13 minutes reading time

This information is for the use of licensed financial advisers and other wholesale clients only.

Global macro and rates

Global developments

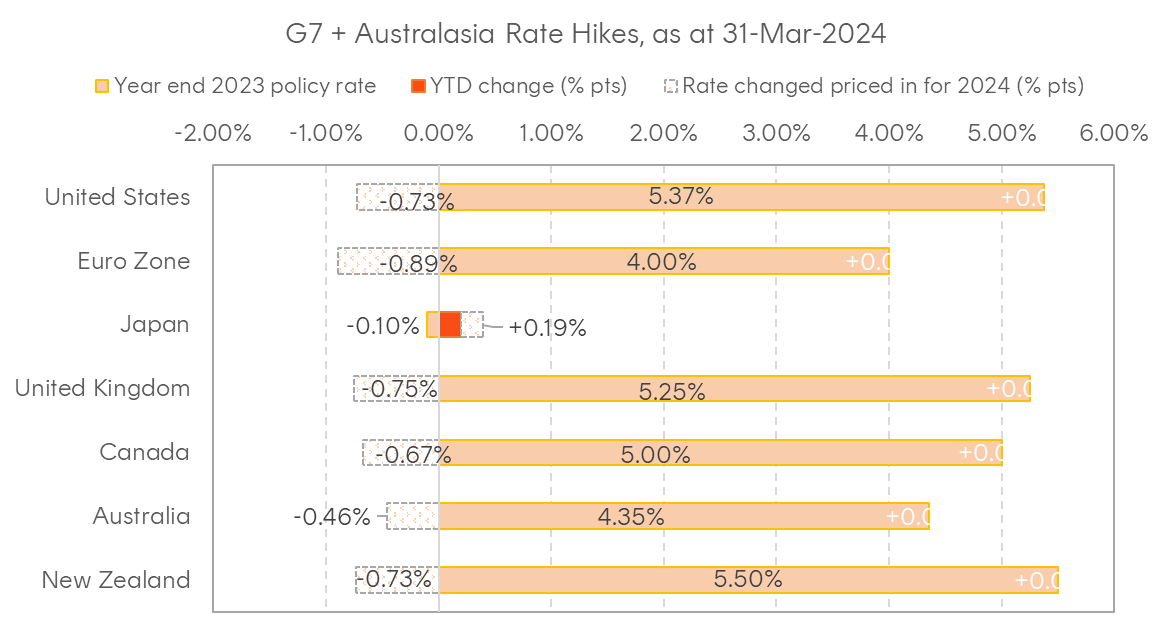

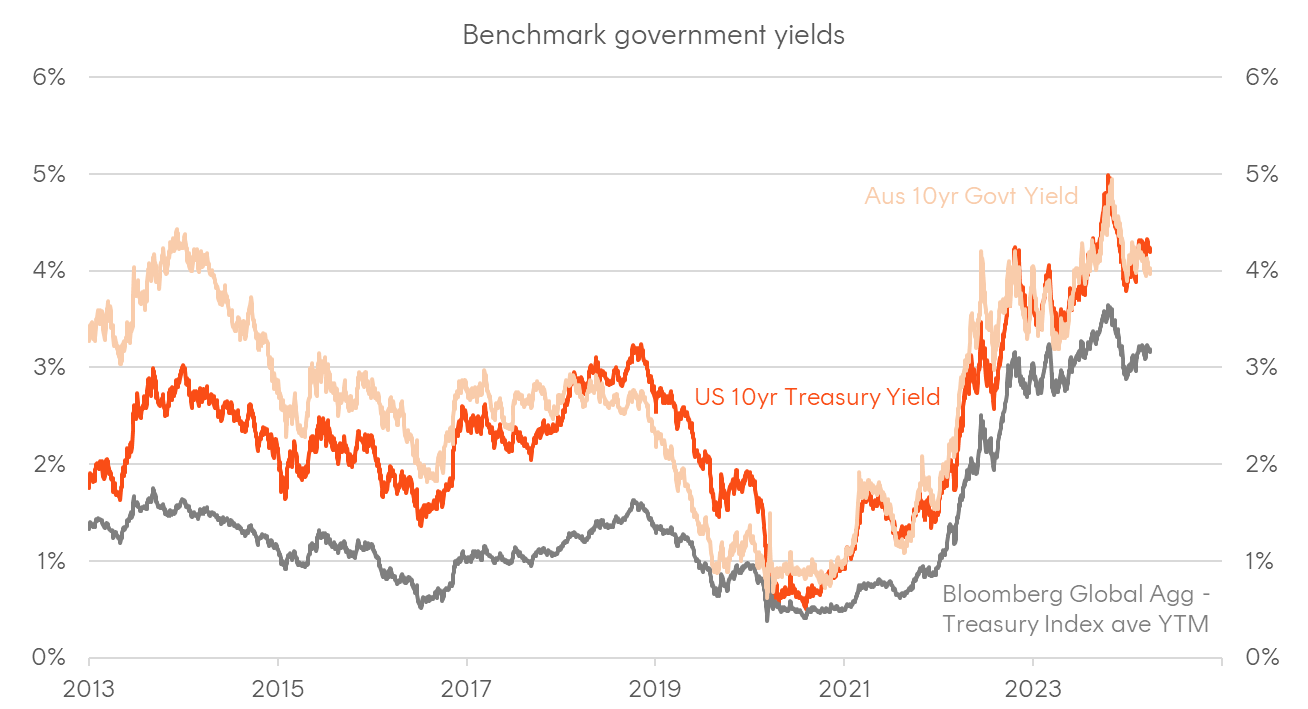

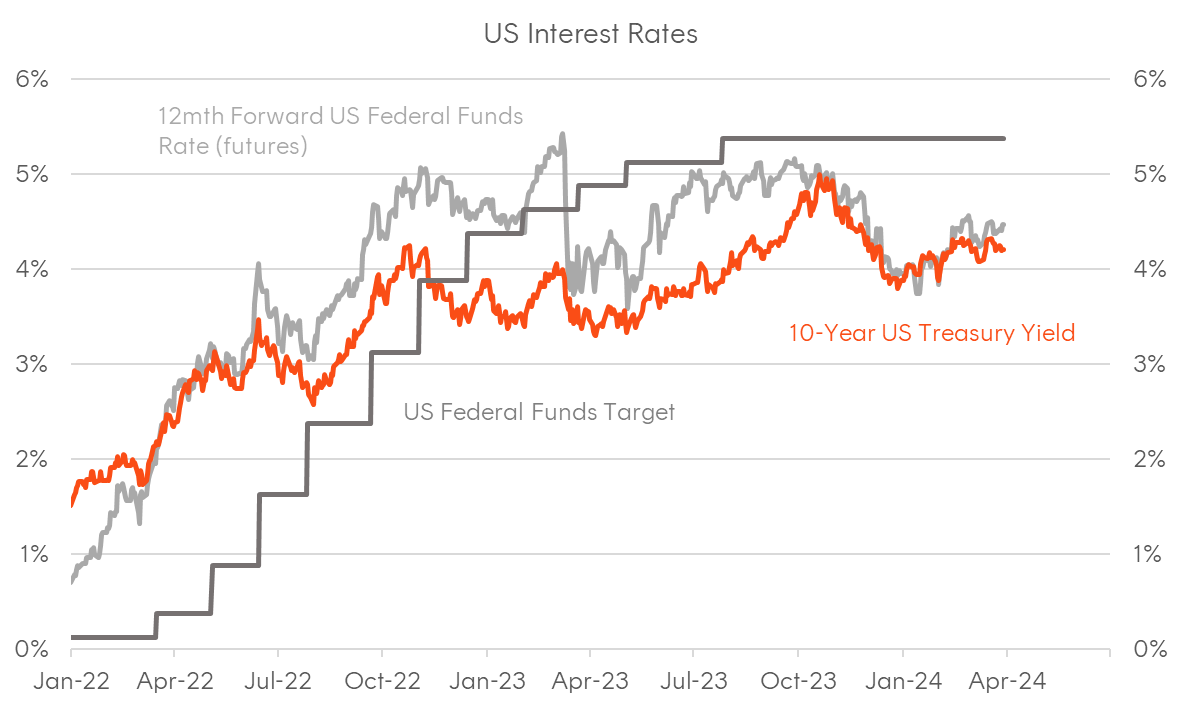

Global bond yields drifted modestly higher in the March quarter of 2024, as rate cut expectations were partially unwound from forward rate markets amid stronger-than-expected economic activity data and a relatively sticky US inflation backdrop. The average yield on the Bloomberg Global Treasury Index rose by 24 basis points over the quarter, with US Treasuries leading the move. Ten-year note yields increased by 32 basis points, with the movement largely evenly split between higher real yields (implied by TIPS) and inflation break-evens. The shape of the US yield curve remained broadly unchanged, with the spread between 10-year and 2-year yields recording its seventh consecutive quarter of inversion.

There were two FOMC meetings during the quarter (no changes to interest rates), with the January meeting striking a neutral tone regarding the statement and Chair Powell’s responses in the Q&A, arguing that the Fed would need to see more evidence of inflation moderating before commencing cuts. The highly anticipated March meeting saw Powell adopt a more dovish tone in his rhetoric, considering the economic resilience of the US economy over the preceding months, although the dot plot saw some hawkish revisions at the margin. Specifically, the median FOMC member projected fewer rate cuts for 2025 compared to the December forecasts, in addition to increasing the estimate for the long-run Fed funds rate, marking the first such move in several years. This presented the first clear evidence of the Committee revising their estimates of the so-called “neutral rate” higher.

The other major global policy development of note was the Bank of Japan (BoJ) raising interest rates for the first time in 17 years, following the strongest and most enduring domestic inflation pressures in over 30 years (albeit modest by global standards in the post-Covid era). In addition to rate hikes, the BoJ also formally ended its Yield Curve Control (YCC) programme and announced an end to purchases of ETFs and J-REITs. The BoJ stopped short of formally ending Quantitative Easing, however, and pledged to maintain the current pace of JGB purchases.

