US earnings season: The ‘Magnificent 7’ report

7 minutes reading time

- Thematic

An increasingly unstable global geopolitical stage, which has intensified in recent years with the outbreak of conflict in Europe and the Middle East, and growing tensions amongst major global powers, has led to the largest increase in defence spending since 2009.

Many countries are investing significantly in their national defence, including modernising defence capabilities, following decades of stagnant and in many cases decreasing investment. Defence contractors have seen a surge in cash flows and order books as governments, including those in the North Atlantic Treaty Organisation (NATO), re-commit to annual target expenditure.

ARMR Global Defence ETF provides exposure to global companies involved in defence-related industries, headquartered in NATO member and major NATO ally countries (such as Australia, Japan, and South Korea).

Defence spending is accelerating globally

After decades of relative peace and stability, the emergence of threat actors and major conflict, such as Russia’s full-scale invasion of Ukraine, has accelerated defence spending on a global scale last seen during the Cold War.

For the first time since 2009 every region in the world experienced rising defence spending in 2023. Last year also marked the 9th consecutive year that global defence spending increased, reaching a record US$2.4t. Looking ahead, many major governments have announced greater spending plans for the future, particularly across the European continent.

Source: World Bank Group. 1977 to 2023.

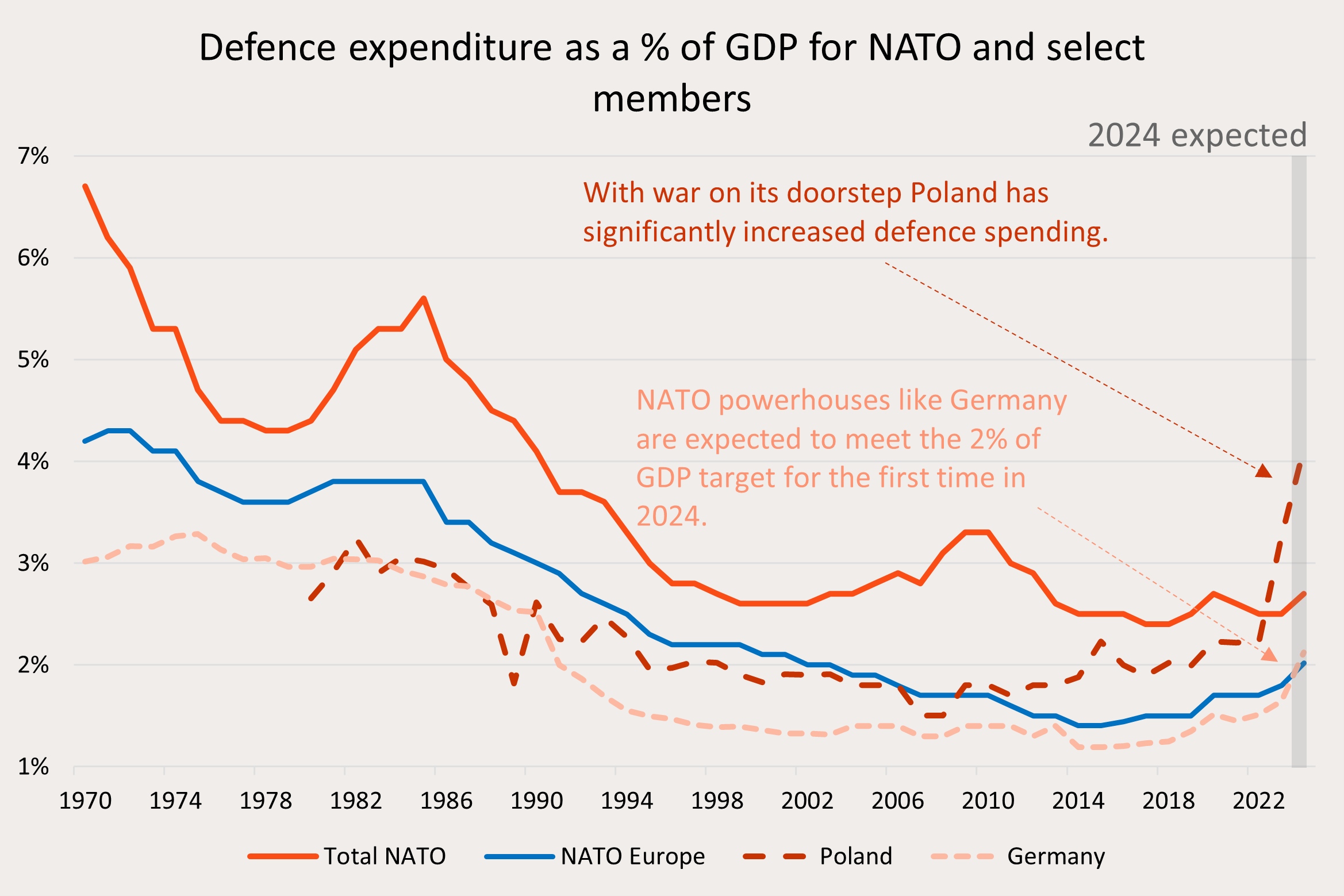

NATO’s response

Following the Cold War, the last period posing a major threat of global warfare, NATO members expenditure on defence fell significantly as countries enjoyed a ‘peace dividend’ – a period in which countries felt they could spend less on defence due to the perceived level of global peace. This saw European NATO members spending drop to a collective 1.40% of GDP in 2014.

In the same year, triggered by Russia’s invasion of Crimea and amid ongoing tension in the Middle East, NATO members agreed to commit to a 2% of GDP spending requirement.

However, up until recent years many members were still failing to meet this target or showed limited intent to do so.

More recently, Russia’s full-scale invasion of Ukraine prompted European governments to finally respond, with Europe’s defence expenditure now reaching nominal levels last seen during the Cold War – despite still being well below spending levels historically seen as a percentage of GDP.

Source: NATO. 1970 to 2024. 2024 numbers are NATO estimates.

Ushering in a new era of defence spending, a record 23 NATO members are expected to meet the 2% of GDP target in 2024. This is a substantial increase from just six members meeting the target in 2021. The US is still the largest spender on defence within NATO, and the world, totaling $916bn in 2023 and representing 68% of NATO’s total defence spending.

Increasingly this spending is going toward modern defence technologies as governments require specialised solutions to evolving threats. For example, current projects funded by NATO allies include developing advanced military semiconductor chips and sensors, artificial agents to autonomously manage protection and counterattack in response to cyberaggression, unmanned vehicles, and space communication systems. These new technologies are often at the forefront of innovation and have applications beyond just defence.

