Benign wages = no need for higher unemployment

6 minutes reading time

- Global shares

Global markets

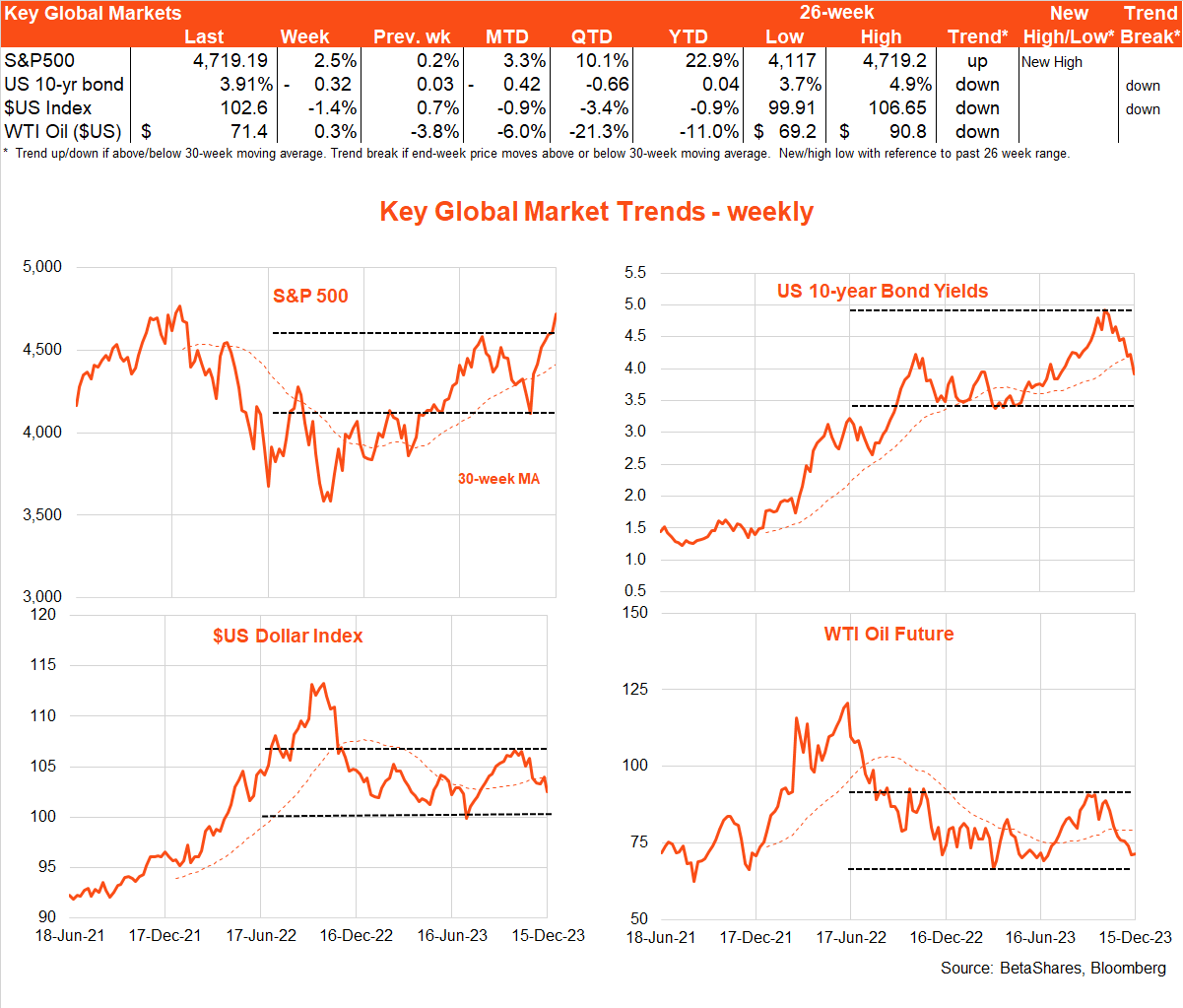

Bond and equity markets surged last week after a surprise dovish pivot by the US Federal Reserve. US 10-year bond yields dropped a lazy 0.32% to 3.91%, while the S&P 500 popped 2.5% higher. The $US also dropped 1.4%, helping the $A rise to US67c.