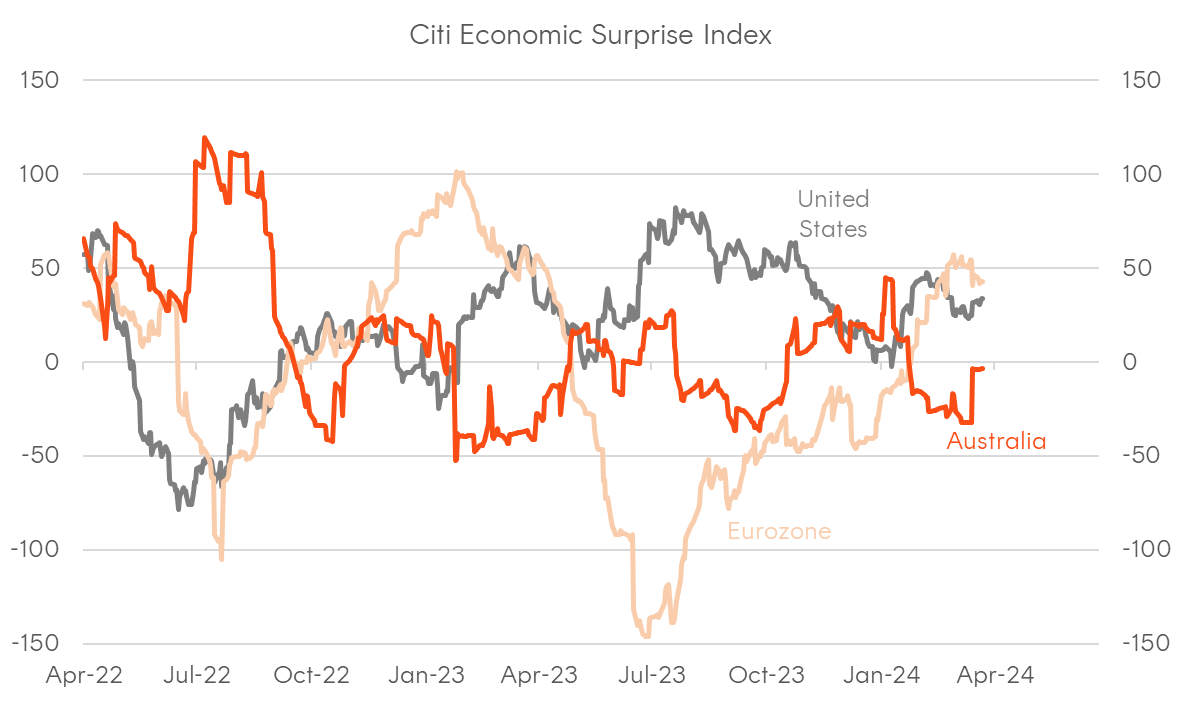

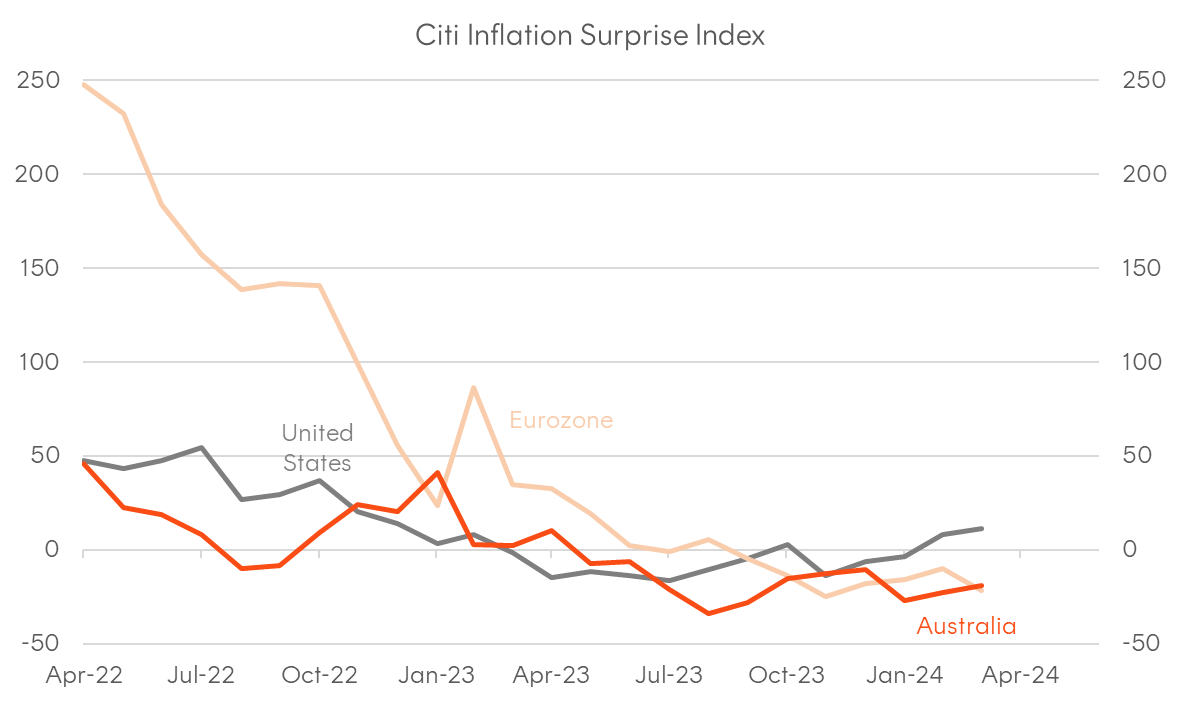

Key economic data globally tended to print above expectations, with the Citi US Economic Surprise Index remaining in positive territory, while the Euro area index returned to positive territory as leading indicators turned higher. Specifically, global and US manufacturing PMI indices returned to levels consistent with an economic expansion, indicating a bottoming out of the manufacturing cycle alongside a belated pickup in Chinese economic activity. US economic activity more broadly remains well above trend levels, in both real and nominal terms, and continues to outperform the rest of the developed world. Inflation data globally was mixed, with inflation tending to surprise on the upside in the US and key inflation gauges appearing to bottom out at levels well above the Fed’s 2% target. A rise in commodity prices was also recorded during the period, coinciding