How Liberation Day upended markets: A timeline

4 minutes reading time

Week in review

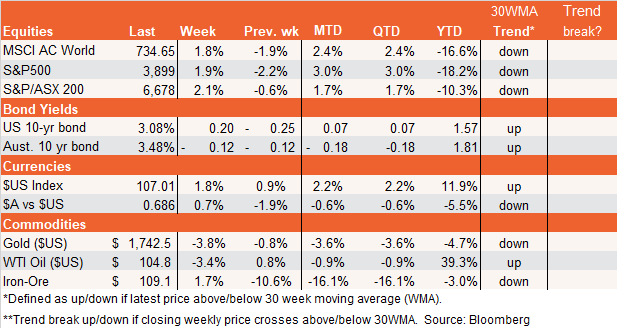

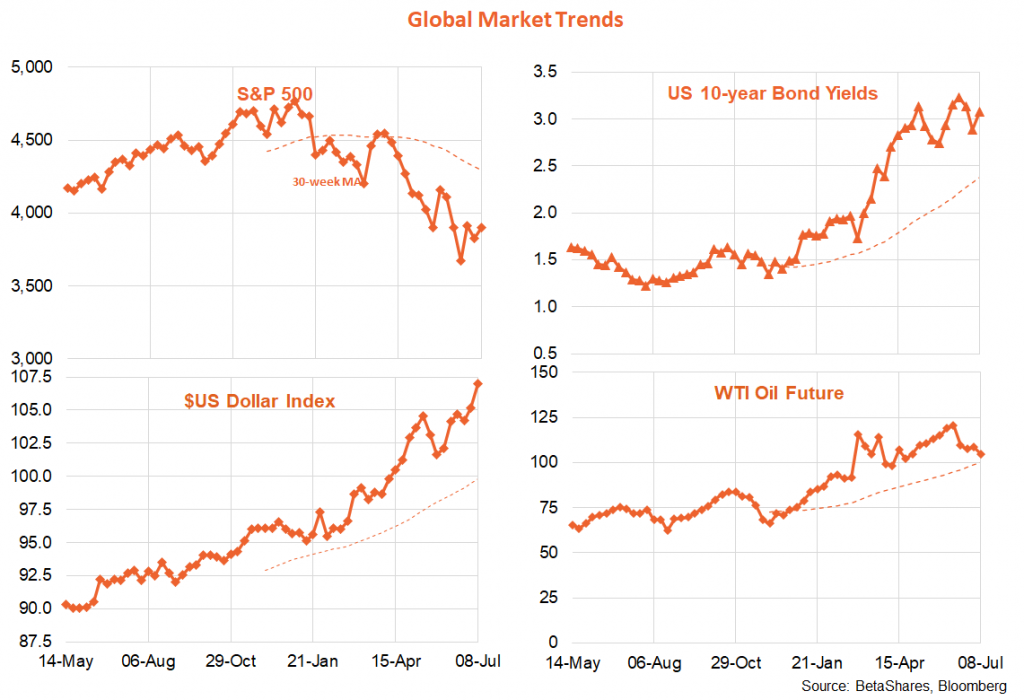

If ever one wanted confirmation that Wall Street is not priced for recession, last week was it. In a curious twist, equities saw fit to rally mid-week on better than expected surveys of the US manufacturing and services sector, even though this also sent bond yields and the US dollar higher and likely cemented another 0.75% Fed rate hike later this month. A stronger than expected payrolls report on Friday, however, left the market a little more perplexed – unsure whether to rejoice at economic resilience or fear the Fed’s response.

The minutes of the recent Fed meeting – at which it hiked by 0.75% – were unsurprisingly hawkish. A range of Fed speakers last week continued to talk tough on bringing down inflation even while downplaying the risks of recession. But hey, they would say that wouldn’t they!

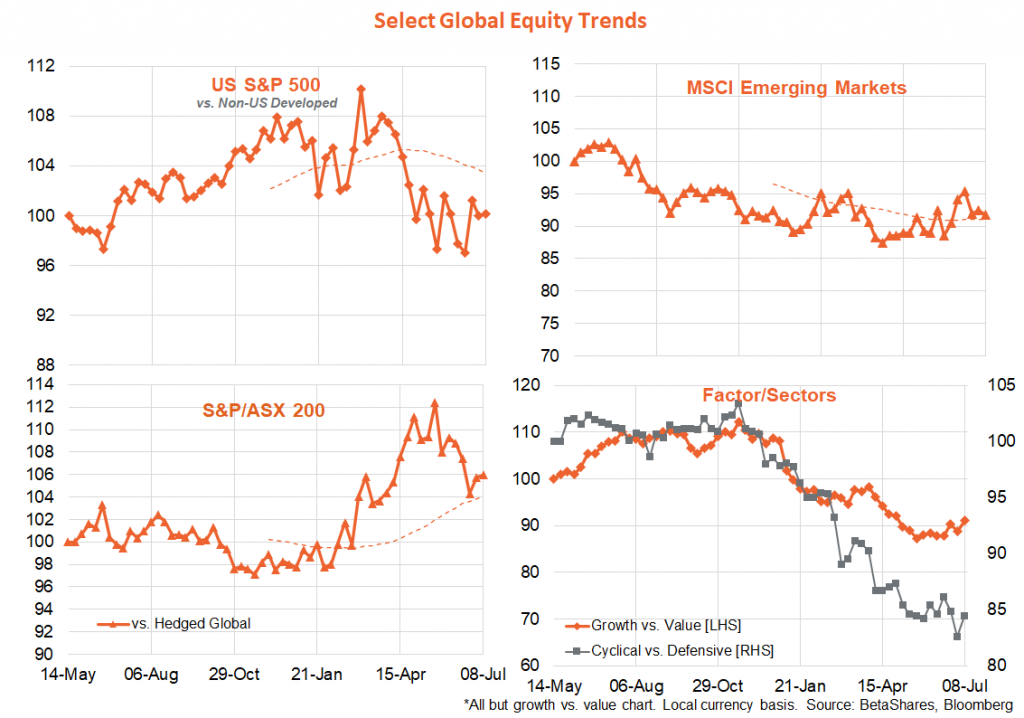

All told, it was a week in which growth/cyclical/technology stocks outperformed value/defensive/commodity stocks – as flickering hopes of a US soft landing re-emerged.

