Market Trends: January 2025

6 minutes reading time

- Commodities & gold

Gold prices have continued their spectacular run this year, surpassing the US$2,500 mark and becoming one of the best performing assets outside of equities so far in 2024.

There are several factors that have driven gold’s sustained rally, namely:

- A weaker US dollar

- The opportunity cost of holding gold and inflation

- Demand from central banks and investors.

In this note, we dig into each of these factors and explore how they have helped the yellow metal reach all-time highs.

For Australian investors, gold can provide both a source of return and diversification for multi asset portfolios, but one must be mindful of the relationship between gold and the US dollar when seeking exposure to the yellow metal.

A weaker US dollar

As the gold price is most commonly quoted in US dollars (USD), it may come as no surprise that a weaker USD has tended to be positive for gold prices for two reasons:

- It makes gold cheaper for purchasers holding other currencies, and

- Importantly, gold is often viewed as a preferred store of value if there is a debasement or rapid weakening of the world’s reserve currency – i.e., the USD.

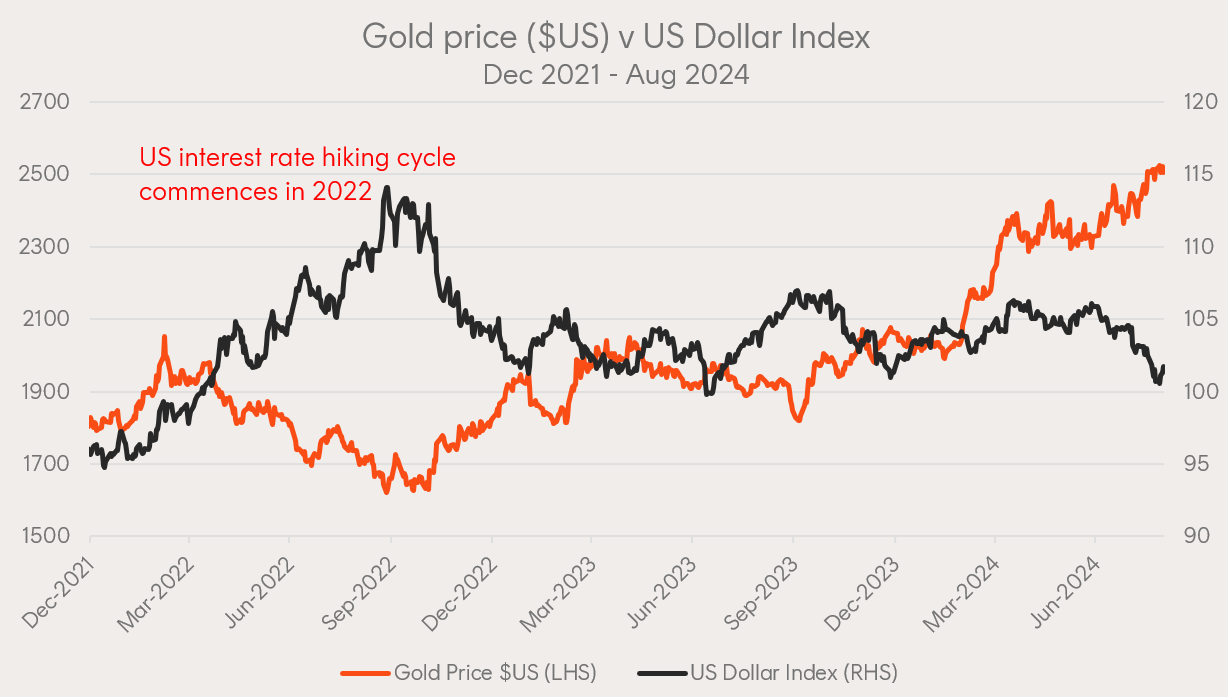

As the Fed began aggressively hiking rates in 2022, US cash and bond yields became increasingly attractive. This drove demand for the currency that saw the broad US Dollar Index rally from 95 to over 110. In this environment of USD strength, the gold price fell to around US$1,600, only recovering when demand for USD receded from November 2022.

Source: Betashares, Bloomberg. As at 30 August 2024. Past performance is not indicative of future returns. Gold price does not take into account any fund management fees and costs.

In the year to date, gold has risen over 20% whilst the US Dollar Index has fallen 1.3%.