with forward-looking US inflation indicators turning higher, including the “prices paid” sub-component of the most recent Manufacturing ISM report.

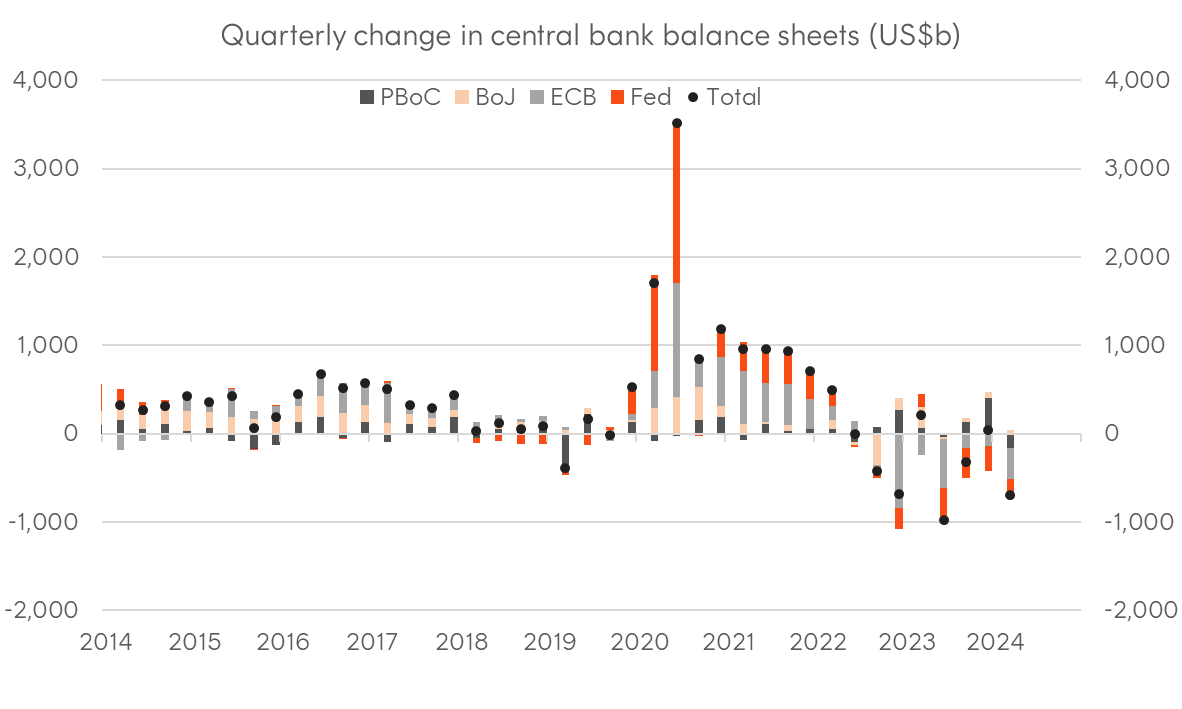

Measures of global liquidity during the quarter were mixed, with central bank balance sheet changes consistent with a tightening, while market-based measures of financial conditions indicated liquidity remains abundant. The largest central banks – the Fed, ECB, BoJ, and People’s Bank of China (PBoC) – collectively reduced the size of their balance sheets, although any major liquidity impact was possibly tempered by the contraction being a result of maturities rather than outright asset sales. In addition, much of the tightening from the Fed’s balance sheet runoff was possibly offset by the existence of the Fed’s Reverse Repo facility, which helped sterilise increased Treasury bill issuance, which might have otherwise created a liquidity drain at the margin.