So much for the hawkish hold! Contrary to my expectations last week that the Fed might try to maintain a tightening bias at last week’s policy meeting, Fed chair Powell came close to popping champagne bottles and declaring mission accomplished in this quest to tame inflation.

Although rates were left on hold as widely expected, and the policy statement did retain a mild tightening bias, the party really got started when traders looked at the updated ‘dot plot’ of Fed policy expectations and Powell started riffing at the press conference.

The dot plot removed the expectation of one further rate hike this year (no surprise given rates were left on hold) and added a third expected rate cut to the two already pencilled in for next year. As a result, the Fed’s base case Fed fund rate for end-2024 dropped by 0.5% to 4.6%. Powell suggested rates had likely peaked and conceded the Committee did start to contemplate when rates might be cut. What a Christmas present!

Other US economic news was a little less bond-bullish. The headline November US consumer price index was a touch higher than expected (0.1% versus flat market expectation) while core prices were in line with the markets 0.3% expected gain. Annual headline inflation slowed to 3.1% from 3.2% while annual core inflation held steady at 4.0%. The 0.3% gain in US November retail sales was also firmer than expected, suggesting consumer spending remained reasonably healthy in Q4.

Contrary to the Fed’s early Xmas generosity, both the Bank of England and the European Central Bank played Ebenezer Scrooge by retaining firm tightening biases at the respective policy meetings last week.

As regards bond yields, while the US market has now priced in aggressive rate cuts for next year, this does not necessarily mean that long-term bond yields can’t fall further – it is one thing to expect rate cuts, it’s another to actually get them! My modelling suggests that even if the Fed only cuts rates twice next year, but the market ends the year expecting four further rate cuts in 2025, US 10-year bond yields could end next year around 3.25%.

The main event this week will be the likely benign update of the Fed’s preferred inflation measure – the private consumption expenditure deflator (PCED) for November on Friday (US time). Core prices (i.e. excluding food and energy) are expected to edge up another 0.2%, bring down the annual rate further from 3.5% to 3.4%. Note annual core PCED inflation is usually lower than that of the more widely known CPI – in part due to more regular expenditure weighting updates and, specifically at present, due to its lower weight on housing inflation, which remains relatively high.

Goods and housing inflation in the PCED report are likely to ease further. Of particular interest will be the degree of slowing in the still relatively sticky core-services excluding housing component (or the ‘super core’ measure as dubbed by the Fed). Either way, the good news is that annualised growth in the overall core PCED is running at an encouraging 2.5% over the previous six months.

Also worth watching this week will be the extent of any Fed pushback on the market’s now wild enthusiasm for rates cuts as early as March next year. We saw a little of that with comments from Fed President John Williams last Friday who downplayed the chances of early rate cuts. Atlanta Fed President Raphael Bostic speaks on Tuesday and recently suggested rates cuts could come in later rather than earlier next year.

