A 0.35% rate cut?

4 minutes reading time

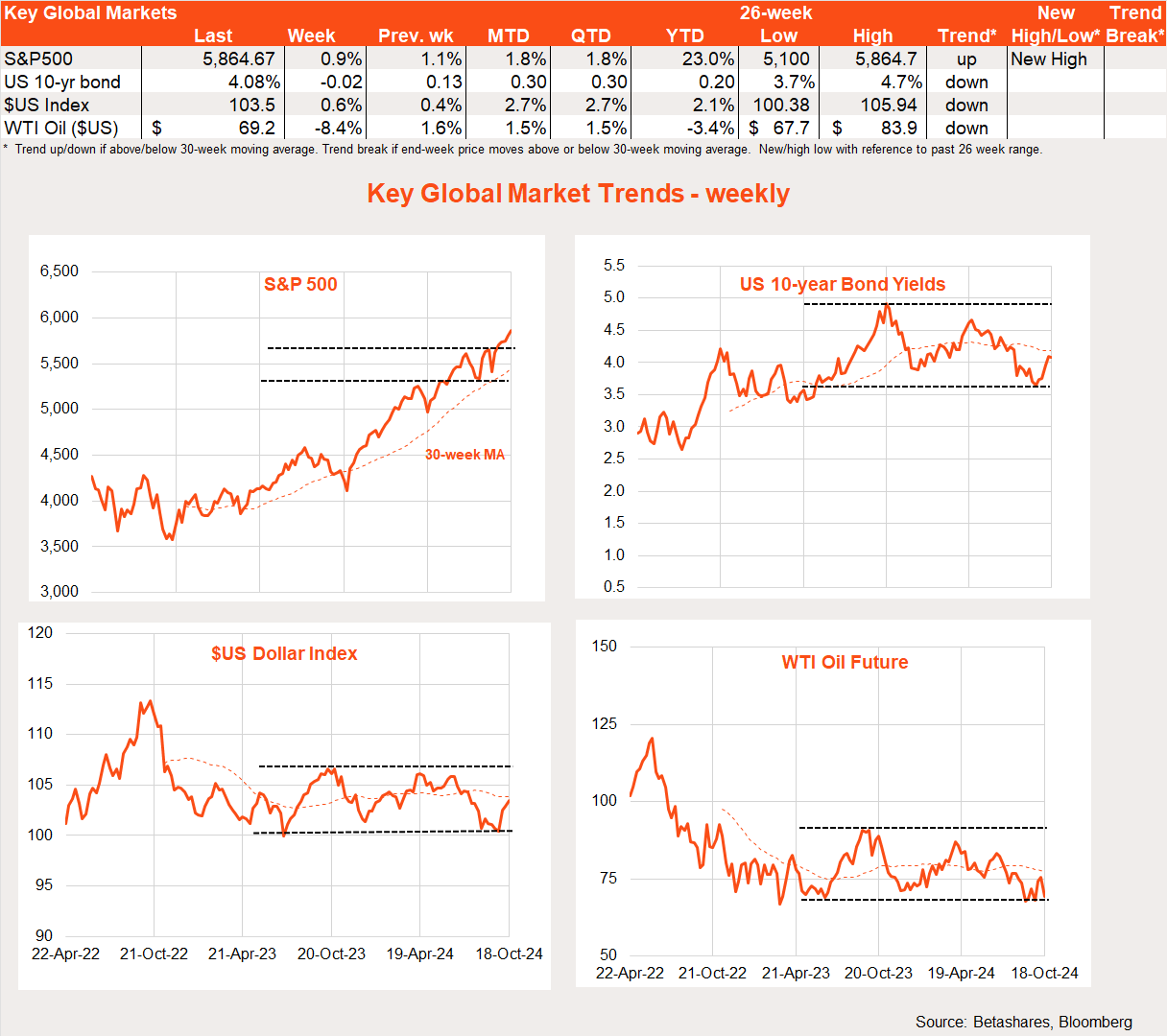

Global markets

Global equities moved higher again last week largely reflecting ongoing good US earnings reports. Declining oil prices – due to weak Chinese demand and the continued absence of long-feared Middle East supply disruptions – also supported sentiment.

There was little in the way of major global economic news or events last week, allowing equities to continue to grind higher under the comforting ‘soft landing’ scenario.

The US market is still clinging to the expectation of another 0.25% rate cut next month, despite the recent upside CPI inflation surprise and still solid economic growth. Case in point: US retail sales surprised on the upside last week, while weekly jobless claims surprised on the downside.

The US earnings reporting season also rolls on, with so far encouraging results. Netflix on Friday surged 11% alone, following reports of stronger than expected subscriber growth. Bank of America analysts also reckon there’s another 40% upside to Nvidia’s share price.

Outside of the US, UK inflation surprised on the downside, paving the way for another rate cut at the next Bank of England policy meeting. The European Central Bank followed through with back-to-back rate cuts last week.

Meanwhile in China, annual Q3 GDP growth edged lower to 4.6% – from 4.7% in Q2 – which still failed to impress markets despite the result being a touch higher than the 4.5% market expectation. Markets are baying for yet more Chinese stimulus, which officials seem reluctant to provide – possibly because they reckon the economy is still chugging along reasonably well and they don’t want to just reflate the property bubble.