Domestic developments

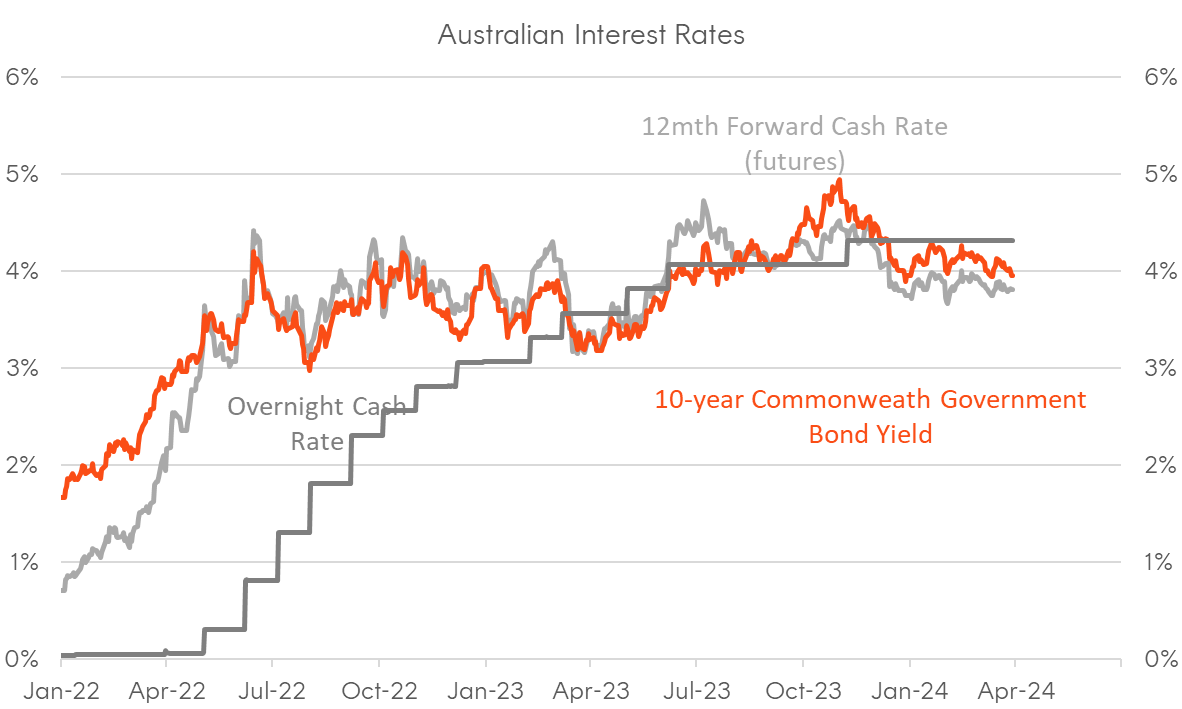

In Australia, 10-year Commonwealth Government Bond yields ended the quarter unchanged, outperforming most global peers amid a benign policy backdrop and mixed economic data. Market pricing of cash rate expectations over the medium term were also little changed, with 12-month forward cash rate futures ending the quarter 8 basis points higher (in interest rate terms), a move much smaller than the 52bps rise in equivalent fed funds pricing.

On the policy front, the RBA adopted a new schedule (of 8 meetings 6 weeks apart instead of the monthly meeting schedule previously) outlined following last year’s review, although both the February and March meetings were largely inconsequential for markets (with no changes to the cash rate target), with the forward rates market largely of the view the RBA would remain data dependent.

Inflation data during the period affirmed the trend of moderation in price pressures, and the Q4 quarterly CPI print in addition to the monthly readings for January and February printed below expectations. However, the magnitude of the downside surprises was modest and was seen as unlikely to materially alter the RBA’s own inflation forecasts, although it arguably supported local bond markets relative to global peers. In contrast to the relatively dovish inflation data, labour market data remained robust, with the unemployment rate recording an unexpected drop in February (to 3.7% from 4.1% previously), upending the consensus among economists that the labour market was now trending in a looser direction. However, despite the surprise February jobs print, other measures of economic activity tended to fall short of expectations, and GDP growth remained below trend levels.

In terms of domestic liquidity developments, the size of the RBA’s balance sheet was largely unchanged over the quarter, while the stock of exchange settlement (ES) balances declined by approximately A$19 billion (-5.5%). The next major liquidity event domestically will be the final round of Term Funding Facility (TFF) maturities, which will conclude by 30 June, totalling approximately A$95 billion. Also of note, the RBA announced plans to transition towards a so-called “ample reserves regime” from the “excess reserves regime” adopted following the covid response. This would involve the RBA’s balance sheet remaining flexible to ensure the overnight cash rate trades at the target (floor), but in practice would likely result in a much smaller balance sheet than at present (following maturities of the remaining TFF loans and outright holdings purchased during QE) and a much smaller footprint in the local bond market.