Lower real yields

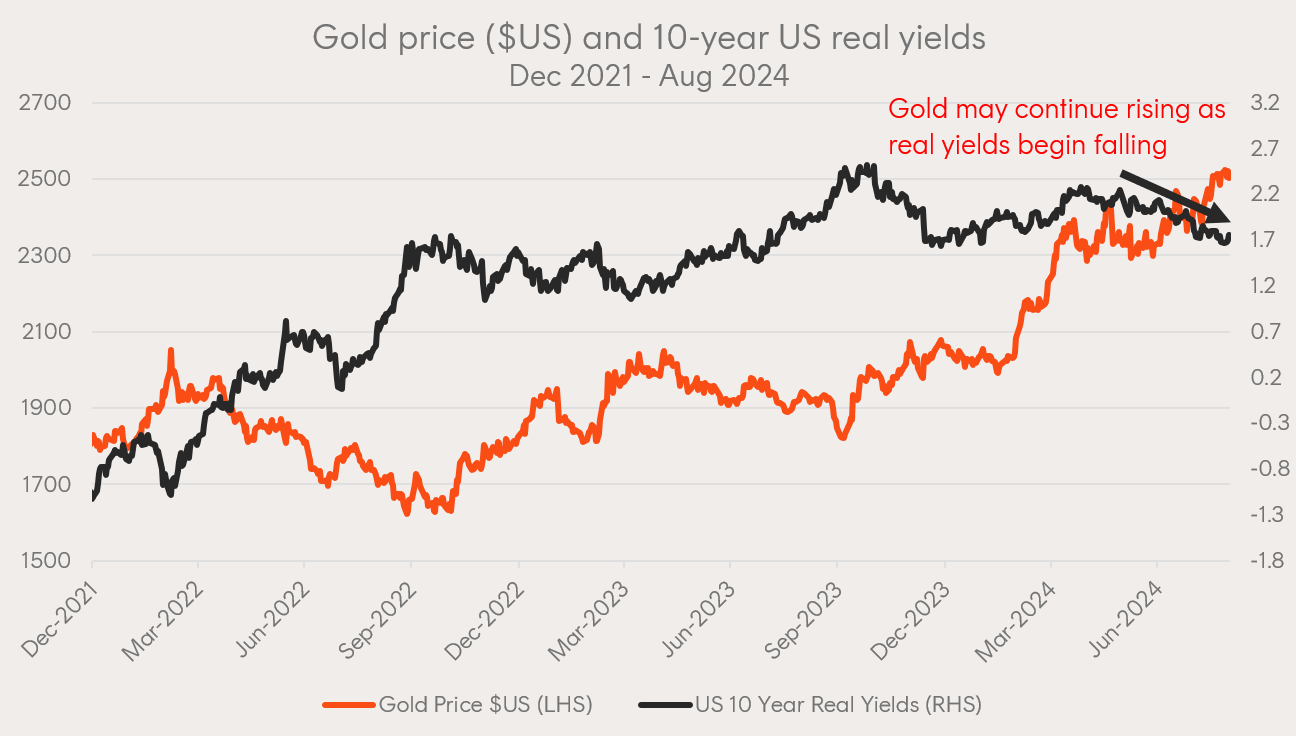

Gold tends to provide a hedge against inflation, however the opportunity cost of holding a non-income producing asset like gold is impacted by interest rates on the yield on risk free assets (cash/bonds). These competing drivers on the price of gold are captured in the “real” yield, which is the government bond yield adjusting for expected inflation.

Where government bond yields fall faster than long run inflation expectations, the difference between the two, the real yield, will fall. As a result, gold becomes relatively more attractive as an asset.

Gold may continue rising as real yields begin falling

Source: Betashares, Bloomberg. As at 30 August 2024. Past performance is not indicative of future returns. Gold price does not take into account fund management fees and costs.

The chart above shows how real yields have been trending lower since April 2024, off the back of increasing expectations of US rate cuts, providing a potential tailwind for gold.

