Charts of the month: March 2025

5 minutes reading time

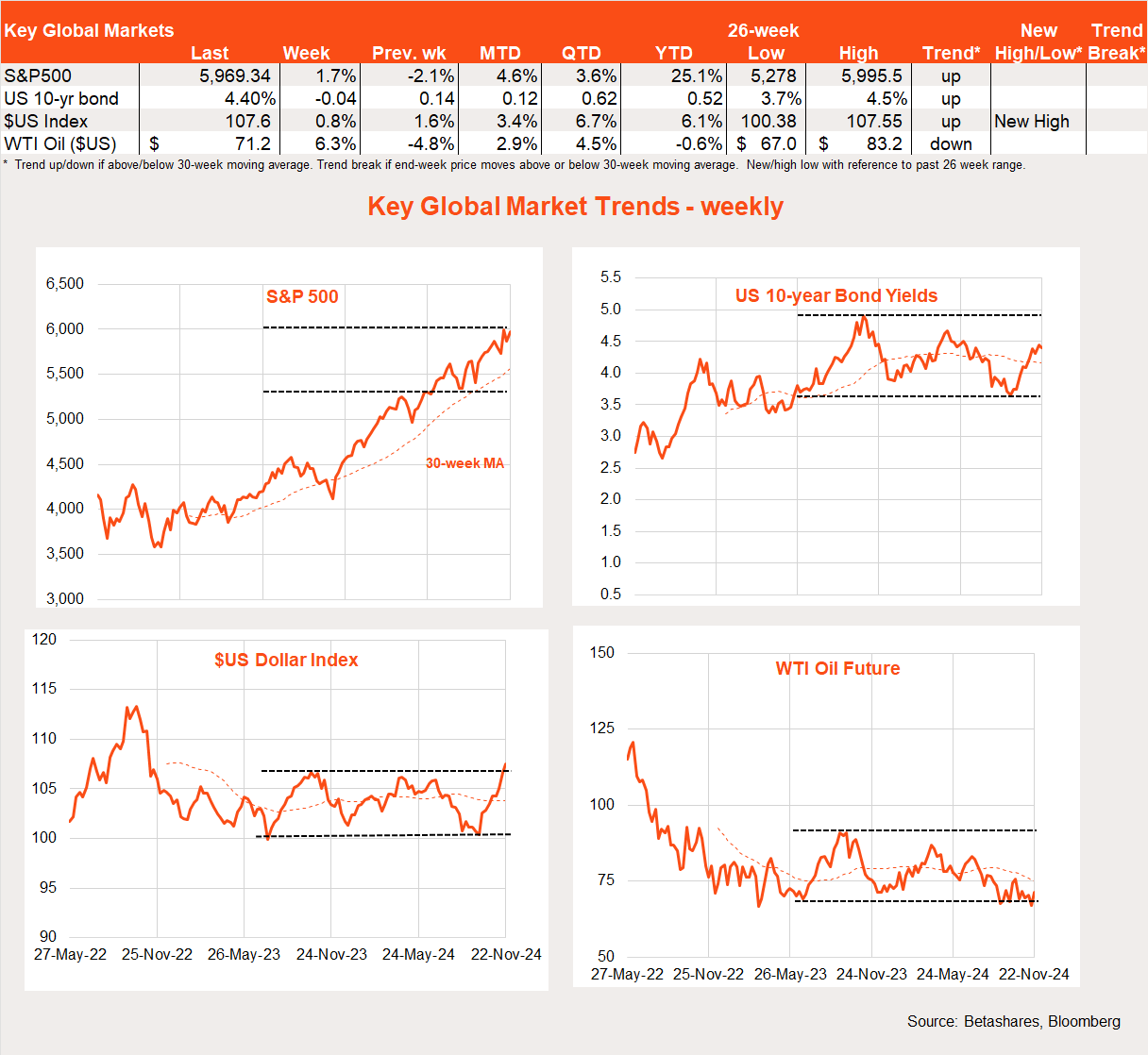

Global markets

Global equities bounced back last week, helped by ongoing strength in the US economy and excitement around the ‘Trump trades’ in the wake of Donald Trump’s return to the US Presidency.