Credit

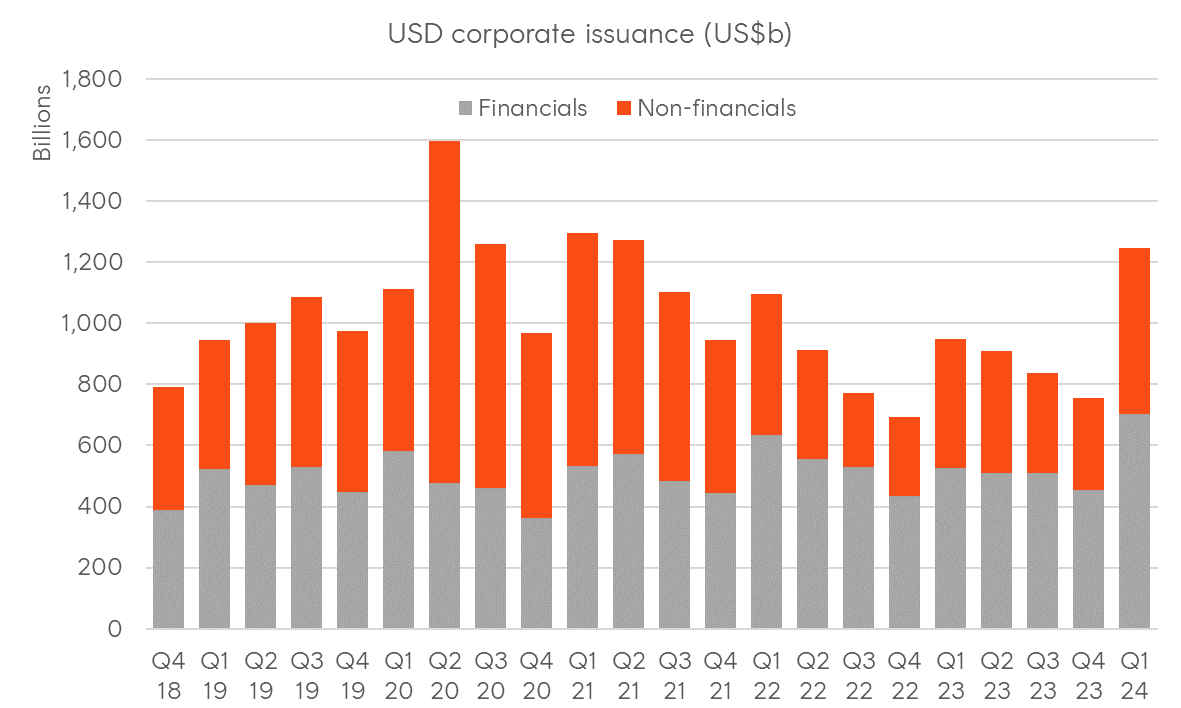

Global credit markets were characterised by positive risk sentiment and elevated issuance. Despite the highest volume of bond sales since 2021, USD 5-10-year investment-grade spreads to US Treasuries ended the quarter 8 basis points tighter, while high-yield spreads compressed by 20 basis points. Driving the movement was a constructive macroeconomic backdrop for credit, strength in global equity markets, in addition to yield-sensitive investors being still attracted to elevated outright yields as expectations of a US recession over the medium term continued to recede. The increase in bond issuance was widely attributed to a moderation in policy uncertainty from the Fed, with realised and implied levels of US interest rate volatility declining over the quarter. This, combined with the US Treasury recently shifting its issuance focus away from longer-dated bonds and notes to bills, provided a window for corporate treasurers to access an outright-yield-focused investor base in size.

