5 minutes reading time

- Fixed income, cash & hybrids

Compared to global peers, Australians tend to have a very low allocation to fixed income (bonds) in their investment portfolios, preferring to allocate to cash and term deposits. Yet bonds can be a reliable and stable income investment, providing a relatively high level of capital stability alongside meaningful diversification from growth assets such as equities.

Let’s get back to bond basics

Bonds represent an investment in the debt of governments to fund deficits, or companies to help finance business activities. Corporate bonds in the Australian market are predominately issued by large, well-known, highly rated companies, such as the ASX Top 50 or large international companies with operations in Australia (eg Apple). Bonds can be ‘fixed rate’, where the interest paid (known as the coupon) is set at the outset, or ‘floating rate’ where the interest rate paid is referenced to a market rate that is directly influenced by changes to the Reserve Bank of Australia (RBA) cash rate.

Not all assets are created equal

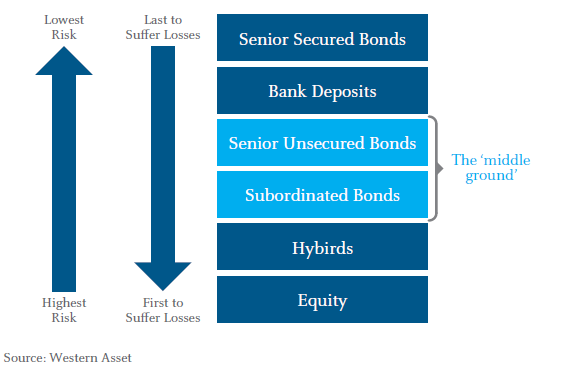

Different types of securities, such as bonds or equities, come with different risks. The riskiness of a security is determined by its relative positioning within the capital structure as this is the order in which assets are distributed in the event of a default.

Figure 1 (below) details a basic bank capital structure. Term deposits have the lowest capital risk whereas equity is the first to suffer losses during a default. Hybrids sit one level above equities, generally paying a higher level of income than term deposits and corporate bonds and sitting higher than bonds on the risk spectrum.

Figure 1: Basic bank capital structure

Bonds sit above hybrids and equities in the capital structure, with the issuer contractually obliged to make coupon payments and return the principal at maturity. This typically generates more dependable income, hence bonds tend to exhibit lower volatility of returns.

Three key reasons to invest in fixed income

- Income – The majority of fixed income total returns are derived from the contractual payment of regular coupons and this income is far more consistent and predictable than that of riskier asset classes like equities.

- Liquidity – The Australian bond market is very deep, with over A$1.2 trillion^ worth of bonds on issue. For a professional investor, most of this market is easily tradeable at low cost, providing a source of liquidity to an overall portfolio.

- Diversification – When equities go down, bonds normally tend to go up, hence bonds are often seen as a safe haven, providing a portfolio ballast in times of market stress.

Are current low yields a risk to Australian fixed income?

Domestic interest rates have fallen dramatically, leading commentators to sight an impending ‘doomsday’ when bond yields move back up to more ‘normal’ levels. We view this as an over simplified scenario as coupon returns, roll down (capital appreciation as bonds get closer to maturity) and the effect of credit spreads (typically falling as rates rise) can all help cushion the downside risk.

Bonds & Active Management

Traditional passive fixed income benchmarks in our view have flaws, namely, that generally the higher the level of indebtedness that a company has, the more the weight it is given in the benchmark. As such, our view is that investing in an actively managed bond fund can be a good alternative to such benchmarks. Skilled active fixed income managers can lower portfolio duration in the face of rising rates and adjust the portfolio’s exposure to any of the factors listed above to generate returns. If interest rates do increase, they can also reinvest coupons and maturities at the higher prevailing rates.

Introducing BNDS – the first fixed income Active ETF in Australia

The BetaShares Legg Mason Australian Bond Fund (managed fund) (ASX: BNDS) is an Active ETF that aims to deliver income and maximise the investment opportunities from Australian fixed income whilst also providing the defensive attributes that high quality fixed income has to offer. The Fund is managed with the proven investment expertise of active fixed income specialist, Western Asset, one of the world’s leading dedicated fixed income managers.

^as at Sept 2018

BetaShares Capital Ltd (ABN 78 139 566 868 AFSL 341181) (BetaShares) is the issuer and responsible entity of the BetaShares Legg Mason Australian Bond Fund (managed fund) (ARSN 608 058 493) (Fund). BetaShares has appointed Legg Mason Asset Management Australia Ltd (ABN 76 004 835 849 AFSL 240827) (Legg Mason Australia) as investment manager for the Fund. Legg Mason Australia is part of the Global Legg Mason Inc. group. Western Asset, a division within Legg Mason Australia, provides the investment management services for the Fund. Any reference to ‘Legg Mason Australia’ or ‘Western Asset’ is a reference to Legg Mason Asset Management Australia Limited. Before making an investment decision you should read the Product Disclosure Statement (PDS) for the Fund carefully and consider, with or without the assistance of a financial advisor, whether such an investment is appropriate in light of your particular investment needs, objectives and financial circumstances. The PDS is available and can be obtained by contacting BetaShares on 1300 487 577 or Legg Mason Australia on 1800 679 541 or at www.betashares.com.au or www.leggmason.com.au. This information does not take into account the investment objectives, financial objectives or particular needs of any particular person. Neither BetaShares, Legg Mason Australia, nor any of their related parties guarantees any performance or the return of capital invested. Past performance is not necessarily indicative of future performance. Investments are subject to risks, including, but not limited to, possible delays in payments and loss of income or capital invested.