There was little in the way of major global economic data last week, with the highlight being Friday’s global manufacturing and service sector PMI data. The key takeaway from these reports was the ongoing strength in the US economy yet the weak and seemingly deteriorating outlook for Europe. Both Japanese and European stocks lagged last week while the S&P 500 returned 1.7%. The NASDAQ-100 returned 1.9%.

In Trump-related news, the choice of hedge fund billionaire Scott Bessent as his nominated Treasury Secretary was at least less weird and wacky than some of his other Administrative choices – markets breathed a quiet sigh of relief. That said, Bessent seems just as keen as Trump on tariffs, so his selection in no way seems to lessen the odds of ‘trade wars’ in the new year.

Other key news included the escalation of Russia-Ukraine tensions, with the latter firing US and UK missiles into Russian territory and the former retaliating by warning it could resort to nuclear weapons. Perhaps surprisingly, equity markets seemed to take the latter threat in their stride – maybe sensing not even Putin would really go that far.

Despite beating both earnings and revenue market expectations, Nvidia’s share price initially dipped after its results last week but then quickly recovered lost ground. AI euphoria remains firmly in place. Also firmly in place is crypto euphoria, with Bitcoin surging further last week to be within touching distance of $US100,000. It’s up a lazy 50% since early October.

Last but not least, several Fed members spoke of the need for ‘patience’ in cutting rates further. Markets still see a rate cut next month as a 60% chance, though now see only two further rate cuts in 2025.

Global week ahead

Global highlights this week include minutes to the last Fed meeting and the October reading for the US private consumption expenditure (PCE) deflator.

I doubt much new will come from the minutes, while the market so far seems remarkably comfortable with the recent levelling out in annual core PCE inflation at around 2.7%. Core prices are expected to again rise 0.3% in the month, which would edge up annual core inflation to 2.8%. The market won’t care until the Fed cares, it seems – and the latter still sees inflation as continuing to gradually fall over the coming year, helped by eventually lower housing costs.

Also important will be any further escalation of the Russia-Ukraine battle.