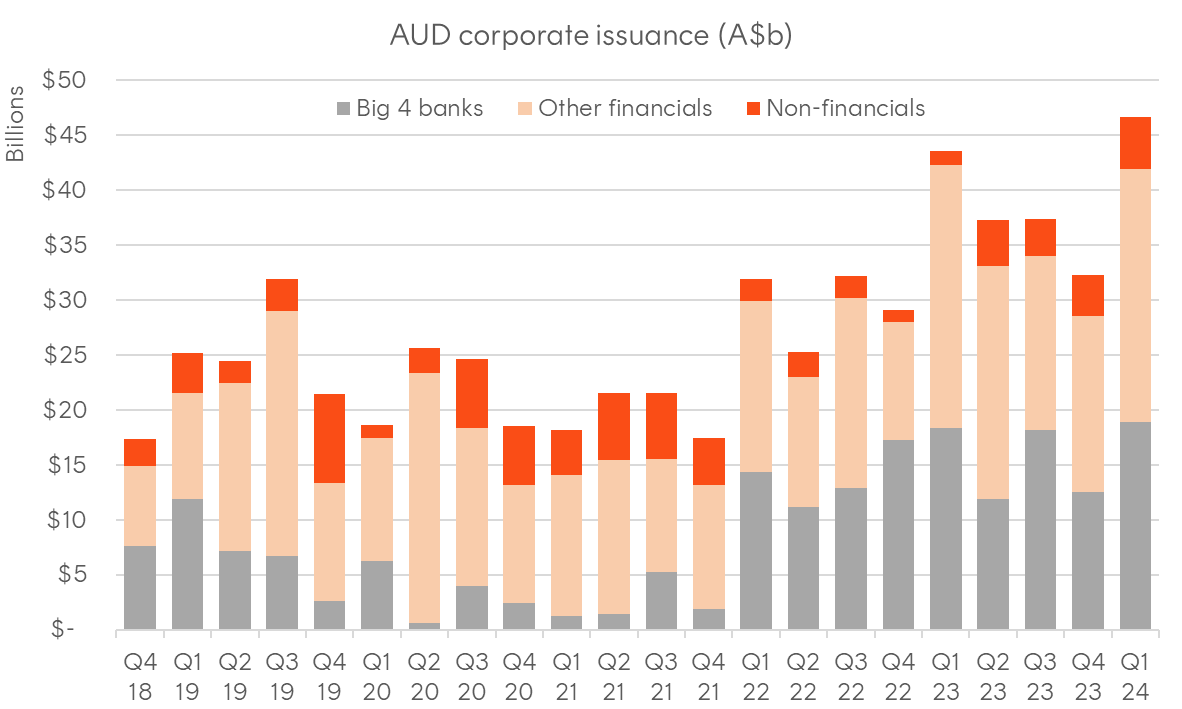

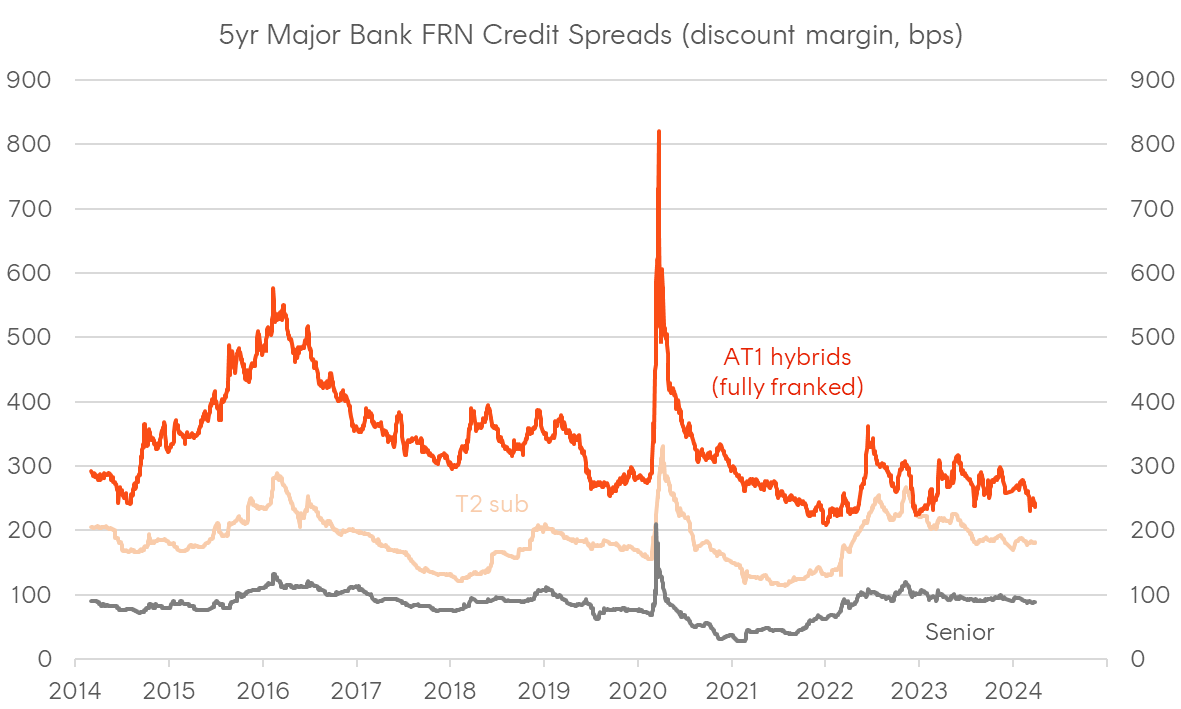

In Australia, AUD 5-10 year corporate bond spreads (to Commonwealth Government bond yields) compressed by 6 basis points, largely in line with global developments. In the floating-rate bank credit space, spreads on senior major bank FRNs were largely unchanged over the period amid issuance ahead of the RBA’s final round of TFF maturities. Spreads on Tier 2 major bank subordinated notes widened marginally as new issuance entered indices with concessionary pricing, while spreads on listed AT1 bank hybrids compressed by 25 basis points on a fully franked basis alongside outperformance from ordinary bank shares. Major banks issued approximately A$19 billion during the quarter in the domestic market across the capital structure (from A$12.5 billion last quarter), while other financials also increased the level of issuance (A$22 billion from A$16 billion in the December quarter). Issuance from non-financial corporates remained the smallest part of local bond market issuance, although there was a modest increase in the amount and number of individual deals coming to market over the quarter.

A key development for domestic credit markets was the ratings actions from both Moody’s and S&P, which upgraded several Australian banks across various parts of the capital structure. Specifically, Moody’s upgraded senior bonds for NAB, WBC, and ANZ and Tier 2 ratings for all the majors by one notch (to AA equivalent from AA- previously), while S&P upgraded tier 2 (to A- from BBB+) and AT1 ratings (to BBB from BBB-) for all four majors.

