6 minutes reading time

Overview

- The Fed kept interest rates unchanged by unanimous decision, as expected by all 108 economists surveyed by Bloomberg.

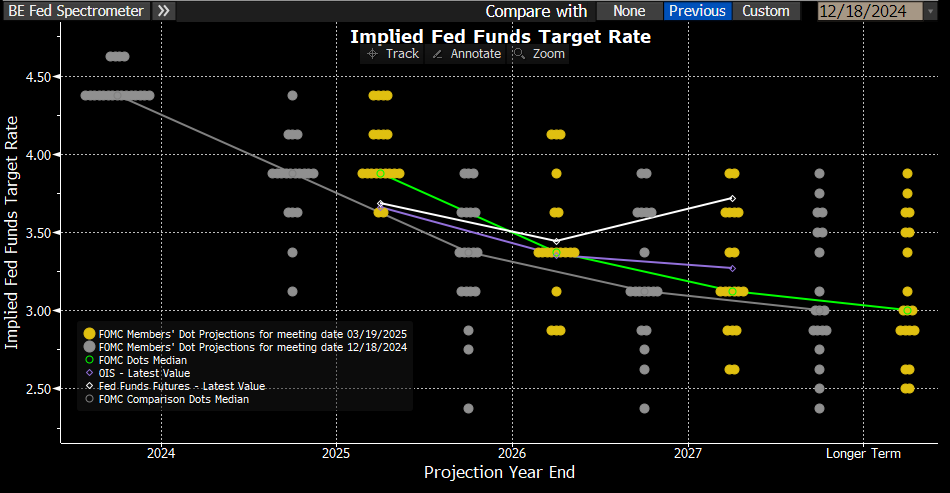

- The new dot plot shows the median Fed official still expects two rate cuts in 2025, unchanged from December. However, projections have shifted more hawkish, with a wider dispersion among member forecasts.

- On key economic projections, the median Fed official now expects core inflation to reach 2.8% by the end of 2025, up from the 2.5% forecast in December. Growth estimates have also been sharply revised downward to 1.7% from 2.1%.

- While uncertainty has increased, stagflation risks are rising, with downside risks to GDP and upside risks to both unemployment and inflation. Powell noted that recession risks have “moved up, but it’s not high,” estimating a 1-in-4 chance of a recession over the next 12 months.

- In his press conference, Powell acknowledged that tariffs are already affecting the economy and have been factored into economic forecasts. He expects the impact to be transitory but emphasized significant uncertainty. He also reiterated that long-term inflation expectations remain stable and distinguished between sentiment-driven concerns and hard economic data, which remains solid.

- The pace of quantitative tightening (QT) will slow starting in April, with monthly Treasury securities redemptions capped at $5 billion, down from the previous $25 billion. The $35 billion monthly redemption cap on agency debt and mortgage-backed securities (MBS) will remain unchanged. Powell confirmed the Fed’s intention to shift to a Treasury-only portfolio, stressing that this decision is purely technical and not a signal of future rate policy.

- Markets initially reacted with mild risk-on sentiment following the statement’s release, which strengthened as Powell’s press conference progressed. The S&P 500 closed up 1.08%, while the Nasdaq gained 1.30%. Two-year Treasury yields fell by 6 basis points, and 10-year yields declined by 4 basis points. While both the statement and Powell’s remarks were neutral, the S&P 500 rebounded after four consecutive weekly declines. The Fed’s commitment to two rate cuts in 2025, despite higher inflation projections, was enough to support a relief rally.