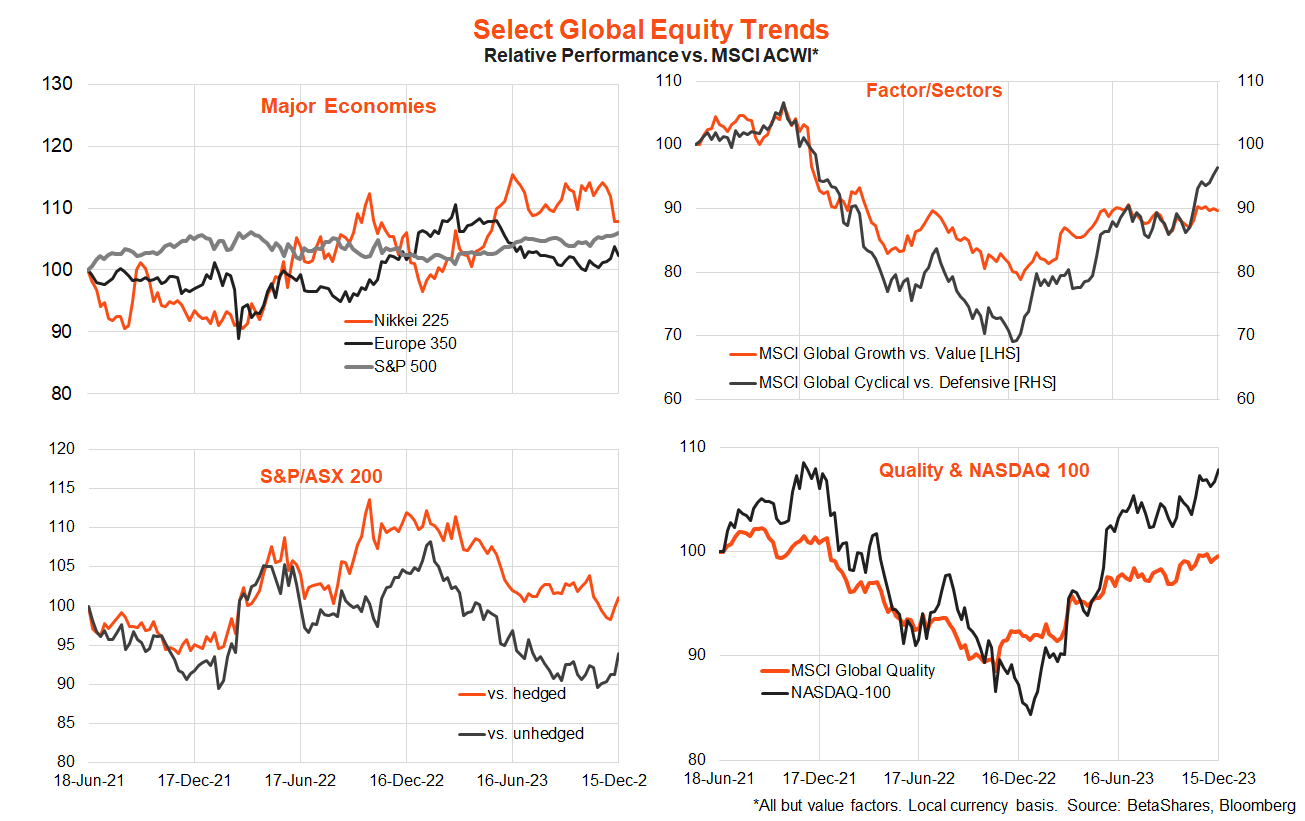

In terms of global equity trends, cyclicals are outperforming defensives while growth and value remains neck and neck. The relative strength of Japan appears to be wilting under the influence of recent Yen strength (or $US weakness), while the relative outperformance of the NASDAQ-100 and global quality is continuing. Encouragingly, there’s been an uptick in Australia’s relative performance in recent weeks.