Structural demand from central banks and investors

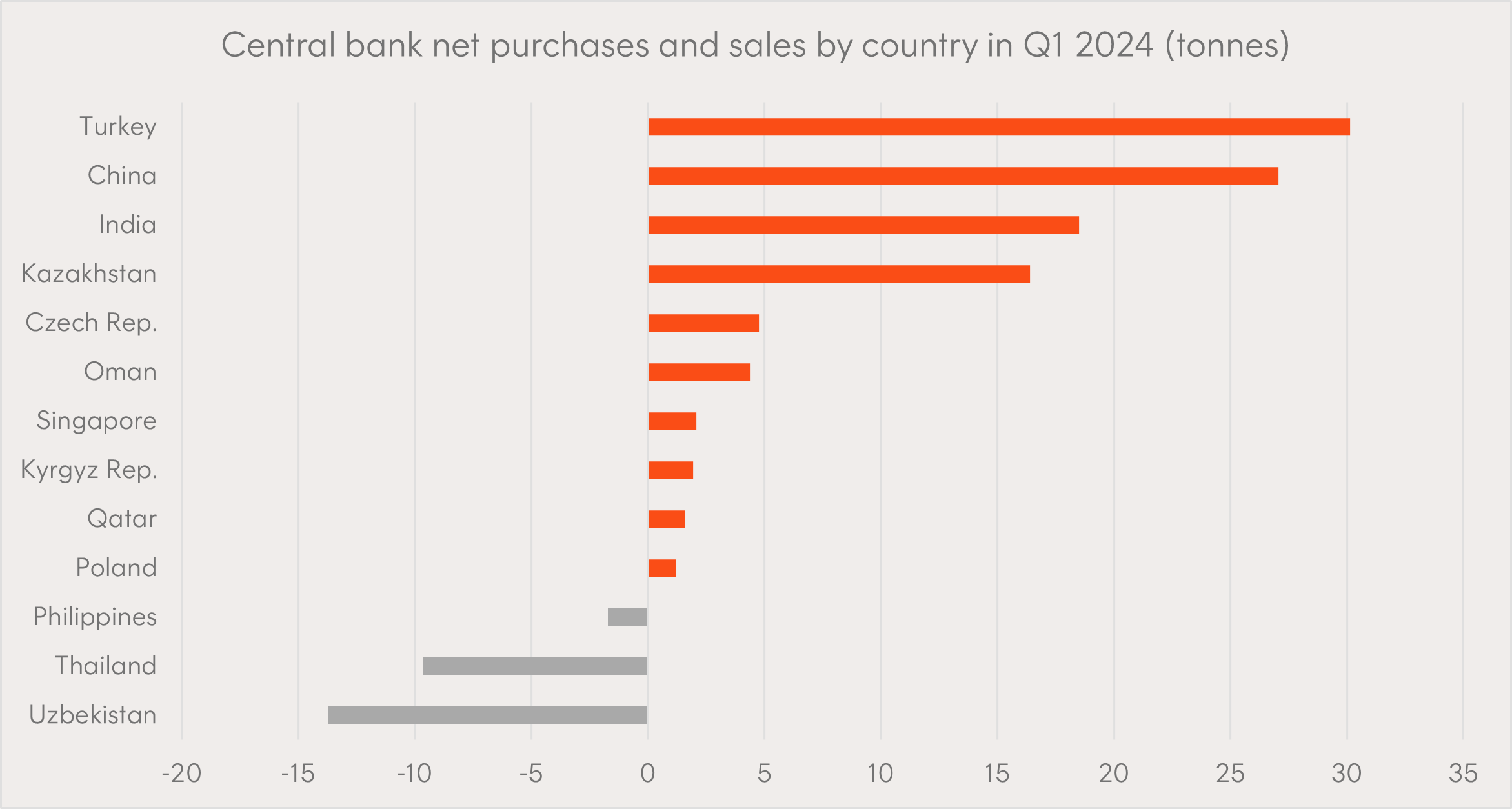

Central banks are one of the largest holders of gold, accounting for around a fifth of all the gold that has been mined throughout history1.

As a reliable store of value, holding gold is important for central banks to diversify their reserves beyond foreign currencies like the USD and US Treasuries. In the wake of the Ukraine invasion, the US showed they were not afraid to ‘weaponise’ the dollar-centric global financial system by imposing crippling sanctions on another nation state. As the world’s reserve currency, the USD gives the United States enormous leverage on the world stage.

In response to this threat, the central banks of countries that wish to remain non-aligned or independent of the US have become huge buyers of gold in recent years. Total reported central bank buying for the first half of 2024 grew to 483 tonnes. Emerging market countries China, India, and Turkey were the three largest net purchasers of gold in Q1 2024.

Source: World Gold Council. Net purchases and sales from 1 January 2024 to 31 March 2024.

While Chinese demand for gold jewellery has fallen in response to higher prices and weaker consumer confidence, Chinese investor demand for gold bars and coins has been strong. Access to alternative investment channels is limited in China, so gold is often viewed as the ‘next best’ investment opportunity whilst the property and stock markets continue to deteriorate.

In the first half of the year, Chinese sales in bars and coins increased 46% over the year to 213 tonnes as investors sought gold as a store of value2.

How to access gold in your portfolios

Gold can provide both a source of return and diversification for multi asset portfolios, beyond equities and bonds.

The outlook for the USD gold price remains constructive, with interest rate cuts likely to see both the USD continue to weaken (with no sign from the Fed to prevent this) and real yields declining. Geopolitical uncertainty remains a left tail risk for markets going forward, and structural demand forces from central banks and Chinese households mean gold may remain well bid.

For investors looking to trade gold via ETFs traded on the ASX, it’s worth noting that the weekly correlation between gold returns denominated in USD and changes in the AUD/USD spot exchange rate has been around +0.5 over the five years to 28 August 2024, suggesting that the AUD/USD has tended to appreciate when the USD price of gold has increased. As a result, investors looking to capture further strength in gold might be doing themselves a disservice by being unhedged.

QAU Gold Bullion ETF – Currency Hedged provides the only currency-hedged exposure to the performance of gold bullion on the ASX.

- By currency hedging, QAU provides investors ‘purer’ exposure to the USD gold price rather than the AUD price of gold.

Investors can also gain currency-hedged exposure to global gold mining companies through MNRS Global Gold Miners Currency Hedged ETF

- Lower interest rates may benefit gold miners’ operations by reducing production costs and lowering the cost of capital across projects. Gold miners have been a bright spot in a year of poor performance across other areas of the resources sector and can often provide a leveraged play on the price of gold with relatively magnified exposure to spot gold price movements (both up and down).

There are risks associated with an investment in QAU and MNRS, including market risk, gold price risk and currency hedging risk for QAU, and market risk, sector risk, international investment risk, mining sector risk and concentration risk for MNRS. Investment value can go up and down. An investment in each Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Sources:

1. https://www.gold.org/goldhub/data/gold-reserves-by-country ↑

2. https://www.chinadaily.com.cn/a/202407/30/WS66a839f4a31095c51c510a33.html ↑