropped back further last week, reflecting both global weakness and dashed near-term rate cut hopes due to a strong employment report.

It was a mixed week for sentiment around the RBA. A drop in the NAB index of business conditions and more dovish commentary in the RBA’s post-meeting statement initially raised market hopes that the Bank could cut rates as early as February after all.

Then came Thursday’s November employment report, with another strong 36k gain in employment and – of even more note – drop in the unemployment rate from 4.1% to 3.9%. There are suspicions that seasonal quirks might account for the surprise drop in unemployment – with the ABS noting: “November we saw a higher than usual number of people moving into employment who were unemployed and waiting to start work in October.”

And? Does that mean November’s unemployment rate is downwardly biased (and so could bounce back in December), or previously monthly rates were upwardly biased? As for seasonal quirks, there seems nothing odd about the unemployment rate movements this time last year.

All up, markets have taken the employment result with a grain of salt and are still clinging to their hope of an early 2025 rate cut (February is an almost 30% chance, with a full rate cut priced in April).

RBA signaling of late has been very confusing – so it’s hard to know what they really care about or are waiting for. As such, I’ll leave my base case for a May rate cut in place.

There is little of note data-wise in Australia this week, though Federal Treasurer Jim Chalmers will announce a deterioration in the budget outlook in Wednesday’s mid-year review due to China weakness and lower expected commodity prices. One implication is that the bleaker budget outlook could limit planned spending in next year’s pre-election Budget, which would not be unwelcome by the RBA.

Have a great week!