6 minutes reading time

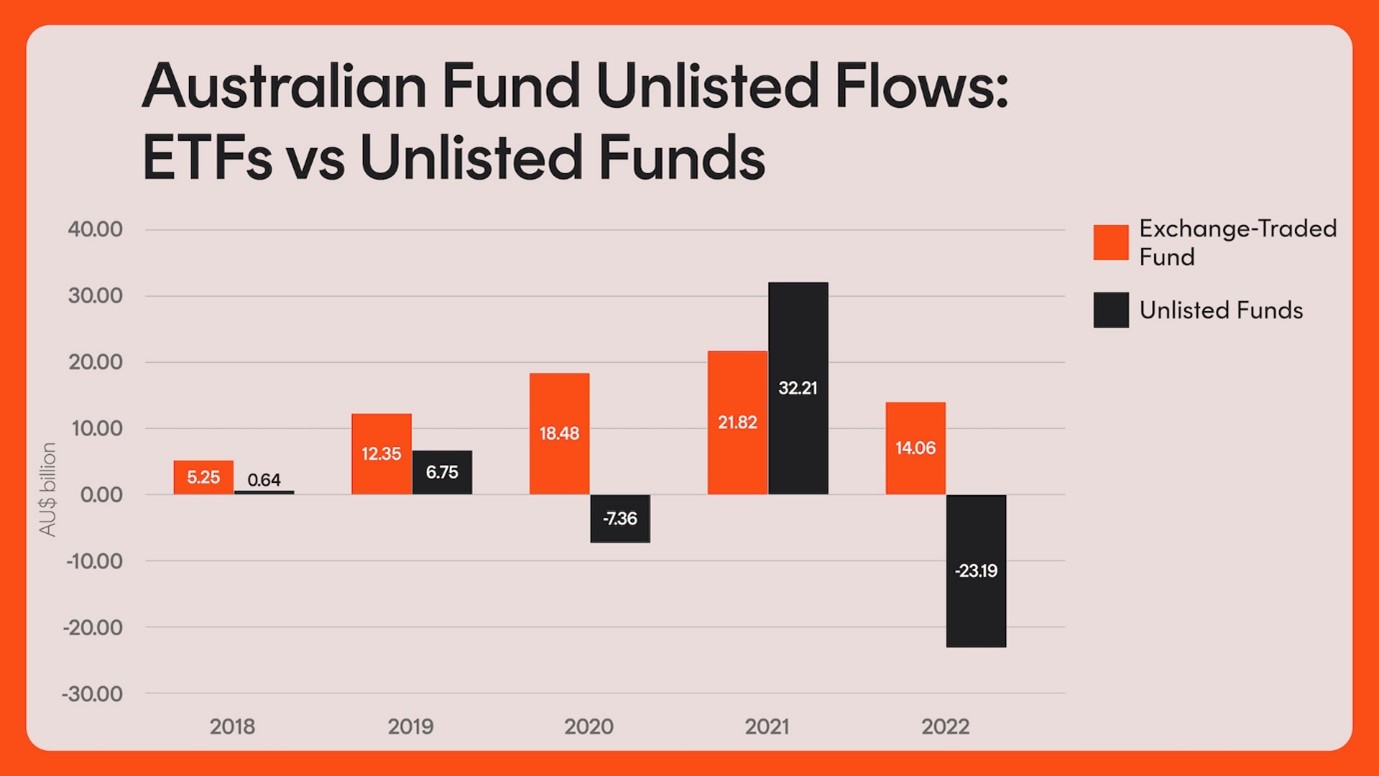

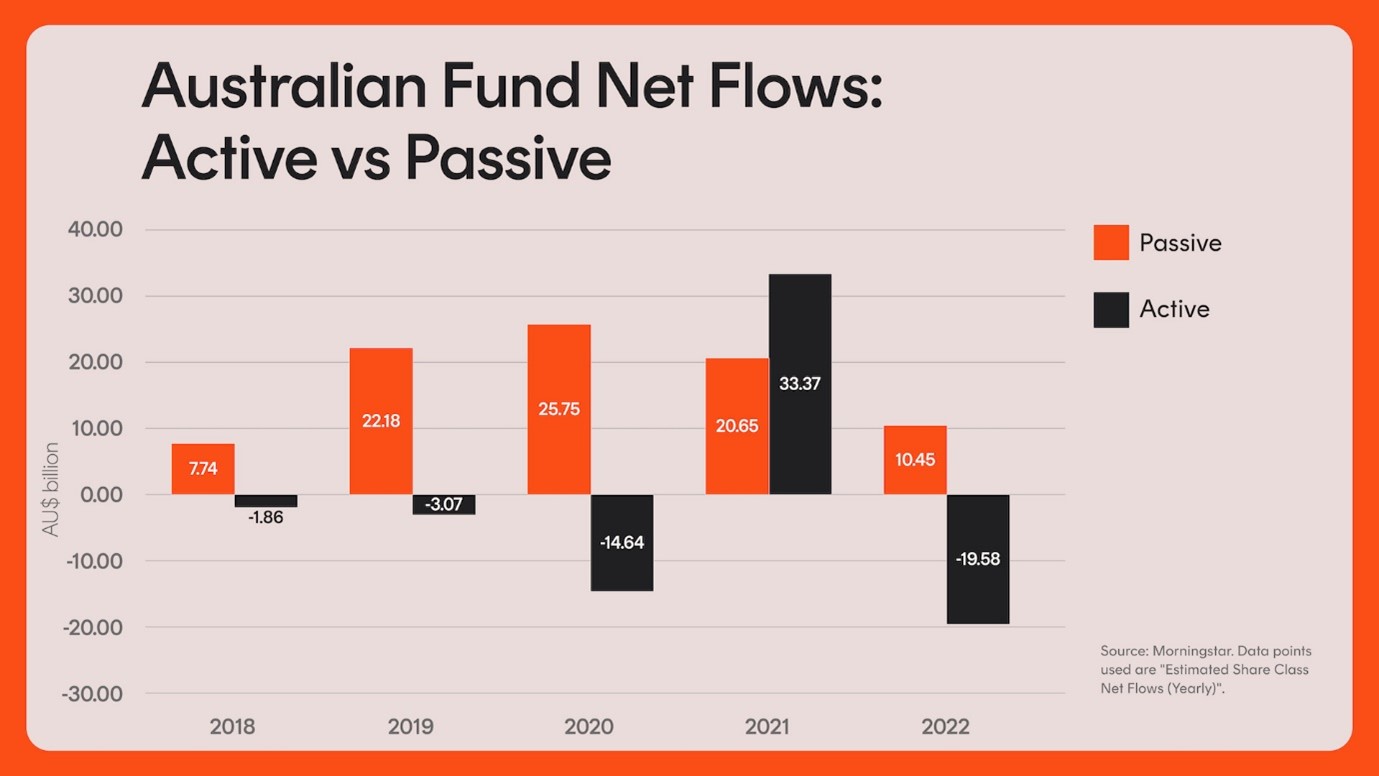

One of the big investment trends of 2022 was the switch to low-cost, diversified investments. While passive funds, in particular ETFs, have been taking market share for many years now, 2022 saw a significant acceleration in this trend – as shown in the charts below.

It’s easy to see why investors are drawn to passive. The latest data from S&P’s long-running SPIVA scorecard shows that active managers failed to outperform their index after fees over almost every asset class and time period.

Investors are clearly growing to appreciate the importance of having a solid core portfolio that can withstand tough times and generate wealth over the long term.

For those investors who wish to express tactical views to complement their core portfolio, satellite exposures such as individual stocks, actively managed funds, and thematic ETFs can offer this flexibility.

Here are four ETFs for a strong core, and two satellite exposures to consider:

Strategic exposures to strengthen your core

A strong core portfolio is an important part of an overall investment strategy as it provides a stable base of investments that are designed to generate consistent returns over the long term, regardless of short-term market fluctuations. By focusing on a core portfolio, investors can seek to manage risk and volatility while still achieving their long-term investment goals.

A200 Australia 200 ETF

Australian shares form the backbone of many Australian investors’ portfolios, and for good reason. Apart from the attractive long-term returns[1] and well-known companies, Australian shares also offer the benefit of franking credits, which enhance the after-tax returns for Australian investors.

A200 aims to track the performance of an index (before fees and expenses) comprising 200 of the largest companies by market capitalisation listed on the ASX. This includes familiar names such as BHP Group, Commonwealth Bank of Australia, and CSL.

A200 is available for the ultra-low management cost of just 0.04% p.a., making it the lowest cost Australian shares ETF in the world.[2]

QLTY Global Quality Leaders ETF

When looking for international equity exposure, diversifying their Australian equity holdings is a key consideration for many investors. One way to achieve this is with the Betashares Global Quality Leaders ETF (QLTY). QLTY can be complementary to Australian holdings due to its significant exposures to Information Technology and Health Care, which contrasts with the two largest sector allocations in A200, Financials and Materials.