Global week ahead

In a still data-light environment, a major global focus should be the ongoing US earnings reporting season, with Tesla, IBM, Coca-Cola and GM among the major companies stepping up to the plate.

There’s also a bunch of Fed speakers who will give their own take on the chances of another rate cut next month. One potential market concern will be if more Fed voting members play down the need for another rate cut as early as November.

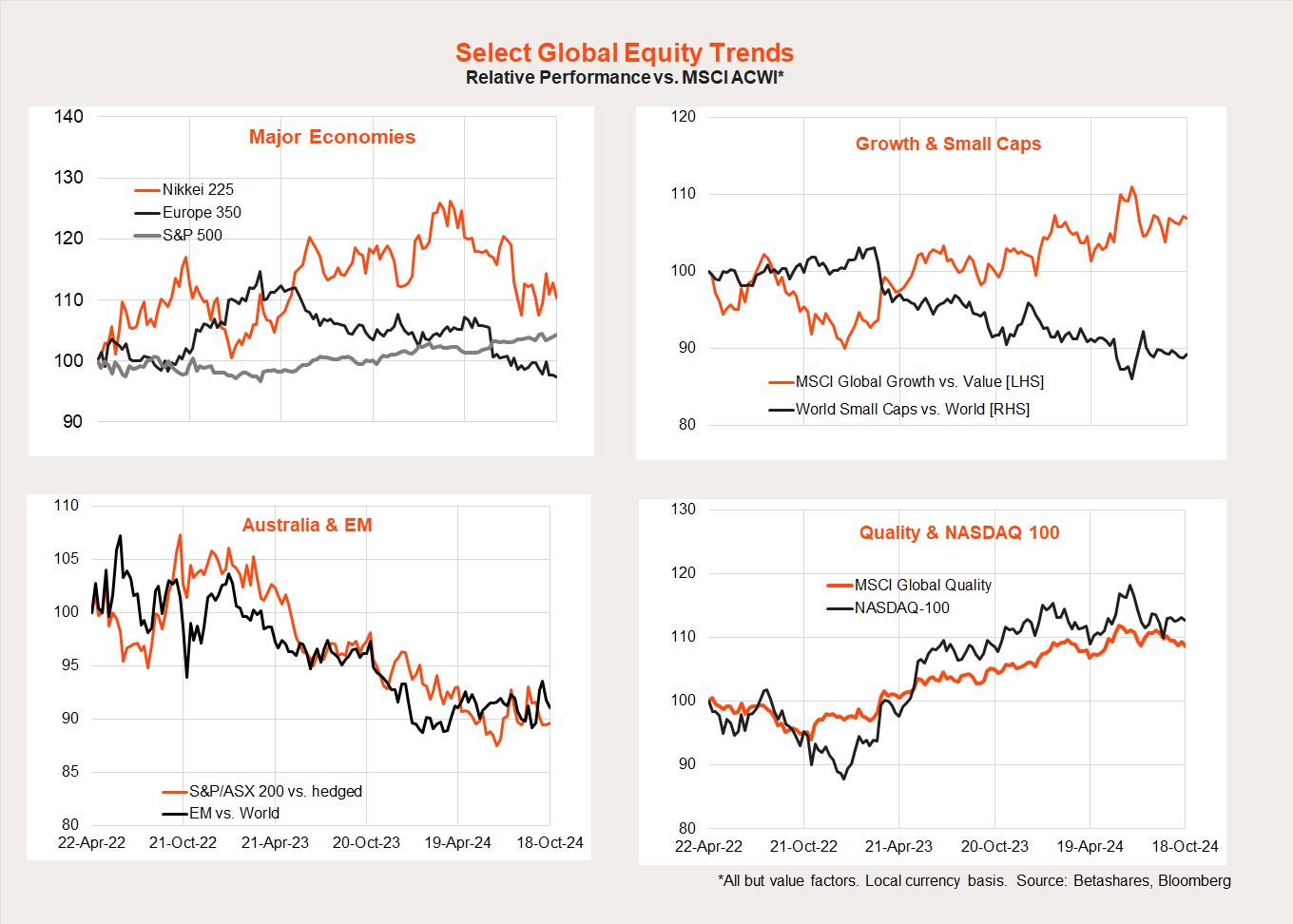

Market trends

Disappointment over Chinese stimulus has seen a pullback in emerging markets of late after a recent pop higher. Otherwise the major enduring trend appears one of US outperformance grinding on – albeit with more performance coming from outside the large-cap technology sector.

Australian market

The local S&P/ASX 200 index lifted a further 0.8% last week, helped by the rise in global markets. The $A edged back, reflecting a firm $US and weaker iron-ore prices.

The main local highlight last week was the stronger-than-expected September labour force report, with 64k in new jobs created keeping the unemployment rate steady at 4.1%. The admirable aspect of this report is that we’re managing to find jobs for the still rapidly expanding labour force, largely thanks to runaway growth in the care sector.

While the solid labour market does not rule out rate cuts provided inflation continues to ease, it does remove the case for near-term rate cuts out of downside concerns for the economy.

There’s little in the way of major data this week, with the local highlight likely to be a ‘fireside chat’ at an investment conference by RBA Deputy Governor Andrew Hauser this morning.

PS. A big thankyou to all those who donated at the 24-hour cycle Spinathon. The event raised over $140k for premature and critically-ill babies at the Royal Hospital for Women.

Have a great week!