Defence, the investment perspective

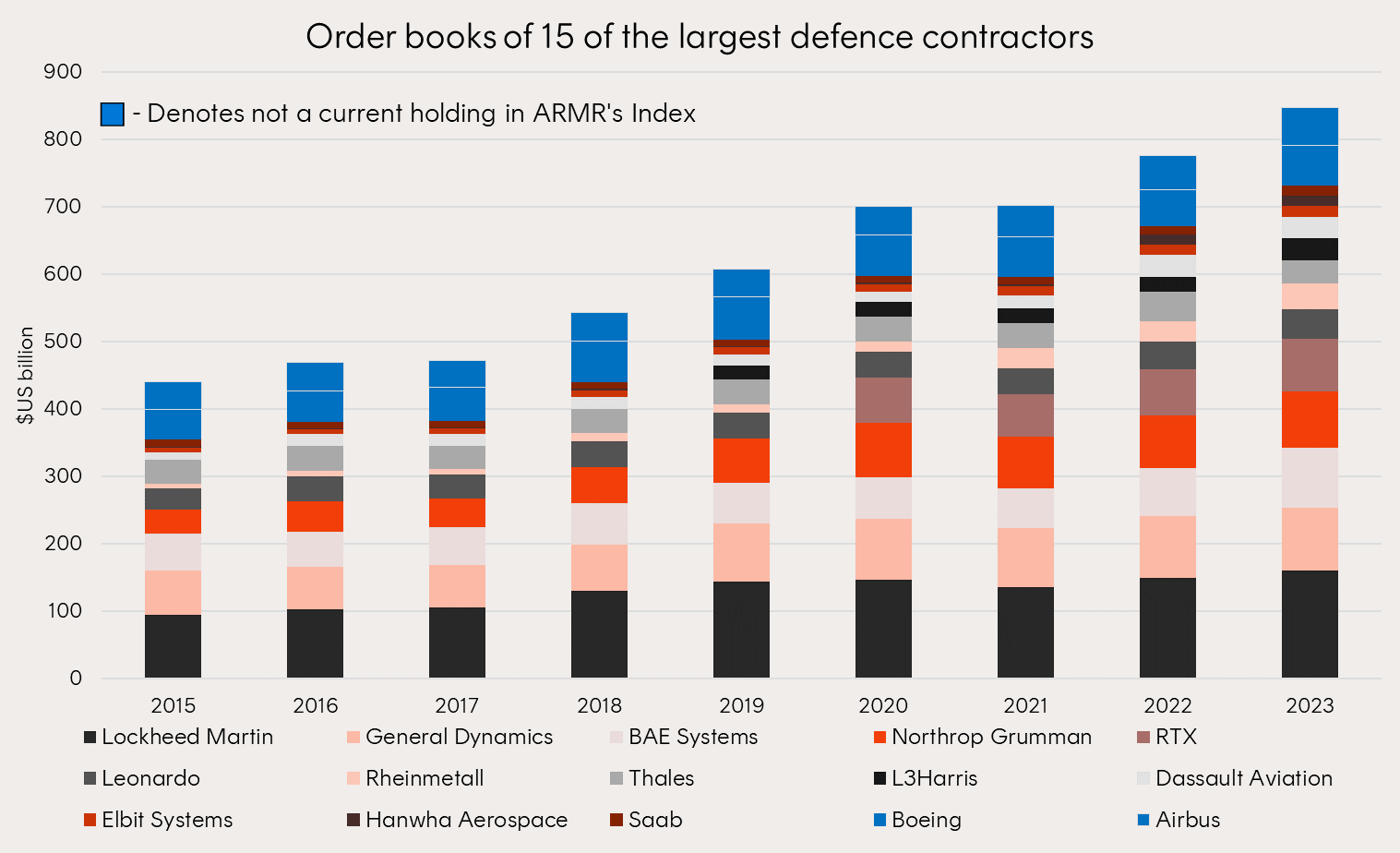

Large global defence contractors have been the biggest beneficiaries of government spending plans. Order books at 15 of the largest global defence contractors have steadily increased since the 2014 invasion of Crimea. In the past two years they have experienced a 21% increase.

However, with long lead times from shifts in policymaking, budgets, and placing orders, we are only now seeing the significant order flow and these orders will take even longer to be realised in revenues and earnings on completion. This can be viewed as a positive long-term tailwind for investors in this industry.

Source: Financial Times. FT analysis of companies’ data. Figures for Leonardo, Elbit, Thales, Hanwha and Rheinmetall are to end Q3 2023; Dassault is to end Q2. Currency conversions at Feb 22 2024 rates. Non-defence businesses excluded except where detailed breakdowns were not available

The same 15 defence contractors are forecast to generate free cash flow of $52bn in 2026, almost double their combined cash flow at the end of 2021. These increased cash flows should flow through to shareholder returns. For instance, last year saw share buybacks at their highest levels in five years for aerospace and defence companies in both the US and Europe.

ARMR: Leading exposure across every dimension of defence

ARMR aims to track the performance of an index (before fees and expenses) that provides exposure to leading companies involved in the global defence sector.

ARMR’s index seeks pure-play exposure, to leading companies which derive more than 50% of their revenues from the development and manufacturing of military and defence equipment as well as defence technology.

While investors may already have exposure to several holdings in ARMR given their representation in leading market indices such as the S&P 500, FTSE 100 and the MSCI World Index, ARMR provides a cost-effective way for investors to obtain a more targeted exposure to these pure-play defence companies.

