How Liberation Day upended markets: A timeline

6 minutes reading time

The term “passive income” has become a buzzword in recent years, and for good reasons.

Beyond the pressures of rising living costs, many of us strive for financial freedom to pursue our personal passions.

Exchange-traded funds (ETFs) can be a powerful tool to build a passive income stream, offering regular and attractive cash flow throughout the year.

But in this blog, we aim to do more than just suggest income ETFs; we want to help you get into the mindset of setting a passive income goal and understand how you can align your investing strategy to achieve it.

The power of setting goals

Just like setting goals to improve our personal habits, like running more or learning a new skill, fuels positive change, goal setting can help to drive financial progress.

When it comes to passive income, setting a specific target, for example, seeking to generate $12,000 annually, can help you create a roadmap to get there. A solid passive income plan goes well beyond seeking high dividends yields and should consider:

- Diversification: Don’t put all your eggs in one basket or chase the highest-yielding product. If income from one asset declines, your other investments could keep providing cash.

- Investment capacity: Achieving your goal will require discipline and regular investing. How much can you realistically set aside to meet this objective?

- Risk tolerance: Understand your comfort level with market fluctuations. This helps you choose ETFs that align with your risk preference.

- Time horizon: Passive income requires patience. Give your portfolio time to grow and make sure you don’t need the invested money anytime soon.

- The big picture: Investors should not lose sight of total returns in their pursuit of income. While achieving a passive income target quickly may seem appealing, sacrificing growth potential could be detrimental in the long term.

Selecting ETFs for passive income

Setting clear goals is crucial, but choosing the right investment tools to achieve them is equally important. When it comes to ETFs for passive income, thorough research is key. Here is a handy checklist to help you make the right choices.

| What to consider | Why is it important? |

| Has the ETF paid distributions consistently? | Look for ETFs with a history of regular distributions. This can also give you a clue about the volatility and growth of that income. |

| Sustainability of yield | Websites typically will only show you an ETF’s current yield. You need to determine if that level of income is sustainable. |

| Costs | Fees erode your returns. Consider the management costs and potential transaction fees when building your passive income strategy. |

| Cash flow timing | How often you receive income may matter. Some ETFs pay monthly, while others may pay distributions quarterly and semi-annually (or less frequently). |

| Low yields aren’t necessarily bad | Some ETFs, particularly international funds, can get a bad rap due to their low yields. But some strategies target attractive income stocks overseas that have a solid track record of growing their dividends over time. |

Take time doing your research and consider seeking financial advice to help you structure a portfolio that’s right for you. Each Betashares fund page provides information pertinent for income investors including current yield, historical distributions and distribution frequency.

Putting theory into practice: a hypothetical portfolio

Now that you have a basic framework for structuring a passive income investing strategy, let’s look at how it could be applied in practice.

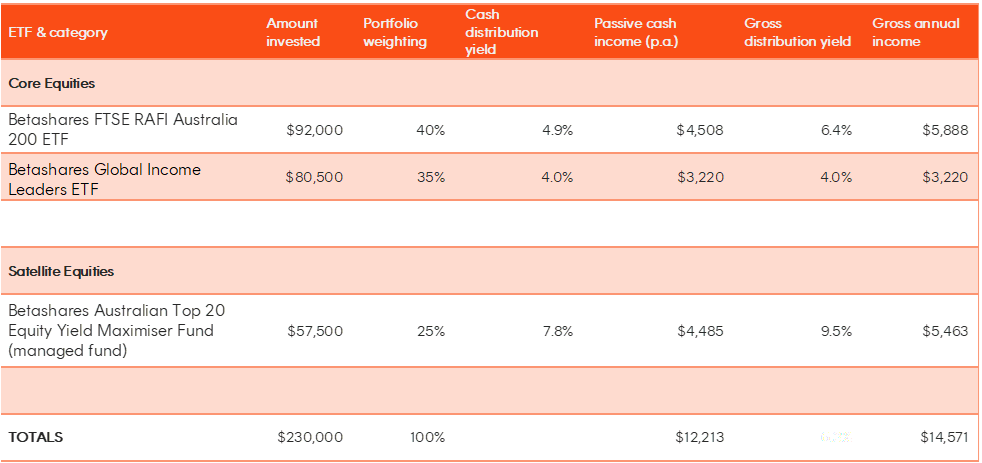

In the table below, for illustrative purposes we’ve created a hypothetical equities portfolio with a total amount invested of $230,000 using a “core-satellite” investing approach, which would have generated at least $12,000 in ‘passive’ income over the 12-month period to the end of June 2024. This method involves:

- Investing the majority of the portfolio in a few diversified, broad market equities ETFs that have the potential to provide relatively stable yields (the ‘core’).

- Allocating a smaller portion of the portfolio to a potentially higher-yielding equity ETF to supplement overall income (the ‘satellite’).

We’ve detailed the table to include the investment amounts for each ETF, their overall weight in the portfolio, and the income an investor would’ve received over the past year.