Outlook

Although the outlook for fixed income remains uncertain, volatility across the bond market continues to moderate as the range of policy outcomes from both the Fed and RBA narrows. Although the market is still pricing in an easing cycle to begin this year and the Fed appears sanguine regarding the economic backdrop, much of the cuts initially priced in have been removed as the US economy continues to surprise with its resilience.

It should also be noted that the aggressive rally in global bonds at the end of last year was likely exacerbated by short covering from the systematic community, with a sequence of more benign Treasury Refinancing Announcements (TRAs) in H2 2023 acting as the initial catalyst for the reversal. However, with fiscal policy still in play and the US budget deficit still running at 6% of GDP, there’s a high likelihood that issuance – both absolute dollar volume and the duration supplied to the market – will increase over the coming quarters. Elevated issuance at a time when the inflation cycle is re-accelerating could lead to a further move higher in yields. The US yield curve also continues to confound many by remaining inverted, although this is largely due to the market still being of the view that the neutral fed funds rate is roughly around the Fed’s latest long-run dot plot estimate of 2.625%. If the market were to revise higher its assessment (which may require continued above-trend growth and inflation remaining above 3%), we’d likely see an aggressive “bear steepening” of the US yield curve (long-term yields rising by more than short-term yields to reflect a repricing higher in medium-term forward interest rates). That said, without further upward revisions to the Fed’s own neutral rate assessment, the current stance of policy would be viewed as highly restrictive, and their current framework would likely be prescribing cuts. Indeed, Chair Powell has already stated that inflation does not actually need to print 2% (annualised) for the Fed to commence easing, and such an outcome might initially drive a “bull steepening” (short-term yields falling by more than long-term yields) of the curve.

While the picture for rates remains complicated, the environment for credit appears more constructive, supported by a moderation in interest rate volatility, financial conditions remaining accommodative, and the US and global economy showing surprising resilience to higher rates. Investment grade credit remains an attractive choice for outright yield-focused investors, although USD spreads are arguably already discounting a soft-landing outlook for the US economy, in addition to saddling Australian investors with high FX hedging costs. In contrast, AUD investment grade spread potentially offer compelling relative value, trading well above USD equivalents and above prior cycle “tights”. Specifically, both fixed rate corporate bonds and high quality supranational and government-related entities continue to offer a relatively favourable risk-return profile compared to Commonwealth government securities, and investors might consider getting their domestic duration exposure outside the traditional route of Treasuries.

Within the floating rate space, major bank credit offers potential upside across the capital structure following the latest round of ratings upgrade. However, senior FRNs are potentially the most interesting segment, with spreads continuing to trade wider than historical averages and above similarly rated globally systematically important peers amid elevated issuance ahead of the unwind of the RBA’s TFF. Once the programme formally ends on 30 June and if global credit conditions remain favourable, it’s possible that discount margins on ‘major bank senior’ compress to much tighter levels.

Chart 1: G7 + Australasia Policy Rates, as at 31-March-2024

Source: Bloomberg

Chart 2: 10-year Government bond yields, as at 31-March-2024

Source: Bloomberg

Chart 3: Quarterly change in balance sheets from selected central banks (US$b)

Sources: Bloomberg, Fed, ECB, BoJ, PBoC

Chart 4: USD corporate bond issuance, breakdown by BICS sectors, as at 31-March-2024

Source: Bloomberg

Chart 5: AUD corporate bond issuance, breakdown by BICS sectors, as at 31-March-2024

Source: Bloomberg

Chart 6: US interest rates, as at 31-March-2024

Source: Bloomberg

Chart 7: Australian interest rates, as at 31-March-2024

Source: Bloomberg

Chart 8: Global economic surprises, as at 31-March-2024

Source: Citi

Chart 9: Global inflation surprises, as at 31-March-2024

Source: Citi

Chart 10: Corporate bond spreads; as at 31-March-2024

Source: Bloomberg

Chart 11: Australian major bank credit spreads history, as at 31-March-2024

Source: Bloomberg

The information contained in this document is general information only and does not constitute personal financial advice. It does not take into account any person’s financial objectives, situation or needs. It has been prepared by Betashares Capital Limited (ABN 78 139 566 868, Australian Financial Services Licence No. 341181) (“Betashares”).

The information is provided for information purposes only and is not a recommendation to make any investment or adopt any investment strategy. Betashares assumes no responsibility for any reliance on the information in this document. Past performance is not indicative of future performance. Investments in Betashares Funds are subject to investment risk and the value of units may go down as well as up.

Future results are inherently uncertain. This information may include opinions, views, estimates, projections, assumptions and other forward-looking statements which are, by their very nature, subject to various risks and uncertainties. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in such forward-looking statements. Forward-looking statements are based on certain assumptions which may not be correct. You should therefore not place undue reliance on such statements.

Any person wishing to invest in Betashares Funds should obtain a copy of the relevant PDS from www.betashares.com.au and obtain financial advice in light of their individual circumstances. You may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for the Betashares Fund and is available at www.betashares.com.au/target-market-determinations.