ARMR may be appropriate as a satellite position in a well-diversified portfolio.

ARMR will hold the largest pure-play defence companies as shown in the below table (as at 30 September 2024).

Source: Defense News, Top 100 for 2024 list. Data for the Top 100 list comes from information Defense News solicited from companies, from companies’ earnings reports, from analysts, and from research by Defense News, the International Institute for Strategic Studies and SPADE Indexes.

Current portfolio holdings in ARMR include:1

Air: General Dynamics

- Awarded a $491 million contract extension by the US Space Force in August 2024 for satellite ground systems.

Land: Rheinmetall

- German defence supplier has experienced a tripling in orders (current backlog of €38.3b) since Russia’s full-scale invasion of Ukraine. Rheinmetall produces a variety of armoured vehicles, munitions, and defence electronics.

Sea: BAE Systems

- Selected by the Australian government to build Australia’s new fleet of nuclear-powered submarines.

Space: RTX Corp

- Leading American multinational aerospace and defence conglomerate producing ‘smarter defence systems’ such as high-energy laser systems that help defeat drone swarm threats. In 2024 RTX has been awarded a US$1.2b contract with Germany and over US$1b from US defence forces.

Cyber & AI: Palantir Technologies

- Awarded US$480m contract through to 2029 with the US Army. Using AI and computer vision to help militaries access battlefield resources and identify enemy targets.

For more information, please visit ARMR’s fund page here.

There are risks associated with an investment in ARMR, including market risk, sector risk and concentration risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on the Betashares website.

1. As at 30 September 2024. No assurance is given that any of the companies in the fund’s portfolio will remain in the portfolio or will be profitable investments.