Whilst not indicative of future performance, quality stocks also have a long-term history of outperformance versus the broader stock market, and have tended to experience better performance during down months, as we explained in this recent article. The holdings in QLTY’s index are ranked based on four key factors – return on equity, debt-to-capital, cash flow generation ability and earnings stability.

OZBD Australian Composite Bond ETF

With bond yields rising significantly over the last year, many investors are again considering the traditional role bonds have played, offering defensive characteristics and income. OZBD is designed to be a core portfolio allocation for fixed income, providing exposure to high quality Australian government and corporate bonds.

The holdings in OZBD have an average credit rating of AA, and offer a yield-to-worst of 4.07% p.a.[3]

AAA Australian High Interest Cash ETF

Cash plays an important role in portfolios, offering liquidity and flexibility. While yields on bank deposits have become more attractive recently, high yields are often tied to conditions or are subject to ‘honeymoon’ periods. The 3.7% p.a.[4] interest rate currently offered on the Betashares Australian High Interest Cash ETF is available to all unitholders, with interest paid monthly and the fund is easily accessible via the ASX.

Satellite exposures for diversification and growth

Satellite exposures are typically smaller, specialised investments that might be expected to have higher potential returns than, or a lower correlation with, the broader market. They often include exposures that are underrepresented in the core portfolio.

Satellite investments may help to improve diversification, increase returns, or provide exposure to specific areas that investors feel strongly about but investors should be mindful these investments may also present higher risk.

HACK Global Cybersecurity ETF

Cybercrime is estimated to have cost US$8.4 trillion in 2022, with that number projected to surpass US$20 trillion by 2026.[5] These days, every company needs to have a cybersecurity plan, and the appropriate software, hardware, and expertise to implement it.

Rather than trying to pick the winning companies in this fast-growing sector, investors can gain access to the growth of the industry in a single trade with the Betashares Global Cybersecurity ETF (HACK). The Fund’s portfolio includes today’s industry leaders as well as emerging players.

IIND India Quality ETF

India accounts for ~18% of the global population[6], and its large, growing, young population has driven economic growth for years. Its democratic Government’s ability to attract strong foreign investment in the wake of Covid has also had a profound impact on the economy.

As such, India’s stock market appears to be an attractive proposition for investors looking to diversify their emerging market exposure.

Betashares India Quality ETF (ASX: IIND) provides exposure to a diversified portfolio of the 30 highest quality Indian companies based on a combined ranking of the following key factors: high profitability, low leverage and high earnings stability.

IIND’s methodology equally weights exposure to large and mid-cap Indian companies, which allows exposure to some potentially more dynamic companies with stronger fundamentals than large caps alone.

ETFs provide the tools to build a long-term portfolio

ETFs provide investors with a simple and cost-effective way to build a diversified portfolio. The six ETFs listed above offer exposure to a range of different asset classes and investment themes. A combination of core and satellite ETFs can help investors achieve their long-term investment goals while managing risk and volatility.

[1] The Solactive Australia 200 Index, which A200 aims to track, has returned 8.33% per annum over the 10 years to 28 February 2023, gross of fees and costs. A200’s management fee is 0.04% p.a. You cannot invest directly in an index.[2] Source: Bloomberg, based on expense ratios of Australian shares ETFs based in Australia or on overseas exchanges. Other costs, such as transaction costs, may apply. Refer to the PDS for more information.

[4] As at 21 March 2023.

[3] As at 22 March 2023. See this article for an explanation of yield to worst.[4] As at 21 March 2023.[5] Source: Statistica.

[6] Source: World population review

Important Information

There are risks associated with an investment in the Funds, which may include market risk, security specific risk, credit risk, interest rate risk, industry sector risk, currency risk, international investment risk, index tracking risk, and cybersecurity companies’ risk.

Betashares Capital Ltd (ABN 78 139 566 868 AFSL 341181 (Betashares)) is the issuer of the Funds. This information does not take into account any person’s objectives, financial situations or needs. Investors should consider the appropriateness of the information taking into account such factors and seek financial advice. Investment value can go up and down. For more information on risks and other features of the Funds, please see the Product Disclosure Statement available from www.betashares.com.au. You may also wish to consider the relevant Target Market Determination available at www.betashares.com.au/target-market-determinations.