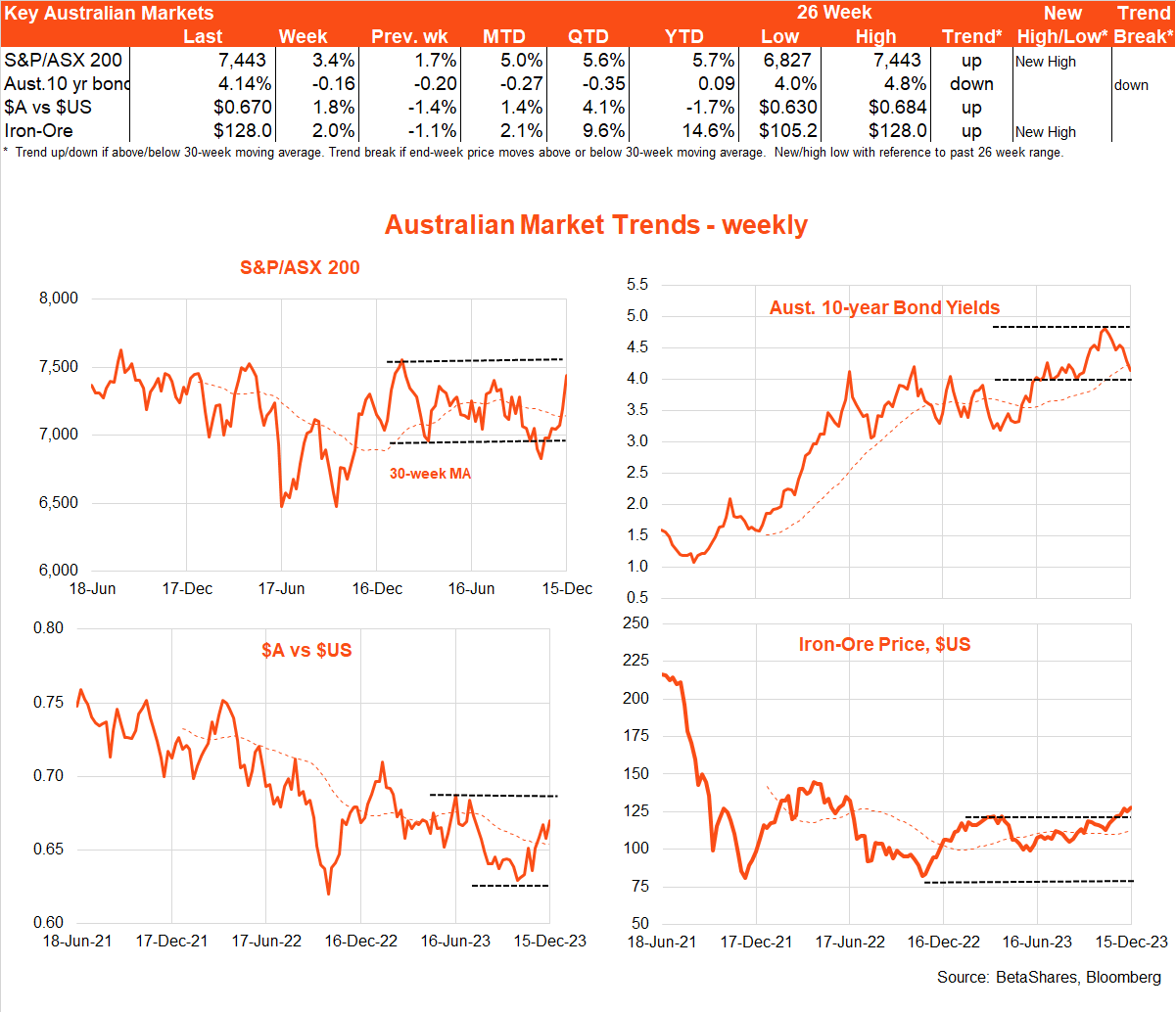

Australian markets

The local market participated in the global cheer last week, with bond yields falling and stock prices and the $A rising – the latter also helped by continued strength in iron-ore prices.

There was a lot of news to digest in Australia last week, with the Mid-Year Federal Budget update and a mixed November labour market report.

Helped by the immigration surge and high commodity prices, net budget revenues were again revised up substantially – though credit to Treasurer Jim Chalmers, 90% of this budget bounty was saved rather than spent. In a way, fiscal policy is arguably playing at least a passive role in helping to contain inflation – if only by allowing ‘automatic stabilisers’ to drag back some of the strength in labour income and corporate profits through higher taxes.

Although employment surged by a further 65k in November, this was not enough to stop the unemployment rate edging up to 3.9% due to very strong labour force growth. The RBA would take this as evidence that immigration, while clearly adding to demand in parts of the economy such as housing, is at least helping ease labour constraints – and hence potential future wage inflation.

In a data-light week, the key local highlight this week will be minutes to the RBA’s December policy meeting.

Please note this will be the last Bites for the year! After taking a rest and reflecting on life, I’ll be back on board with the first Bites of the new year on Monday, January 29. I wish regular readers all the best for the festive season and may markets be kind to you.

Have a great week and holiday break!

3 comments on this

Merry Christmas all the best for 24

Thanks for your weekly Bulletin David – always a good read.

Have a happy Yuletide and New Year. Regards, Percy

Thank you for your insights throughout ‘23. Best wishes for ‘24.