Markets moves

|

Equities |

Current level |

Prior close level |

1d change |

Last FOMC (29/01) level |

Changes between FOMC meetings |

|

S&P 500 |

5675.29 |

5614.66 |

1.08% |

6039.31 |

-6.03% |

|

NASDAQ |

19736.66 |

19483.36 |

1.30% |

21411.46 |

-7.82% |

|

ASX 200 SPI futures |

7936.00 |

7883.00 |

0.67% |

8475.00 |

-6.36% |

|

Bonds |

Current level |

Prior close level |

1d change |

Last FOMC |

Changes between |

|

UST 2-year yield |

3.98 |

4.04 |

-6 bps |

4.21 |

-24 bps |

|

UST 10-year yield |

4.25 |

4.28 |

-4 bps |

4.53 |

-28 bps |

|

UST 10-year real yield |

1.91 |

1.98 |

-7 bps |

2.12 |

-20 bps |

|

UST 10-year inflation breakeven |

2.33 |

2.30 |

3 bps |

2.41 |

-8 bps |

|

AU 3y bond futures yield |

3.79 |

3.78 |

1 bps |

3.78 |

1 bps |

|

AU 10y bond futures yield |

4.44 |

4.46 |

-1 bps |

4.40 |

4 bps |

|

Commodities & FX |

Current level |

Prior close level |

1d change |

Last FOMC |

Changes between |

|

WTI Oil |

67.22 |

67.58 |

-0.53% |

72.62 |

-7.44% |

|

Spot Gold |

3046.11 |

3000.60 |

1.52% |

2759.36 |

10.39% |

|

AUDUSD |

0.6354 |

0.6384 |

-0.47% |

0.6231 |

1.97% |

|

Bitcoin |

85748.32 |

83958.01 |

2.13% |

103751.41 |

-17.35% |

|

VIX |

19.85 |

20.51 |

-0.66 |

16.56 |

3.29 |

Betashares Fixed Income desk comments

- The Fed continues its wait-and-see approach and is increasingly likely to keep policy rates steady for an extended period as economic uncertainty rises under the new U.S. administration. This uncertainty was anticipated in the Fed’s January meeting, and Powell, through his latest comments, is seeking greater flexibility to respond to potential growth or inflation shocks.

- As has been the case so far this year, fiscal policy—not monetary policy—remains the primary market driver. The Fed’s position will become increasingly challenging if growth and inflation continue to diverge, raising the risk of stagflation. It is too early to determine the Fed’s priority in such a scenario, but for now, Powell maintains that inflation is transitory—the infamous “T word,” given the 2022 experience when inflation proved anything but transitory.

- With market volatility persisting, we continue to see value in maintaining duration in portfolios as a risk hedge. U.S. Treasuries remain our preferred duration exposure, with convexity offering good value for those expecting sharp movements in bond yields. Since the Fed’s January FOMC meeting, when we first proposed adding duration via USTs, 10-year Treasury yields have fallen by 28 basis points. With Treasury Secretary Bessent aiming to lower the 10-year yield, we continue to view this as a solid bet and a hedge against “temporary” market corrections.

Latest Fed dot plot

Note that for 2025 projections, dots have shifted up overall

Source: Bloomberg

Fed economic projections (full Summary of Economic Projections available here)

Source: US Federal Reserve

Evolution of the Fed’s Balance sheet

Source: Bloomberg

5y-5y forward breakeven inflation rate

Source: Bloomberg

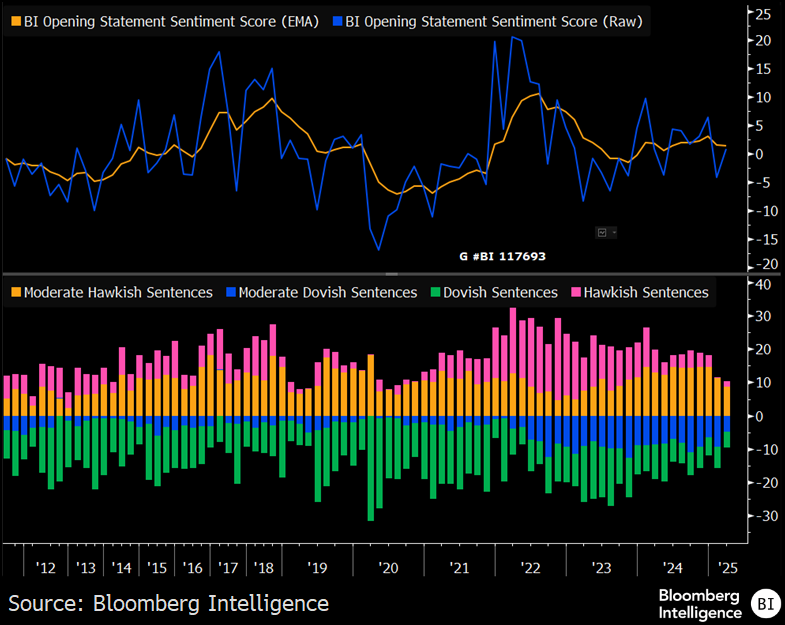

Bloomberg intelligence natural language process (NLP) model

This shows the sentiment of Powell’s opening remarks was effectively zero, or true neutral. It’s less dovish than the January reading but more dovish than December.

Source: Bloomberg

Long run history of Fed funds rate vs US 2- and 10-year government bond yields

Source: Bloomberg