Notes:Yield info as at 28 June 2024. Each fund’s yield is calculated by summing the prior 12-month net or gross per unit distributions divided by the closing NAV per unit at the end of the relevant period. Gross distribution yield takes into account franking credits. Not all Australian investors will be able to receive the full value of franking credits. Yield will vary and may be lower at time of investment. Past performance is not indicative of future performance. This hypothetical portfolio is provided for illustrative purposes only and is not a recommendation to invest or adopt any investment strategy.

While this example only includes equities, investors may also want to consider including cash and fixed income in their portfolios depending on their circumstances. While yields on cash and fixed income can be lower than the yields from equity income, these asset classes can offer additional diversification, reduced volatility, and more predictable income.

What are the lessons?

It’s important to emphasise that the hypothetical portfolio discussed above is not a recommendation. Instead, it serves as an illustration to help you understand how to start planning your own passive income journey.

When we consider that $230,000 was needed to achieve a $12,000+ annual income stream, there are some key takeaways for investors:

Think long-term

- Building a passive income stream isn’t a get-rich-quick scheme. It requires research, planning, and consistent effort over time, similar to a runner training for a marathon.

- Whether you aim for $12,000 or $1,200 annually, having a clear objective provides direction and a roadmap for success.

Be disciplined

- Determine how much you can set aside regularly to build your portfolio, and thus your passive income stream, over time.

- Platforms like Betashares Direct can automate your investing with zero brokerage*, ensuring you stay disciplined about putting your money to work in a cost-effective manner.

*Refer to the Betashares Invest PDS for info on interest retained by Betashares and AutoPilot portfolio fees.

Embrace diversification

- Spreading your investments across different ETFs and asset classes can help manage risk and lower income volatility.

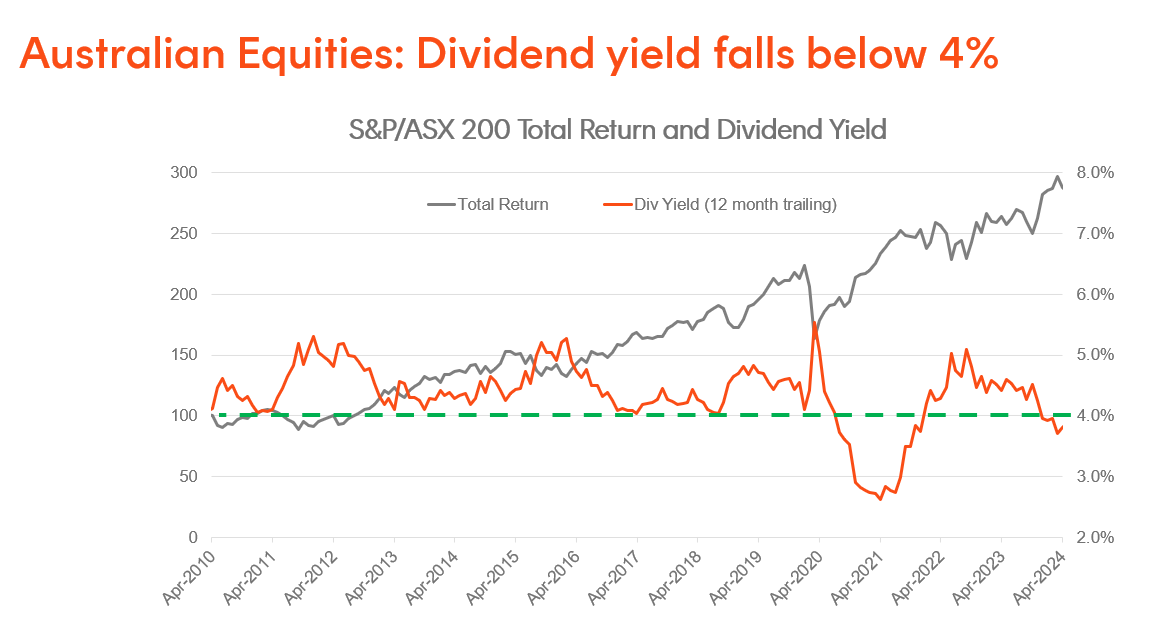

- Yields across different asset classes can fluctuate. For instance, Australian shares yielded approximately 5% (excluding franking) two years ago (see below). Today, certain fixed income strategies like subordinated debt may provide more attractive income than shares.

Source: Bloomberg. As at 1 May 2024. Chart excludes franking credits. You cannot directly invest in an index. Past performance is not an indicator of future performance.

Let money make money

- Let the power of compounding do its work and help you get to your goals quicker.

- Have a process to regularly monitor and rebalance your portfolio to stay within asset allocation targets.

By setting a goal, starting to invest, and staying disciplined, you can develop a robust strategy and reach your passive income goals faster than you might think!

Disclaimer

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

2 comments on this

where is the table ? it appears completely missing ?

have you forgetton it, or is there another reason its not visible to me ?

Hi Rich, thank you for bringing that to our attention. The table should now appear in the blog.