Market trends

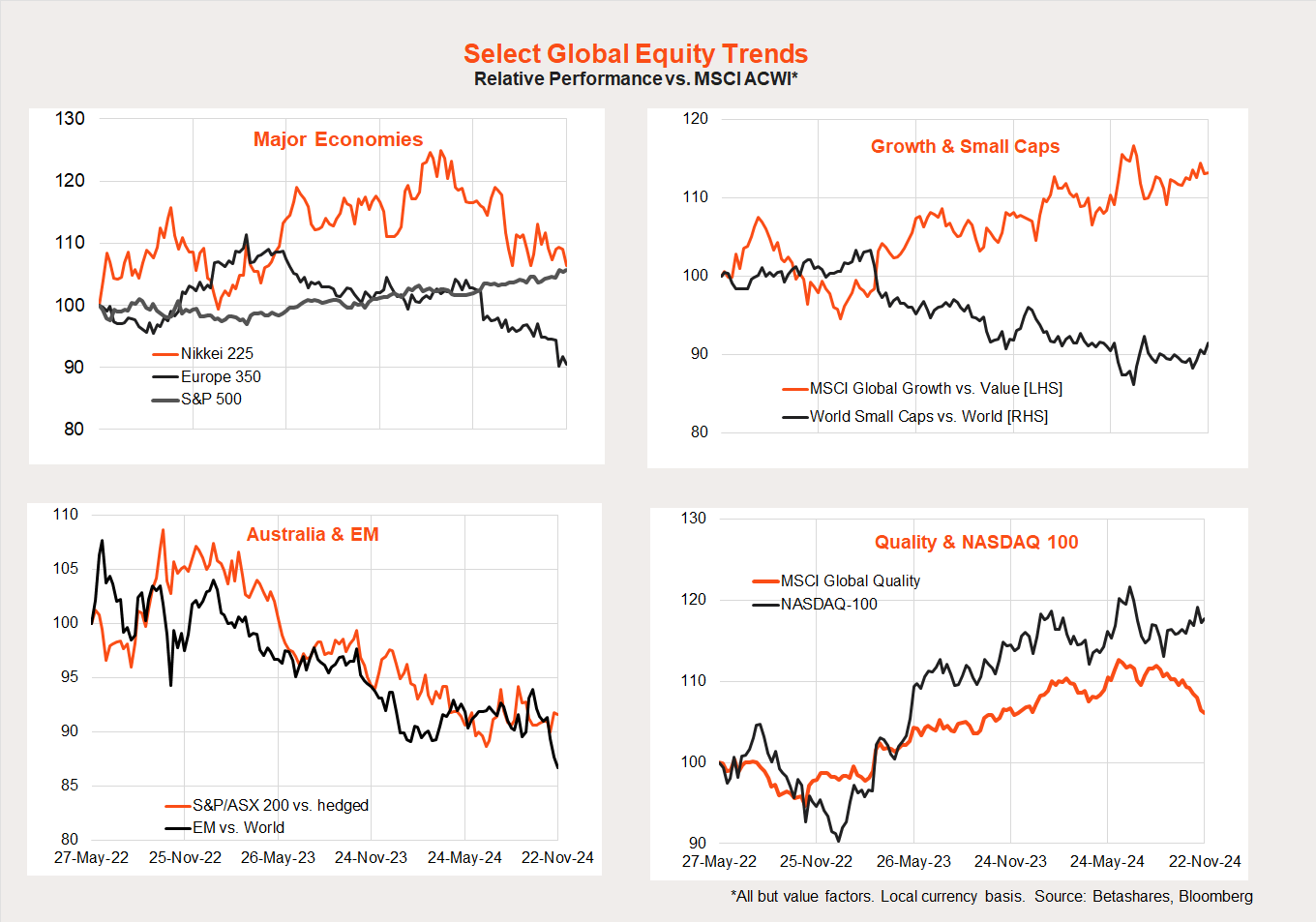

The one clear global equity trend to emerge from the Trump victory has been a strengthening of US equity outperformance. There are also tentative signs of a bounce in small cap performance, though this has not stopped continued relatively good performance from global growth and the NASDAQ-100.

Global quality has also underperformed somewhat of late, which from a sector perspective seems to reflect its underweight exposure to the outperforming financial sector, and overweight exposure to the underperforming health care sector.