The US 10-year versus 2-year bond yield spread (the “yield curve”) has inverted, while weekly jobless claims have quietly lifted a lazy 35% since their low in late March.

Is the US economy in recession? Not yet. It is likely to tumble into recession? In my view, yes. Can recession be avoided? Yes, but only if US inflation slows quickly enough to allow the Fed to pause within the next few months.

We’re in a race against time. But I fear time is running out fast. There are signs that US inflation in some areas is cooling – notably used cars, clothes and furniture. And there’s also encouraging signs that red-hot wage inflation is easing somewhat. But rents (a key component of core inflation) and energy prices (a key component of headline inflation) are likely to remain firm. The challenge for the equity market is that inflation is cooling, but it needs a sustained slowdown in economic growth (and likely recession) to make sure.

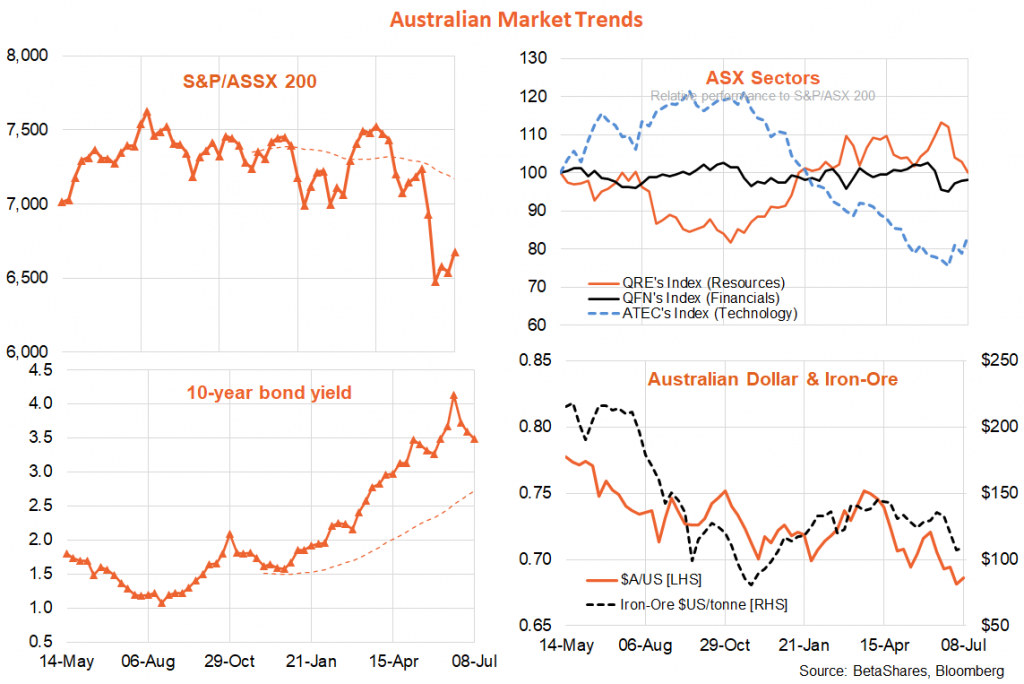

In Australia, the RBA hiked rates by another 0.5% as widely expected, while continued strength in ANZ Job Ads confirmed the economy retains considerable momentum. Despite this, local bonds notably outperformed US bonds last week, with the Australian-US 10-year bond yield spread narrowing by 0.32%. The market’s expected cash rate in one year’s time has narrowed markedly in recent weeks from 4.25% to 3.5%, while the one-year ahead Fed funds rate has only eased back from 3.75% to 3.5%. Market expectations for the terminal cash rate in both countries (though especially in Australia) still remain too aggressive in my view.

Week ahead

The highlight this week will be Wednesday’s US June Consumer Price Index report. Headline annual inflation expected to accelerate back to a new cycle high of 8.8% from 8.6% due to continued strength in energy prices. Excluding food and energy prices, however, annual growth in core CPI is expected to continue to ease to a (still high) 5.8% from a recent peak of 6.5% in April. If achieved, these results would be consistent with the Fed hiking by another 0.75% at the July 26-27 policy meeting.

The local equity market staged a modest comeback in recent weeks, though to my mind this still smells like a bear market rally.

Mixed evidence on the economy may also come on Friday. US consumer sentiment likely to remain despondent, even though retail sales may remain firm.

This week also heralds the start of the Q2 US earnings reporting season. Very early reports suggest earnings likely held up well enough. As with employment and retail spending, it premature to expect much earnings weakness at this stage. The focus will be on company outlook statements, which should be somewhat more cautious than usual.

In Australia, we get updates on business and consumer confidence. These are likely to become increasingly more downbeat as local rates push higher.

Thursday’s employment report is expected to remain firm. A 25k gain in employment is expected for June, with the unemployment rate expected to edge down to 3.8% from 3.9%. If achieved, the employment report would be consistent with another 0.5% RBA hike hike next month, assuming the Consumer Price Index report later this month is as “hot” as widely expected.