Charts of the month: March 2025

7 minutes reading time

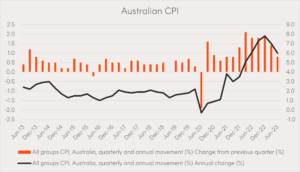

Last week’s Australian Consumer Price Index (CPI) figures showed a significant drop in year-on-year inflation, falling from 7% in the March quarter to 6% in the June quarter. While this is still well above the RBA’s target band, it’s a notable move in the right direction.

The real news though came in the quarter-on-quarter data, which showed a rise of just 0.8%. If inflation were to continue at this rate for the next three quarters, the y-o-y number would drop to just 3.2% – just a fraction above the target range. June’s q-o-q figure is the lowest we’ve seen since September 2021.

Source: ABS, Betashares1.

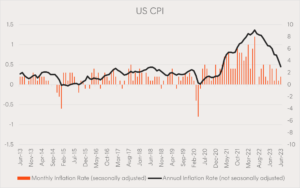

It’s not just in Australia that inflation is falling. In the US, inflation fell to 3% y-o-y in June 2023, after peaking at over 9% in June 2022.

Source: US Bureau of Labor Statistics, Betashares1.

Similarly, Canada, the UK, and the Euro area have all seen significant falls in inflation from their peaks last year.

| Location | 2022 peak inflation | Latest inflation rate |

| Australia | 7.8% | 6.0% |

| USA | 9.1% | 3.0% |

| Canada | 8.1% | 4.0% |

| Euro area | 10.6% | 5.5% |

| United Kingdom | 11.1% | 7.3% |

Sources: ABS, BLS, Statistics Canada, Eurostat, Office for National Statistics1.

While there are no guarantees that these trends will continue, the speed and quantity of the falls is no doubt welcomed by central bankers, consumers, and investors.

So far, central banks have maintained a hard line on rate rises, with both the US Fed and the ECB raising rates last week. However, the RBA left rates on hold yesterday, stating that “the recent data are consistent with inflation returning to the 2-3 per cent target range over the forecast horizon”.

If inflation does get down to the target range and stay there, it may offer central banks the opportunity to pause, stop, or even reverse rate hikes. Particularly if we also see softening the in labour market.

Betashares Chief Economist David Bassanese commented last week:

The CPI result today is pleasing on a number of fronts – coming in lower than market expectations and the RBA’s May forecasts. It’s also obvious that rapid fire rate hikes from the RBA are doing their job. While there still could be one more rate hike left before the end of the year, the CPI print offers a good case for the RBA to hold off again at their policy meeting next week.

If inflation has peaked, and a peak in interest rates follows, this could mark a major shift in the market dynamics that we’ve experienced over the last 18 months.

So how can investors who expect inflation to keep falling position themselves for such an environment?

Here are 6 ETF ideas to consider.

Technology

If the scenario outlined above does play out, it could have a positive effect on company valuations.

Falling interest rates lower the cost of a company’s borrowings and the cost of raising new capital. Additionally, the value of a future company’s cashflows increases as interest rates fall. The further into the future these cashflows are expected to occur, the greater the effect.

As many technology companies are typically expected to grow for long periods, the valuation uplift that they receive due to lower expected interest rates can be significant. We saw this occur during the post-Covid market of 2020 and 2021, while the inverse was true in 2022.

How to get exposure to technology

NDQ Nasdaq 100 ETF aims to track the performance of the NASDAQ-100 Index (before fees and expenses). The NASDAQ-100 comprises 100 of the largest non-financial companies listed on the NASDAQ market. With its strong focus on technology, NDQ provides diversified exposure to a high growth potential sector that is under-represented in the Australian sharemarket.

ATEC S&P/ASX Australian Technology ETF aims to track the performance of the S&P/ASX All Technology Index (before fees and expenses). ATEC provides diversified exposure to the innovative companies leading Australia’s fast-growing technology sector, including WiseTech Global, REA Group, Xero, carsales.com and more.*

*No assurance is given that these companies will remain in the portfolio or will be profitable investments.

Quality

Quality investing seeks out companies with stable earnings, low debt, attractive cash flow, and high return on equity. Quality companies have the potential to perform well across a broad range of market environments.

Quality companies tend to have lower debt levels, meaning that any reduction in interest expenses from falling rates would be small. However, the valuation uplift from falling interest rates still applies. And like technology companies, quality companies tend to gain more of their value from cashflows further in the future. This makes them more sensitive to changes in interest rates than the broad market.

If rates were to fall while the economy remained strong and growth in company earnings continued, higher earnings could add a further boost.

However, if inflation and interest rates are falling due to a faltering economy, the low leverage and relatively stable earnings of quality companies may offer resilience in the event of a market drawdown.

How to get exposure to quality

QLTY Global Quality Leaders ETF aims to track an index (before fees and expenses) that comprises 150 high quality global companies (ex-Australia) from a range of geographies and global sectors, many of which are under-represented in the Australian sharemarket.

AQLT Australian Quality ETF aims to track an index (before fees and expenses) that comprises 40 high quality Australian companies. AQLT’s Index has tended to have different sector weightings to benchmark Australian equities indices[2], with higher exposure to sectors such as consumer discretionary and lower exposure to the materials (mining) sector.

High quality bonds

While falling inflation may occur in a ‘goldilocks’ scenario of strong economic growth and employment, the possibility remains that the economy could experience a ‘hard landing’ scenario – i.e. a recession. Historically, central banks have cut interest rates during recessions.

During times of economic distress, high quality government bonds have tended to be among the better performing assets, as investors seek the safety and liquidity they offer.

As with shares, the value of future cashflows from bonds increases as interest rates fall. And again, this effect is most pronounced when those cashflows are further in the future. In bonds, this is measured by a metric called ‘modified duration’, which indicates the sensitivity of a bond or bond portfolio to changes in interest rates. The higher the modified duration, the more sensitive the bond or portfolio is to these changes.

How to get exposure to high quality bonds

AGVT Australian Government Bond ETF invests primarily in a portfolio of relatively ‘long duration’ Australian government bonds. Eligible bonds must be AUD denominated fixed-rate bonds and have a term to maturity of between 7 to 12 years.

AGVT currently has a modified duration of 7.86 years[3].

GGOV U.S. Treasury Bond 20+ Year ETF – Currency Hedged aims to track the performance of an index (before fees and expenses) that provides exposure to a portfolio of high-quality, long-dated, income-producing US Treasury bonds, hedged into AUD. US Treasury bonds are among the highest credit quality and most liquid of all securities.

GGOV currently has a modified duration of 17.30 years3.

An open question

It remains to be seen whether inflation will continue to fall as we’ve seen in recent months, and whether interest rates will follow suit. Even if both of these do occur, it could happen either during a recession, or while the economy is growing.

The ETFs discussed above offer the tools to prepare investors for various scenarios, but should always be considered in the context of a well-diversified core portfolio that’s appropriate for the investor’s risk tolerance.

There are risks associated with an investment in the above funds, which may include market risk, currency risk, sector risk, concentration risk and credit risk. Investment value can go up and down. For more information on risks and other features of the funds, please see the Product Disclosure Statement and Target Market Determination, both available on www.betashares.com.au.

References:

1. Inflation data sourced from ABS, BLS, Statistics Canada, Eurostat, Office for National Statistics. Data collected and charted by Betashares.2. Represented by the S&P/ASX 200 Index

3.As at 27 July 2023