Australian market

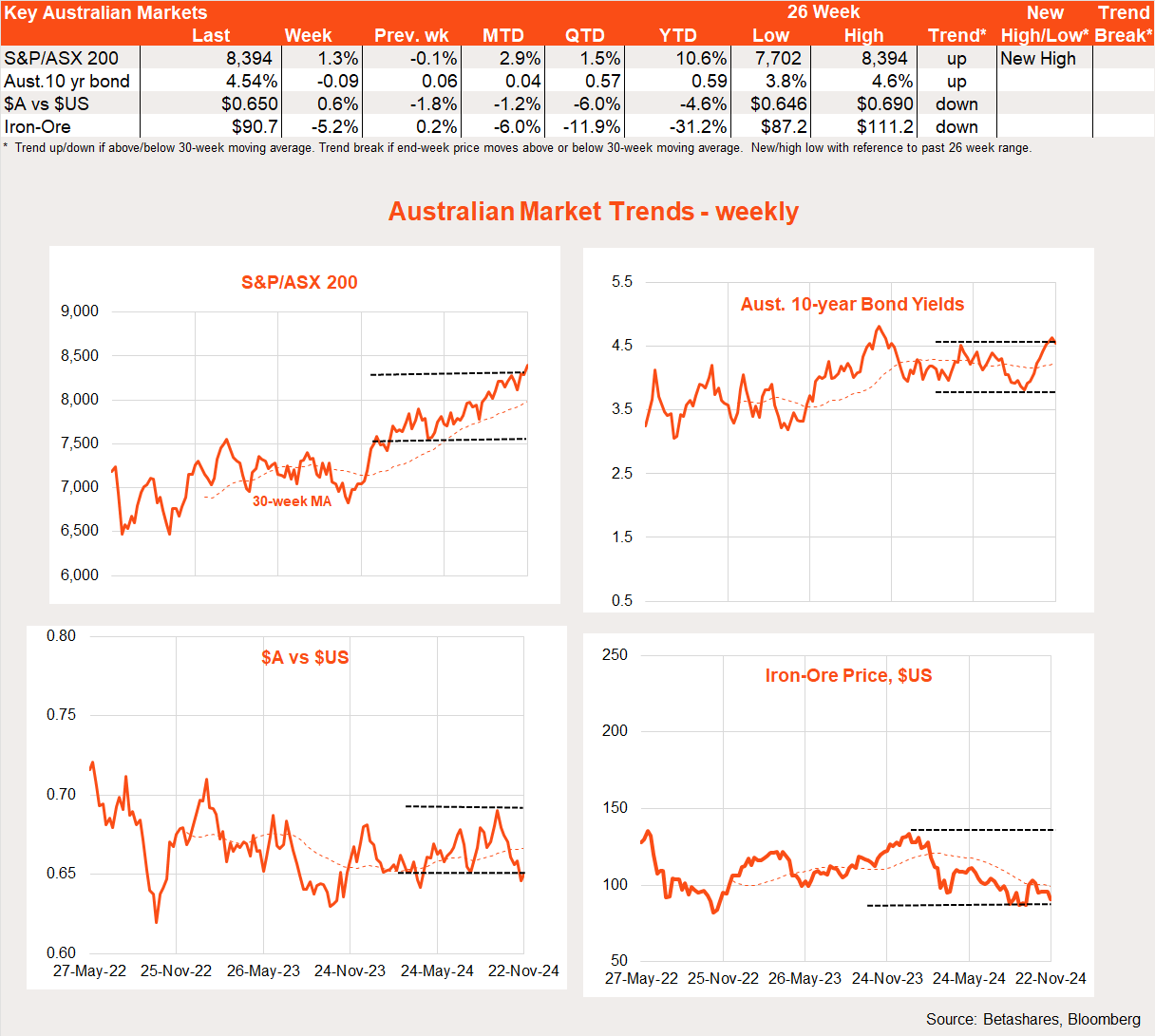

Local stocks also bounced back last week, despite further hawkish RBA commentary. RBA hawkishness helped the $A recover some lost ground, despite weaker iron-ore prices and USD strength.

The killer blow from the minutes to the RBA’s November meeting was the comment that even if “inflation declined materially more quickly than currently forecast..[the Board] would need to observe more than one good quarterly inflation outcome to be confident that such a decline in inflation was sustainable”.

This suggests that even if the Q4 CPI in late January is pretty good (say, with annual trimmed mean inflation falling to 3.25% instead of the RBA’s current 3.5% forecast), it might not be enough to see the RBA cut in February – as I had been anticipating.

Clearly my call is at risk! Barring a sudden weakening in consumer spending or employment, it seems increasingly likely the RBA won’t contemplate a rate cut until May, following the Q1 2025 CPI report. The advent of Trump and reduced US rate cut expectations in 2025 has also likely hardened the RBA’s resolve.

Delaying a rate cut also sidesteps politics to an extent. The RBA’s May meeting will be over 19-20 May, or several days after the latest date (17 May) that a Federal election would likely need to take place.

Looking to the week ahead, the October monthly CPI report will be the key highlight. Annual trimmed mean inflation using the monthly CPI was down to 3.2% in September, so of interest will be whether this notoriously volatile measure corrects back up or sinks even lower – potentially to below 3%.

Have a great week!